HMRC's New Side Hustle Tax Rules: A US-Style Snooping Scheme?

Table of Contents

The New HMRC Rules: What Has Changed?

HMRC's updated guidelines significantly alter the tax landscape for those operating side hustles. The key changes aim to improve tax collection from the burgeoning gig economy, but their implementation has raised significant concerns. These changes include:

- Increased Scrutiny of Digital Payment Platforms: HMRC is now actively monitoring transactions made through platforms like PayPal, Stripe, and Revolut, cross-referencing them with tax returns to identify unreported income. This involves increased data sharing agreements with these financial institutions.

- Lowered Income Thresholds for Self-Assessment: The threshold at which individuals are required to file self-assessment tax returns has been lowered for certain types of income, bringing more side hustlers under the remit of mandatory self-assessment. This increases the administrative burden for many.

- Reporting Requirements for Online Marketplaces: Sellers on platforms like eBay and Etsy now face stricter reporting requirements, needing to meticulously record and report all sales and expenses. This is particularly challenging for those managing multiple sales channels.

- Tougher Penalties for Non-Compliance: HMRC has implemented significantly increased penalties for non-compliance, including late filing penalties, and in some cases, criminal prosecution for deliberate tax evasion related to side hustle income.

Data Collection and Monitoring: Concerns About Privacy

HMRC's enhanced data collection methods have raised serious privacy concerns. The agency now utilizes:

- Automated Matching of Bank Transactions: Sophisticated algorithms automatically compare bank statements and other financial data with tax returns, flagging discrepancies for further investigation.

- Increased Use of Algorithms to Identify Potential Tax Evasion: HMRC employs AI-powered systems to analyze vast datasets, identifying patterns and anomalies that may suggest unreported income. This raises the risk of false positives.

- Data Sharing Agreements with Third Parties: The increased data sharing with payment processors and online marketplaces significantly expands HMRC's access to personal financial information.

These methods, while designed to combat tax evasion, bear a striking resemblance to the more aggressive data-driven approaches employed by the IRS in the US, prompting comparisons and concerns about potential overreach. The potential for data breaches and misuse of sensitive financial information adds to these anxieties.

The Impact on the Gig Economy and Self-Employed Workers

The new HMRC side hustle tax rules have far-reaching implications for the gig economy:

- Increased Accounting and Tax Preparation Costs: The increased complexity of tax reporting and record-keeping necessitates higher accounting fees, especially for those without prior experience in self-assessment.

- Deterrent Effect on Individuals Considering Starting a Side Hustle: The added administrative burden and risk of penalties could deter individuals from pursuing entrepreneurial ventures, potentially hindering economic growth.

- Potential for Disproportionate Impact on Low-Income Earners: The increased compliance costs may disproportionately affect low-income individuals who are already struggling to make ends meet, creating an additional financial strain.

Legal and Ethical Considerations: Is it Fair and Proportionate?

The legality and ethics of HMRC's new rules are open to debate:

- Compliance with GDPR and Other Data Protection Regulations: The extensive data collection practices must comply with GDPR and other relevant data protection regulations. Any failure to do so could lead to legal challenges.

- The Potential for Discriminatory Enforcement: Concerns exist about the potential for discriminatory enforcement, with certain groups or types of side hustles facing disproportionate scrutiny.

- The Proportionality of the Penalties Imposed for Non-Compliance: The severity of penalties needs to be proportionate to the offense, avoiding excessively punitive measures that could disproportionately impact low-income earners.

Conclusion: Navigating the New HMRC Side Hustle Tax Landscape

HMRC's new side hustle tax rules represent a significant shift in how the UK government approaches taxation of the gig economy. While designed to improve tax collection and address tax evasion, the increased data collection methods raise legitimate concerns about privacy and potential overreach. The impact on the gig economy, particularly on low-income earners and small businesses, warrants careful consideration. Understanding HMRC's new side hustle tax rules is crucial for navigating the changing landscape of the gig economy. Stay updated on any further changes and seek professional advice to ensure compliance. Don't hesitate to consult with a tax advisor to understand your obligations and protect yourself from potential penalties.

Featured Posts

-

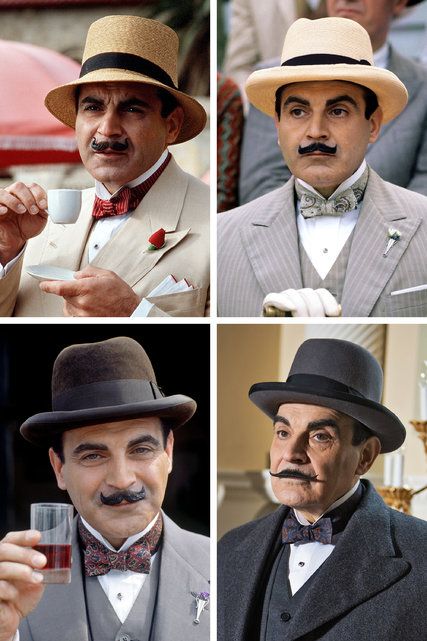

The Evolution Of Agatha Christies Poirot Through The Years

May 20, 2025

The Evolution Of Agatha Christies Poirot Through The Years

May 20, 2025 -

Resilience And Mental Health Building Strength Not Bitterness

May 20, 2025

Resilience And Mental Health Building Strength Not Bitterness

May 20, 2025 -

Croissance Du Trafic Au Port Autonome D Abidjan Chiffres 2021 2022

May 20, 2025

Croissance Du Trafic Au Port Autonome D Abidjan Chiffres 2021 2022

May 20, 2025 -

Unpacking Solo Travel Overcoming Fears And Embracing The Unknown

May 20, 2025

Unpacking Solo Travel Overcoming Fears And Embracing The Unknown

May 20, 2025 -

Philippines And Us To Showcase Military Strength In Expanded Balikatan Drills

May 20, 2025

Philippines And Us To Showcase Military Strength In Expanded Balikatan Drills

May 20, 2025