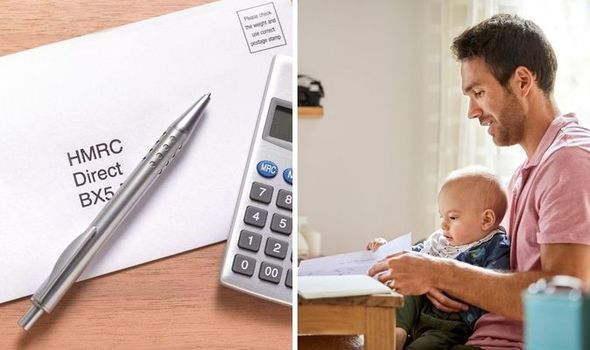

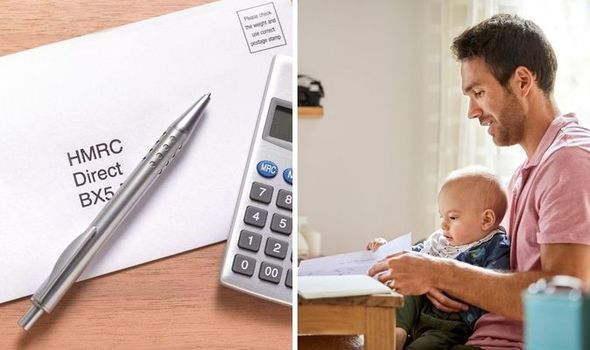

HMRC Child Benefit Warning: Urgent Messages You Shouldn't Ignore

Table of Contents

Receiving Child Benefit is vital for many families, but ignoring crucial messages from HMRC can lead to serious consequences. This article details the urgent messages you should never overlook, explaining what to do if you've received one and how to prevent future issues with your Child Benefit payments. Ignoring these messages could mean delays in payments, potential penalties, and disruption to your family finances. Let's ensure you're fully informed and protected.

Recognizing Official HMRC Communication Regarding Child Benefit

Identifying Genuine HMRC Emails and Letters

It's crucial to distinguish genuine HMRC communications from fraudulent attempts to steal your personal information. Here's how to spot official HMRC correspondence:

- Official Letterhead: Genuine HMRC letters will always feature official letterhead with the HMRC logo and address.

- Email Address: Official HMRC emails will come from an address ending in "@gov.uk". Be wary of emails from similar-looking addresses.

- Government Website Links: Any links within emails or letters should direct you to the official GOV.UK website (www.gov.uk). Never click links from suspicious emails.

- Secure Online Access: Access your HMRC account only through the official GOV.UK website. Look for the padlock symbol in your browser's address bar indicating a secure connection (HTTPS).

Phishing scams are common. Fraudsters often imitate HMRC's style to trick you into revealing personal details. If something feels off, don't click any links or respond.

Understanding the Different Types of Urgent Messages

HMRC may contact you urgently for various reasons:

- Changes to your payments: This could be due to a change in your circumstances, such as a change in your income or the number of children in your care.

- Requests for further information: HMRC might require additional documents to verify your eligibility for Child Benefit.

- Verification of details: You might be asked to confirm your address, bank details, or other personal information.

- Suspected fraud: If HMRC suspects fraudulent activity linked to your Child Benefit claim, they will contact you urgently to investigate.

- Changes in eligibility: Your eligibility for Child Benefit may change based on updated government guidelines.

Responding to Urgent HMRC Child Benefit Messages

What to do if you receive an urgent message

Acting promptly is vital. Here's how to respond:

- Read carefully: Thoroughly review the message to understand the request.

- Gather necessary information: Collect any documents or information requested.

- Respond promptly: Adhere to any deadlines specified in the communication.

- Use official channels: Respond only through the official contact details provided in the communication. Never share sensitive information via unofficial channels.

- Accuracy is key: Ensure all information you provide is accurate and complete.

Failure to respond promptly and accurately may result in delays or suspension of your Child Benefit payments.

Dealing with Suspected Fraudulent Communications

If you suspect a communication is fraudulent:

- Do not respond: Do not click on any links or reply to the message.

- Report to HMRC: Report the suspicious communication immediately through the official HMRC channels. You can usually find details on their website.

- Verify legitimacy: Contact HMRC directly using the details found on their official website to verify the legitimacy of any communication.

Preventing Future HMRC Child Benefit Issues

Keeping your details updated

Keeping your information up-to-date is crucial:

- Update promptly: Notify HMRC immediately of any changes to your address, bank details, or other relevant personal information.

- Use the online portal: Update your information securely through your online HMRC account.

Regularly checking your Child Benefit account

Regularly checking your account is a proactive way to avoid problems:

- Frequent logins: Log in to your HMRC account regularly to review your payment details and check for any messages.

- Enable notifications: Set up email or SMS notifications to receive alerts about important updates.

Conclusion

This article highlighted the critical importance of promptly responding to all urgent messages from HMRC regarding your Child Benefit. Ignoring these messages can lead to delays in payments, potential penalties, and other serious consequences. Stay vigilant and protect your Child Benefit payments by regularly reviewing your HMRC account and responding immediately to any urgent messages. Learn more about managing your Child Benefit and avoiding future issues by visiting the official HMRC website. Don't ignore those important HMRC Child Benefit communications – your financial well-being depends on it!

Featured Posts

-

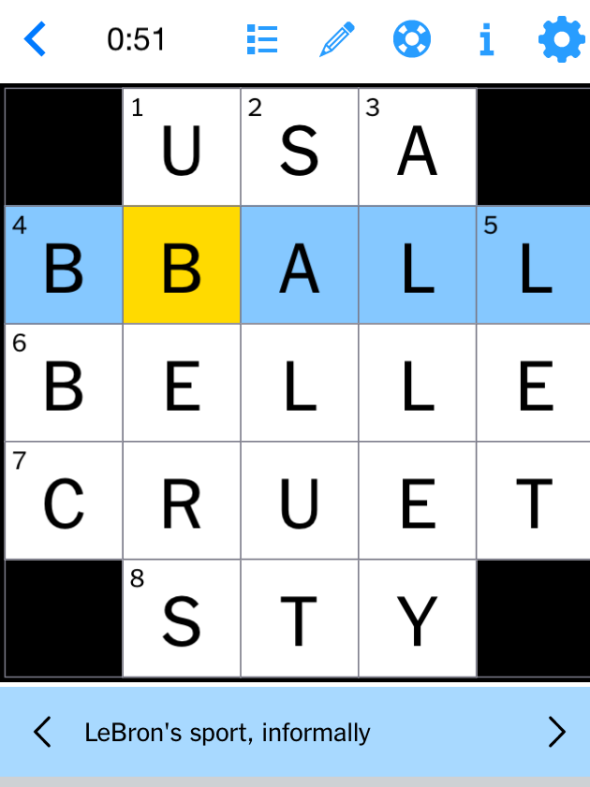

March 13 2025 Nyt Mini Crossword Solutions And Clues

May 20, 2025

March 13 2025 Nyt Mini Crossword Solutions And Clues

May 20, 2025 -

Germanys Nations League Squad Goretzka Included

May 20, 2025

Germanys Nations League Squad Goretzka Included

May 20, 2025 -

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025

Wayne Gretzky Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025 -

Cameroun Macron Referendum Et La Question Du Troisieme Mandat En 2032

May 20, 2025

Cameroun Macron Referendum Et La Question Du Troisieme Mandat En 2032

May 20, 2025 -

The Resilience Mindset Overcoming Adversity And Improving Mental Health

May 20, 2025

The Resilience Mindset Overcoming Adversity And Improving Mental Health

May 20, 2025