House GOP Tax Bill In Jeopardy: Conservative Demands For Medicaid And Clean Energy Changes

Table of Contents

Conservative Concerns Regarding Medicaid Spending in the House GOP Tax Bill

The initial draft of the House GOP tax bill proposed deep cuts to Medicaid, a crucial healthcare program for millions of low-income Americans. This has ignited fierce opposition from within the Republican party itself, with conservative lawmakers pushing for even more drastic cuts or advocating for alternative, potentially more disruptive, reforms. The keyword here is Medicaid Spending, and its impact on the House GOP Tax Bill is undeniable.

-

Deep cuts to Medicaid: The proposed cuts represent a significant reduction in federal funding, forcing states to shoulder a larger burden or implement drastic cuts to services.

-

Conservative calls for deeper cuts: Some conservative factions believe the proposed cuts don't go far enough and are pushing for further reductions, raising concerns about the long-term viability of the program.

-

Impact on low-income families: These cuts threaten access to vital healthcare services for millions of low-income families, potentially leading to worse health outcomes and increased financial strain.

-

Political ramifications: The potential political fallout from significantly reducing Medicaid funding is substantial, particularly in states with large populations reliant on the program.

-

Analysis of proposed cuts: Independent analyses suggest that the proposed cuts could result in millions losing coverage and negatively impact state budgets, particularly those in states with larger Medicaid populations.

-

States most severely affected: States like California, Texas, and Florida, with their large populations and high Medicaid enrollment, are expected to be among the most severely impacted.

-

Counterarguments from proponents: Supporters of the bill argue that the cuts are necessary to control spending and promote fiscal responsibility, pointing to the long-term unsustainability of the current Medicaid system.

-

Potential compromises: Negotiations are underway to find compromises, potentially including block grants or per capita caps, which would shift more responsibility to states while still implementing cost-saving measures.

Clean Energy Provisions and the House GOP Tax Bill: A Source of Friction

The House GOP tax bill also faces significant opposition over its proposed changes to clean energy tax credits. Existing tax credits for renewable energy, crucial for driving investment in solar, wind, and other clean energy technologies, face potential elimination or significant reduction. This has sparked a backlash, particularly from those concerned about the environmental and economic implications. The keywords here are Clean Energy Tax Credits and their impact on the overall House GOP Tax Bill.

-

Elimination or reduction of tax credits: The proposed changes directly threaten the viability of renewable energy projects, impacting jobs and investment in the sector.

-

Conservative opposition: Conservative lawmakers argue that these tax credits represent unnecessary government intervention and distort the market. They advocate for a more free-market approach to energy.

-

Economic impact of clean energy: The debate extends to the broader economic impact of clean energy investments, with proponents highlighting the job creation potential and the long-term benefits of transitioning to a cleaner energy system.

-

Impact on the renewable energy sector: The reduction or removal of these credits could severely hinder the growth of the renewable energy sector, potentially stifling innovation and job growth.

-

Specific tax credits targeted: The bill targets specific tax credits for solar, wind, and other renewable energy sources, potentially leading to project cancellations and delays.

-

Arguments from environmental groups: Environmental groups are fiercely opposing the proposed changes, emphasizing the environmental consequences and the importance of government support for clean energy transition.

-

Economic projections: Economic models project significant job losses and reduced economic growth if the proposed changes are implemented, undermining the overall economic benefits often associated with clean energy initiatives.

-

Potential for bipartisan compromise: There is a possibility for bipartisan compromise, focusing on targeted tax credits for specific clean energy technologies or regions, balancing conservative fiscal concerns with the need to support clean energy development.

The Political Tightrope: Navigating Internal Divisions Within the GOP

The House GOP faces a significant political challenge in navigating the internal divisions over the tax bill. The House GOP is struggling with internal divisions that threaten the passage of the tax bill. The success or failure of the bill will depend heavily on the ability of party leadership to bridge these divides and secure the necessary votes for passage.

-

Political climate and potential for failure: The current political climate, characterized by deep partisan divides, makes the passage of the bill far from certain. Failure could have significant repercussions for the party's standing.

-

Role of party leadership: Party leadership will play a crucial role in mediating the disagreements and negotiating compromises to appease various factions within the party.

-

Amendment negotiations and compromise: The likelihood of the bill's passage hinges on successful amendment negotiations and the willingness of both sides to compromise on key provisions.

-

External pressures: The bill is also subject to significant external pressures from various lobbyists and interest groups, further complicating the legislative process.

-

Key conservative lawmakers: Several prominent conservative lawmakers are leading the opposition, wielding significant influence within the party and making concessions challenging.

-

Strategies employed: Both sides are employing various strategies, including lobbying, public pressure campaigns, and internal negotiations, to sway the outcome.

-

Predictions regarding the final form: Predicting the final form of the bill, if passed, is difficult, as ongoing negotiations could lead to significant changes.

-

Consequences of failure: Failure to pass the tax bill before critical deadlines could have significant political and economic consequences for the party and the country as a whole.

Conclusion

The future of the House GOP tax bill remains highly uncertain, with significant opposition stemming from within the Republican party itself concerning proposed changes to Medicaid and clean energy initiatives. Conservative lawmakers are demanding substantial alterations, creating a tense political climate and jeopardizing the bill's timely passage. The outcome will depend on the ability of party leaders to negotiate compromises and navigate deep divisions within their ranks. The potential impact on Medicaid funding and clean energy policies is vast and far-reaching.

Call to Action: Stay informed about the evolving developments surrounding the House GOP tax bill and its potential impact on Medicaid funding and clean energy policies. Follow our updates for the latest news and analysis on this crucial piece of legislation. Understanding the intricacies of the House GOP tax bill is vital for informed citizens.

Featured Posts

-

Jennifer Aniston Kai Pedro Pascal Mazi Se Dimosia Emfanisi Oi Eyxes Ton Fans

May 18, 2025

Jennifer Aniston Kai Pedro Pascal Mazi Se Dimosia Emfanisi Oi Eyxes Ton Fans

May 18, 2025 -

Kanye West Blames Taylor Swift For Super Bowl Snub

May 18, 2025

Kanye West Blames Taylor Swift For Super Bowl Snub

May 18, 2025 -

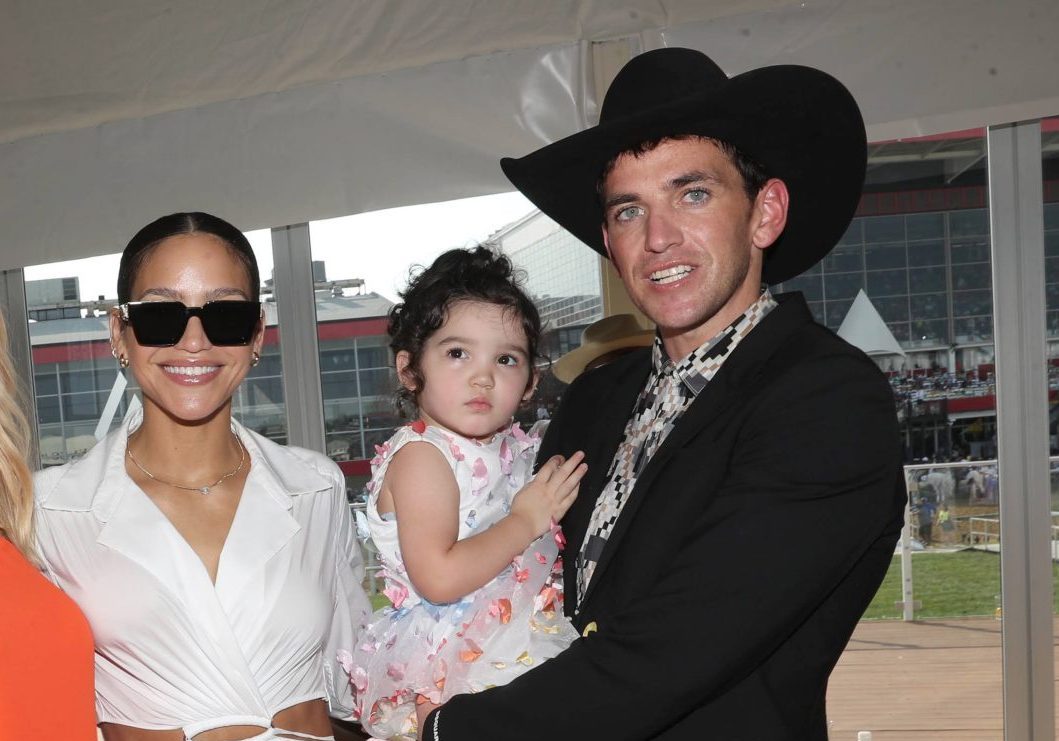

Cassie And Alex Fine Photos From The Mob Land Premiere Red Carpet

May 18, 2025

Cassie And Alex Fine Photos From The Mob Land Premiere Red Carpet

May 18, 2025 -

Selena Gomezs Revelation Impact On Taylor Swift Amidst Justin Baldoni Legal Battle

May 18, 2025

Selena Gomezs Revelation Impact On Taylor Swift Amidst Justin Baldoni Legal Battle

May 18, 2025 -

Nyt Mini Crossword Solution March 6 2025

May 18, 2025

Nyt Mini Crossword Solution March 6 2025

May 18, 2025