GPB Capital Founder David Gentile Convicted: Details Of The 7-Year Sentence

Table of Contents

The Charges Against David Gentile

David Gentile faced a multitude of serious charges, primarily centered around securities fraud and conspiracy. The prosecution argued that Gentile orchestrated a complex scheme to defraud investors through GPB Capital, a private equity firm he founded. These fraudulent activities systematically misled investors about the true financial health and performance of their investments.

- Misrepresentation of GPB Capital's financial performance: Gentile and his associates allegedly presented falsified financial statements and misleading performance reports to potential investors, grossly exaggerating the firm's profitability and the value of its assets.

- Securities fraud through the sale of unregistered securities: The prosecution argued that GPB Capital sold unregistered securities, violating federal securities laws and depriving investors of crucial information and regulatory protection.

- Conspiracy to commit wire fraud and securities fraud: The charges highlighted a coordinated effort among Gentile and other individuals within GPB Capital to perpetrate the fraudulent scheme, utilizing wire communications to further their illegal activities.

- Obstruction of justice: Gentile was also accused of obstructing justice during the investigation by attempting to conceal evidence and mislead investigators.

GPB Capital, under Gentile's leadership, allegedly used the proceeds from these fraudulent activities to fund unrelated ventures and enrich themselves, leaving investors with significant financial losses and a profound lack of trust in the financial system. The impact on investors was devastating, resulting in substantial financial losses and erosion of confidence in private equity investments.

The Trial and Conviction

The trial of David Gentile was a lengthy and complex affair, meticulously detailing the alleged fraudulent activities and the scheme's devastating consequences. The prosecution presented compelling evidence, including financial documents, emails, and witness testimonies, painting a picture of a systematic and deliberate effort to deceive investors.

- Length of the trial: The trial spanned several months, involving numerous witnesses and a substantial amount of evidence.

- Key witnesses for the prosecution and defense: The prosecution called several key witnesses, including former GPB Capital employees and investors who testified about the alleged fraudulent activities. The defense presented witnesses to challenge the prosecution's case.

- Significant pieces of evidence presented: Key pieces of evidence included internal financial documents that revealed discrepancies in the reported financial performance of GPB Capital, as well as emails demonstrating communication among individuals involved in the scheme.

- Judge's comments during the sentencing: During the sentencing hearing, the judge emphasized the severity of Gentile's crimes and their devastating impact on countless investors. The judge's comments highlighted the calculated nature of the fraud and the significant breach of trust involved.

Ultimately, the jury found David Gentile guilty on all counts, leading to his conviction and subsequent sentencing to seven years in prison. The jury’s deliberations were extensive, reflecting the complexities of the case and the weight of the evidence presented.

Implications of the David Gentile Conviction

The David Gentile conviction carries significant implications for investors, the financial industry, and regulatory oversight. The case highlights the vulnerabilities within the private equity sector and the potential for abuse when proper regulations and due diligence are lacking.

- Financial losses suffered by investors: Thousands of investors suffered substantial financial losses as a result of GPB Capital's fraudulent activities. Many lost their life savings.

- Potential for civil lawsuits and class-action claims: The conviction opens the door for investors to pursue civil lawsuits and class-action claims against Gentile and other individuals involved in the scheme to recoup their losses.

- Increased regulatory scrutiny of private equity firms: The case is likely to lead to increased regulatory scrutiny of private equity firms, particularly those operating with less transparency.

- Lessons learned for investors regarding due diligence and risk management: Investors must take more proactive steps to conduct thorough due diligence before investing in any firm, particularly private equity, which are often less regulated.

Similar Cases and Lessons Learned

The David Gentile case is not an isolated incident. History is replete with examples of investment fraud that underscore the importance of vigilance and due diligence.

- Examples of other significant investment fraud cases: Cases like Madoff's Ponzi scheme serve as stark reminders of the potential for large-scale investment fraud and the devastating consequences for unsuspecting investors.

- Key red flags investors should be aware of: Investors should be wary of overly high returns, lack of transparency, high-pressure sales tactics, and unregistered securities.

- Best practices for conducting thorough due diligence before investing: Independent verification of financial statements, seeking professional financial advice, and understanding the investment's risks are crucial.

- Importance of seeking professional financial advice: Consulting with a qualified financial advisor can provide valuable guidance and help investors avoid falling prey to fraudulent schemes.

Conclusion

The David Gentile conviction underscores the severity of financial fraud and the devastating consequences for those involved. The 7-year sentence serves as a stark warning to others contemplating similar schemes. This case highlights the critical need for investor awareness and due diligence in navigating the complexities of the investment world. Understanding the details of the David Gentile conviction, and similar cases, is paramount to protecting your financial future. Learn more about protecting yourself from investment fraud and take steps to safeguard your investments. Further research on the David Gentile conviction and similar cases is strongly recommended.

Featured Posts

-

Bundesliga Showdown Relegation Bound Kiel And Champions League Aspiring Mainz Meet

May 11, 2025

Bundesliga Showdown Relegation Bound Kiel And Champions League Aspiring Mainz Meet

May 11, 2025 -

Premiere Parisienne D Eric Antoine Presence Remarquee D Une Ancienne Miss Meteo

May 11, 2025

Premiere Parisienne D Eric Antoine Presence Remarquee D Une Ancienne Miss Meteo

May 11, 2025 -

La Vie Privee D Eric Antoine Devoilement De Sa Relation Avec Une Personnalite M6

May 11, 2025

La Vie Privee D Eric Antoine Devoilement De Sa Relation Avec Une Personnalite M6

May 11, 2025 -

Nu Kan Du Stemme Dansk Melodi Grand Prix 2025

May 11, 2025

Nu Kan Du Stemme Dansk Melodi Grand Prix 2025

May 11, 2025 -

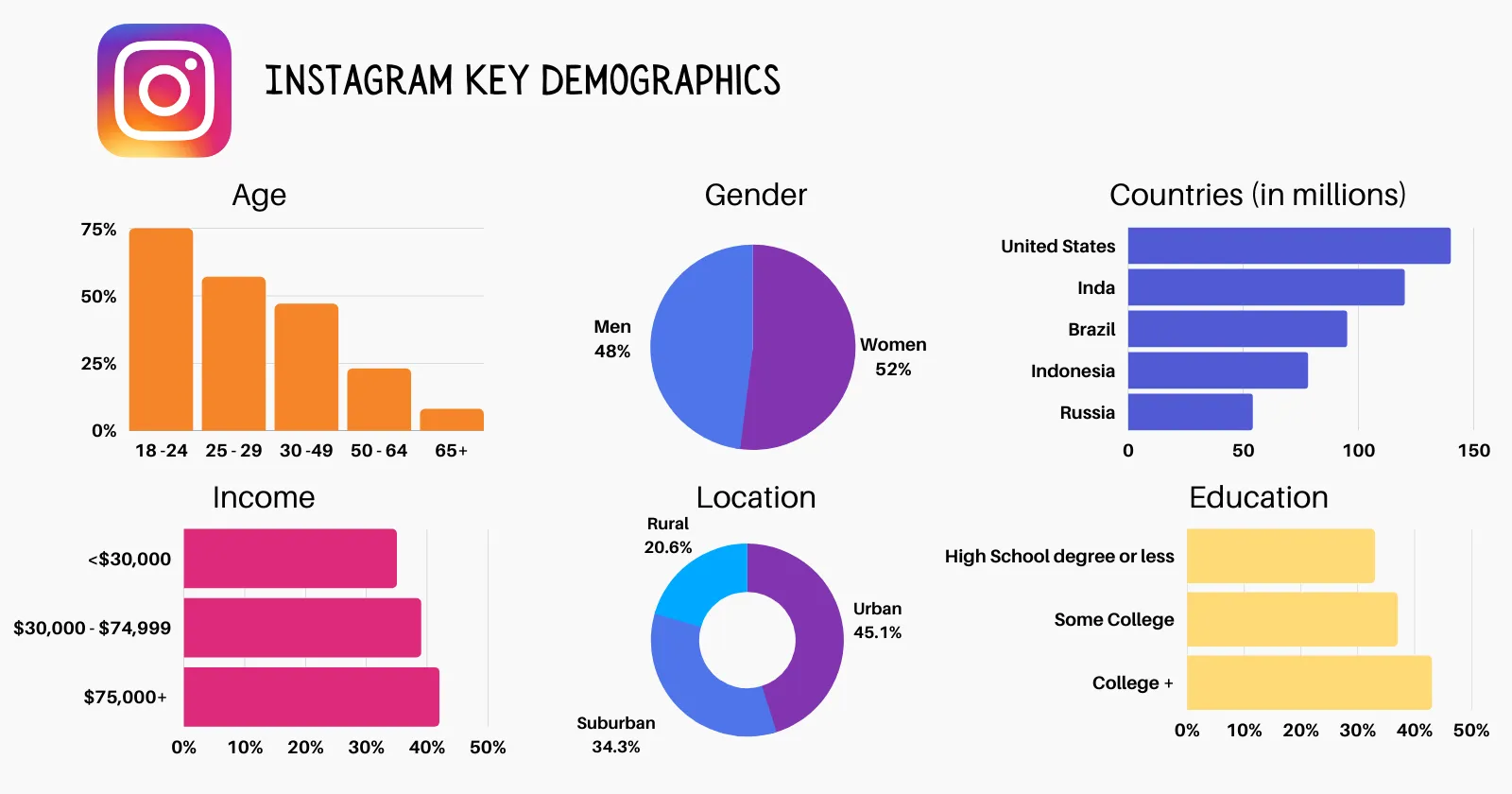

The Instagram Vs Tik Tok War A Ceos Take

May 11, 2025

The Instagram Vs Tik Tok War A Ceos Take

May 11, 2025