HKD/USD Exchange Rate: Analyzing The Significant Interest Rate Decrease

Table of Contents

The Hong Kong Monetary Authority (HKMA)'s Role in Managing the HKD/USD Peg

Hong Kong operates under a linked exchange rate system, where the Hong Kong dollar (HKD) is pegged to the US dollar (USD) within a narrow band. This currency board system aims to maintain stability and predictability in the HKD/USD exchange rate. The Hong Kong Monetary Authority (HKMA) plays a vital role in managing this peg.

-

HKMA Intervention Mechanisms: The HKMA intervenes in the forex market by buying or selling US dollars to maintain the HKD within the designated band. If the HKD weakens significantly, the HKMA buys US dollars, increasing demand for USD and supporting the HKD. Conversely, if the HKD strengthens excessively, the HKMA sells US dollars.

-

Impact of Interest Rate Cuts: Interest rate cuts can complicate the HKMA's task. Lower interest rates in Hong Kong can make the HKD less attractive to investors compared to higher-yielding US dollar assets, potentially putting downward pressure on the HKD and requiring more significant HKMA intervention to maintain the peg. This intervention can deplete the HKMA's foreign exchange reserves.

-

Trading Band Adjustments: While the band is typically narrow, the HKMA retains the flexibility to widen or narrow it depending on market conditions. A widening of the band might be considered if significant pressure on the peg persists. The decision to adjust the band is a complex one, balancing the need for stability with the potential implications for the Hong Kong economy. Related keywords: Hong Kong dollar peg, currency board, monetary policy, exchange rate mechanism.

Impact of US Federal Reserve Interest Rate Decisions on the HKD/USD Exchange Rate

Decisions made by the US Federal Reserve (the Fed) significantly impact the HKD/USD exchange rate. Changes in US interest rates influence capital flows between Hong Kong and the US.

-

Interest Rate Differentials and Currency Valuation: A higher US interest rate relative to Hong Kong's rate generally attracts capital flows into the US, increasing demand for the USD and strengthening it against the HKD. Conversely, a lower US interest rate can weaken the USD relative to the HKD.

-

Potential Capital Flight: If the US interest rate differential becomes significantly attractive, there's a potential for capital flight from Hong Kong as investors seek higher returns in US dollar assets. This outflow of capital can put downward pressure on the HKD.

-

Investor Sentiment and Market Speculation: Investor sentiment and market speculation also play a crucial role. Negative news about the US or Hong Kong economy can trigger capital flows and impact the HKD/USD exchange rate irrespective of interest rate changes. Related keywords: US Federal Reserve, interest rate differential, capital flow, foreign exchange reserves, investor sentiment.

Economic Factors Influencing the HKD/USD Exchange Rate Beyond Interest Rates

Beyond interest rate movements, several other economic factors influence the HKD/USD exchange rate.

-

Global Economic Uncertainty: Periods of global economic uncertainty or recession can negatively impact the Hong Kong economy and put downward pressure on the HKD. This is because Hong Kong's economy is highly dependent on global trade and investment.

-

Trade Imbalances: Trade imbalances between Hong Kong and the US can influence the exchange rate. A large trade surplus for Hong Kong could put upward pressure on the HKD, while a deficit could have the opposite effect.

-

Geopolitical Events: Geopolitical events, such as international conflicts or political instability, can create uncertainty and volatility in the foreign exchange market, impacting the HKD/USD exchange rate. Related keywords: global economic outlook, trade war, geopolitical risk, inflation, economic growth.

Predicting Future HKD/USD Exchange Rate Movements

Accurately predicting future HKD/USD exchange rate movements is notoriously difficult. The forex market is influenced by a multitude of interconnected factors, making precise forecasting challenging.

-

Economic Indicators: Various economic indicators, such as inflation rates, GDP growth, unemployment figures, and consumer confidence indices, provide insights into the potential direction of the exchange rate.

-

Technical and Fundamental Analysis: Technical analysis examines past price movements and trading patterns to identify potential trends, while fundamental analysis focuses on underlying economic factors to assess the long-term value of a currency.

-

Inherent Uncertainty: Despite the tools and techniques available, predicting future exchange rates remains inherently uncertain. Unforeseen events can dramatically alter market dynamics. Related keywords: currency forecasting, technical analysis, fundamental analysis, market prediction, economic indicators.

Conclusion

The recent decrease in interest rates has created a complex interplay of factors affecting the HKD/USD exchange rate. The HKMA's role in maintaining the peg, the impact of US Federal Reserve decisions, and broader economic conditions all contribute to the overall movement. While predicting future exchange rates is challenging, understanding these factors provides valuable insights.

Call to Action: Stay informed about changes in the HKD/USD exchange rate and the actions taken by the HKMA and the US Federal Reserve to effectively manage your financial exposure. Regularly monitor the HKD/USD exchange rate for informed decision-making related to international transactions and investments. Learn more about managing your risk in the fluctuating HKD/USD exchange rate environment.

Featured Posts

-

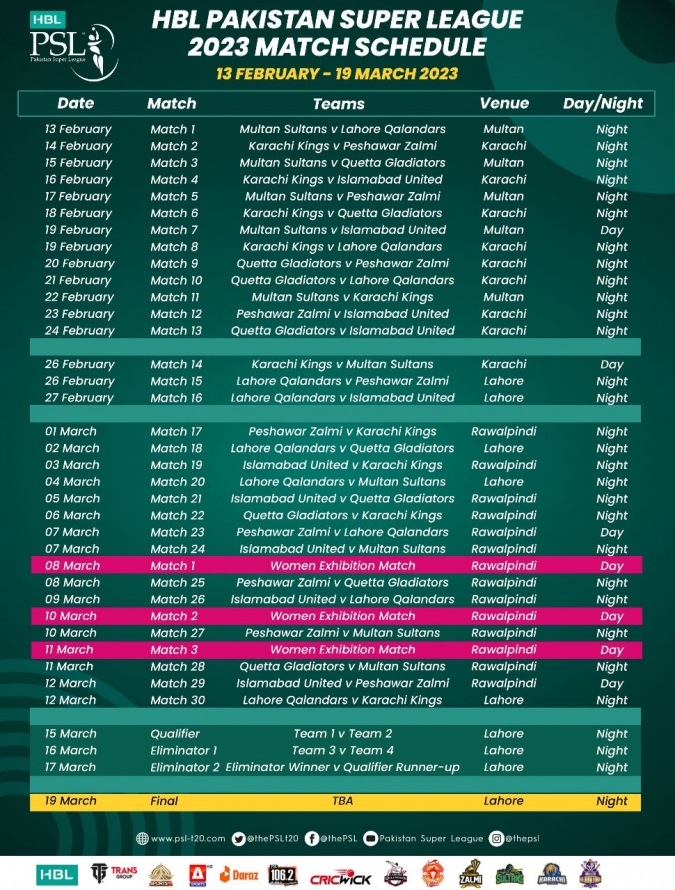

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025 -

Paramount S 7 Best Kept Streaming Secrets Movies

May 08, 2025

Paramount S 7 Best Kept Streaming Secrets Movies

May 08, 2025 -

Luis Enrique Ben Pastrim Ne Psg 5 Lojtare Largohen

May 08, 2025

Luis Enrique Ben Pastrim Ne Psg 5 Lojtare Largohen

May 08, 2025 -

Ps 5 Pro Enhanced Top Exclusive Games Now Available

May 08, 2025

Ps 5 Pro Enhanced Top Exclusive Games Now Available

May 08, 2025 -

Trump Says Cusma Benefits All But Keeps Termination Option Open

May 08, 2025

Trump Says Cusma Benefits All But Keeps Termination Option Open

May 08, 2025