Growing Tensions Impact Pakistan Stock Exchange Operations

Table of Contents

Geopolitical Instability and its Ripple Effect on the PSX

Regional conflicts and shifting international relations significantly influence investor confidence in the PSX. Geopolitical risk is a major factor impacting market sentiment and leading to increased market volatility. The perception of instability directly affects investment decisions, both domestic and foreign.

-

Impact of terrorism and security concerns: Security incidents and the threat of terrorism negatively affect investor sentiment, leading to capital flight and decreased market activity. The perception of risk increases, making investors hesitant to commit capital.

-

Influence of global power dynamics: Changes in global power dynamics and international relationships can have cascading effects on Pakistan's economy and, consequently, the PSX. Sanctions or trade disputes can disrupt economic activity and impact investor confidence.

-

Foreign policy decisions and their market consequences: Significant shifts in foreign policy can trigger uncertainty in the market. Any perceived weakening of international relations can lead to immediate downturns in the PSX.

-

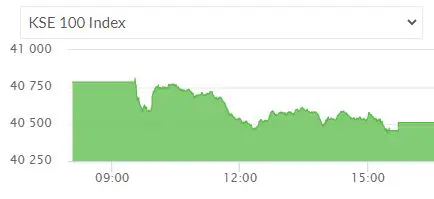

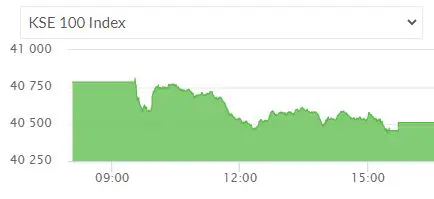

Examples of specific events and their immediate effects on the PSX: For instance, major geopolitical events such as heightened tensions with neighboring countries or international sanctions can cause sharp and immediate drops in the PSX KSE-100 index, reflecting investor anxieties. Data showing correlations between specific events and market fluctuations would provide compelling evidence of this impact. Analyzing historical data on investor sentiment and geopolitical risk can provide valuable insights into the magnitude of these effects.

Economic Challenges and their Impact on Pakistan Stock Exchange Trading

Pakistan's macroeconomic environment plays a crucial role in shaping PSX performance. High inflation, currency devaluation, and substantial debt levels create economic uncertainty, impacting investor behavior and market stability.

-

Analysis of inflation's impact on investor behavior: High inflation erodes purchasing power and reduces investor confidence, pushing them towards safer, more conservative investment options.

-

The role of currency fluctuations in affecting stock prices: A depreciating currency can negatively impact stock prices, particularly for companies with significant foreign currency-denominated liabilities. This increases the cost of imports and reduces profitability.

-

The effect of government policies on market stability: Government fiscal and monetary policies significantly influence market stability. Uncertain or inconsistent policies can increase economic uncertainty and deter investment.

-

Discussion of potential economic reforms and their projected impact: The implementation of structural economic reforms aimed at improving fiscal discipline and attracting foreign investment could positively impact the PSX in the long term. However, the short-term effects of such reforms may be uncertain, potentially increasing volatility. Keywords like "economic uncertainty," "inflationary pressures," "currency devaluation," and "fiscal policy" are essential for attracting relevant searches.

Regulatory Measures and Their Effectiveness in Mitigating Risks to PSX Operations

The Securities and Exchange Commission of Pakistan (SECP) plays a vital role in regulating the PSX and mitigating risks. The effectiveness of SECP policies in maintaining market stability and investor confidence is crucial for the overall health of the exchange.

-

Evaluation of SECP's role in maintaining market stability: The SECP's role involves overseeing market operations, enforcing regulations, and protecting investor rights. Analysis of their effectiveness in these areas is critical.

-

Assessment of the effectiveness of regulatory interventions: Assessing the impact of SECP's interventions on market volatility and investor confidence requires a detailed analysis of past interventions and their subsequent effects on the PSX.

-

Discussion of potential improvements to regulatory frameworks: Identifying areas for improvement in the regulatory framework could enhance investor confidence and promote market stability. This might include transparency measures, strengthened investor protection, and proactive risk management strategies.

-

Comparison to regulatory measures in other emerging markets: Benchmarking the SECP's regulatory approach against those in other emerging markets can offer valuable insights into potential areas for improvement and best practices. Keywords like "regulatory oversight," "market regulation," "risk management," and "SECP policies" will improve this section's SEO.

Future Outlook: Predicting the Trajectory of Pakistan Stock Exchange Operations

The future trajectory of the PSX hinges on a complex interplay of factors, presenting both opportunities and challenges.

-

Analysis of long-term growth prospects: Pakistan's long-term economic growth potential, coupled with potential improvements in its business environment, could positively impact the PSX's long-term growth prospects.

-

Discussion of potential future challenges and threats: Continued geopolitical instability, economic vulnerabilities, and unforeseen global events remain significant threats.

-

Potential for foreign investment and its impact: Attracting significant foreign investment is crucial for boosting market capitalization and liquidity.

-

Strategies for investors to navigate the uncertain market: Investors need to adopt diversified investment strategies, focusing on fundamental analysis and risk management to navigate the uncertain market conditions. Keywords like "market outlook," "investment strategies," "future growth," and "long-term investment" are vital here.

Conclusion: Understanding the Impact on Pakistan Stock Exchange Operations

This analysis highlights the complex interplay of geopolitical tensions, economic challenges, and regulatory measures affecting Pakistan Stock Exchange operations. Understanding these factors is paramount for investors to make informed decisions. Monitoring key indicators, such as inflation, currency exchange rates, and geopolitical developments, is vital for predicting market trends and managing investment risk effectively. Staying updated on the latest developments impacting Pakistan Stock Exchange operations is crucial. For further insights, consult reputable financial news sources and research reports focusing on PSX performance and investment strategies. Actively monitor the Pakistan Stock Exchange operations for informed investment decisions.

Featured Posts

-

Fury Over Caravan Sites Transforming Uk Cities Into Ghettos

May 09, 2025

Fury Over Caravan Sites Transforming Uk Cities Into Ghettos

May 09, 2025 -

Madeleine Mc Cann Case Update On Julia Wandelts Arrest In The Uk

May 09, 2025

Madeleine Mc Cann Case Update On Julia Wandelts Arrest In The Uk

May 09, 2025 -

Mestarien Liigan Puolivaelieraet Bayern Muenchen Inter Ja Psg Seuraavaksi

May 09, 2025

Mestarien Liigan Puolivaelieraet Bayern Muenchen Inter Ja Psg Seuraavaksi

May 09, 2025 -

Co So Giu Tre Tien Giang Phai Co Bien Phap Ngan Chan Bao Hanh Tre Em

May 09, 2025

Co So Giu Tre Tien Giang Phai Co Bien Phap Ngan Chan Bao Hanh Tre Em

May 09, 2025 -

Nyt Strands Today April 6 2025 Clues And Solutions

May 09, 2025

Nyt Strands Today April 6 2025 Clues And Solutions

May 09, 2025