High Stock Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

Understanding Current High Stock Valuations: A Deeper Dive

The term "high stock valuations" refers to a situation where the prices of stocks are considered expensive relative to their underlying fundamentals. Several metrics are used to assess valuations, including:

- Price-to-Earnings Ratio (P/E Ratio): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are willing to pay more for each dollar of earnings, indicating potentially high expectations for future growth.

- Market Cap to GDP: This compares the total market capitalization of all publicly traded companies to a country's gross domestic product. A high ratio suggests a potentially overvalued market.

- Shiller PE Ratio (CAPE Ratio): This adjusts the P/E ratio using inflation-adjusted earnings from the past 10 years, providing a smoother, long-term view of valuation.

Several factors have contributed to the current high valuations:

- Low Interest Rates: Historically low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks. [Link to reputable source on interest rates]

- Quantitative Easing (QE): Central banks' injection of liquidity into the market through QE programs has increased the money supply, boosting asset prices, including stocks. [Link to reputable source on QE]

- Strong Corporate Earnings: Many companies have reported robust earnings, fueling investor optimism and driving up stock prices. [Link to reputable source on corporate earnings]

- Technological Advancements: Innovation in sectors like technology and biotechnology has spurred significant growth and high valuations for companies in these fields. [Link to reputable source on tech advancements]

While these factors have contributed to growth, it's crucial to acknowledge the potential risks associated with high valuations:

- Increased Market Volatility: High valuations can make markets more susceptible to sharp corrections.

- Inflationary Pressures: Sustained high valuations could contribute to inflationary pressures in the broader economy.

- Potential for Overvaluation in Specific Sectors: Some sectors might be significantly overvalued despite the overall market appearing reasonably priced.

BofA's Perspective: Why the Current Market Isn't Necessarily Overvalued

BofA's analysis suggests that while valuations are elevated, a market crash isn't inevitable. Their arguments typically center on:

- Long-Term Growth Potential: BofA often points to the continued growth potential of the global economy and specific sectors, arguing that current valuations are justified by future earnings expectations. [Link to BofA report, if available]

- Sustainable Earnings Growth: Their analysis likely focuses on companies demonstrating consistent and sustainable earnings growth, supporting higher valuations. [Link to BofA report, if available]

- Specific Sector Analysis: BofA may identify sectors or companies that are reasonably valued despite high overall market valuations, highlighting opportunities for selective investment. [Link to BofA report, if available]

BofA's research might emphasize a long-term perspective, suggesting that short-term market fluctuations are less critical than the overall trajectory of economic and corporate growth.

Strategies for Navigating High Stock Valuations

Based on BofA's insights and general investment wisdom, investors can employ several strategies:

- Diversification: Spread investments across different asset classes (stocks, bonds, real estate, etc.) to mitigate risk.

- Long-Term Investing: Maintain a long-term investment horizon, allowing time to ride out short-term market volatility.

- Value Investing: Focus on companies with strong fundamentals and a history of consistent earnings growth, potentially offering better value relative to their price.

- Risk Management: Implement stop-loss orders and other risk management techniques to limit potential losses.

- Regular Portfolio Review: Regularly review and adjust your portfolio to reflect changing market conditions and your investment goals.

Addressing Common Concerns About High Stock Valuations

Many investors worry about:

- Market Crashes: While high valuations increase the risk of a correction, history shows that markets recover over time. [Link to data on historical market corrections]

- Inflation: Inflation can erode the real value of investments, but a balanced portfolio and diversification can help mitigate this risk. [Link to data on inflation and investment strategies]

It's crucial to stay informed by consulting reliable financial news sources and potentially seeking advice from a financial advisor. Don't rely solely on anecdotal evidence or social media for investment decisions.

Maintaining Perspective on High Stock Valuations – A Call to Action

BofA's perspective, coupled with sound investment principles, suggests that while high stock valuations warrant caution, panic selling is rarely the optimal response. Informed decision-making, a long-term outlook, and a well-diversified portfolio are key to navigating this market. Consult with a financial advisor, conduct thorough research, and develop a robust investment plan to successfully manage your portfolio in the face of high stock valuations. [Link to BofA's relevant resources, if available]

Featured Posts

-

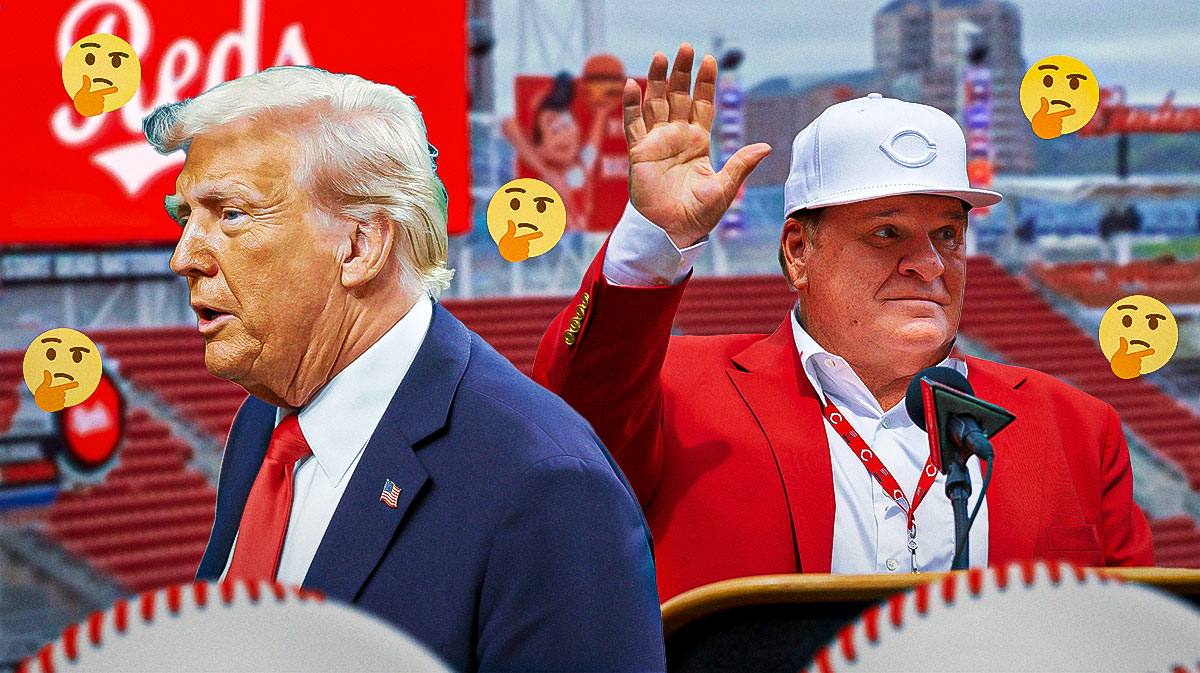

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025

Trumps Posthumous Pardon For Pete Rose A Presidential Promise

Apr 29, 2025 -

Kenyon Clarke Of Du Val Facing Charges Following Remuera Incident

Apr 29, 2025

Kenyon Clarke Of Du Val Facing Charges Following Remuera Incident

Apr 29, 2025 -

Capital Summertime Ball 2025 Tickets The Official Buying Guide

Apr 29, 2025

Capital Summertime Ball 2025 Tickets The Official Buying Guide

Apr 29, 2025 -

Nyt Spelling Bee February 26th 360 Hints Answers And Solution

Apr 29, 2025

Nyt Spelling Bee February 26th 360 Hints Answers And Solution

Apr 29, 2025 -

Khazna Data Centers Post Silver Lake Acquisition Saudi Arabia Expansion Plans Unveiled

Apr 29, 2025

Khazna Data Centers Post Silver Lake Acquisition Saudi Arabia Expansion Plans Unveiled

Apr 29, 2025