Grayscale's XRP ETF Filing: Impact On XRP Price And Potential Record High

Table of Contents

What is an ETF? Before we dive in, let's quickly define an Exchange-Traded Fund (ETF). An ETF is an investment fund traded on stock exchanges, offering investors diversified exposure to a specific asset class, like stocks or, in this case, potentially, cryptocurrencies. The approval of a Grayscale XRP ETF would signify a significant milestone for XRP, potentially opening it up to a much broader range of investors.

This article will analyze the potential impact of Grayscale's XRP ETF filing on XRP's price and its potential to reach a record high.

Grayscale's Track Record and the Significance of XRP ETF Approval

Grayscale's Past ETF Successes (or Failures):

Grayscale Investments has a history of navigating the complex regulatory landscape of cryptocurrency ETFs. While they've achieved success with some crypto ETF offerings, others have faced delays and challenges. Their experience with Bitcoin and Ethereum ETFs provides valuable insight into the potential hurdles and triumphs awaiting the XRP ETF. The SEC's past decisions on similar applications will heavily influence the outcome of Grayscale's XRP ETF application. Analyzing these past decisions gives us a clearer picture of the potential regulatory path ahead.

XRP's Unique Position in the Crypto Market:

XRP, the native cryptocurrency of Ripple Labs, holds a unique position in the crypto market. Unlike many other cryptocurrencies that primarily focus on decentralized applications (dApps), XRP is designed for fast and low-cost cross-border payments. This functionality makes it attractive to institutional investors seeking efficient and cost-effective solutions for international transactions.

- Easier Access: An XRP ETF would significantly simplify access for institutional and retail investors, lowering the barrier to entry for those unfamiliar with cryptocurrency exchanges.

- Increased Liquidity and Trading Volume: The increased accessibility would likely lead to substantially higher trading volume and liquidity for XRP, potentially stabilizing its price.

- Regulatory Challenges: However, regulatory hurdles remain a significant concern. The SEC's stance on XRP and its classification as a security could impact the ETF's approval process.

Potential Impact on XRP Price

Price Prediction Models and Analyst Opinions:

Predicting the price of any cryptocurrency is inherently speculative, but several price prediction models and financial analysts offer insights into the potential impact of Grayscale's XRP ETF. Some analysts predict a significant short-term price surge upon approval, while others suggest a more gradual, long-term appreciation. The range of predictions varies widely, depending on the model and assumptions used. It's crucial to consult multiple sources and understand the limitations of these predictions.

Factors Influencing XRP Price Beyond the ETF Filing:

The price of XRP is not solely determined by the ETF filing. Several other crucial factors influence its value:

- Short-Term Surge: Approval of the ETF could trigger a significant short-term price surge due to increased buying pressure.

- Long-Term Appreciation: If the ETF is successful, sustained investor interest could lead to significant long-term price appreciation.

- Negative Regulatory Response: Conversely, a negative regulatory response could result in a price drop. Broader market trends, technological developments within the XRP ecosystem, and news regarding Ripple's ongoing legal battle with the SEC will all contribute to XRP price fluctuations.

Reaching a Record High: Feasibility and Challenges

Historical XRP Price Performance:

Examining XRP's historical price performance is crucial. While XRP has reached impressive highs in the past, various factors contributed to those peaks and subsequent corrections. Understanding these historical trends helps gauge the feasibility of reaching a new all-time high.

Market Sentiment and Investor Confidence:

Market sentiment and investor confidence are vital in driving price appreciation. A positive outlook on XRP's future, fueled by the ETF's potential success and broader adoption, is essential for reaching a new record high.

- Factors for Surpassing Previous Highs: Achieving a new all-time high requires sustained buying pressure, positive regulatory developments, and a robust increase in adoption.

- Potential Resistance Levels: XRP may encounter resistance levels at previous highs, requiring significant buying pressure to break through.

- Impact of Macroeconomic Conditions: Broader macroeconomic factors, such as inflation, interest rates, and overall market sentiment, can also significantly impact XRP's price.

Conclusion

Grayscale's XRP ETF filing presents a significant opportunity for XRP, potentially impacting its price and leading to a new record high. While the approval is not guaranteed and several factors influence XRP's price, the potential benefits of increased accessibility and liquidity are undeniable. The success of the Grayscale's XRP ETF hinges on regulatory approval, market sentiment, and broader macroeconomic conditions. Stay updated on the Grayscale's XRP ETF and its progress. Learn more about XRP investing and monitor the XRP price trends closely. The impact of this development could be substantial, shaping the future of XRP and the broader cryptocurrency market.

Featured Posts

-

Los Angeles Angels Baseball Your 2025 Streaming Guide No Cable

May 08, 2025

Los Angeles Angels Baseball Your 2025 Streaming Guide No Cable

May 08, 2025 -

Psl Matches In Lahore Impact On School Schedules

May 08, 2025

Psl Matches In Lahore Impact On School Schedules

May 08, 2025 -

Bitcoin Market Shift Binance Sees Buying Volume Outpace Selling For First Time In Half A Year

May 08, 2025

Bitcoin Market Shift Binance Sees Buying Volume Outpace Selling For First Time In Half A Year

May 08, 2025 -

Angels Defeat White Sox In Rain Shortened Game Thanks To Paris Homer

May 08, 2025

Angels Defeat White Sox In Rain Shortened Game Thanks To Paris Homer

May 08, 2025 -

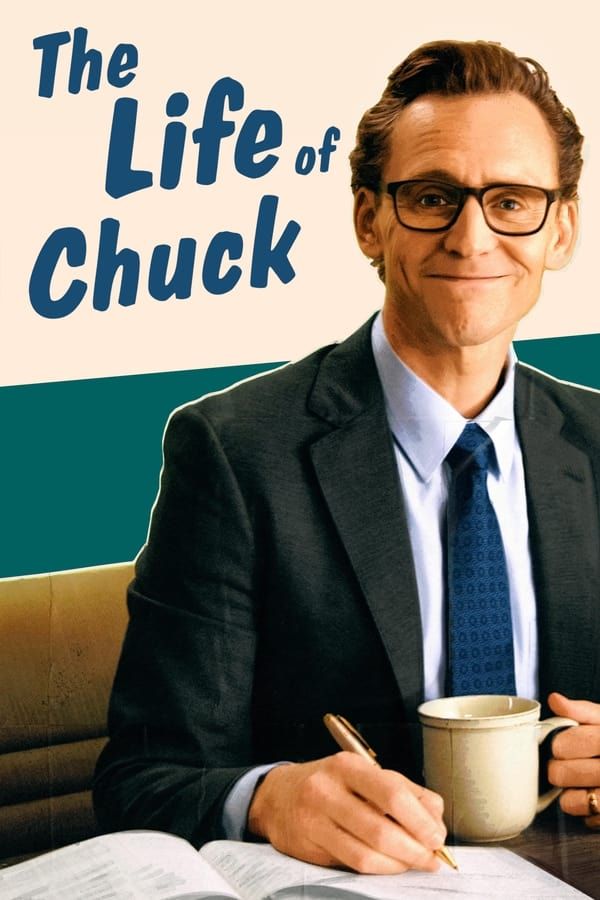

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025

Stephen King Praises The Life Of Chuck Movie Trailer Released

May 08, 2025