Home Depot Earnings: Disappointing Results, Tariff Guidance Maintained

Table of Contents

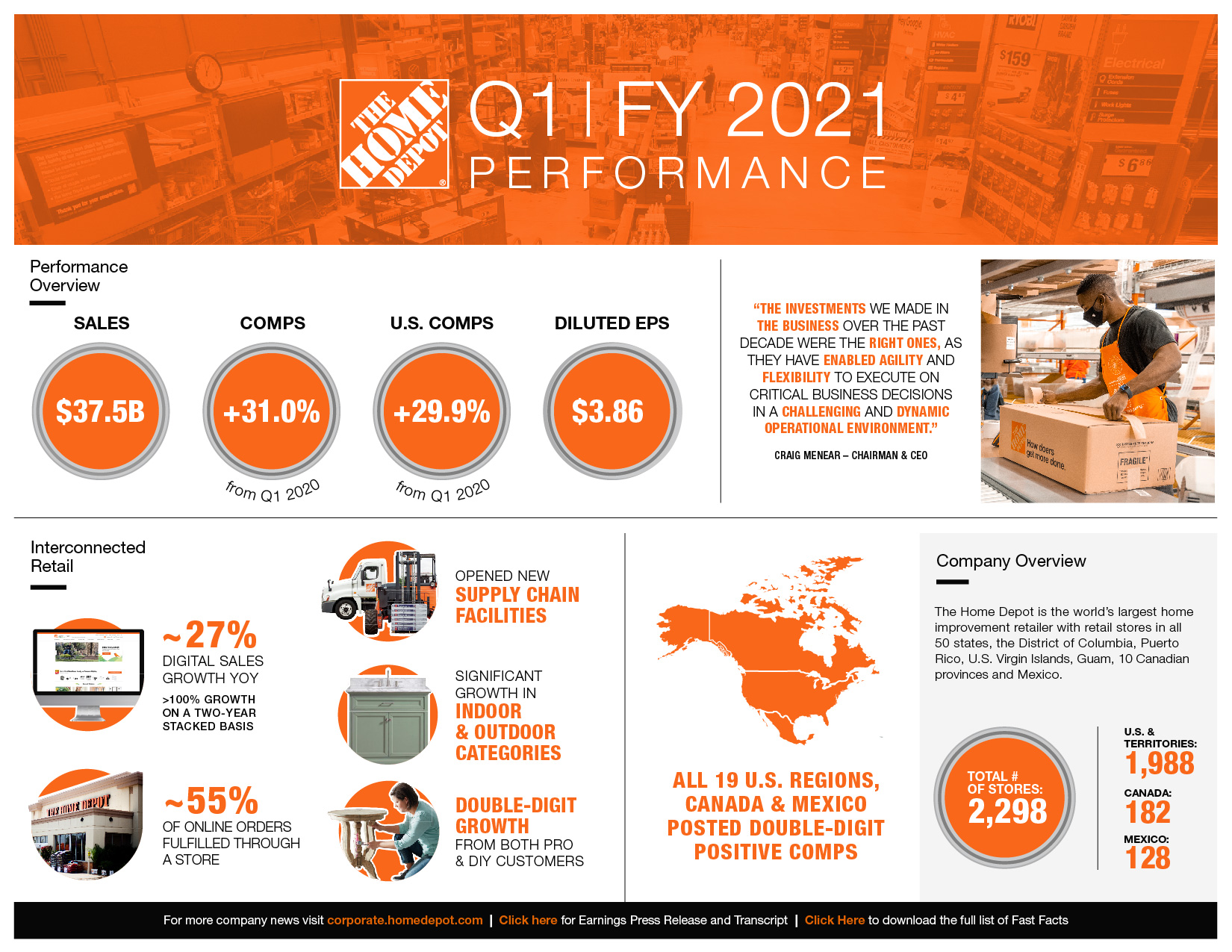

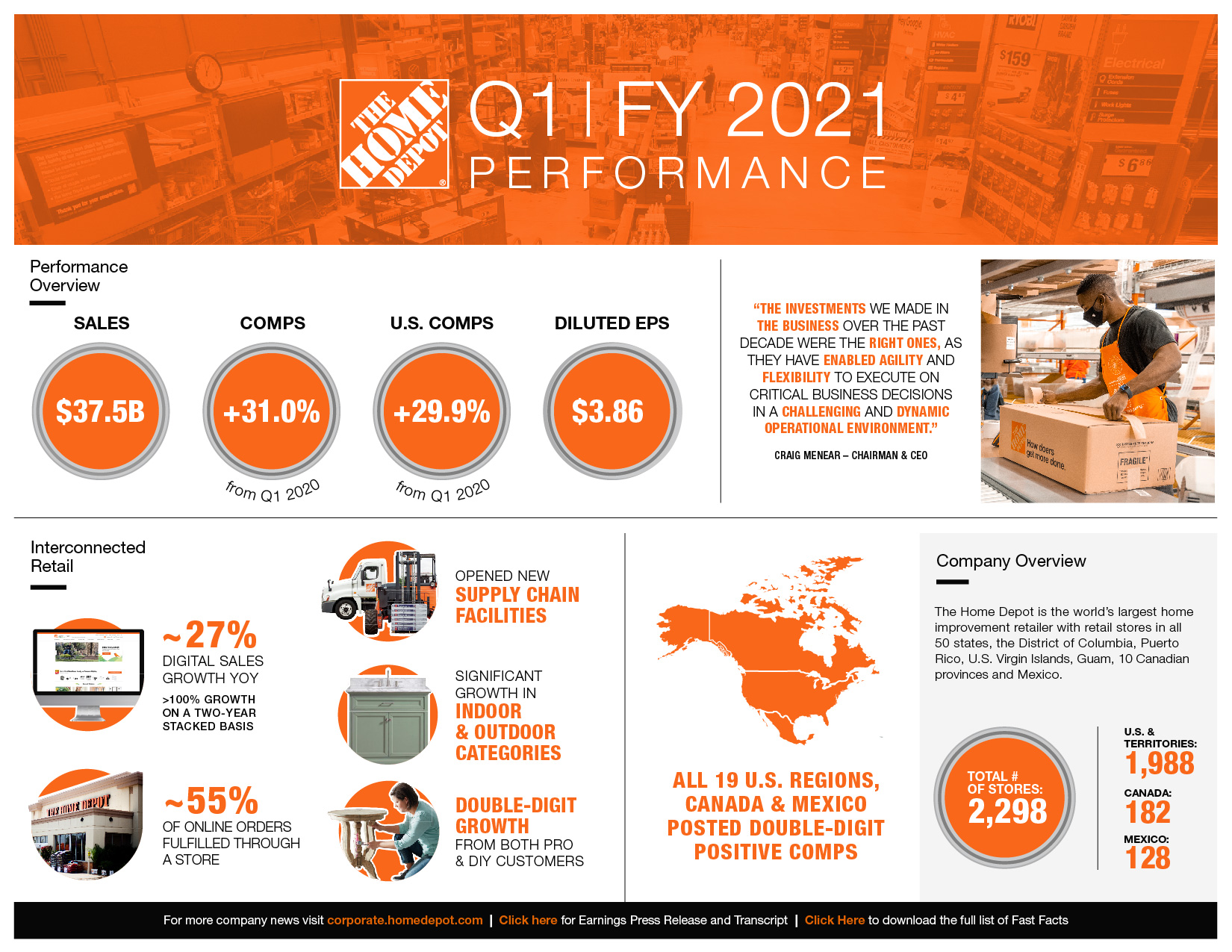

Disappointing Sales Growth in Q[Quarter]

Home Depot's Q[Quarter] sales growth significantly underperformed analyst expectations. While specific numbers will vary depending on the quarter in question (replace "[Quarter]" with the actual quarter), let's assume for this example that sales grew by only 2%, compared to the projected 4% and the previous quarter's 5%. This slower-than-expected growth raises serious questions about the company's future performance and the health of the broader home improvement sector.

Impact of Macroeconomic Factors

Several macroeconomic factors likely contributed to this disappointing sales performance. The current economic climate is characterized by uncertainty and several headwinds:

- Decreased consumer confidence: Rising inflation and interest rates have eroded consumer confidence, leading to reduced discretionary spending on home improvement projects. Many homeowners are delaying renovations or smaller purchases.

- Higher borrowing costs: Increased mortgage rates and higher interest on home equity lines of credit (HELOCs) make financing home improvement projects more expensive, thus impacting demand.

- Inflation impacting discretionary spending: Rising prices for essential goods and services have squeezed household budgets, leaving less room for non-essential expenditures like home improvements.

Weakness in Specific Product Categories

The slowdown wasn't uniform across all product categories. Certain segments experienced a more pronounced decline:

- Lower demand for appliances: High prices and economic uncertainty have dampened demand for major appliances, impacting a significant portion of Home Depot's revenue.

- Lumber price fluctuations: While lumber prices have decreased from their pandemic highs, volatility continues to affect both consumer and professional demand. This unpredictability makes project planning more difficult.

- Decreased DIY project starts: Consumers are increasingly hesitant to undertake large DIY projects due to economic uncertainty and the higher cost of materials.

Profitability Pressures

Beyond disappointing sales growth, Home Depot is facing significant pressure on its profitability. Increased costs across various areas are eroding margins.

Supply Chain Challenges

Ongoing supply chain disruptions continue to plague Home Depot, impacting both inventory levels and pricing:

- Shipping delays: Delays in receiving goods from suppliers continue to disrupt inventory management and lead to stockouts.

- Material shortages: Shortages of key building materials and components are impacting the availability of certain products, leading to lost sales.

- Increased transportation costs: Elevated fuel prices and transportation bottlenecks significantly increase the cost of getting goods to stores.

Inflationary Impacts on Costs

Inflationary pressures are impacting Home Depot's cost structure across the board:

- Higher wages: The company is facing pressure to increase wages to retain employees in a competitive labor market.

- Increased energy costs: Rising energy prices increase operational expenses for heating, lighting, and transportation.

- Raw material price increases: The rising cost of raw materials, such as lumber and steel, directly impacts product pricing and profitability.

These increased costs have directly impacted Home Depot's gross margin, operating income, and net income, further contributing to the disappointing earnings report. The specific figures should be referenced from the official earnings release.

Tariff Guidance Remains Unchanged

Despite the disappointing results, Home Depot has maintained its guidance regarding the impact of tariffs on its business. This indicates a belief that the company can navigate the challenges posed by trade policies.

Impact of Tariffs on Pricing

Home Depot has not indicated any significant changes to its pricing strategy in response to tariffs, suggesting a focus on absorbing the costs rather than immediately passing them onto consumers. This could be a strategic choice to maintain market share, at the expense of short-term profitability.

- Potential price increases on specific product categories: While current pricing remains largely unaffected, future price adjustments on specific imported goods are possible.

- Strategies to mitigate tariff impact: Home Depot is likely exploring various strategies to minimize the impact of tariffs, such as sourcing from alternative suppliers and negotiating better terms with existing partners.

Long-Term Outlook on Tariffs

The long-term implications of tariffs on Home Depot's business strategy remain uncertain. The company is likely adapting to the ongoing trade uncertainties:

- Potential sourcing changes: Home Depot may explore shifting sourcing to regions with more favorable trade agreements.

- Investment in domestic suppliers: Increased investment in domestic suppliers could reduce reliance on imported goods and mitigate tariff impacts.

- Hedging strategies: Implementing various financial strategies to mitigate the risk associated with tariff fluctuations.

Home Depot's continued commitment to navigating tariff complexities underscores the company's long-term resilience and adaptability.

Conclusion

Home Depot's recent earnings report revealed disappointing sales growth and profitability pressures driven by macroeconomic factors, supply chain challenges, and inflationary costs. Despite these challenges, the company maintained its tariff guidance, indicating a long-term strategy to manage trade uncertainties. The impact of these factors on future Home Depot earnings remains a key area to watch. Understanding these factors is crucial for investors and stakeholders alike.

Call to Action: Stay informed about future Home Depot earnings announcements and market analysis to better understand the performance of this major home improvement retailer and the broader economic climate affecting its sector. Continue following our coverage for updates on Home Depot earnings and market trends. Understanding Home Depot earnings is key to understanding the broader home improvement market.

Featured Posts

-

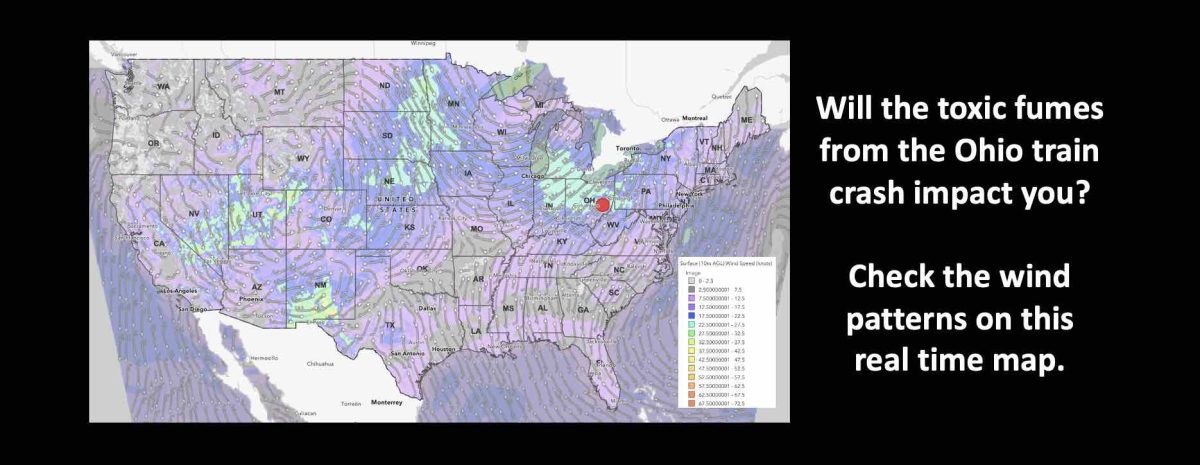

Ohio Derailment The Continued Threat Of Persistent Toxic Chemicals

May 22, 2025

Ohio Derailment The Continued Threat Of Persistent Toxic Chemicals

May 22, 2025 -

Is Your Relationship A Love Monster Recognizing The Signs

May 22, 2025

Is Your Relationship A Love Monster Recognizing The Signs

May 22, 2025 -

Project Finance Secured Freepoint Eco Systems Partners With Ing

May 22, 2025

Project Finance Secured Freepoint Eco Systems Partners With Ing

May 22, 2025 -

Wyoming Otter Conservation A Pivotal Moment For Management

May 22, 2025

Wyoming Otter Conservation A Pivotal Moment For Management

May 22, 2025 -

Southern French Alps Weather Impact Of Recent Storms And Late Snow

May 22, 2025

Southern French Alps Weather Impact Of Recent Storms And Late Snow

May 22, 2025