Hengrui Pharmaceuticals Receives Green Light For Hong Kong Share Offering

Table of Contents

Details of the Hong Kong Share Offering

The Hengrui Pharmaceuticals Hong Kong share offering represents a substantial fundraising opportunity. While precise details are still emerging, initial reports suggest a significant offering size. Key aspects of the share sale include:

- Total number of shares to be offered: [Insert number of shares when available. Placeholder: X million shares]

- Expected price range per share: [Insert price range when available. Placeholder: HKD Y - Z]

- Target fundraising amount: [Insert target amount when available. Placeholder: HKD X billion]

- Key dates for the offering: [Insert dates when available. Placeholder: Pricing date: [Date], Listing date: [Date]]

- Lead underwriters: [Insert names of underwriters when available. Placeholder: [Underwriter 1], [Underwriter 2], [Underwriter 3]]

- Potential use of funds: The proceeds from the share offering are expected to be primarily allocated to further research and development (R&D) initiatives, expansion into new therapeutic areas and geographical markets, and potential debt reduction. This strategic allocation highlights Hengrui’s commitment to long-term growth and innovation.

Strategic Implications for Hengrui Pharmaceuticals

Hengrui's decision to pursue a Hong Kong share offering is a strategically significant move driven by several key factors. This IPO offers considerable benefits:

- Access to a broader investor base: Listing in Hong Kong opens doors to a wider range of international and regional investors, providing access to a significantly larger pool of capital compared to relying solely on domestic markets.

- Increased capital for R&D and innovation: The substantial capital raised will fuel Hengrui's ambitious R&D pipeline, accelerating the development of innovative therapies and strengthening its competitive edge in the global pharmaceutical landscape.

- Expansion into new therapeutic areas or geographical markets: The influx of capital will allow Hengrui to aggressively pursue expansion into new therapeutic areas and geographical markets, solidifying its position as a major player in the global pharmaceutical industry.

- Strengthening of the company's financial position: The successful completion of the share offering will significantly strengthen Hengrui's financial standing, enhancing its resilience and providing greater flexibility for future strategic initiatives.

- Enhanced brand recognition: Listing on a prominent exchange like the Hong Kong Stock Exchange will further enhance Hengrui's brand recognition and credibility on the global stage.

Impact on the Hong Kong Stock Market

The Hengrui Pharmaceuticals Hong Kong share offering is anticipated to have a positive ripple effect on the Hong Kong stock market. Its potential impacts include:

- Potential increase in trading volume: The offering is likely to generate substantial trading volume, adding liquidity to the market and attracting increased investor interest.

- Attracting further investment in the Hong Kong pharmaceutical sector: Hengrui's successful listing could serve as a catalyst, attracting further investment into the Hong Kong pharmaceutical sector and stimulating growth within this important industry segment.

- Potential impact on overall market sentiment: A successful IPO from a major Chinese pharmaceutical company like Hengrui could positively influence overall investor sentiment and market confidence.

- Opportunities for investors: The offering provides investors with an excellent opportunity to gain exposure to a leading Chinese pharmaceutical company with a strong track record and significant growth potential.

Conclusion

The approval of Hengrui Pharmaceuticals' Hong Kong share offering marks a pivotal moment for the company and the broader market. This strategic move promises to significantly enhance Hengrui's financial strength, accelerate its global expansion, and bolster its R&D capabilities. The offering also holds significant potential to boost investor interest in the Hong Kong stock market and the pharmaceutical sector as a whole. Stay tuned for updates on the Hengrui Pharmaceuticals Hong Kong share offering and consider exploring investment opportunities in this dynamic and promising company. For more information, refer to reputable financial news sources and Hengrui Pharmaceuticals' investor relations page.

Featured Posts

-

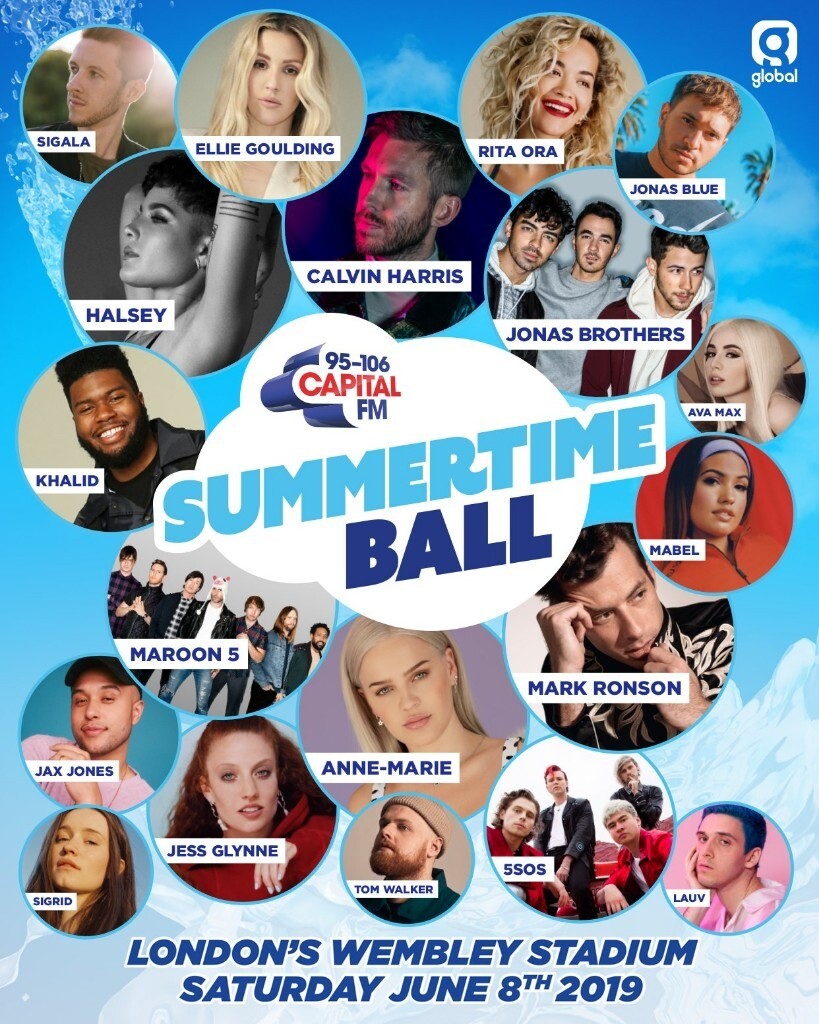

Capital Summertime Ball 2025 Tickets Avoid Scams And Buy Safely

Apr 29, 2025

Capital Summertime Ball 2025 Tickets Avoid Scams And Buy Safely

Apr 29, 2025 -

Why Making An All American Product Is So Difficult

Apr 29, 2025

Why Making An All American Product Is So Difficult

Apr 29, 2025 -

Brazil To Host Chargers And Justin Herbert In 2025 Season Opener

Apr 29, 2025

Brazil To Host Chargers And Justin Herbert In 2025 Season Opener

Apr 29, 2025 -

Pw C Withdraws From Nine African Countries Impact On Senegal Gabon And Madagascar

Apr 29, 2025

Pw C Withdraws From Nine African Countries Impact On Senegal Gabon And Madagascar

Apr 29, 2025 -

Ramiro Helmeyer A Commitment To Fc Barcelonas Glory

Apr 29, 2025

Ramiro Helmeyer A Commitment To Fc Barcelonas Glory

Apr 29, 2025