Harvard President: Revoking Tax-Exempt Status Would Be 'Highly Illegal'

Table of Contents

President's Statement: The Legal Ramifications of Revoking Harvard's Tax-Exempt Status

Harvard's president, in a recent address to the university community, firmly stated that attempts to revoke Harvard's tax-exempt status would be unlawful and a violation of established legal precedents. This statement followed increased public and political pressure regarding the institution's vast endowment and its perceived contribution to wealth inequality. The legal basis for Harvard's tax-exempt status rests on Section 501(c)(3) of the Internal Revenue Code, which grants exemption to organizations operating for charitable, religious, educational, scientific, and literary purposes.

- Specific legal arguments: The president's statement likely hinges on arguments demonstrating Harvard's continued compliance with 501(c)(3) requirements, emphasizing its extensive research, teaching, and charitable contributions.

- Potential legal challenges/precedents: Any challenge would likely face significant hurdles, given the established legal precedent supporting tax-exempt status for universities fulfilling their educational missions. Cases involving similar challenges to non-profit designations could be cited.

- Relevant case laws/legal opinions: References to relevant Supreme Court cases and IRS rulings regarding the criteria for maintaining 501(c)(3) status would be central to a legal defense.

[Link to relevant news article] [Link to Section 501(c)(3) of the Internal Revenue Code]

The Debate Surrounding Harvard's Tax-Exempt Status

The debate around Harvard's Harvard tax-exempt status is multifaceted. Critics argue that its massive endowment, coupled with relatively high tuition fees, contradicts the spirit of a charitable organization and exacerbates wealth inequality. They advocate for revoking the tax exemption to address these concerns and potentially redistribute resources.

- Arguments for revoking: Proponents argue that Harvard's significant financial resources should be subject to taxation, similar to for-profit institutions. They point to the institution's ability to significantly lower tuition or increase financial aid.

- Counterarguments: Defenders of Harvard's tax-exempt status highlight the university's significant contributions to research, education, and charitable initiatives. They emphasize the importance of preserving the tax-exempt status for universities to foster innovation and public good.

- Broader implications: The outcome of this debate will have far-reaching implications for other non-profit institutions, particularly universities and colleges. It could set a precedent for how society views and regulates non-profit organizations with substantial endowments.

The Implications for Higher Education and Non-Profit Organizations

Revoking Harvard's tax exemption for universities would have severe financial consequences, not only for Harvard but also for the broader higher education landscape.

- Financial implications: Loss of tax-exempt status would significantly increase Harvard's tax burden, potentially affecting its ability to fund research, provide financial aid, and maintain its infrastructure.

- Impact on charitable giving: It could discourage charitable donations to universities, as donors might hesitate to contribute to institutions facing increased tax liabilities.

- Effect on research funding and academic programs: Reduced funding could lead to cuts in research programs, impacting scientific advancements and technological innovation. Academic programs might also be scaled back or eliminated.

- Broader implications for the non-profit sector: The precedent set by such a decision could undermine the stability and funding models of other non-profit organizations, impacting their ability to fulfill their missions.

Understanding the Criteria for Tax-Exempt Status for Educational Institutions

Educational institutions must meet strict criteria to qualify for and maintain tax-exempt status under Section 501(c)(3). The IRS plays a crucial role in overseeing these organizations, ensuring compliance with regulations.

- Key aspects of the IRS code: The IRS scrutinizes institutions’ adherence to their stated charitable purposes, financial transparency, and adherence to governance standards.

- Specific compliance requirements: Universities must demonstrate their commitment to educational mission, public benefit, and responsible financial management.

- Regular audits and reporting procedures: Regular audits and financial reporting are crucial for maintaining compliance and transparency.

- Consequences of non-compliance: Non-compliance can lead to the revocation of tax-exempt status, resulting in significant financial penalties and reputational damage.

Conclusion: The Future of Harvard's Tax-Exempt Status and its Broader Implications

The debate surrounding Harvard's Harvard tax-exempt status highlights the complex relationship between higher education, wealth, and the public good. While the president’s assertion regarding the illegality of revoking its status carries significant weight, the underlying concerns about wealth inequality and access to higher education remain critical. Understanding the legal framework governing tax exemption for universities and engaging in informed discussions about its societal impact is crucial. We encourage readers to delve deeper into the legal aspects of Harvard's non-profit status and explore the resources available to better understand the intricacies of this ongoing debate. Let's continue the conversation about fair taxation and the role of universities in society.

Featured Posts

-

Wind Power For Trains Reducing Pollution And Saving Energy

May 04, 2025

Wind Power For Trains Reducing Pollution And Saving Energy

May 04, 2025 -

James Burns Belfast Ex Soldiers Hospital Hammer Incident

May 04, 2025

James Burns Belfast Ex Soldiers Hospital Hammer Incident

May 04, 2025 -

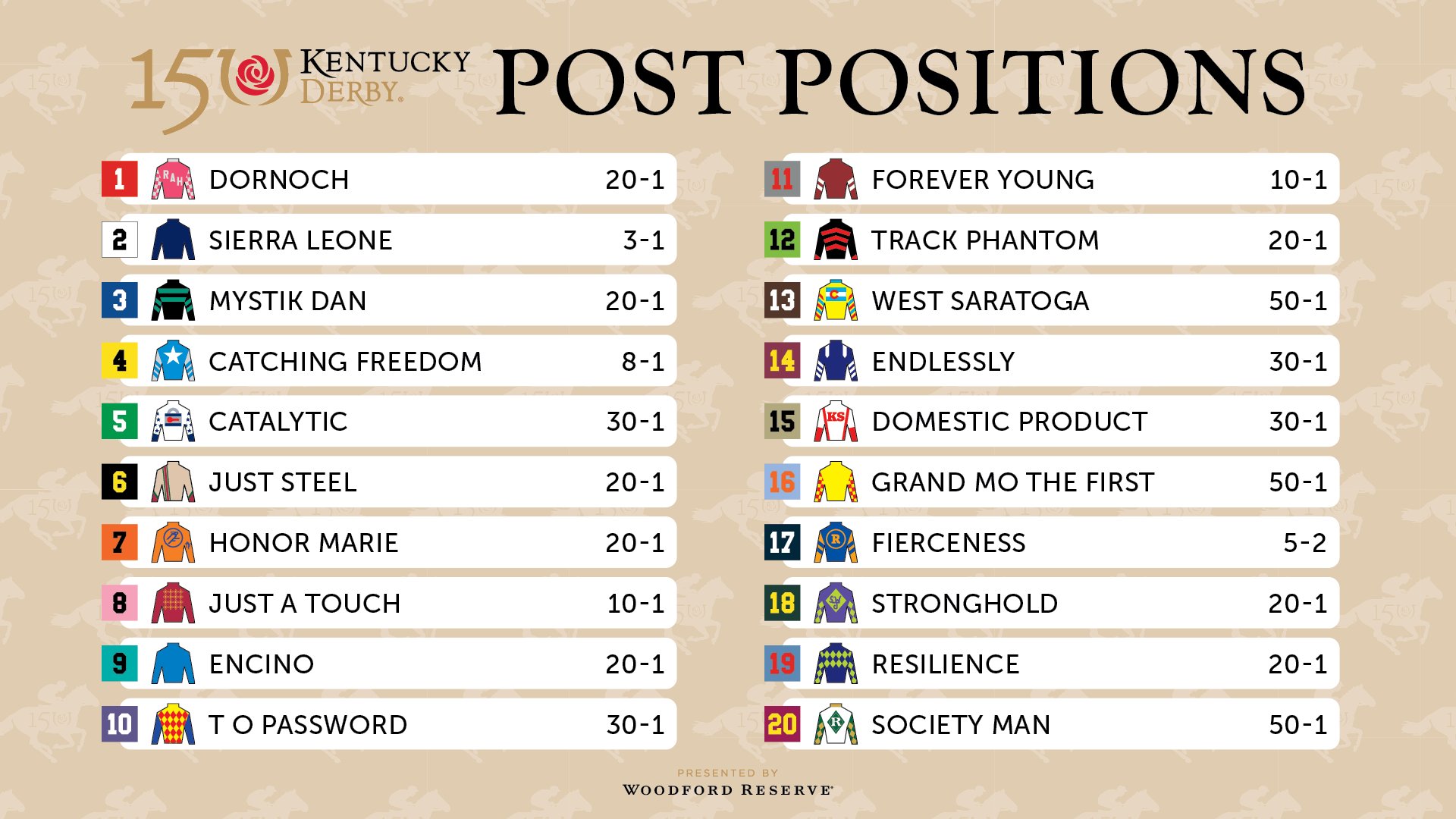

Kentucky Derby 2025 Analyzing The Potential Race Pace

May 04, 2025

Kentucky Derby 2025 Analyzing The Potential Race Pace

May 04, 2025 -

Ufc 314 Volkanovski Vs Lopes Who Won And Lost At Ufc 314

May 04, 2025

Ufc 314 Volkanovski Vs Lopes Who Won And Lost At Ufc 314

May 04, 2025 -

Exploring The Alleged Feud Between Blake Lively And Anna Kendrick

May 04, 2025

Exploring The Alleged Feud Between Blake Lively And Anna Kendrick

May 04, 2025