How Brexit Is Hampering UK Luxury Exports To The EU Market

Table of Contents

Increased Bureaucracy and Customs Delays

Brexit has introduced significant new customs checks and paperwork for goods moving between the UK and the EU. This increased bureaucracy translates directly into considerable challenges for UK luxury exporters. The impact is multifaceted:

- Increased processing times: Luxury goods, often requiring specialized handling and delicate transportation, are particularly vulnerable to delays caused by extensive customs checks. This can lead to missed sales windows, especially for time-sensitive products or seasonal collections.

- Higher administrative costs: Businesses now need to invest in specialist staff or external consultants to navigate the complex customs regulations, adding a significant layer of expense to the export process. This includes the cost of software, training, and compliance management.

- Increased risk of errors: The intricate paperwork and ever-evolving regulations increase the risk of errors, which can lead to significant delays, penalties, and even the rejection of entire shipments of luxury goods at the border. This not only impacts profitability but also damages brand reputation.

For example, a shipment of high-end bespoke suits, delayed at the border due to missing or incorrect paperwork, could miss a crucial fashion week showcase, resulting in significant financial losses and reputational damage.

Tariff and Non-Tariff Barriers

Beyond the increased customs bureaucracy, Brexit has also introduced new tariffs and a range of non-tariff barriers, further hindering UK luxury exports to the EU. These challenges include:

- Increased costs: New tariffs directly increase the price of goods, reducing competitiveness against EU-based luxury brands and impacting profit margins. This price increase is often passed onto the consumer, potentially reducing demand.

- Regulatory divergence: Differing product standards and regulations between the UK and EU create significant hurdles for compliance. Luxury goods often require specific certifications and testing, adding to the costs and complexity of exporting. These regulations can range from labeling requirements to specific material standards.

- Supply chain disruptions: The complexities of navigating new trade rules disrupt established supply chains. Delays and increased costs at each stage of the supply chain impact the overall efficiency and profitability of exporting luxury goods.

Example: Changes to food safety regulations could significantly impact the export of luxury food items such as high-end British chocolates or gourmet cheeses, requiring substantial adjustments to packaging, labeling, and production processes to meet EU standards.

The Impact on Specific Luxury Sectors

Brexit's impact is felt across various luxury sectors. The challenges vary depending on the product and its specific regulatory requirements.

- Luxury Fashion: Increased costs and customs delays impact the timely delivery of high-fashion collections, affecting seasonal sales and brand image.

- High-End Automobiles: Complex regulations and potential tariffs increase the price of luxury vehicles, affecting sales and competitiveness in the EU market.

- British Wine and Premium Spirits: Changes in labeling and alcohol duty regulations add costs and complexities to the export process.

- Bespoke Tailoring: The need for specialized customs handling and potentially increased shipping times can impact the delivery timelines for bespoke garments.

The Diminishing Appeal of "Made in Britain"

The "Made in Britain" label once held significant prestige, signifying quality and craftsmanship. However, Brexit's complexities have potentially weakened this advantage, impacting buyer confidence.

- Consumer perception: Consumers may now perceive the origin of goods as less certain, adding an element of uncertainty to the purchase decision. Increased costs associated with Brexit could also lead buyers to seek out more affordable alternatives.

- Impact on brand image and market share: The increased complexities and costs associated with exporting could lead luxury brands to reduce their presence in the EU market, impacting their brand image and market share.

- Mitigation strategies: Luxury brands need to proactively address these challenges by clearly communicating the value proposition of their "Made in Britain" products, highlighting the quality and craftsmanship, and working to streamline the export process to minimise any delays.

Conclusion

Brexit has created significant obstacles for UK luxury exports to the EU market. Increased bureaucracy, new tariffs, regulatory divergence, and supply chain disruptions are all contributing to a decline in competitiveness. The "Made in Britain" label, once a powerful selling point, may also be losing some of its luster. Understanding the complexities of navigating post-Brexit trade is crucial for UK luxury businesses. Proactive strategies to address customs procedures, regulatory compliance, and supply chain resilience are vital to maintain market share and competitiveness in the EU. To learn more about mitigating the impact of Brexit on your UK luxury exports, and explore strategies for navigating these new challenges, [link to relevant resource/service].

Featured Posts

-

Hamilton Och Leclerc I F1 Diskvalificeringsdrama

May 20, 2025

Hamilton Och Leclerc I F1 Diskvalificeringsdrama

May 20, 2025 -

Moeder Voor De Tweede Keer Jennifer Lawrence En Haar Gezin Groeit

May 20, 2025

Moeder Voor De Tweede Keer Jennifer Lawrence En Haar Gezin Groeit

May 20, 2025 -

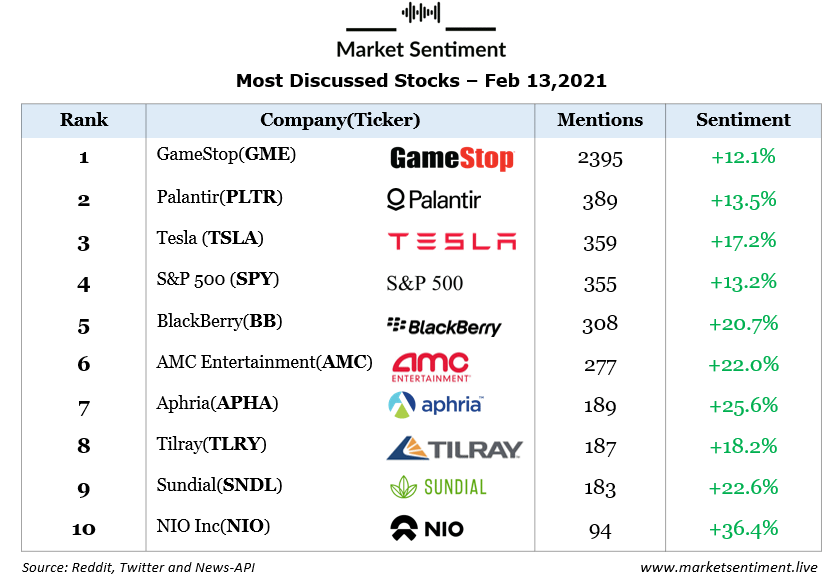

The 12 Most Discussed Ai Stocks On Reddit

May 20, 2025

The 12 Most Discussed Ai Stocks On Reddit

May 20, 2025 -

The Impact Of Brexit On Uk Luxury Exports To The Eu

May 20, 2025

The Impact Of Brexit On Uk Luxury Exports To The Eu

May 20, 2025 -

Jalkapallo Kamara Ja Pukki Sivussa Avausottelussa

May 20, 2025

Jalkapallo Kamara Ja Pukki Sivussa Avausottelussa

May 20, 2025