High Stock Market Valuations: A BofA Analyst's Take

Table of Contents

BofA's Valuation Metrics and Key Findings

BofA's assessment of current high stock market valuations relies on a comprehensive analysis of several key metrics. Their findings provide a nuanced picture of the market's overall health and potential risks.

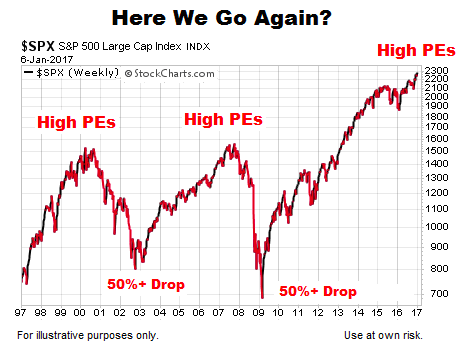

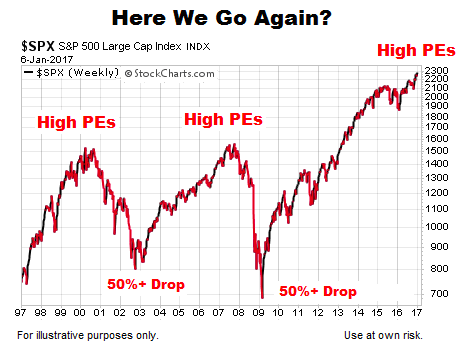

Price-to-Earnings (P/E) Ratios

BofA's analysis of Price-to-Earnings ratios reveals a mixed picture. While some sectors exhibit high P/E ratios, suggesting potential overvaluation, others show more modest valuations.

- Technology Sector: BofA notes significantly high P/E ratios in the technology sector, exceeding historical averages by a considerable margin. This reflects investor optimism about future growth, but also raises concerns about potential overvaluation if growth fails to materialize.

- Energy Sector: Conversely, the energy sector shows relatively low P/E ratios, potentially presenting attractive investment opportunities for investors with a higher risk tolerance. This is partly due to recent price volatility and the transition to renewable energy.

- Discrepancies: A key finding highlights discrepancies between current P/E ratios and long-term growth prospects in several sectors. BofA's report suggests that some companies with high P/E ratios may not justify their valuations based on their projected future earnings. For example, the report points to a specific example of Company X, whose current P/E ratio of 40 is significantly higher than its historical average of 20, and whose projected earnings growth doesn't fully support this elevated ratio.

Other Key Valuation Ratios

Beyond P/E ratios, BofA employs other crucial valuation ratios to form a holistic view.

- Price-to-Sales (P/S): This ratio, comparing a company's market capitalization to its revenue, shows elevated levels across various sectors, indicating potentially high valuations relative to sales. BofA suggests this metric should be considered alongside others for a complete assessment.

- Price-to-Book (P/B): The Price-to-Book ratio, comparing market capitalization to net asset value, also displays higher than average values, suggesting potential overvaluation in some cases.

- PEG Ratio: BofA's analysis incorporates the PEG ratio (P/E ratio divided by the expected earnings growth rate), aiming to account for the impact of future growth. High PEG ratios indicate potentially overvalued stocks even if P/E ratios appear acceptable.

BofA's Overall Assessment of Current Valuations

BofA's overall assessment is cautious. While acknowledging the strong corporate earnings and low interest rates supporting current valuations, the analysts express concerns about the elevated levels of several key valuation metrics. They conclude that certain sectors appear overvalued relative to historical averages and projected future growth.

- Key Factors: Interest rate hikes, potential economic slowdowns, and geopolitical instability are cited as key factors influencing their assessment. These factors can impact investor sentiment and potentially lead to market corrections.

- Market Outlook: BofA's report projects moderate economic growth in the near term but cautions against the risks associated with high valuations in a potentially volatile environment.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these dynamics is critical for making informed investment decisions.

Low Interest Rates

Historically low interest rates have played a significant role in driving up stock valuations.

- Impact on Investment: Low borrowing costs incentivize investment in equities, increasing demand and consequently pushing prices higher. This is because the returns from bonds and other fixed-income investments are relatively low, making stocks more attractive.

- Monetary Policy: The accommodative monetary policies implemented by central banks globally have contributed to these low interest rates. As interest rates rise, this effect might diminish.

Strong Corporate Earnings

Robust corporate earnings have supported high stock valuations, at least in some sectors.

- Earnings Growth: Strong earnings growth in several sectors has justified higher valuations for some companies. However, BofA's report suggests this is not universally true.

- Profitability: High profitability has bolstered investor confidence and driven up stock prices. However, sustainable earnings growth is key to maintaining these valuations.

Other Macroeconomic Factors

Beyond interest rates and earnings, other macroeconomic elements play a role.

- Inflation: Inflationary pressures, if sustained, can impact corporate profits and investor sentiment, potentially influencing stock valuations.

- Economic Growth Expectations: Positive economic growth expectations typically drive up stock prices, contributing to high valuations. However, the uncertainty surrounding future growth needs to be considered.

- Technological Advancements: Breakthroughs in technology often lead to investment booms in related sectors, pushing valuations higher.

Investment Implications and Strategies

BofA's analysis has significant implications for investors.

BofA's Recommendations for Investors

BofA advises caution in the current market environment. While opportunities exist, the high valuations necessitate a careful approach.

- Asset Allocation: The report suggests a cautious asset allocation strategy, potentially reducing exposure to sectors deemed overvalued.

- Sector-Specific Strategies: BofA suggests focusing on sectors with stronger fundamentals and sustainable growth prospects, such as certain areas within the energy sector.

Potential Risks and Opportunities

Investing in a market with high valuations involves inherent risks.

- Market Corrections: High valuations increase the likelihood of market corrections, meaning the potential for significant price drops.

- Market Bubbles: Certain sectors could be experiencing speculative bubbles, where prices are detached from underlying fundamentals.

- Opportunities: Despite the risks, opportunities exist for investors who conduct thorough due diligence and focus on undervalued companies with strong growth potential.

Conclusion: Navigating High Stock Market Valuations

BofA's analysis of high stock market valuations reveals a complex picture. While strong corporate earnings and low interest rates have contributed to elevated valuations, concerns remain regarding potential overvaluation in certain sectors and the impact of macroeconomic factors. Understanding these dynamics is crucial for investors. Key takeaways include the need for a cautious investment approach, diversification, and thorough due diligence. Understanding high stock market valuations is crucial for making informed investment decisions. Stay informed about market trends and consult with a financial advisor to develop a strategy that aligns with your risk tolerance and financial goals. Remember to regularly review your investment portfolio and adjust your strategy as market conditions change.

Featured Posts

-

The Evolution Of Androids Design Language

May 16, 2025

The Evolution Of Androids Design Language

May 16, 2025 -

Proyek Strategis Nasional Giant Sea Wall Dan Peran Swasta

May 16, 2025

Proyek Strategis Nasional Giant Sea Wall Dan Peran Swasta

May 16, 2025 -

Jill Biden And Joe Biden Advised To Distance Themselves From Politics

May 16, 2025

Jill Biden And Joe Biden Advised To Distance Themselves From Politics

May 16, 2025 -

Tactical Analysis Preparing To Face The San Jose Earthquakes

May 16, 2025

Tactical Analysis Preparing To Face The San Jose Earthquakes

May 16, 2025 -

Androids Refreshed Design Language User Interface Improvements

May 16, 2025

Androids Refreshed Design Language User Interface Improvements

May 16, 2025