High Stock Valuations And Investor Worry: BofA's Analysis

Table of Contents

BofA's Key Findings on High Stock Valuations

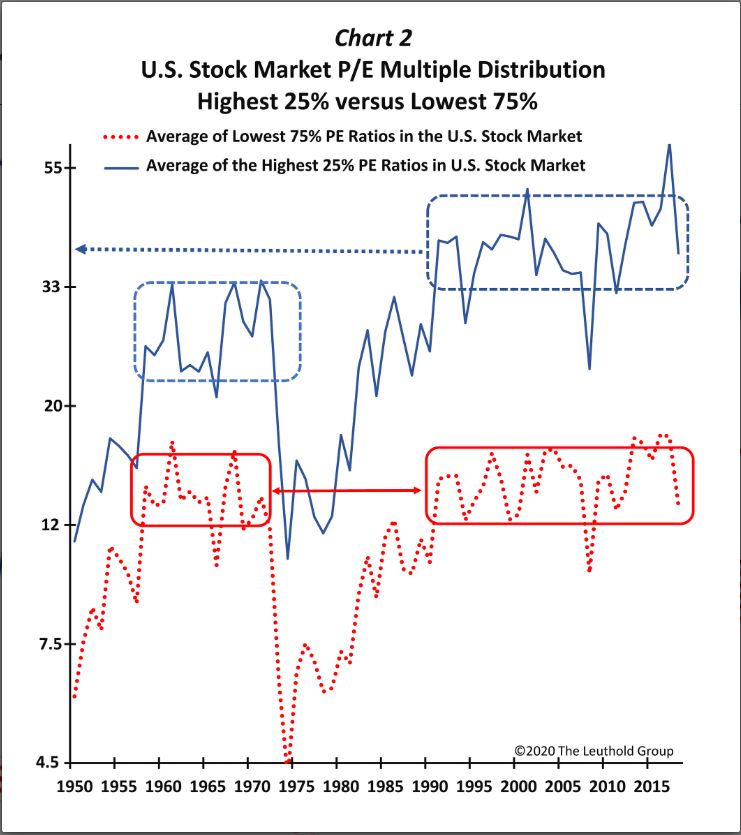

BofA's latest report paints a picture of a market characterized by elevated valuations. The analysis utilizes several key valuation metrics, primarily focusing on the Price-to-Earnings ratio (P/E) to assess the relative expensiveness of stocks. While specific data points from the report may vary depending on the release date, the overall trend consistently points towards high valuations across numerous sectors.

- High P/E Ratios: BofA's assessment likely reveals that current P/E ratios for the broader market are significantly above historical averages, suggesting that stocks are trading at premium prices compared to their earnings. This discrepancy warrants careful consideration.

- Sector-Specific Overvaluations: Certain sectors are often highlighted as exhibiting particularly high valuations. Technology stocks, for instance, are frequently identified as being susceptible to significant corrections due to their often-high growth expectations baked into their prices. Other sectors, depending on macroeconomic factors, may also experience similar pressures.

- Individual Overvalued Stocks: While BofA likely avoids explicitly naming specific stocks as "overvalued," the report may indirectly point toward certain companies with exceptionally high P/E ratios, indicating a higher level of risk compared to others. Independent analysis of specific companies remains crucial for individual investors.

- Interest Rate Impact: The report undoubtedly acknowledges the impact of rising interest rates on stock valuations. Higher interest rates increase the cost of borrowing, making investments less attractive and potentially leading to a decrease in stock prices, especially for growth stocks heavily reliant on future earnings.

Investor Sentiment and the Impact of High Stock Valuations

High stock valuations are significantly impacting investor sentiment, leading to increased risk aversion and market volatility. The fear of a market correction or even a crash is palpable.

- Reduced Trading Volume: Investor apprehension may be reflected in reduced trading volume, suggesting a reluctance to engage in the market due to uncertainty.

- Increased Cash Holdings: Many investors are opting for increased cash holdings as a precautionary measure, reducing their exposure to the potentially volatile stock market.

- Market Corrections and Crashes: The historical relationship between high valuations and subsequent market corrections or crashes is a major source of concern. While not guaranteed, the risk of a significant downturn is certainly amplified in such environments.

- Alternative Investment Strategies: As a result, investors are exploring alternative investment strategies, such as diversifying into less volatile asset classes or adopting more conservative investment approaches.

Strategies for Navigating High Stock Valuations

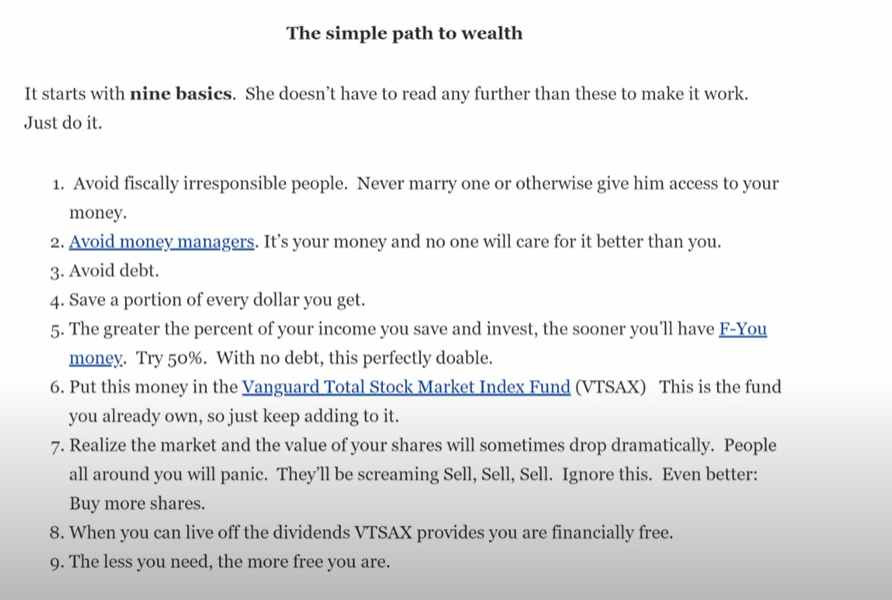

Given the elevated valuations, investors need a proactive strategy to navigate the current market landscape. A diversified approach, coupled with robust risk management, is paramount.

- Portfolio Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) is crucial to reduce overall portfolio risk. Diversification across geographical regions and sectors is equally important.

- Risk Management Techniques: Implementing stop-loss orders, setting realistic profit targets, and maintaining adequate cash reserves are effective risk management techniques.

- Value Investing: Value investing, a strategy focused on identifying undervalued companies, can be a compelling approach in a high-valuation market. This involves finding companies with strong fundamentals trading at prices below their intrinsic worth.

- Defensive Investing: Defensive investing involves focusing on companies with stable earnings and lower volatility, offering a degree of protection against market downturns. These companies are often less affected by market fluctuations.

Long-Term Outlook and Potential Risks

The long-term outlook for the stock market remains uncertain, contingent on numerous macroeconomic and geopolitical factors.

- Inflation's Impact: Persistent inflation erodes purchasing power and can significantly impact stock valuations. High inflation often forces central banks to raise interest rates, further impacting stock prices.

- Recession Risk: The risk of a recession, triggered by various factors including high inflation and interest rates, presents a significant threat to the stock market. A recession would likely lead to lower corporate earnings and reduced stock prices.

- Geopolitical Risks: Geopolitical instability, such as wars or trade disputes, can introduce substantial uncertainty and volatility into the market. These events can disrupt supply chains and negatively affect investor sentiment.

Conclusion

BofA's analysis underscores the significant concerns surrounding high stock valuations. The potential for market corrections or crashes, combined with the impact of inflation and geopolitical risks, necessitates a cautious and informed investment approach. It's vital to understand the risks associated with high stock valuations and adapt your investment strategy accordingly. Stay informed about high stock valuations and develop a robust investment strategy to navigate market uncertainty. Conduct thorough research and consider consulting a financial advisor before making investment decisions. Learn more about managing your portfolio effectively in the face of high stock valuations.

Featured Posts

-

I Nea Komodia Jay Kelly Me Toys Kloynei Kai Santler Ploki Ithopoioi Kai Imerominia Kykloforias

May 11, 2025

I Nea Komodia Jay Kelly Me Toys Kloynei Kai Santler Ploki Ithopoioi Kai Imerominia Kykloforias

May 11, 2025 -

Le Fil D Ariane Avec Chantal Ladesou La Nouvelle Saison Sur Tf 1

May 11, 2025

Le Fil D Ariane Avec Chantal Ladesou La Nouvelle Saison Sur Tf 1

May 11, 2025 -

Bundesliga Absteiger Bochum Und Holstein Kiel Leipzig Entgeht Der Champions League

May 11, 2025

Bundesliga Absteiger Bochum Und Holstein Kiel Leipzig Entgeht Der Champions League

May 11, 2025 -

High Yield Dividend Investing The Easy Path To Success

May 11, 2025

High Yield Dividend Investing The Easy Path To Success

May 11, 2025 -

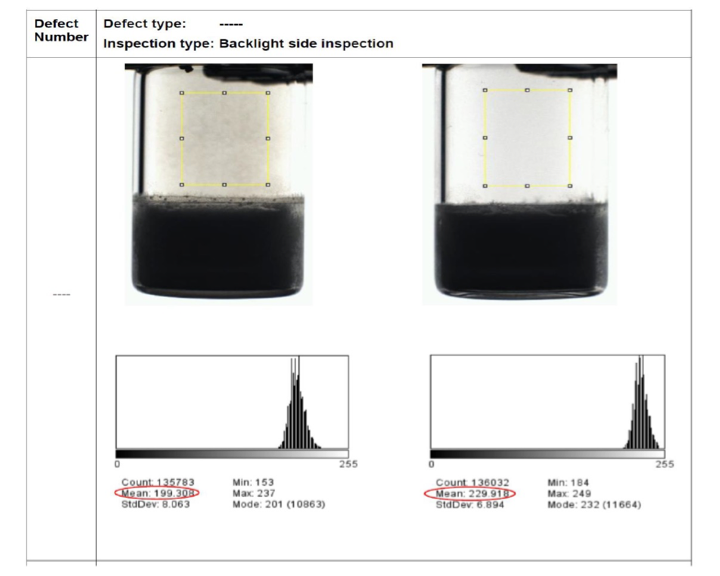

Optimization Strategies For Automated Visual Inspection Of Lyophilized Vials

May 11, 2025

Optimization Strategies For Automated Visual Inspection Of Lyophilized Vials

May 11, 2025