HMRC Overpayments: How To Check Your Payslip And Claim A Refund

Table of Contents

Understanding Your Payslip: Key Information to Look For

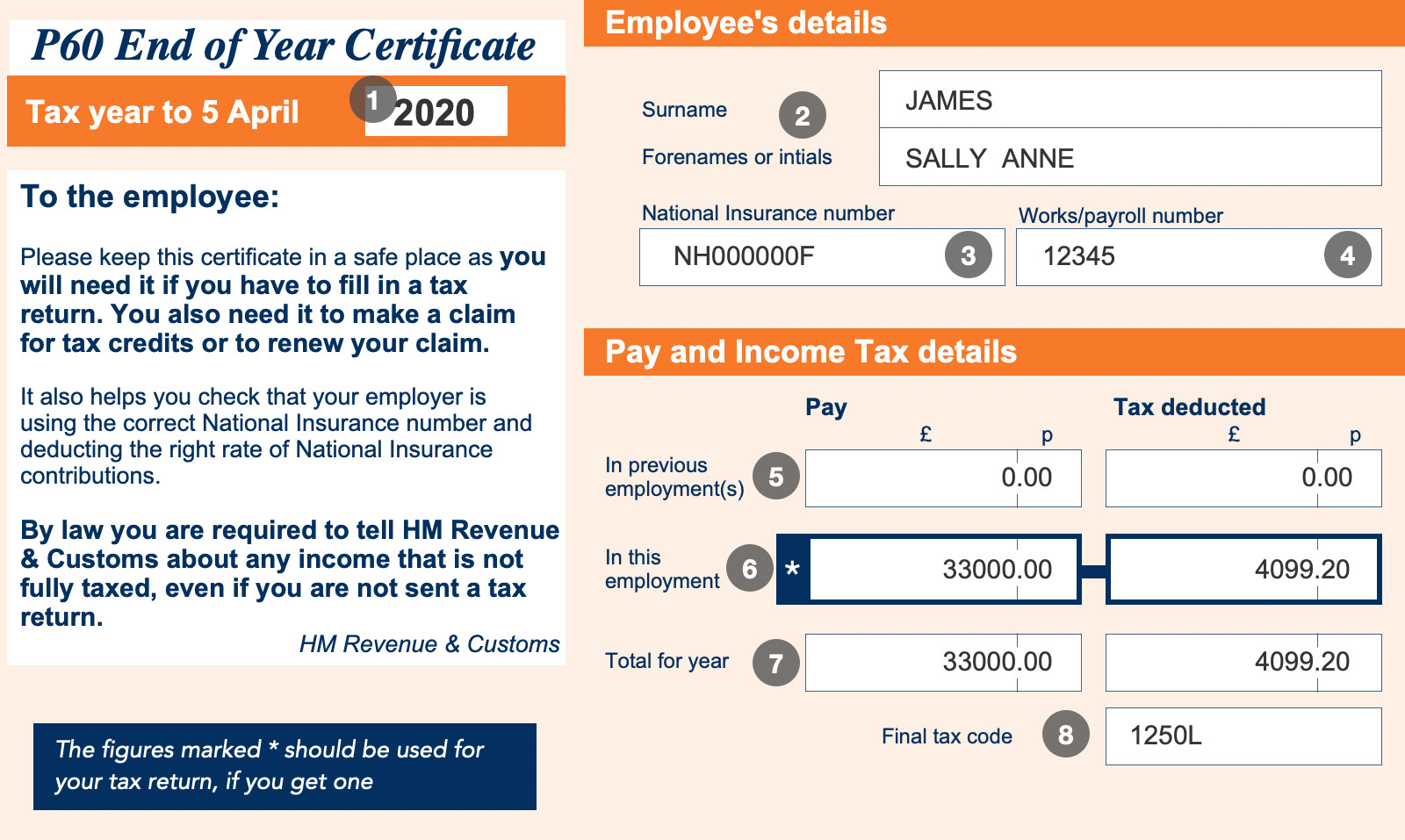

Regularly reviewing your payslip is crucial for managing your finances and identifying any potential issues. Your payslip contains vital information regarding your tax and National Insurance contributions, allowing you to detect discrepancies and potential HMRC overpayments. Let's examine the key areas:

-

Importance of Payslip Review: Consistent payslip checks help prevent unnoticed tax discrepancies and ensure accurate financial records. It's good practice to check your payslip each month.

-

Key Sections to Focus On:

- Tax Code: This code determines how much income tax is deducted from your earnings. An incorrect tax code is a common cause of HMRC overpayments.

- Tax Paid: This shows the total amount of income tax deducted from your pay during the pay period.

- National Insurance Contributions: This section shows your National Insurance contributions for the period. Check for any unusual amounts.

- Deductions: Examine any deductions from your pay to ensure they are accurate and expected.

-

Visual Aids: (Insert image of a sample payslip with key areas like tax code, tax paid, and National Insurance contributions highlighted)

-

Data Points to Scrutinize:

- Tax Code Accuracy: Verify your tax code matches the one provided by HMRC. Contact HMRC if there's a discrepancy.

- Tax Paid vs. Expected Tax: Compare the tax deducted with your expected tax liability based on your income and allowances.

- National Insurance Contributions: Ensure the contributions align with your earnings and employment status.

- Unusual Deductions or Payments: Investigate any unexpected deductions or payments not previously explained.

Identifying Potential HMRC Overpayments on Your Payslip

Identifying potential HMRC overpayments requires careful comparison and analysis of your payslips. Look out for these common indicators:

-

Common Signs of Overpayment:

- Significantly Higher Tax Paid Than Expected: If your tax deductions are considerably higher than anticipated based on your income and allowances, it may indicate an overpayment.

- Inconsistencies Across Payslips: Noticeable differences in tax deductions across consecutive payslips without a clear explanation could signal an error.

-

Tips for Comparing Payslips:

- Side-by-Side Comparison: Compare payslips from different pay periods to spot inconsistencies.

- Use Spreadsheets: For a more organized approach, use a spreadsheet to track your tax deductions over time.

- Online Portals: Some employers offer online payslip summaries, facilitating easier comparison.

-

Signs of Potential Overpayment:

- Unexpectedly High Tax Deductions: This is a strong indicator of a possible overpayment.

- Discrepancies Between Payslip Figures and Tax Calculations: If your own calculations differ significantly from your payslip, investigate further.

- Changes in Your Tax Code That Haven't Been Communicated Clearly: If your tax code changed without a clear explanation from your employer or HMRC, review the implications.

How to Claim a Refund for HMRC Overpayments

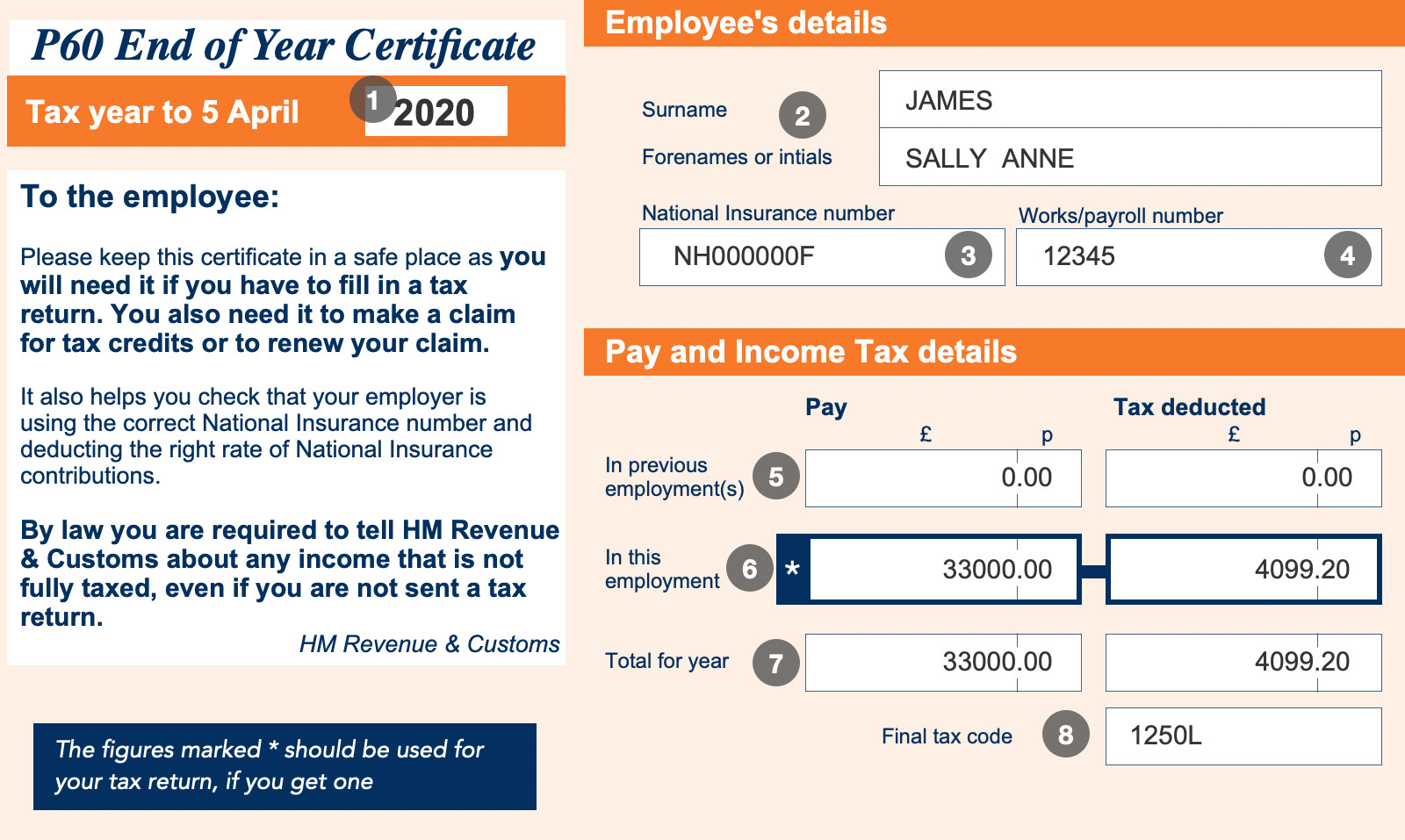

Claiming a refund for HMRC overpayments involves a structured process. Follow these steps carefully:

-

Step-by-Step Guide:

- Gather Necessary Documentation: This includes your payslips, P60 (for the previous tax year), and your National Insurance number.

- Complete the Relevant HMRC Form: Download the appropriate form from the HMRC website. Ensure all information is accurate and complete.

- Submit Your Claim: You can submit your claim online through the HMRC website, by post, or by phone.

- Track the Status of Your Claim: Once submitted, track the progress of your claim using HMRC's online services.

-

Methods of Contacting HMRC:

- Online: The HMRC website offers various online services for managing your tax affairs.

- Phone: Contact HMRC's helpline for assistance.

- Post: Send your claim and supporting documents by post to the appropriate HMRC address.

-

Importance of Record Keeping: Keep copies of all correspondence, including your claim form, supporting documents, and any communication with HMRC.

What to Do If Your Claim is Rejected

If your claim for HMRC overpayments is rejected, don't despair. Understanding the reasons for rejection and the appeals process is key:

-

Possible Reasons for Rejection:

- Incomplete Paperwork: Ensure you've provided all necessary documents.

- Insufficient Evidence of Overpayment: Provide clear evidence supporting your claim, such as detailed payslip comparisons and calculations.

- Errors in the Claim Form: Double-check the accuracy of your completed form.

-

Appeals Process: If your claim is rejected, review the reasons provided and gather any additional evidence needed to support your appeal. Follow HMRC's appeals process carefully.

-

HMRC Support Channels: If you face difficulties, contact HMRC's helpline or seek guidance from a tax advisor.

Conclusion: Secure Your Refund: Taking Action on HMRC Overpayments

Regularly reviewing your payslips is crucial for identifying potential HMRC overpayments. By following the steps outlined in this guide, you can effectively check for discrepancies, gather the necessary documentation, and submit a claim for any overpaid tax. Don't delay – reclaim what's rightfully yours! Check your payslips now and initiate an HMRC overpayment claim if necessary. For further assistance and to access relevant forms, visit the official HMRC website: [Insert HMRC Website Link Here]. Don't miss out on claiming your HMRC Overpayment Refund – take action today! Learn more about claiming an HMRC overpayment check to ensure you receive all the money you are owed.

Featured Posts

-

Canadian Tires Potential Hudsons Bay Acquisition Opportunities And Challenges

May 20, 2025

Canadian Tires Potential Hudsons Bay Acquisition Opportunities And Challenges

May 20, 2025 -

Dubai Holding Increases Reit Ipo To 584 Million

May 20, 2025

Dubai Holding Increases Reit Ipo To 584 Million

May 20, 2025 -

Rodenje Drugog Djeteta Jennifer Lawrence Sve Sto Znamo

May 20, 2025

Rodenje Drugog Djeteta Jennifer Lawrence Sve Sto Znamo

May 20, 2025 -

Premiere Petite Fille Pour Michael Schumacher Annonce Officielle

May 20, 2025

Premiere Petite Fille Pour Michael Schumacher Annonce Officielle

May 20, 2025 -

Big Bear Ai Bbai Stock Buy Rating Holds Amidst Rising Defense Spending

May 20, 2025

Big Bear Ai Bbai Stock Buy Rating Holds Amidst Rising Defense Spending

May 20, 2025