High Stock Market Valuations: BofA's Arguments For Investor Calm

Table of Contents

BofA's Perspective on Current Market Valuations

BofA's overall stance is that while stock market valuations are elevated compared to historical averages, they aren't necessarily unsustainable or indicative of an imminent market crash. Their analysts suggest a more nuanced perspective than simply declaring a bubble.

-

BofA Reports and Analyst Statements: Several BofA reports, including their regular market commentaries and specific equity strategy papers, support this view. While specific reports change frequently, the overarching message often emphasizes the importance of considering the broader economic context and not solely focusing on price-to-earnings (P/E) ratios in isolation.

-

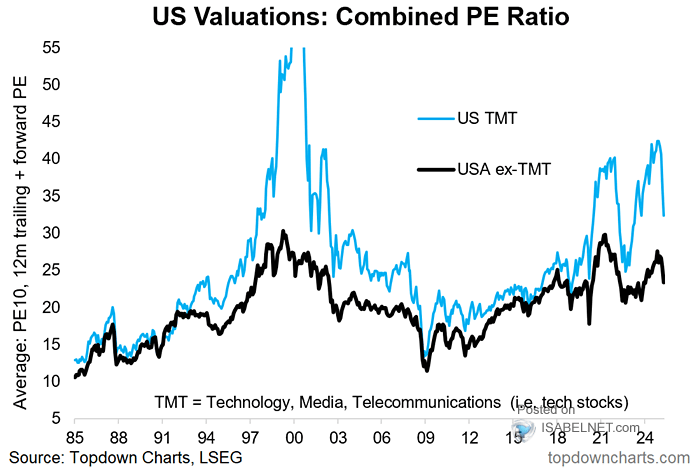

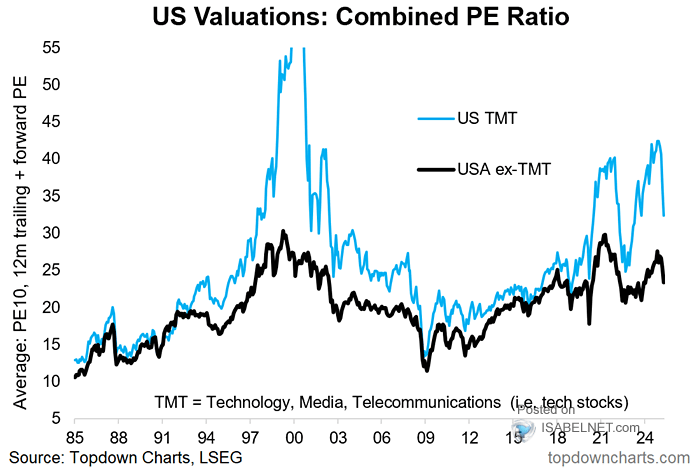

Valuation Metrics: BofA uses a variety of valuation metrics, including traditional P/E ratios, the cyclically adjusted price-to-earnings ratio (Shiller PE), and other forward-looking measures to assess market valuations. Their analysis often considers these metrics in conjunction with other fundamental factors.

-

Mitigating Valuation Risks: BofA often highlights factors that mitigate valuation risks, such as strong corporate earnings growth (discussed further below), persistently low interest rates (also explored below), and potential for further technological innovation driving future growth. This holistic approach emphasizes that valuation is only one piece of the puzzle.

The Role of Low Interest Rates in Supporting High Valuations

Low interest rates play a significant role in supporting high stock market valuations. This is a key element of BofA's argument for investor calm.

-

Inverse Relationship: There's an inverse relationship between interest rates and stock valuations. Lower interest rates make borrowing cheaper for companies, encouraging investment and potentially boosting earnings. Furthermore, low rates reduce the attractiveness of bonds, leading investors to seek higher returns in the equity market, driving up prices.

-

Impact on Discounted Cash Flow Models: Low discount rates, a consequence of low interest rates, increase the present value of future earnings in discounted cash flow (DCF) models, a common valuation tool. This translates to higher valuations for companies with strong future growth prospects.

-

Bonds vs. Equities: When interest rates are low, bond yields are also low, making equities a relatively more attractive investment for seeking higher returns, even with higher valuations. BofA often highlights this relative attractiveness in its analyses.

Strong Corporate Earnings and Future Growth Potential

BofA's analysis frequently points to strong corporate earnings and robust future growth potential as key justifications for current valuations.

-

Data Supporting Growth: BofA cites data showcasing strong corporate earnings growth across various sectors, particularly in technology, healthcare, and consumer staples. They often provide sector-specific analyses highlighting the drivers of this growth.

-

Sectors with Strong Growth Prospects: BofA typically identifies specific sectors with particularly promising growth prospects, providing detailed rationales for their optimistic assessments. This granular analysis adds credibility to their overall view on valuations.

-

Earnings Support Valuations: By demonstrating strong current earnings and projecting continued future growth, BofA argues that current high valuations are at least partially justified by the underlying fundamentals of the corporate sector.

Addressing Inflation and Potential Economic Slowdown Concerns

While acknowledging the risks posed by inflation and potential economic slowdowns, BofA's analysis attempts to temper overly pessimistic views.

-

Inflation's Impact: BofA analyzes the impact of inflation on stock prices, acknowledging potential negative effects but often highlighting the ability of companies to pass on increased costs to consumers in certain sectors, mitigating some of the inflationary pressure.

-

Economic Slowdown Assessment: BofA assesses the likelihood and potential severity of an economic slowdown, often presenting various scenarios and their likely effects on the market. Their assessments are generally data-driven and incorporate a range of economic indicators.

-

Risk Mitigation Strategies: While specific strategies may vary over time, BofA generally suggests diversification and a balanced approach to portfolio management to mitigate potential risks associated with an economic slowdown or increased inflation.

BofA's Recommended Portfolio Strategies

BofA's recommendations often involve maintaining a diversified portfolio, considering defensive sectors alongside growth stocks, and potentially adjusting allocations based on their ongoing analysis of the economic outlook. The exact strategies vary depending on the current market conditions and are best obtained from their most recent publications and analyst reports.

Conclusion

BofA's arguments for investor calm regarding high stock market valuations hinge on the interplay between low interest rates, strong corporate earnings, and a nuanced assessment of potential economic headwinds. While acknowledging the inherent risks associated with elevated valuations, they highlight the importance of considering the broader economic context. This holistic approach suggests that current valuations, while high, may not necessarily signal an immediate market crash.

While understanding BofA's perspective on high stock market valuations is crucial, it's essential to remember that market conditions are constantly evolving. Conduct thorough research, consult with a qualified financial advisor to develop a personalized investment strategy aligned with your risk tolerance, and stay informed about future updates on high stock market valuations and BofA's ongoing analysis. Making informed decisions about your investments in the face of high stock market valuations requires careful consideration and ongoing monitoring.

Featured Posts

-

Jensons Fw 22 Extended Whats New And Improved

May 26, 2025

Jensons Fw 22 Extended Whats New And Improved

May 26, 2025 -

Suspect Apprehended In Myrtle Beach Hit And Run Death

May 26, 2025

Suspect Apprehended In Myrtle Beach Hit And Run Death

May 26, 2025 -

Auction Alert Rare Michael Schumacher Benetton F1 Show Car

May 26, 2025

Auction Alert Rare Michael Schumacher Benetton F1 Show Car

May 26, 2025 -

Nach Langer Wartezeit Der Hsv Kehrt In Die Bundesliga Zurueck

May 26, 2025

Nach Langer Wartezeit Der Hsv Kehrt In Die Bundesliga Zurueck

May 26, 2025 -

Affaire Le Pen Decision D Appel Apres Condamnation A De La Prison Et Ineligibilite

May 26, 2025

Affaire Le Pen Decision D Appel Apres Condamnation A De La Prison Et Ineligibilite

May 26, 2025