HMRC Child Benefit Alert: Action Required For Payments

Table of Contents

Understanding Recent HMRC Child Benefit Changes

Recent changes to the HMRC Child Benefit system affect eligibility, payment methods, and reporting requirements. Staying informed is key to avoiding disruptions to your payments.

-

Changes to the income threshold: The income threshold for Child Benefit eligibility has remained unchanged for several years, but it is crucial to review your income annually to ensure you remain eligible. If your income exceeds the threshold, you may be required to repay some or all of the benefit received. Keep accurate records of your income to avoid unexpected repayments. It's advisable to check the official HMRC website for the most up-to-date income thresholds.

-

New online verification processes: HMRC is increasingly using online verification processes to ensure the accuracy of the information provided. This might involve online identity verification or requests for additional documentation. Responding promptly to these requests is crucial to prevent delays in your payments. Failure to do so can result in a suspension of payments.

-

Updates to reporting requirements for changes in circumstances: Any changes affecting your eligibility, such as a change in address, the birth of a child, a child reaching a certain age, or a significant change in your income, must be reported to HMRC immediately. Failure to do so can lead to overpayments or delays. This also includes changes in the number of children eligible for the benefit.

-

Potential impact on tax credits: Your eligibility for Child Benefit may affect your entitlement to other benefits, such as tax credits. Understanding the interplay between these benefits is essential. If you receive both Child Benefit and tax credits, any changes to one could impact the other. Contact HMRC for clarification if you are unsure about the impact of these changes on your individual situation.

Common Reasons for Child Benefit Delays or Suspension

Several factors can cause delays or suspensions in your Child Benefit payments. Understanding these reasons can help you avoid problems.

-

Failure to update personal details (address, bank account): Always keep HMRC informed of any changes to your address or bank account details. Outdated information can lead to payments being returned or delayed. Regularly review your online HMRC account to ensure your details are accurate and up-to-date.

-

Inaccurate or incomplete information provided on application forms: Ensure all information provided on your application form is accurate and complete. Inaccuracies can lead to delays or even rejection of your claim. Double-check your application before submission.

-

Non-compliance with reporting requirements: Failing to report changes in your circumstances promptly can result in delays or suspensions. Remember to notify HMRC of any relevant changes immediately, regardless of how minor they may seem.

-

Suspected fraud or irregularities: HMRC investigates any suspected fraud or irregularities relating to Child Benefit claims. If your claim is flagged for investigation, you will be contacted and asked to provide additional information. Cooperation with HMRC during this process is crucial.

How to Avoid Delays in Your HMRC Child Benefit Payments

Proactive measures can prevent delays in receiving your Child Benefit.

-

Regularly check your online HMRC account: Monitoring your account regularly allows you to identify and address any potential issues early. This helps prevent minor problems from escalating into major delays.

-

Promptly report any changes in circumstances: Notify HMRC immediately of any changes that could affect your eligibility, such as changes in address, income, or family circumstances.

-

Ensure your contact details are up-to-date: Maintaining accurate contact information ensures HMRC can reach you if they need to verify information or address any concerns. This includes your phone number, email address, and postal address.

-

Keep accurate records of your children's details and income information: Maintaining organized records facilitates a smooth and efficient process if you need to contact HMRC regarding your payment. This should include birth certificates, payslips, and bank statements.

What to Do if Your Child Benefit Payment is Delayed or Suspended

If your Child Benefit payment is delayed or suspended, follow these steps:

-

Contact HMRC directly via phone or online: Use the official HMRC contact details to report the issue. Be prepared to provide your National Insurance number and other relevant information.

-

Gather all relevant documentation (e.g., payslips, birth certificates): Having this documentation readily available will expedite the process of resolving the issue. This allows for quick verification and processing.

-

Understand the appeal process if necessary: If you believe your payment was incorrectly delayed or suspended, you have the right to appeal the decision. Understand the appeals process and gather necessary evidence to support your case.

-

Seek advice from a benefits advisor if you are struggling: If you are having difficulty navigating the process, seek assistance from a qualified benefits advisor. They can provide guidance and support throughout the process.

Online Resources and Support for HMRC Child Benefit

Several online resources can assist you with your Child Benefit claim.

-

Link to the official HMRC Child Benefit page: [Insert Link to Official HMRC Child Benefit Page]

-

Link to relevant HMRC contact information: [Insert Link to Relevant HMRC Contact Information]

-

Link to online forms and applications: [Insert Link to Online Forms and Applications]

-

Link to support services for those facing difficulties: [Insert Link to Support Services for Those Facing Difficulties – e.g., Citizens Advice]

Conclusion

Staying informed about HMRC Child Benefit updates is crucial for ensuring timely and uninterrupted payments. By following the guidance outlined above, you can proactively manage your Child Benefit claim and avoid potential problems. Remember to regularly review your HMRC account and promptly report any changes in your circumstances to maintain your eligibility for HMRC Child Benefit. If you have any questions or concerns, don't hesitate to contact HMRC directly using the resources provided. Take action today to secure your HMRC Child Benefit payments!

Featured Posts

-

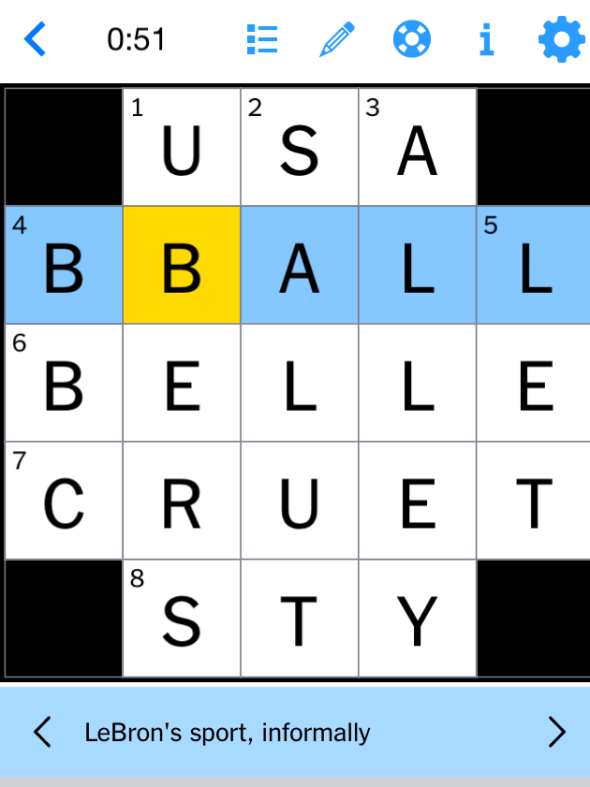

March 20th 2025 Nyt Mini Crossword Hints And Solutions

May 20, 2025

March 20th 2025 Nyt Mini Crossword Hints And Solutions

May 20, 2025 -

Analyzing Michael Strahans Interview Acquisition A Ratings War Case Study

May 20, 2025

Analyzing Michael Strahans Interview Acquisition A Ratings War Case Study

May 20, 2025 -

Eurovision 2025 Meet The Contestants

May 20, 2025

Eurovision 2025 Meet The Contestants

May 20, 2025 -

D Wave Quantum Qbts Understanding The 2025 Stock Decline

May 20, 2025

D Wave Quantum Qbts Understanding The 2025 Stock Decline

May 20, 2025 -

Nyt Mini Daily Puzzle Answers And Clues For May 13 2025

May 20, 2025

Nyt Mini Daily Puzzle Answers And Clues For May 13 2025

May 20, 2025