HMRC Website Down: Thousands Unable To Access Online Services In The UK

Table of Contents

The Extent of the HMRC Website Outage

The current HMRC website problems are affecting a significant number of users nationwide. While precise figures are unavailable at this time, social media is awash with complaints from frustrated individuals and businesses unable to access crucial online tax services. Reports suggest widespread inaccessibility across the UK, impacting everything from self-assessment tax returns to accessing PAYE information. The sheer volume of complaints highlights the scale of the disruption and the significant reliance on HMRC’s online platforms.

Number of Affected Users:

Determining the exact number of affected users is difficult without official confirmation from HMRC. However, the sheer volume of complaints flooding social media platforms like Twitter and Facebook suggests a truly widespread issue affecting potentially hundreds of thousands of taxpayers. The lack of official communication from HMRC regarding the extent of the "HMRC website down" situation only fuels speculation and adds to the overall anxiety. Keywords like "HMRC website problems," "taxpayer disruption," and "online tax services" are trending heavily, showcasing the magnitude of the problem.

- Reports of widespread inaccessibility across the UK.

- Social media flooded with complaints from frustrated users using hashtags such as #HMRCDown and #TaxProblems.

- Significant impact on self-assessment deadlines and other time-sensitive tax tasks.

- Potential delays in tax refunds and payments, causing further financial uncertainty.

Potential Causes of the HMRC Website Outage

The reasons behind the HMRC website outage remain unconfirmed. However, several potential causes can be considered. These range from typical technical issues to more serious security incidents. The lack of transparency from HMRC is unfortunately adding to the uncertainty and anxiety.

Technical Issues:

Several technical explanations could account for the "HMRC server issues." These include:

- Distributed Denial-of-Service (DDoS) Attack: A malicious DDoS attack could overwhelm the HMRC servers, making them inaccessible to legitimate users. This is a common tactic used to disrupt online services.

- Hardware or Software Failure: A major hardware malfunction within the HMRC infrastructure, such as server failure or network problems, could be to blame. Software glitches or bugs could also be a contributing factor to the system failure.

- Unscheduled Maintenance: While less likely given the widespread impact and lack of prior warning, unforeseen complications during scheduled maintenance could be responsible for the prolonged outage.

- Lack of Official Communication: The absence of clear and timely communication from HMRC is exacerbating the situation, leading to increased speculation and anxiety among users.

Impact on Taxpayers and Businesses

The HMRC website outage is having a substantial impact on both individual taxpayers and businesses across the UK. The consequences extend beyond mere inconvenience, potentially leading to significant financial implications.

Financial Implications:

The inability to access crucial online tax services carries substantial financial risks:

- Potential late filing penalties for self-assessment tax returns: Missed deadlines due to the HMRC website being down could result in significant penalties.

- Disruption to business operations: Businesses reliant on HMRC online services for VAT returns, PAYE submissions, and other essential tasks face operational delays and potential financial losses.

- Difficulty accessing crucial tax information: The inability to access tax information online could significantly impact financial planning and decision-making for both individuals and businesses.

- Increased stress and anxiety: The uncertainty surrounding tax deadlines and potential penalties is causing increased stress and anxiety for those affected.

What Taxpayers Can Do During the HMRC Website Outage

While the HMRC website is down, taxpayers should explore alternative methods to stay informed and address urgent tax matters.

Alternative Methods:

While accessing online services directly might be impossible, several alternative channels exist:

- Check the official HMRC website and social media: Though the main website might be down, HMRC may provide updates on its social media channels or a dedicated news page.

- Attempt to access services during off-peak hours: Traffic may lessen during less busy times, increasing the chance of accessing the site.

- Contact HMRC by phone: If absolutely necessary, contact HMRC via their phone lines, acknowledging that call wait times are likely to be significantly longer than usual.

- Gather relevant documents: Gather all necessary documents and information to expedite any processes once services are restored.

Conclusion

The widespread outage of the HMRC website has demonstrably caused significant disruption to thousands of UK taxpayers and businesses. The causes are still uncertain, but the impact is undeniable. The reliance on digital services, and the need for robust contingency plans to manage situations like these, has been starkly highlighted. While the situation is undoubtedly frustrating, staying informed through official HMRC channels and considering alternative contact methods remains crucial. Keep checking the HMRC website for updates and official announcements regarding service restoration. Regularly check the HMRC website for news on service restoration.

Featured Posts

-

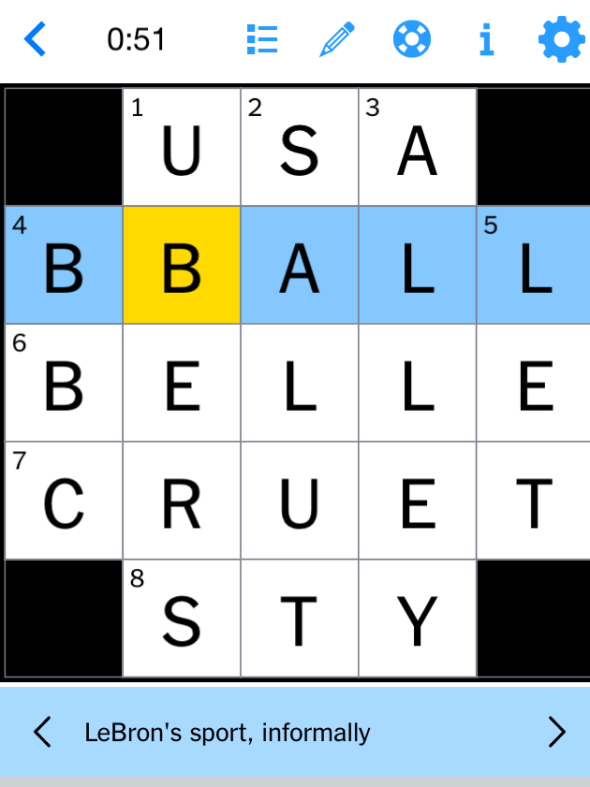

Unlock The Nyt Mini Crossword April 26 2025 Hints

May 20, 2025

Unlock The Nyt Mini Crossword April 26 2025 Hints

May 20, 2025 -

Resilience Training Enhance Your Mental Strength And Wellbeing

May 20, 2025

Resilience Training Enhance Your Mental Strength And Wellbeing

May 20, 2025 -

Robin Roberts Fancy Comment Amid Gma Layoffs What We Know

May 20, 2025

Robin Roberts Fancy Comment Amid Gma Layoffs What We Know

May 20, 2025 -

La Petite Fille De Michael Schumacher Un Joli Prenom Revele

May 20, 2025

La Petite Fille De Michael Schumacher Un Joli Prenom Revele

May 20, 2025 -

Manaus Festival Da Cunha Com Maiara E Maraisa Confirmacao Oficial

May 20, 2025

Manaus Festival Da Cunha Com Maiara E Maraisa Confirmacao Oficial

May 20, 2025