Heavy Rare Earths Revolution: Lynas Emerges As Top Producer Outside China

Table of Contents

Lynas's Strategic Advantage: Location and Processing Capabilities

Lynas's success stems from a strategic combination of factors, primarily its advantageous location and advanced processing capabilities. Unlike many rare earth miners who simply extract and export raw ores, Lynas boasts a vertically integrated approach, adding significant value through downstream processing.

Keywords: Lynas Malaysia, rare earth processing, downstream processing, value chain, Mount Weld mine, separation technology

- Access to High-Quality Ore: Lynas's Mount Weld mine in Australia provides access to one of the world's highest-grade rare earth deposits, offering a significant cost advantage. This superior ore quality is crucial for efficient and cost-effective processing.

- Advanced Separation Technologies: The company employs cutting-edge separation technologies to produce high-purity rare earth oxides. This sophisticated processing is crucial for meeting the stringent purity requirements of modern applications in electronics and clean energy.

- Strategic Malaysian Location: Lynas's processing facilities in Malaysia provide proximity to key Asian markets, minimizing transportation costs and lead times. This strategic location is critical for serving the burgeoning demand in the region.

- Downstream Processing Focus: By investing heavily in downstream processing, Lynas transforms raw materials into higher-value products, increasing profit margins and strengthening its position in the value chain. This integrated approach reduces reliance on external processors and strengthens supply chain resilience.

Meeting the Growing Demand for Heavy Rare Earths

Heavy rare earths, including neodymium, praseodymium, dysprosium, and terbium, are indispensable components in permanent magnets used in electric vehicles (EVs) and wind turbines. The global push towards renewable energy and electric mobility is driving an unprecedented surge in demand for these critical minerals. Lynas is uniquely positioned to capitalize on this growth.

Keywords: electric vehicles, wind turbines, permanent magnets, green technology, neodymium magnets, dysprosium magnets, supply chain security

- Strategic Partnerships: Lynas has forged strong partnerships with leading manufacturers in the EV and renewable energy sectors, securing long-term contracts and guaranteeing market access. These partnerships ensure consistent demand and support expansion plans.

- Capacity Expansion Plans: The company is aggressively expanding its production capacity to meet the escalating global demand. These expansion projects are crucial for maintaining supply and preventing shortages.

- Sustainable Mining Practices: Lynas is committed to sustainable and responsible mining practices, minimizing its environmental footprint and building a positive reputation within the industry. This commitment is vital for securing social license to operate and attracting investment.

- R&D Investment: Continued investment in research and development is improving extraction and processing efficiency, leading to lower costs and higher yields. This innovation is crucial for maintaining a competitive edge.

Challenges and Opportunities for Lynas

While Lynas's prospects are bright, the company faces significant challenges and opportunities. Navigating these complexities will be key to its long-term success.

Keywords: geopolitical risks, competition, regulatory hurdles, environmental concerns, investment needs

- Geopolitical Risks: Sourcing from Australia and operating in Malaysia introduces geopolitical risks that need careful management. Diversifying sources and operations can mitigate these risks.

- Intense Competition: Competition from Chinese producers remains fierce. Lynas must maintain a competitive edge through efficiency, innovation, and strategic partnerships.

- Regulatory Hurdles: Navigating regulatory hurdles, both in Australia and Malaysia, requires proactive engagement with government agencies. Transparency and responsible operations are crucial.

- Environmental Concerns: Addressing environmental concerns and ensuring responsible mining and processing practices are essential for maintaining a positive public image and securing long-term licenses.

- Significant Investment Needs: Funding substantial capacity expansion and technological advancements requires securing significant capital investment. Demonstrating consistent profitability and strong growth prospects is key.

The Geopolitical Implications of Lynas's Success

The emergence of Lynas as a major non-Chinese producer of heavy rare earths has profound geopolitical implications. It represents a critical step towards diversifying supply chains and reducing reliance on a single dominant player.

Keywords: supply chain diversification, geopolitical stability, US-China trade relations, Western economies, national security

- Supply Chain Resilience: A diversified supply chain for heavy rare earths enhances the security of Western economies, reducing vulnerability to geopolitical instability in China.

- Geopolitical Stability: A more balanced global supply reduces reliance on a single source, contributing to overall geopolitical stability.

- Strengthened Partnerships: Lynas's success is fostering stronger partnerships between the company and Western governments, creating a more collaborative approach to securing critical minerals.

- Market Influence: Lynas's increased production capacity has the potential to significantly influence the global pricing and trade dynamics of heavy rare earths.

Conclusion

Lynas's rise as a leading producer of heavy rare earths outside China signifies a pivotal shift in the global landscape. Its strategic advantages, focus on meeting growing demand, and commitment to sustainable practices position it for sustained success. The geopolitical implications are far-reaching, offering Western economies a critical opportunity to bolster their energy security and reduce reliance on a single supplier. Investing in the future of heavy rare earths is investing in a cleaner, more sustainable future. Learn more about Lynas and its vital role in the heavy rare earth revolution by visiting their website and following their progress in this critical sector.

Featured Posts

-

Conference Champions Crowned A Track Roundup Of Award Winners

May 17, 2025

Conference Champions Crowned A Track Roundup Of Award Winners

May 17, 2025 -

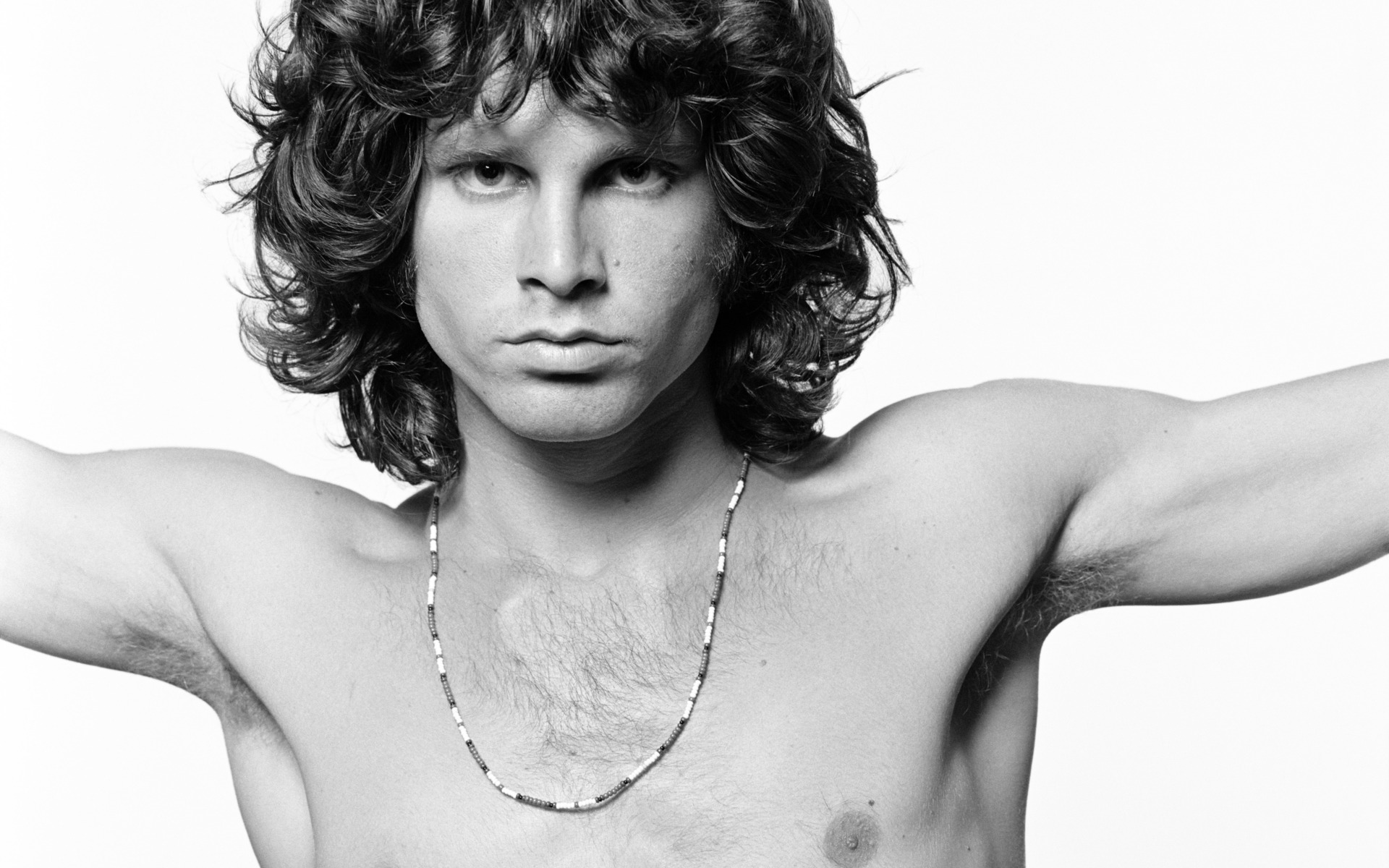

New York Maintenance Man Is It Really Jim Morrison Fans Claim Investigated

May 17, 2025

New York Maintenance Man Is It Really Jim Morrison Fans Claim Investigated

May 17, 2025 -

Thu Thiem Thien Duong Dien Anh Voi Phoi Canh Ven Song Hut Hon

May 17, 2025

Thu Thiem Thien Duong Dien Anh Voi Phoi Canh Ven Song Hut Hon

May 17, 2025 -

Investigation Reveals Final Moments Before Bayesian Superyacht Capsize

May 17, 2025

Investigation Reveals Final Moments Before Bayesian Superyacht Capsize

May 17, 2025 -

Tokyo Real Estate Soundproof Apartments And Quiet Salons For Peaceful Living

May 17, 2025

Tokyo Real Estate Soundproof Apartments And Quiet Salons For Peaceful Living

May 17, 2025