High Stock Market Valuations: A BofA Analysis For Investors

Table of Contents

BofA's Key Findings on High Stock Market Valuations

Bank of America's recent analysis sheds light on the prevailing high stock market valuations, raising important questions for investors about potential risks and opportunities. Their findings highlight several key concerns regarding current market multiples and price-to-earnings ratios (P/E). The analysis uses a range of valuation metrics to assess the overall health and potential for future growth within the market.

- Elevated P/E Ratios: BofA's report likely indicates that current P/E ratios for many sectors are significantly above their historical averages, suggesting that stocks may be overvalued. Specific data points from their report would need to be included here (e.g., "BofA found the average P/E ratio for the S&P 500 to be X, significantly higher than the historical average of Y").

- Sectoral Variations: The analysis may identify specific sectors as being particularly overvalued (e.g., technology) or undervalued (e.g., energy or financials). This information is crucial for strategic portfolio allocation. Including concrete examples of overvalued and undervalued sectors, based on BofA's findings, is essential.

- Cautious Outlook: BofA likely issues warnings about the potential for market corrections or periods of increased volatility given the elevated valuations. This cautionary note underscores the need for prudent risk management strategies.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors have contributed to the current environment of high stock market valuations. Understanding these factors is crucial for making informed investment decisions.

- Low Interest Rates and Quantitative Easing: The prolonged period of low interest rates and quantitative easing (QE) policies implemented by central banks have injected significant liquidity into the market, driving up asset prices, including stocks. This low interest rate environment has made borrowing cheaper for corporations and individuals, increasing demand for investments.

- Strong Corporate Earnings: Despite macroeconomic headwinds, many companies have reported strong earnings, further supporting high stock prices. This positive earnings performance has fueled investor confidence, contributing to elevated valuations. High earnings growth relative to inflation also supports higher valuations.

- Technological Innovation: Breakthroughs in technology continue to drive growth in specific sectors, supporting premium valuations for innovative companies. Rapid technological advancements frequently lead to disruptive changes in industries, creating attractive investment opportunities but also posing significant risks.

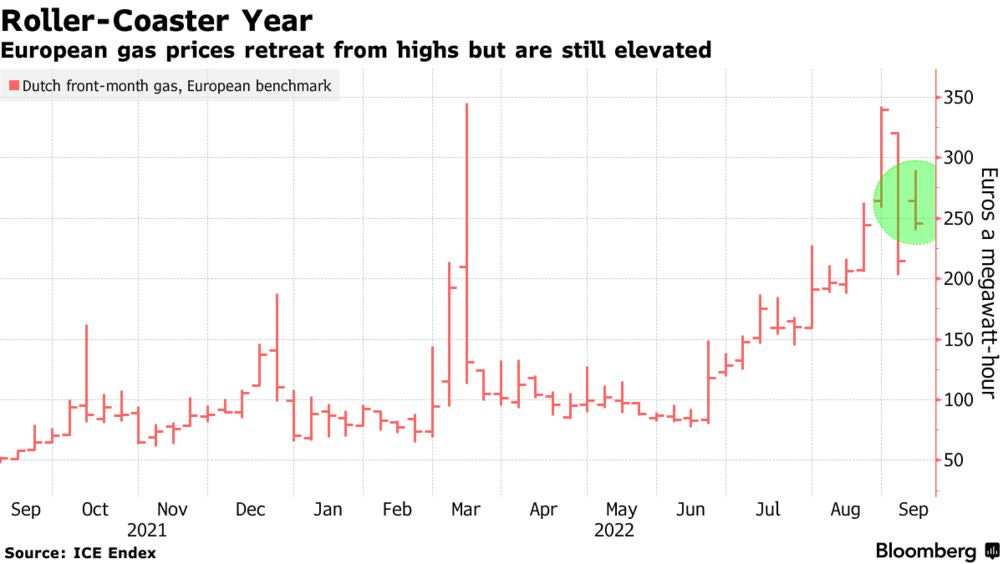

- Inflation and Economic Growth: The interplay between inflation and economic growth significantly impacts stock valuations. High inflation can erode purchasing power and affect corporate profitability, while strong economic growth tends to support higher stock prices. Analyzing the specific relationship observed by BofA in their analysis is important.

Investment Strategies in a High Valuation Environment

Navigating high stock market valuations requires a thoughtful and adaptable investment approach. Several strategies can help investors mitigate risk and potentially capitalize on opportunities.

- Value Investing: Focus on undervalued companies with strong fundamentals, offering a potentially higher return relative to their current market price. This involves identifying companies trading below their intrinsic value.

- Defensive Strategies: Shifting towards more defensive sectors (e.g., consumer staples, utilities) that are less sensitive to economic fluctuations can help protect portfolios during periods of market uncertainty. These are less volatile sectors that generally offer higher dividends than growth sectors.

- Portfolio Diversification: Diversifying investments across different asset classes (e.g., stocks, bonds, real estate) and sectors can reduce overall portfolio risk. This approach minimizes exposure to any single investment.

- Sector Rotation: Actively shifting investments from overvalued sectors to potentially undervalued ones based on market conditions and economic forecasts can improve portfolio performance. This requires careful monitoring of market trends and financial news.

- Long-Term Investment Horizon: Maintaining a long-term perspective can help investors ride out short-term market volatility and benefit from the long-term growth potential of the market. A long-term perspective minimizes the impact of short-term fluctuations.

Risks Associated with High Stock Market Valuations

High stock market valuations inherently carry significant risks that investors must acknowledge and address.

- Market Corrections: High valuations increase the likelihood of a market correction – a sharp and sudden decline in stock prices. This can lead to substantial portfolio losses if not properly managed.

- Increased Volatility: High valuations often correlate with increased market volatility, meaning that stock prices can experience larger and more frequent swings. This volatility poses challenges to investors attempting to time the market and to generate consistent returns.

- Inflation and Interest Rate Hikes: Rising inflation and subsequent interest rate hikes by central banks can negatively impact corporate profits and stock valuations, leading to a market downturn. These factors have a direct bearing on stock valuation and pricing models.

- Geopolitical Risks: Global events and geopolitical uncertainty can also trigger market corrections, regardless of underlying valuations. Investors need to be aware of geopolitical risks and their potential impact.

Mitigation Strategies: Investors can mitigate these risks through careful diversification, risk management techniques, and a thorough understanding of the companies they invest in. Thorough due diligence is essential before making investment decisions.

Navigating High Stock Market Valuations – A Call to Action

BofA's analysis underscores the importance of understanding the current environment of high stock market valuations and its associated risks. The strategies discussed – value investing, defensive positioning, diversification, and sector rotation – offer potential approaches to managing risk and pursuing opportunities in this challenging landscape. Remember, maintaining a long-term investment horizon is key.

To effectively manage your portfolio in the face of high stock market valuations, conduct further research, consult with a qualified financial advisor, and develop a well-informed investment strategy. Understanding BofA's analysis on high stock valuations, combined with careful planning and risk management, is crucial for navigating this complex market and achieving your financial goals. Don't underestimate the importance of developing robust high stock market valuation strategies to protect your investments.

Featured Posts

-

Is A New Cold War Inevitable Analyzing The Deterioration Of U S China Relations

Apr 22, 2025

Is A New Cold War Inevitable Analyzing The Deterioration Of U S China Relations

Apr 22, 2025 -

Analyzing The Economic Costs Of Trumps Policies

Apr 22, 2025

Analyzing The Economic Costs Of Trumps Policies

Apr 22, 2025 -

Hegseths Signal Chat Controversy Family Members Included In Sensitive Discussions

Apr 22, 2025

Hegseths Signal Chat Controversy Family Members Included In Sensitive Discussions

Apr 22, 2025 -

Deadline Looms Kyivs Crucial Decision On Trumps Ukraine Plan

Apr 22, 2025

Deadline Looms Kyivs Crucial Decision On Trumps Ukraine Plan

Apr 22, 2025 -

Will The Next Conclave Define Pope Franciss Historical Impact

Apr 22, 2025

Will The Next Conclave Define Pope Franciss Historical Impact

Apr 22, 2025