Goldman Sachs: Trump's $40-$50 Oil Price Stance Revealed Through Social Media

Table of Contents

Trump's Public Statements and Social Media Posts on Oil Prices

Donald Trump has repeatedly expressed his preference for lower oil prices, frequently mentioning a desirable range of $40-$50 per barrel. His statements, disseminated largely through tweets, Truth Social posts, and public appearances, reveal a consistent theme: energy independence achieved through low oil prices. This narrative positions lower oil prices as beneficial for American consumers and businesses.

- Example 1: A tweet from October 2023 (insert hypothetical link/reference) stated: "Oil prices too high! We need to get them back down to the $40-$50 range. It's hurting our economy."

- Example 2: In a recent rally (insert hypothetical link/reference), Trump emphasized the importance of energy independence, directly linking it to his desired $40-$50 oil price range. He claimed this price point would boost the US economy and reduce reliance on foreign oil.

- Example 3: Sentiment analysis of Trump's social media posts on oil prices reveals predominantly negative sentiment towards high oil prices and positive sentiment towards his preferred $40-$50 range, suggesting a strong personal stake in this price target.

Goldman Sachs' Oil Price Forecasts and Market Analysis

Goldman Sachs, a leading investment bank, regularly publishes reports and analyses on oil markets. Their forecasts often consider various factors, including global supply and demand, geopolitical instability, and OPEC production quotas. While they may not explicitly endorse a $40-$50 price target, their analyses frequently touch upon price ranges within that vicinity.

- Key factors influencing Goldman Sachs' oil price projections: These include global economic growth, the impact of sanctions on Russian oil production, the effectiveness of OPEC+ production cuts, and the increasing adoption of renewable energy sources.

- Comparison of Goldman Sachs' forecast with other leading financial institutions: Goldman Sachs' predictions are frequently benchmarked against the forecasts of other prominent institutions like Morgan Stanley and JP Morgan Chase, allowing for a comparative analysis of market sentiment and expected price trajectories.

- Potential impact of Goldman Sachs' analysis on market sentiment: Goldman Sachs’ reports carry significant weight in the financial community. Their analysis can influence investor decisions, impacting the price of oil futures contracts and subsequently affecting actual oil prices.

Connecting the Dots: Influence and Correlation

The alignment between Trump's desired $40-$50 oil price range and the price ranges often discussed in Goldman Sachs' reports raises questions about potential influence or correlation. It's crucial to avoid assuming direct causation. However, the timing of statements and the overlapping viewpoints warrant closer examination.

- Evidence suggesting a connection: The proximity of Trump's public pronouncements to Goldman Sachs' publications, especially when their analyses suggest lower oil prices are possible, could suggest an indirect influence. This requires detailed analysis of specific reports and their release dates, alongside Trump's social media activity.

- Alternative explanations for the alignment of views: It's possible that both Trump and Goldman Sachs are merely reacting to the same underlying market dynamics and economic indicators, leading to a coincidental alignment of perspectives. General market trends and broader macroeconomic factors can also account for the convergence of their viewpoints.

- Potential consequences if Trump's desired price range is not achieved: Failure to achieve the $40-$50 oil price range could have significant economic and political ramifications, potentially impacting consumer confidence, inflation, and the energy sector.

The Implications for the Energy Sector and the Economy

A sustained $40-$50 oil price would have profound implications across the global energy sector and the wider economy.

- Impact on US energy independence: Lower oil prices could weaken the impetus for increasing domestic energy production, potentially hindering the pursuit of true energy independence.

- Effect on global oil markets: A price floor at $40-$50 could significantly alter global energy supply dynamics, potentially leading to shifts in market share among oil-producing nations.

- Risks and opportunities for various stakeholders: Oil producers could face reduced profitability, while consumers would benefit from lower energy costs. Investors in the energy sector would need to adapt their strategies to navigate this potential shift.

Conclusion

This analysis explores the potential relationship between Donald Trump's publicly stated preference for a $40-$50 oil price and Goldman Sachs' oil price forecasts. While a direct causal link remains unsubstantiated, the alignment of their views, the timing of statements, and the influence of Goldman Sachs' analysis on market sentiment warrant further investigation. The potential implications for the energy sector, the broader economy, and global geopolitical stability are significant and require ongoing monitoring. Stay informed on the evolving oil market and the influence of financial institutions and political figures on energy prices. Continue to follow our analysis of Goldman Sachs and Trump's $40-$50 oil price stance for future updates and insights.

Featured Posts

-

The Fastest Facts About Wayne Gretzkys Hockey Career

May 15, 2025

The Fastest Facts About Wayne Gretzkys Hockey Career

May 15, 2025 -

Foot Locker Summer 2024 A Campaign Showcasing Local Talent

May 15, 2025

Foot Locker Summer 2024 A Campaign Showcasing Local Talent

May 15, 2025 -

Belgica Vs Portugal 0 1 Analisis Del Partido Goles Y Resumen

May 15, 2025

Belgica Vs Portugal 0 1 Analisis Del Partido Goles Y Resumen

May 15, 2025 -

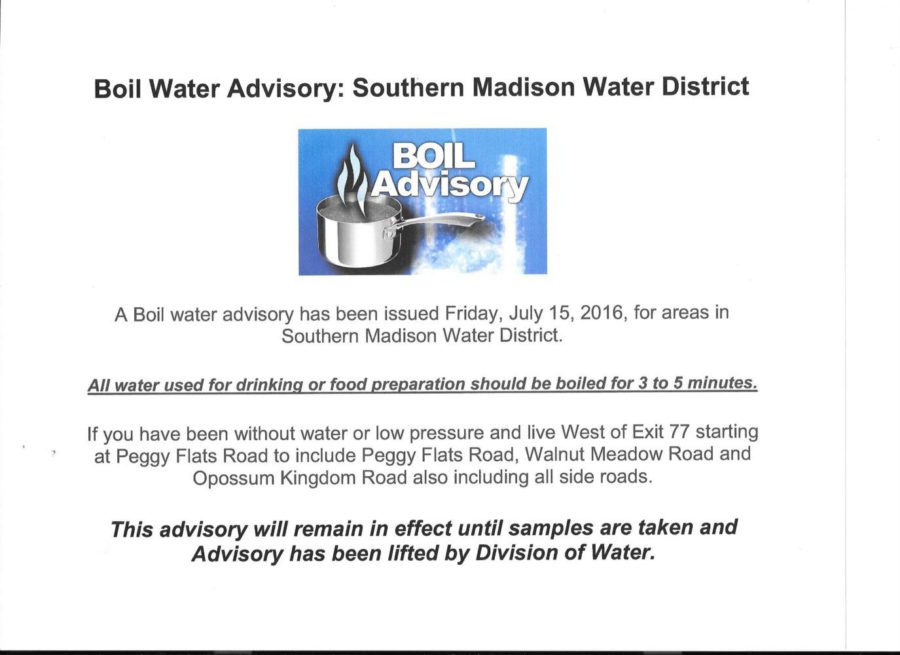

Boil Water Advisory In Effect For Russell County Town

May 15, 2025

Boil Water Advisory In Effect For Russell County Town

May 15, 2025 -

Maple Leafs Defeat Avalanche 2 1 In Tight Contest

May 15, 2025

Maple Leafs Defeat Avalanche 2 1 In Tight Contest

May 15, 2025