Higher Inflation, Higher Unemployment: The Rise Of Economic Uncertainty

Table of Contents

Understanding the Inflation-Unemployment Nexus

The relationship between inflation and unemployment has long been a central theme in macroeconomic discussions. Traditionally, economists have pointed to an inverse relationship, often illustrated by the Phillips Curve.

The Phillips Curve and its Limitations:

The Phillips Curve suggests an inverse relationship: lower unemployment typically leads to higher inflation, and vice versa. However, this traditional model is proving insufficient to explain current economic realities. The simultaneous occurrence of high inflation and rising unemployment, a phenomenon known as stagflation, challenges the core tenets of the Phillips Curve.

- Supply shocks: Unexpected disruptions to supply chains, like those experienced during the COVID-19 pandemic and the ongoing war in Ukraine, can drive up prices while simultaneously dampening economic activity and increasing unemployment.

- Geopolitical instability: Conflicts and trade wars create uncertainty, affecting production, distribution, and consumer confidence, leading to both inflationary pressures and job losses.

- Wage-price spiral: When inflation is high, workers demand higher wages to maintain their purchasing power. Businesses respond by increasing prices, further fueling inflation, potentially creating a self-perpetuating cycle. This can lead to job losses if businesses cannot afford increased wages.

- Historical examples: The stagflation of the 1970s serves as a stark reminder that the Phillips Curve is not a universally applicable law. Periods of high inflation and high unemployment demonstrate that the simple inverse relationship doesn't always hold true.

The Role of Supply Chain Disruptions:

Global supply chains, already strained before the pandemic, have experienced significant disruptions, contributing to both higher inflation and unemployment. Shortages of key components and raw materials have driven up prices, while reduced production and business closures have led to job losses.

- Microchip shortage: The global shortage of semiconductors has impacted various industries, from automobiles to electronics, leading to higher prices and reduced production.

- Shipping bottlenecks: Port congestion and a shortage of shipping containers have caused delays and increased transportation costs, contributing to inflationary pressures.

- Just-in-time inventory: The reliance on just-in-time inventory management has made businesses more vulnerable to supply chain disruptions. When supply chains are disrupted, businesses may face production halts and be forced to lay off workers.

The Impact of Geopolitical Instability:

Geopolitical instability, including wars, sanctions, and trade disputes, significantly impacts inflation and unemployment. These events disrupt global trade, increase energy prices, and create uncertainty, leading to reduced investment and job losses.

- The war in Ukraine: The conflict in Ukraine has led to a significant surge in energy prices, impacting inflation globally. The war has also disrupted supply chains and reduced investment, contributing to unemployment.

- Trade wars: Trade disputes and sanctions can restrict access to essential goods and resources, driving up prices and impacting employment in affected sectors.

The Consequences of Higher Inflation and Unemployment

The combined effects of higher inflation and higher unemployment have far-reaching consequences for individuals, businesses, and society as a whole.

Eroding Purchasing Power:

High inflation erodes the purchasing power of wages, reducing consumers' living standards. As prices rise faster than wages, people can afford less, leading to a decline in their overall financial well-being.

- Essential goods: The rising cost of essential goods like food and energy disproportionately affects low-income households.

- Housing costs: Soaring housing costs, driven by inflation and supply chain issues, place immense pressure on household budgets.

- Real wages: When inflation outpaces wage growth, real wages (wages adjusted for inflation) decline, reducing consumer spending and economic growth.

Increased Social and Political Instability:

Economic hardship caused by high inflation and unemployment can fuel social unrest and political instability. People struggling to make ends meet are more likely to engage in protests and other forms of social unrest.

- Increased crime rates: Economic hardship can be a contributing factor to increased crime rates.

- Social protests: High inflation and unemployment can trigger widespread social protests and demonstrations.

- Political upheaval: Economic crises often lead to political instability and shifts in political power.

Impact on Business Investment and Growth:

High inflation and economic uncertainty deter businesses from investing and expanding, hindering economic growth. Businesses are less likely to hire new employees or invest in capital expenditures when the future is uncertain.

- Reduced hiring: Businesses are hesitant to hire new employees when demand is uncertain and inflation is high.

- Decreased capital expenditure: Businesses postpone investments in new equipment and technology due to uncertainty.

- Impact on small businesses: Small businesses are particularly vulnerable to economic shocks, as they often lack the financial resources to weather difficult times.

Strategies for Mitigating the Effects of Higher Inflation and Unemployment

Addressing the challenges of higher inflation and higher unemployment requires a multi-faceted approach involving government policies, business strategies, and individual financial planning.

Government Policies:

Governments can use fiscal and monetary policies to address inflation and unemployment. However, finding the right balance is challenging, as policies aimed at controlling inflation can sometimes exacerbate unemployment, and vice-versa.

- Fiscal policy: Governments can use fiscal policy tools such as government spending and tax cuts to stimulate the economy and boost employment.

- Monetary policy: Central banks can use monetary policy tools, such as interest rate adjustments and quantitative easing, to control inflation and manage economic growth. However, these measures can have unintended consequences, especially regarding employment levels.

Business Strategies:

Businesses need to adapt to navigate economic uncertainty. Strategies include cost-cutting measures, diversification, and workforce retraining.

- Cost-cutting: Businesses can implement cost-cutting measures to improve efficiency and profitability.

- Diversification: Diversifying product lines and markets reduces reliance on single products or regions and helps mitigate risks.

- Workforce retraining: Investing in employee training and development enhances workforce skills and improves adaptability in changing economic conditions.

Personal Financial Planning:

Individuals can take steps to manage their finances during times of economic uncertainty.

- Budgeting: Creating a detailed budget helps track expenses and identify areas for savings.

- Debt management: Prioritizing debt reduction reduces financial stress and improves resilience to economic shocks.

- Emergency fund: Building an emergency fund provides a safety net during unexpected job losses or financial crises.

- Diversification of investments: Diversifying investments across different asset classes reduces overall risk.

Conclusion

The simultaneous rise of higher inflation and higher unemployment presents a significant challenge to individuals, businesses, and governments worldwide. The interconnectedness of these two economic forces necessitates a comprehensive and nuanced understanding of their causes and consequences. The limitations of traditional economic models, like the Phillips Curve, highlight the need for adaptable strategies. By understanding the interplay of these factors and employing appropriate mitigation strategies at the governmental, business, and personal levels, we can navigate this period of economic uncertainty more effectively. Stay informed about economic trends, adapt your financial strategies, and be proactive in managing your resources. Understanding and addressing the challenges posed by higher inflation and higher unemployment is crucial for building a more resilient and sustainable future.

Featured Posts

-

Greve Sncf Semaine Du 8 Mai Informations Et Perspectives

May 30, 2025

Greve Sncf Semaine Du 8 Mai Informations Et Perspectives

May 30, 2025 -

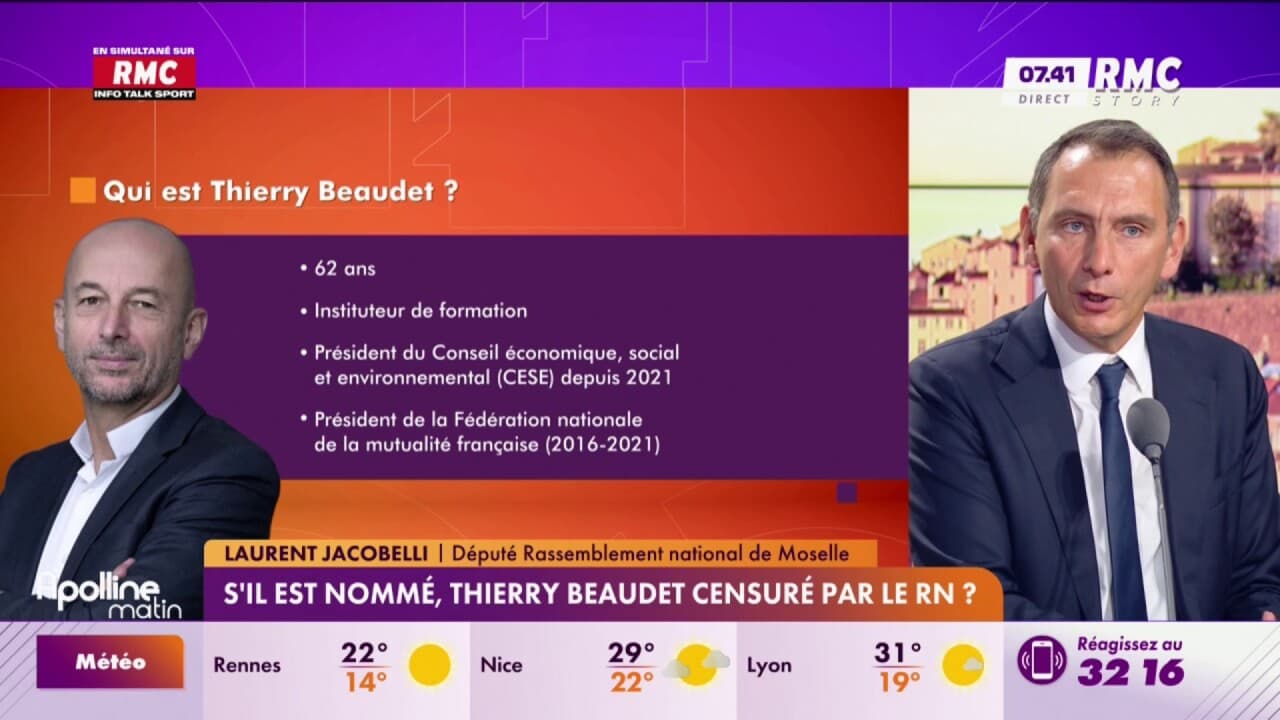

Laurent Jacobelli Un Portrait Du Depute Rn De La Moselle

May 30, 2025

Laurent Jacobelli Un Portrait Du Depute Rn De La Moselle

May 30, 2025 -

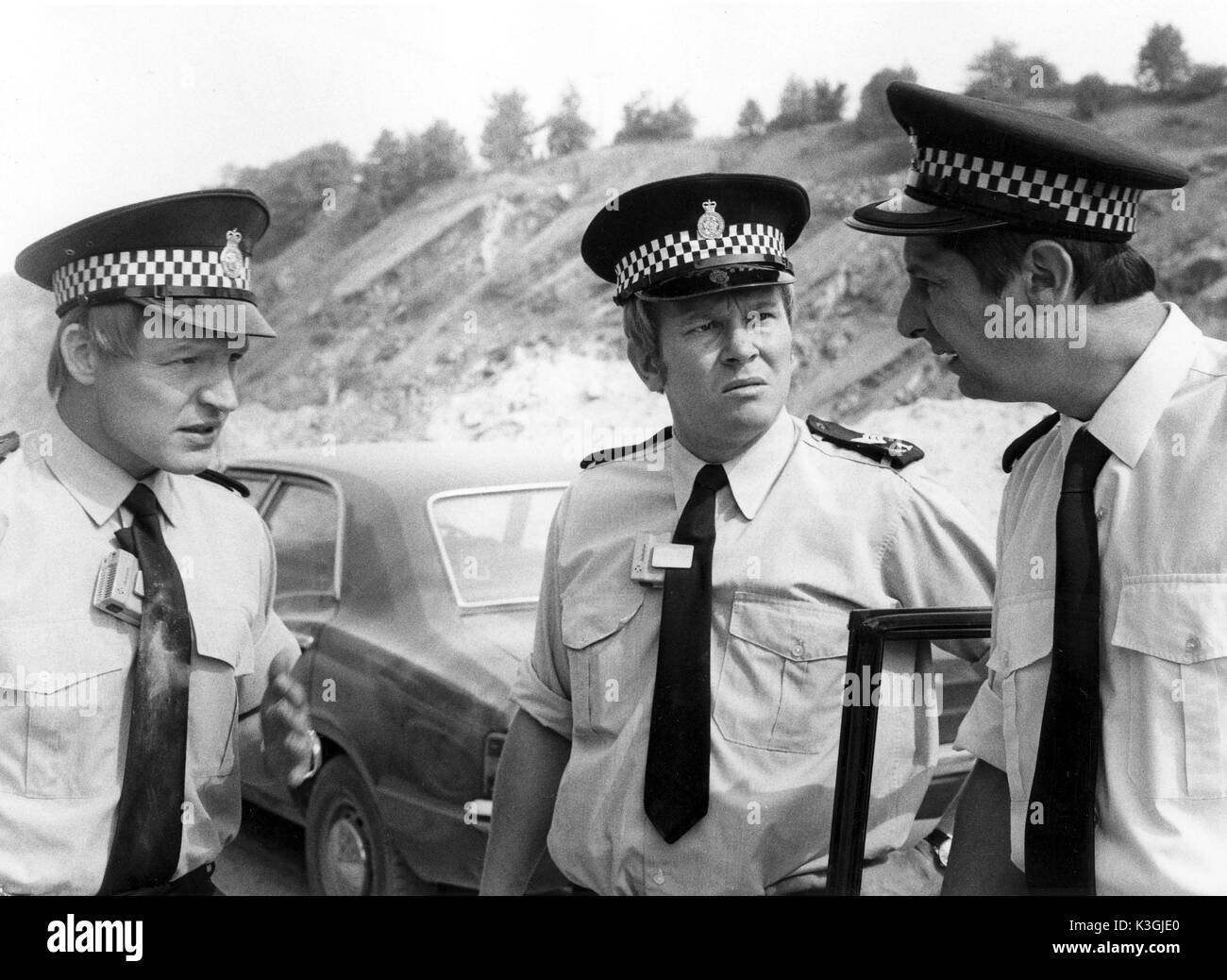

Z Cars On Talking Pictures Tv A Comprehensive Guide

May 30, 2025

Z Cars On Talking Pictures Tv A Comprehensive Guide

May 30, 2025 -

Your Guide To Air Jordan Releases In May 2025

May 30, 2025

Your Guide To Air Jordan Releases In May 2025

May 30, 2025 -

Guillermo Del Toros Sangre Del Toro A Cannes Documentary Premiere

May 30, 2025

Guillermo Del Toros Sangre Del Toro A Cannes Documentary Premiere

May 30, 2025