High Stock Prices: BofA's Rationale For Investor Calm

Table of Contents

H2: BofA's Economic Outlook and its Impact on Stock Prices

BofA's current economic forecast plays a pivotal role in their assessment of high stock prices. Their analysts predict continued, albeit moderated, economic growth, supported by a resilient labor market and sustained consumer spending. While inflation remains a concern, BofA anticipates a gradual decline towards the target rate, driven by easing supply chain pressures and moderating demand.

- Key Economic Indicators:

- Projected GDP growth: [Insert BofA's projected GDP growth rate and timeframe].

- Inflation rate forecast: [Insert BofA's inflation forecast and timeframe].

- Unemployment rate prediction: [Insert BofA's unemployment rate prediction and timeframe].

- Sustainability of High Stock Prices: BofA argues that these positive economic indicators, while acknowledging potential headwinds, justify the current, relatively high stock valuations. They believe that strong corporate earnings and continued investor confidence, bolstered by these economic projections, support the current market levels. However, they caution that unforeseen economic shocks could alter this outlook.

H2: Analyzing Corporate Earnings and Profitability

BofA's assessment of corporate earnings is another key component of their perspective on high stock prices. They highlight robust profitability across several key sectors, including technology, healthcare, and consumer staples. These strong earnings, they contend, are a significant factor in supporting current market valuations.

- High-Performing Sectors:

- Technology: [Specific examples of strong performance within the tech sector, backed by data].

- Healthcare: [Specific examples of strong performance within the healthcare sector, backed by data].

- Consumer Staples: [Specific examples of strong performance within the consumer staples sector, backed by data].

- Addressing Overvaluation Concerns: While acknowledging the potential for overvaluation in certain segments, BofA analyzes Price-to-Earnings (P/E) ratios and other key financial metrics to determine if current earnings justify the high stock prices. They suggest that a nuanced approach, sector by sector analysis, is crucial, rather than a blanket judgment.

H2: The Role of Interest Rates and Monetary Policy

BofA carefully considers the impact of interest rates and monetary policy on stock valuations. They anticipate a continued, though likely slower, pace of interest rate increases by the Federal Reserve, aiming to curb inflation without triggering a recession. This measured approach, according to BofA, is likely to mitigate the negative impact on stock market performance.

- Federal Reserve's Monetary Policy: BofA analyzes the Fed's actions and statements, interpreting their signals regarding future interest rate adjustments. [Insert BofA's interpretation of Fed policy and its impact on the market].

- Interest Rate Predictions:

- [Insert BofA's predictions for interest rate changes in the coming quarters/years].

- [Explain the reasoning behind these predictions, linking them to economic indicators].

H2: Addressing Investor Concerns about Potential Market Corrections

BofA acknowledges the valid concerns many investors have regarding potential market corrections or even a significant downturn. However, they emphasize the importance of a long-term investment strategy and stress the benefits of diversification to mitigate risk.

- Mitigating Risk: BofA recommends a diversified portfolio, incorporating a mix of asset classes to reduce the impact of any single sector's underperformance. They also advocate for regular portfolio rebalancing to maintain the desired asset allocation.

- BofA's Advice for Navigating Volatility:

- Maintain a long-term investment horizon.

- Diversify your portfolio across different asset classes and sectors.

- Regularly review and rebalance your portfolio.

- Avoid making impulsive decisions based on short-term market fluctuations.

Conclusion: Maintaining Calm in the Face of High Stock Prices – BofA's Advice

BofA's rationale for investor calm amidst high stock prices rests on a combination of factors: a positive, albeit cautious, economic outlook; robust corporate earnings in key sectors; a measured approach to interest rate adjustments by the Federal Reserve; and the importance of long-term investment strategies and risk management. While acknowledging the potential for market corrections, BofA emphasizes the need to consider the broader economic picture and the strength of underlying corporate performance. Before making any investment decisions regarding high stock prices, or managing high stock market valuations, it's crucial to consult with a qualified financial professional and conduct thorough, independent research. Remember that understanding high stock prices requires a comprehensive analysis considering multiple factors.

Featured Posts

-

Pabrik Zuffenhausen Jejak Sejarah Porsche 356 Yang Ikonik

Apr 29, 2025

Pabrik Zuffenhausen Jejak Sejarah Porsche 356 Yang Ikonik

Apr 29, 2025 -

Remembering A Happy Day February 20 2025

Apr 29, 2025

Remembering A Happy Day February 20 2025

Apr 29, 2025 -

Revolutionizing Voice Assistant Development Open Ais 2024 Announcements

Apr 29, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcements

Apr 29, 2025 -

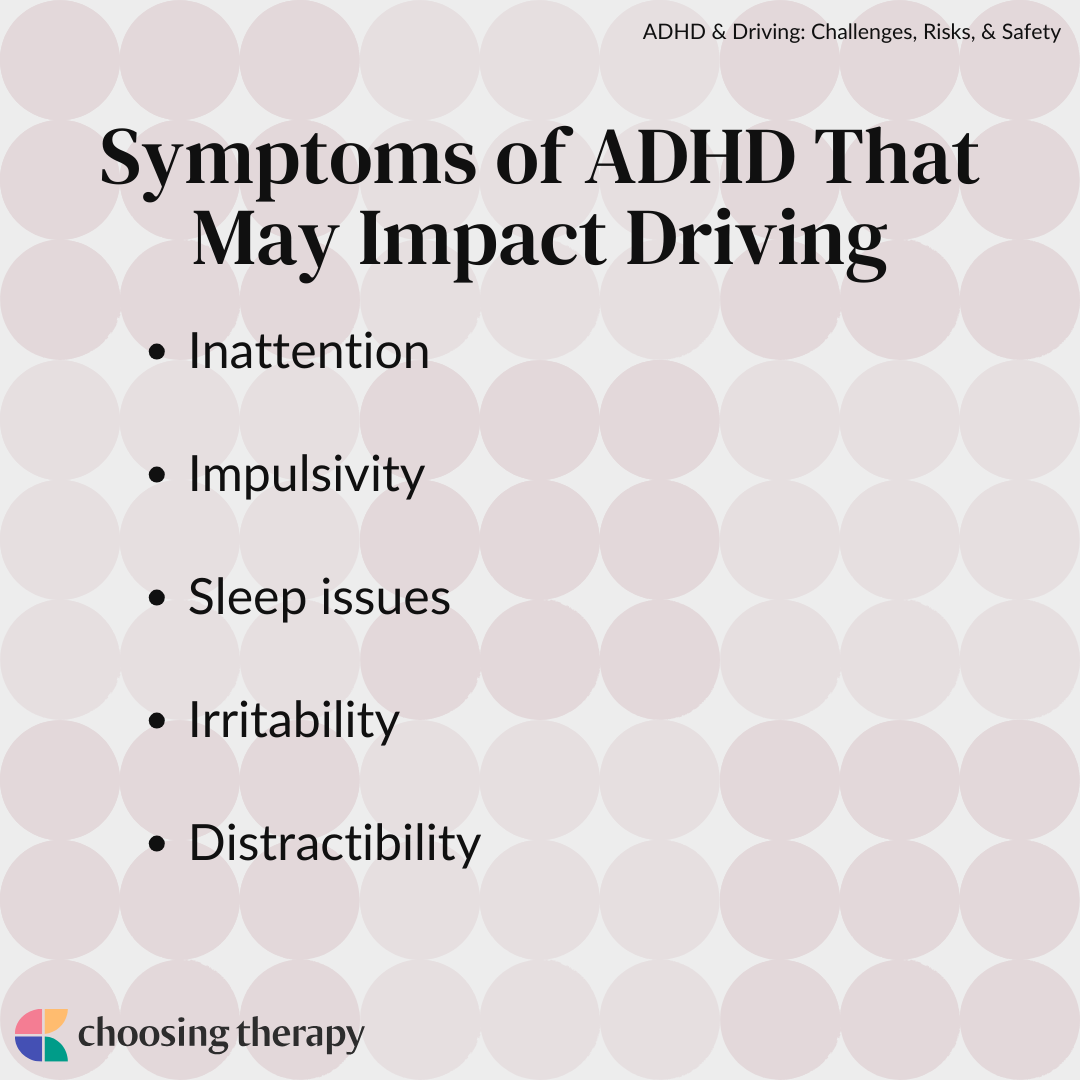

Adhd And Driving Research Based Strategies For Safer Driving

Apr 29, 2025

Adhd And Driving Research Based Strategies For Safer Driving

Apr 29, 2025 -

Us Attorney General Targets Minnesota Over Transgender Sports Policy

Apr 29, 2025

Us Attorney General Targets Minnesota Over Transgender Sports Policy

Apr 29, 2025