High Stock Market Valuations: BofA's Arguments For Investor Confidence

Table of Contents

BofA's Argument: Low Interest Rates Justify High P/E Ratios

The Relationship Between Interest Rates and Stock Valuations

There's an inverse relationship between interest rates and stock valuations. Low interest rates make future earnings more valuable, thus justifying higher Price-to-Earnings (P/E) ratios. This is because when interest rates are low, the opportunity cost of investing in stocks (versus, say, bonds) is reduced. Investors are less inclined to seek the safety of bonds offering meager returns, shifting their focus to potentially higher-yielding equities.

- Lower borrowing costs for companies: Low interest rates translate to cheaper borrowing for corporations. This leads to increased investment in expansion, innovation, and ultimately, higher profitability.

- Investor demand in a low-interest-rate environment: When bonds offer paltry returns, investors seek higher returns elsewhere, driving up demand (and prices) for stocks. This increases P/E ratios, as investors are willing to pay more for each dollar of earnings.

- Current interest rate environment and its impact: The current low-interest-rate environment, a consequence of various economic factors including quantitative easing and global economic uncertainty, significantly contributes to higher stock valuations. This is a key element of BofA's argument for justifying high P/E ratios.

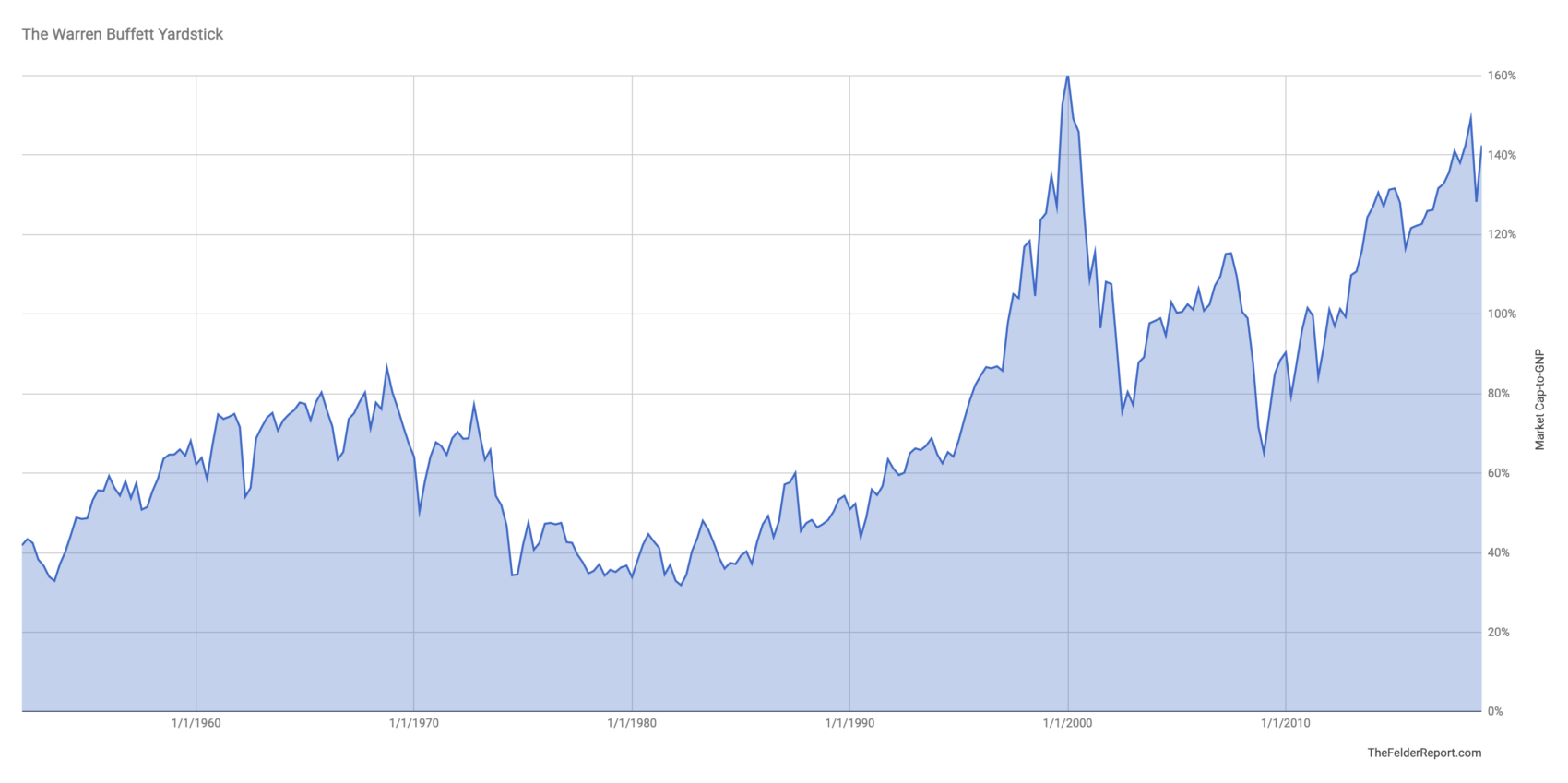

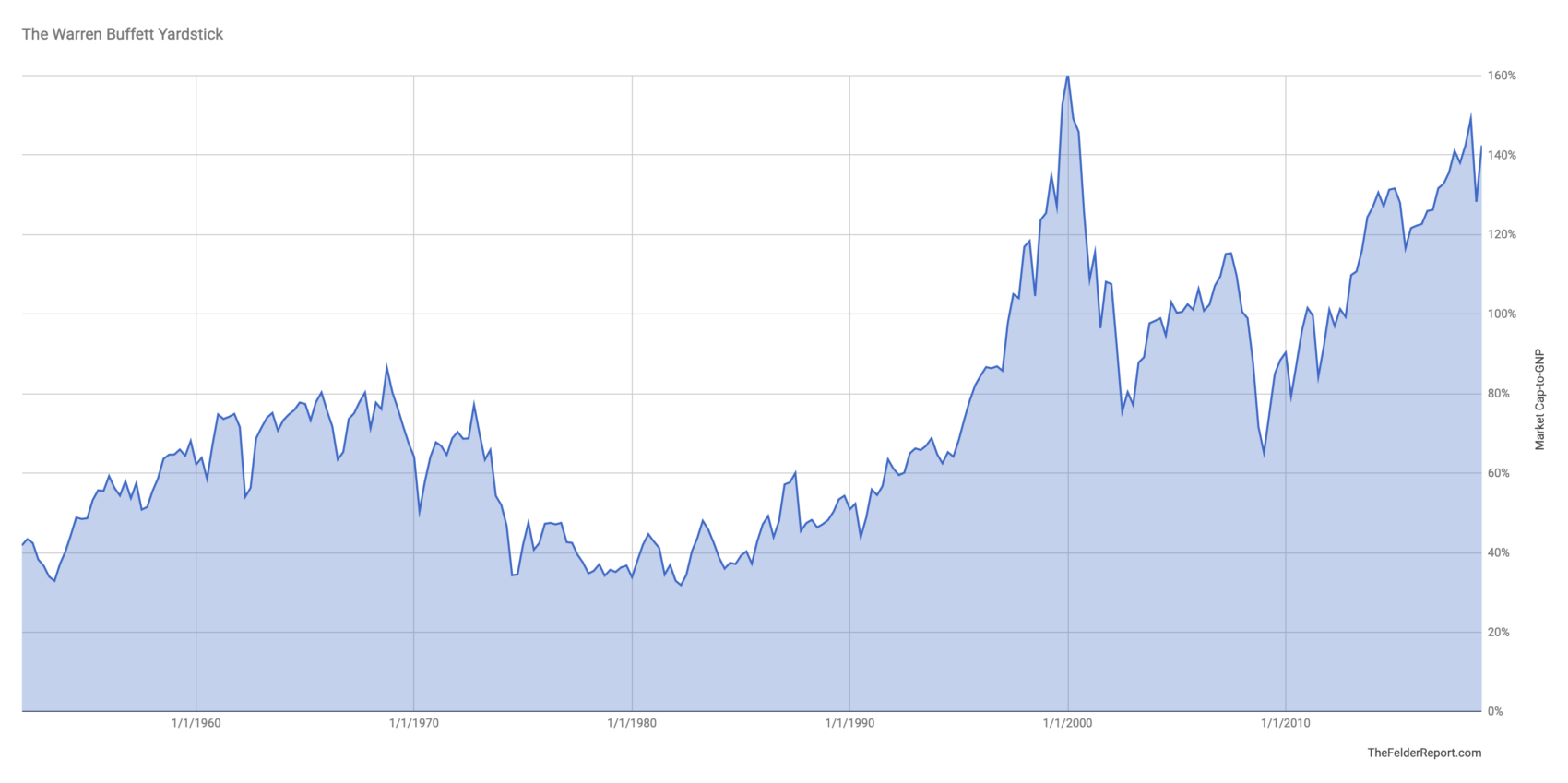

Supporting Details: Recent BofA reports (citations needed here – replace with actual report links and data) show a strong historical correlation between low interest rates and elevated P/E ratios across various market indices. Charts illustrating this correlation would visually reinforce this point.

Strong Corporate Earnings Growth: A Foundation for Higher Valuations

Analyzing Corporate Profitability and Growth Projections

BofA's analysis points to robust corporate earnings growth as a significant justification for current valuations. Their projections highlight continued, albeit potentially moderating, growth across various sectors.

- Sectors with robust earnings growth: Technology, healthcare, and select consumer discretionary sectors are cited as showing particularly strong earnings performance (again, cite BofA reports and specific data here).

- Impact of technological innovation and global economic trends: BofA emphasizes the role of technological advancements and evolving global economic landscapes in driving corporate profitability. These factors contribute to sustained earnings growth, even amidst economic uncertainties.

- BofA's predictions for future earnings growth: BofA's projections for future earnings growth are crucial to their overall assessment. While specifics would need to be sourced directly from BofA reports, incorporating these predictions here is essential.

Supporting Details: Statistical data, including revenue growth figures, earnings per share (EPS) growth, and profit margin expansion across various sectors, should be included to substantiate these claims. Graphs and charts visualizing this data will enhance understanding and impact.

Long-Term Growth Potential Outweighs Short-Term Volatility

The Importance of a Long-Term Investment Horizon

BofA strongly advocates for long-term investment strategies to navigate the inherent volatility of the stock market. This perspective aligns with their view on current high stock market valuations.

- Market cycles and their natural volatility: Stock markets are cyclical, experiencing periods of growth and contraction. Short-term fluctuations are normal and should not necessarily trigger panic selling.

- Long-term historical performance of the stock market: Historically, the stock market has delivered positive returns over the long term, despite periods of volatility. This historical data supports BofA's long-term investment strategy.

- BofA's strategies for long-term investment success: BofA likely offers specific recommendations for long-term investors – these recommendations, along with relevant links to their resources, should be incorporated here.

Supporting Details: Include historical data illustrating the long-term performance of major stock market indices. Charts showing average annual returns over decades are highly relevant. Discuss risk mitigation techniques, such as diversification and strategic asset allocation.

Addressing Concerns Regarding High Valuations

Counterarguments to Market Overvaluation Concerns

Addressing concerns about overvalued markets is crucial. BofA likely counters these concerns by:

- Addressing concerns about potential market bubbles: BofA will likely argue that current valuations, while high, aren't necessarily indicative of a market bubble, pointing to underlying fundamentals and robust earnings growth.

- Discussing the impact of inflation on stock valuations: Inflation's impact on valuations needs to be considered. BofA’s perspective on inflation's influence on their assessment of high stock market valuations should be highlighted.

- Explaining how BofA factors in potential risks: Transparency on how BofA assesses and accounts for potential risks (e.g., interest rate hikes, geopolitical instability) is key.

Supporting Details: Provide data and analysis refuting common concerns about overvaluation. Detail BofA's risk management strategies and how they factor into their overall assessment.

Conclusion

BofA's arguments for maintaining investor confidence despite high stock market valuations rest on three pillars: low interest rates justifying higher P/E ratios, strong corporate earnings growth supporting current valuations, and the long-term growth potential of the market outweighing short-term volatility. While acknowledging inherent market risks, BofA's analysis suggests a nuanced perspective on the current market landscape. Don't let high stock market valuations deter you from a well-informed investment strategy. Understanding BofA's analysis of high stock market valuations can empower you to make better investment decisions. [Link to relevant BofA resources or financial planning tools]

Featured Posts

-

Worldwide Reddit Outage Affecting Thousands Of Users

May 18, 2025

Worldwide Reddit Outage Affecting Thousands Of Users

May 18, 2025 -

Eurovision 2025 Guest Performer The Damiano David Speculation

May 18, 2025

Eurovision 2025 Guest Performer The Damiano David Speculation

May 18, 2025 -

View The Daily Lotto Results Friday April 18 2025

May 18, 2025

View The Daily Lotto Results Friday April 18 2025

May 18, 2025 -

Investigating Red Carpet Rule Infractions Guest Behavior Explained

May 18, 2025

Investigating Red Carpet Rule Infractions Guest Behavior Explained

May 18, 2025 -

Navigating The China Market Challenges Faced By Bmw Porsche And Competitors

May 18, 2025

Navigating The China Market Challenges Faced By Bmw Porsche And Competitors

May 18, 2025