High Stock Valuations: Why BofA Believes Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Understanding the Underlying Factors

BofA's analysis suggests that current high stock valuations aren't entirely unsustainable. Their rationale rests on several key factors:

-

Strong Corporate Earnings Growth: Despite high valuations, many companies are experiencing robust earnings growth. This suggests that the market's pricing might be justified by strong underlying fundamentals. BofA's research points to specific sectors showing exceptional profitability, bolstering their argument.

-

Low Interest Rates: Persistently low interest rates contribute to higher valuations. Lower borrowing costs encourage companies to invest and expand, leading to increased earnings and higher stock prices. This, in turn, supports higher price-to-earnings (P/E) ratios, a common metric used to assess stock valuations.

-

Positive Long-Term Economic Outlook: A generally positive outlook for the global economy fuels investor confidence. BofA's economic projections suggest sustained, albeit moderate, growth in the coming years, further supporting their argument against immediate panic.

-

Data-Driven Analysis: BofA’s analysis utilizes various metrics, including detailed P/E ratio comparisons across different sectors and historical market data, to support their claims. For instance, they might point to specific sectors, like technology or healthcare, where growth prospects justify higher valuations relative to historical norms. They might also compare current P/E ratios to those during previous periods of high valuations, demonstrating that the current situation is not necessarily unprecedented.

-

Less Vulnerable Sectors: BofA's research highlights specific sectors less vulnerable to valuation concerns. These might include companies with strong cash flows, resilient business models, and demonstrably consistent growth trajectories. Identifying these sectors allows investors to focus their investments on more stable areas of the market.

Addressing the Risks: Potential Downside and Mitigation Strategies

While BofA's analysis provides a reassuring perspective, acknowledging the inherent risks associated with high stock valuations is crucial.

-

Interest Rate Hikes: A potential increase in interest rates could negatively impact stock valuations. Higher rates make borrowing more expensive, potentially slowing economic growth and reducing corporate earnings.

-

Geopolitical Risks: Global political instability and unexpected geopolitical events can trigger market volatility and impact stock prices. These risks are inherently difficult to predict and manage.

-

Inflationary Pressures: Sustained inflationary pressures erode purchasing power and can lead to increased interest rates, potentially impacting stock valuations negatively. Inflationary environments often lead to increased uncertainty in the markets.

-

Market Corrections: The possibility of a market correction or even a more significant downturn remains a real concern. High valuations often precede periods of market adjustment.

H3: Diversification and Risk Management

To mitigate these risks, a well-diversified portfolio is paramount. Portfolio diversification spreads your investments across different asset classes, sectors, and geographies, reducing your exposure to any single risk. Effective risk management strategies include careful asset allocation, regularly rebalancing your portfolio, and setting realistic return expectations.

Long-Term Perspective: Why a Long-Term View is Crucial

Maintaining a long-term investment horizon is crucial when navigating periods of high stock valuations.

-

Market Cycles: Markets have historically gone through cyclical periods of high and low valuations. Trying to time the market perfectly is generally unsuccessful.

-

Buy-and-Hold Strategy: A consistent buy-and-hold strategy focused on high-quality companies can often outperform attempts to time the market.

-

Disciplined Investing: Sticking to a well-defined investment plan requires significant emotional discipline, especially during periods of market uncertainty. Ignoring short-term market fluctuations is critical for long-term success.

-

Historical Context: Reviewing historical market data puts current valuations in perspective, illustrating that periods of high valuations have been followed by growth in the past.

Alternative Investment Opportunities: Exploring Other Avenues

While stocks form a core part of many portfolios, exploring alternative investment options can provide a balance during periods of high stock valuations.

-

Bonds: Bonds often act as a counterbalance to stocks. They offer relatively lower returns but also reduced risk.

-

REITs: Real Estate Investment Trusts (REITs) offer exposure to real estate without the direct ownership complexities.

-

Other Asset Classes: Other asset classes, such as commodities or alternative investments, can also be considered as part of a well-diversified portfolio. However, these often come with unique risks and should be carefully researched.

Conclusion: Navigating High Stock Valuations with Confidence

BofA's analysis provides a reasoned perspective on high stock valuations, suggesting that while caution is warranted, panic selling is not necessarily the appropriate response. The key takeaways are the importance of understanding the underlying factors driving valuations, acknowledging associated risks, and utilizing a diversified portfolio and long-term investment strategies. Understanding high stock valuations is crucial for informed investment decisions. Don't let concerns about high stock valuations derail your long-term financial goals. Conduct your own thorough research, consider consulting a qualified financial advisor, and develop a long-term investment strategy that incorporates these principles to successfully navigate periods of high stock valuations.

Featured Posts

-

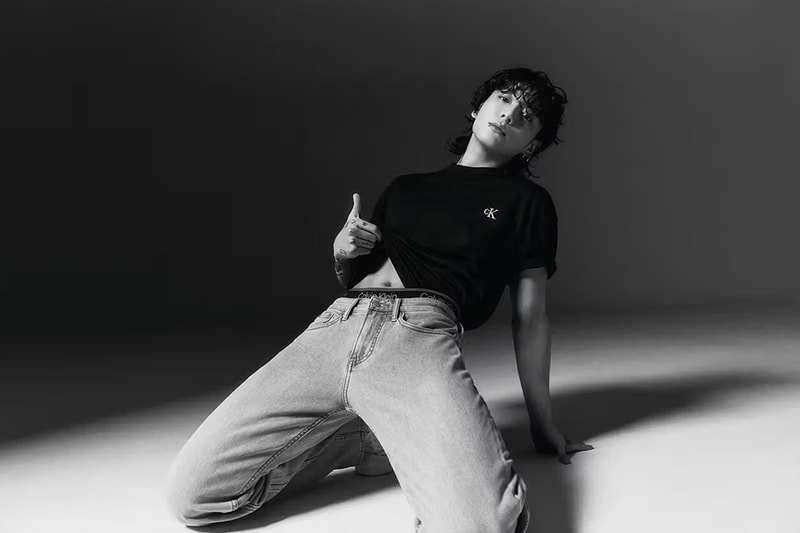

Lily Collins Stars In A New Calvin Klein Campaign See The Photos

May 12, 2025

Lily Collins Stars In A New Calvin Klein Campaign See The Photos

May 12, 2025 -

Yankees Aaron Judge A Historic Start To The Season

May 12, 2025

Yankees Aaron Judge A Historic Start To The Season

May 12, 2025 -

Chantal Ladesou Biographie Et Carriere D Une Grande Actrice

May 12, 2025

Chantal Ladesou Biographie Et Carriere D Une Grande Actrice

May 12, 2025 -

Ofili Takes Third In Inaugural 100 000 Grand Slam Track Race

May 12, 2025

Ofili Takes Third In Inaugural 100 000 Grand Slam Track Race

May 12, 2025 -

Prins Andrew In Opspraak Nieuwe Details Over Betwiste Contacten

May 12, 2025

Prins Andrew In Opspraak Nieuwe Details Over Betwiste Contacten

May 12, 2025