House Votes To Pass Modified Trump Tax Legislation

Table of Contents

Key Changes in the Modified Trump Tax Legislation

The modified Trump tax legislation introduces several key changes to the existing tax code, impacting various aspects of taxation for individuals and corporations. These alterations affect tax brackets, credits, deductions, and rates. Let's examine some of the most significant modifications:

-

Individual Income Tax Brackets: The standard deduction has increased by 10%, offering more significant tax relief for lower- and middle-income taxpayers. Additionally, the highest tax bracket has been slightly lowered, reducing the tax burden on high-income earners. These changes in individual tax rates aim to stimulate economic activity by increasing disposable income.

-

Corporate Tax Rate: The corporate tax rate has seen a minor reduction, decreasing from 21% to 20.5%. This modification is intended to boost business investment and potentially increase job creation. The impact on small businesses, a key driver of economic growth, will be closely watched. Further analysis is needed to assess the true impact of this reduced corporate tax rate on small business profitability and investment.

-

Tax Credits and Deductions: Significant adjustments have been made to existing tax credits and deductions. For example, the child tax credit has been slightly expanded to include a larger number of qualifying dependents. Conversely, deductions related to certain state and local taxes have been further reduced. These changes aim to target specific demographic groups while managing the overall budget deficit.

-

Estate and Gift Taxes: The exemption amounts for estate and gift taxes have been adjusted, though the overall structure of these taxes remains largely unchanged. These alterations primarily impact high-net-worth individuals and families. However, the implications for estate planning strategies require careful review by financial advisors.

-

Impact on Specific Industries: Certain sectors will be more heavily impacted than others. For example, the real estate industry might see adjustments related to depreciation deductions, while the manufacturing sector may experience modifications related to investment tax credits. The long-term effects on these and other industries require further economic analysis.

Political Implications of the House Vote

The House vote on the modified Trump tax legislation carries significant political weight. The voting patterns reveal much about the current political climate and the priorities of the ruling party.

-

Voting Patterns: While the vote largely fell along party lines, a surprising number of representatives from the opposing party also voted in favor of the modified tax law, highlighting areas of bipartisan agreement on certain aspects of tax reform. This suggests a degree of compromise and a willingness to find common ground, although further negotiation in the Senate is expected.

-

Political Motivations: The alterations made to the original Trump tax legislation likely reflect a response to shifting economic conditions, as well as ongoing political pressures. The government is likely balancing economic stimulation with concerns about the national debt and fiscal responsibility.

-

Impact on Upcoming Elections: The modified tax law's effect on voters' perceptions of the ruling party will inevitably influence the upcoming elections. Public opinion polls will reveal the extent to which these tax changes are perceived favorably or negatively. The political landscape in the coming months will greatly depend on these public perceptions.

-

Reactions from Stakeholders: Various political groups and stakeholders have responded to the House vote with a mix of praise and criticism. Business groups often favor tax cuts aimed at stimulating growth, while social welfare organizations raise concerns about the impact on income inequality and social programs.

Economic Impact of the Modified Tax Law

The economic consequences of the modified tax law are complex and subject to ongoing debate among economists. Predicting its effects with certainty is difficult.

-

Economic Growth: Proponents of the modified tax law suggest it will boost economic growth by incentivizing investment and job creation. However, opponents argue that tax cuts for corporations and high-income earners disproportionately benefit the wealthy and may not generate substantial economic growth for the majority.

-

Inflation and National Debt: The potential impact on inflation is a major concern. Reduced tax revenue could lead to increased government borrowing and a widening budget deficit. This could, in turn, fuel inflationary pressures. Monitoring inflation rates and the national debt in the coming years will be critical.

-

Projected Revenue Changes: Government projections of revenue changes will be closely watched. Discrepancies between projected and actual revenue could necessitate further adjustments to fiscal policy. The accuracy of these forecasts is often debated and will have significant ramifications for future government spending and programs.

-

Impact on Different Income Levels: The modified tax law's impact will vary across different income groups. It's crucial to examine the distribution of tax benefits to determine whether it truly leads to broad-based economic improvement or exacerbates existing income inequality.

What the Modified Tax Law Means for You

Understanding how the modified Trump tax legislation affects your personal finances is crucial. Here's how to prepare and adapt to these changes:

-

Practical Advice: Review your tax situation and identify how the modifications in tax brackets, credits, and deductions might impact your tax liability. Compare your tax situation before and after these changes.

-

Tax Planning Strategies: Adjust your tax planning strategies to take advantage of the changes or mitigate any negative impacts. Consider seeking professional tax advice to optimize your tax situation. Consult with a financial advisor for personalized recommendations and strategies.

-

Resources for Understanding: Utilize resources like the IRS website and reputable tax professionals to better understand the implications of the changes. Stay informed about any further clarifications or updates regarding the tax law.

-

Specific Tax Situations: The effects of these changes will vary depending on your individual circumstances. For example, retirement planning and investment strategies might require adjustments based on the updated tax code. Speak with a financial planner for tailored advice.

Conclusion

The House vote to pass the modified Trump tax legislation represents a significant shift in tax policy. This article outlined the key changes, their potential economic and political consequences, and their impact on individuals and businesses. Understanding these alterations is crucial for effective tax planning and financial decision-making. Stay informed about the progress of this modified Trump tax legislation as it moves through the legislative process. Consult with a tax professional to understand how these changes affect your specific situation. Learn more about the implications of the modified Trump tax legislation and how it will impact your financial future.

Featured Posts

-

Whats Leaving Hulu This Month Dont Miss These Films

May 23, 2025

Whats Leaving Hulu This Month Dont Miss These Films

May 23, 2025 -

Rendez Vous With French Cinema 2025 A Festival Preview

May 23, 2025

Rendez Vous With French Cinema 2025 A Festival Preview

May 23, 2025 -

X101 5 Big Rig Rock Report 3 12 This Weeks Rock Hits

May 23, 2025

X101 5 Big Rig Rock Report 3 12 This Weeks Rock Hits

May 23, 2025 -

Neal Mc Donough Rides The Wildest Bull In The Last Rodeo

May 23, 2025

Neal Mc Donough Rides The Wildest Bull In The Last Rodeo

May 23, 2025 -

Karate Kid Legend Of The Karate Kid First Reactions Rave About Jackie Chan And Ralph Macchio

May 23, 2025

Karate Kid Legend Of The Karate Kid First Reactions Rave About Jackie Chan And Ralph Macchio

May 23, 2025

Latest Posts

-

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025

Review Jonathan Groffs Just In Time Captures The Spirit Of Bobby Darin

May 23, 2025 -

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025

Just In Time Musical Review Groffs Performance And The Shows Success

May 23, 2025 -

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025

Jonathan Groffs Just In Time A 1960s Style Musical Triumph

May 23, 2025 -

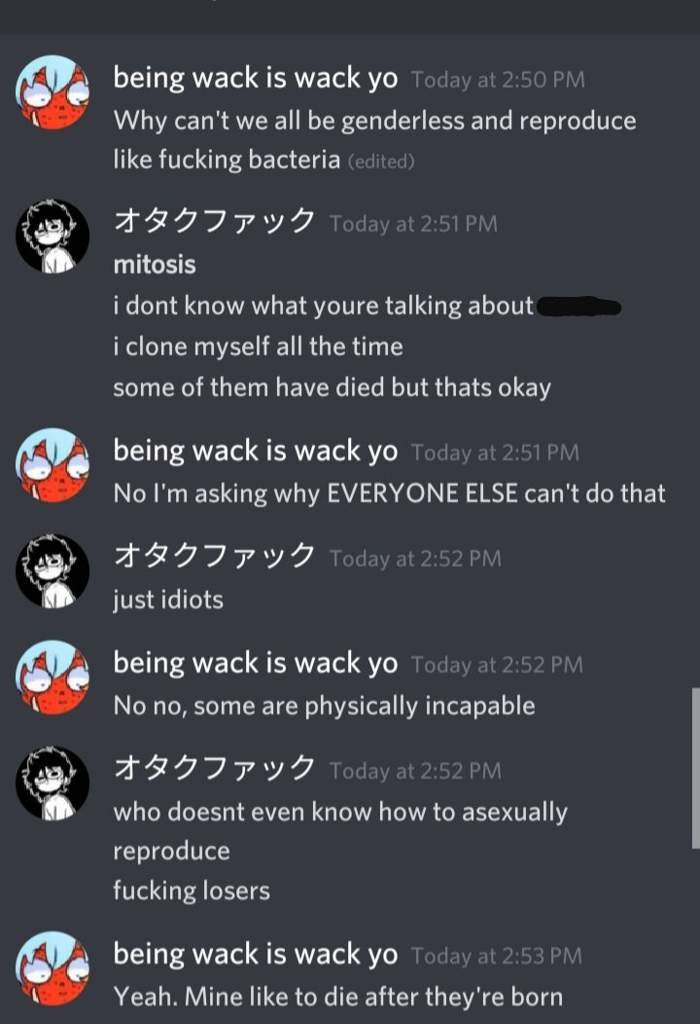

Jonathan Groff And Asexuality An Instinct Magazine Interview

May 23, 2025

Jonathan Groff And Asexuality An Instinct Magazine Interview

May 23, 2025 -

Jonathan Groffs Past An Open Conversation On Asexuality

May 23, 2025

Jonathan Groffs Past An Open Conversation On Asexuality

May 23, 2025