Government Crackdown On Delinquent Student Loans: What Borrowers Need To Know

Table of Contents

Understanding the Definition of Delinquent Student Loans

"Delinquent student loans" refer to federal or private student loans where payments are overdue. Delinquency begins after a grace period, typically six months after leaving school (though this varies depending on the loan type and your repayment plan). Delinquency is measured by the number of missed payments. The longer payments are missed, the more severe the consequences become.

- Delinquency vs. Default: Delinquency is the initial stage of non-payment. Default occurs after a prolonged period of delinquency (usually 9 months), resulting in significantly harsher penalties.

- Loan Program Variations: Delinquency affects different loan programs differently. Federal Direct Loans, Perkins Loans, and private student loans each have specific processes for handling delinquency and default. Check your loan servicer's website for details on your specific loan type.

- Learn More: For comprehensive information on student loan statuses, visit the official websites of the National Student Loan Data System (NSLDS) and the Federal Student Aid website. [Insert links here]

Consequences of Delinquent Student Loans

The repercussions of neglecting delinquent student loan payments are severe and far-reaching. Ignoring the problem will only exacerbate your financial difficulties.

- Wage Garnishment: The government can seize a portion of your wages to repay the debt.

- Tax Refund Offset: Your federal tax refund can be used to settle your delinquent student loan balance.

- Credit Score Damage: Delinquent loans significantly harm your credit score, impacting your ability to secure loans, rent an apartment, or even get a job.

- Difficulty Obtaining Credit: A damaged credit score makes it incredibly challenging to obtain new loans, credit cards, or even secure favorable interest rates.

- Potential Lawsuits: In some cases, the government may initiate legal action to recover the debt.

- Impact on Future Financial Aid: Delinquent loans can jeopardize your eligibility for future federal student aid or scholarships.

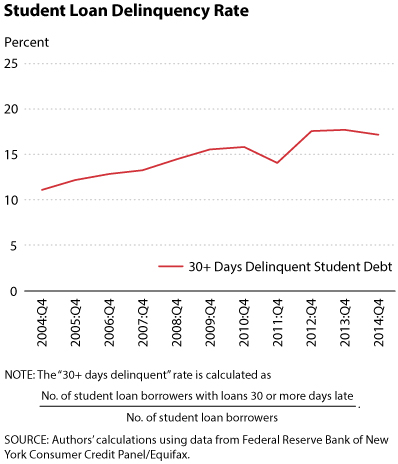

Government Initiatives Targeting Delinquent Student Loans

The government is actively addressing the growing issue of delinquent student loans through various initiatives.

- Increased Enforcement: Agencies are actively pursuing borrowers with delinquent loans, leading to increased wage garnishments and tax refund offsets.

- Repayment Plan Modifications: The government is continually reviewing and adjusting repayment plans to help borrowers manage their debt. Stay informed about changes that might improve your situation.

- Debt Relief Programs (if applicable): While not always available, certain programs may offer debt relief under specific circumstances. Check the Federal Student Aid website for current information. [Insert Link Here]

- Legislative Changes: Keep abreast of new legislation impacting student loan repayment; recent acts may offer new avenues for managing your debt.

Available Repayment Options for Delinquent Student Loans

Several options exist to help borrowers manage delinquent student loans and avoid default.

- Income-Driven Repayment (IDR) Plans: These plans base your monthly payments on your income and family size, making them more manageable for those struggling financially.

- Deferment: This temporarily postpones your payments, but interest may still accrue on unsubsidized loans.

- Forbearance: Similar to deferment, it allows for temporary suspension of payments, but interest may accrue.

- Loan Consolidation: Combining multiple loans into a single loan may simplify repayment and potentially lower your monthly payments.

- Student Loan Rehabilitation: This program allows you to bring your defaulted federal loans back into good standing. You must make nine on-time payments within 20 days of their due date to rehabilitate your loans.

- Communicate with your Loan Servicer: Proactive communication is crucial. Contact your loan servicer to discuss your situation and explore available options before defaulting.

Seeking Professional Help with Delinquent Student Loans

Navigating the complexities of delinquent student loans can be overwhelming. Consider seeking professional guidance.

- Non-profit Credit Counseling Agencies: These agencies provide free or low-cost advice and can help you create a manageable repayment plan, negotiate with lenders, and avoid default. They can also help you understand and access government programs.

- Student Loan Specialists: These professionals specialize in helping borrowers resolve their student loan debt. They can offer personalized strategies and advocate on your behalf.

- Find Reputable Organizations: Thoroughly research and verify the legitimacy of any credit counseling agency or student loan specialist you consider working with. [Insert links to reputable organizations here]

Conclusion: Taking Control of Your Delinquent Student Loans

Ignoring delinquent student loans has serious, long-term consequences for your credit score, financial stability, and future opportunities. Understanding the available repayment options, government initiatives, and the value of professional guidance is crucial to resolving your debt. Don't wait until it's too late. Take immediate action to manage your delinquent student loans. Explore the resources available to you, and seek professional help if needed. Avoiding student loan default is paramount to securing your financial future. Start taking control of your financial situation today; resolving delinquent student loan debt requires proactive steps and a commitment to finding a solution.

Featured Posts

-

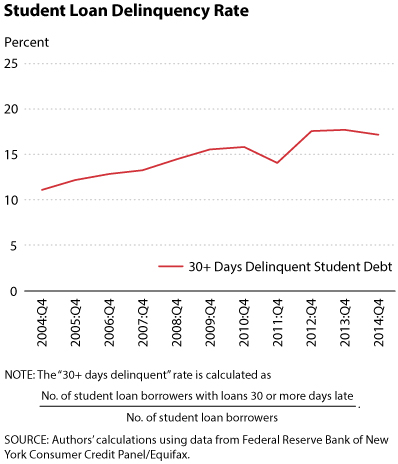

Emirates Id Fee For Newborns A Complete Guide March 2025

May 17, 2025

Emirates Id Fee For Newborns A Complete Guide March 2025

May 17, 2025 -

Everything La Lakers News Highlights And Analysis From Vavel Us

May 17, 2025

Everything La Lakers News Highlights And Analysis From Vavel Us

May 17, 2025 -

Cancelled The Star Wars Andor Book And The Rise Of Ai Fears

May 17, 2025

Cancelled The Star Wars Andor Book And The Rise Of Ai Fears

May 17, 2025 -

Anthonys Below Deck Down Under Replacement Everything We Know

May 17, 2025

Anthonys Below Deck Down Under Replacement Everything We Know

May 17, 2025 -

Bringing Wnba Basketball Back To Detroit Eminems Influence

May 17, 2025

Bringing Wnba Basketball Back To Detroit Eminems Influence

May 17, 2025