How China's Export-Led Growth Increases Tariff Impact

Table of Contents

The Scale of Chinese Exports and its Global Reach

China's massive export volume makes it a key player in numerous global supply chains. This dominance significantly amplifies the impact of tariffs. The sheer scale of Chinese exports underscores its vulnerability. Let's examine the key aspects:

-

Unmatched Export Volume: China consistently ranks as the world's largest exporter, boasting a substantial share of global market trade. This immense volume means even small tariff increases translate into significant financial losses.

-

Dominance in Key Sectors: China holds a commanding position in various sectors, including electronics, textiles, machinery, and consumer goods. Tariffs targeting these sectors directly affect global markets reliant on Chinese production.

-

Export Diversification: While China has diversified its export markets, its significant reliance on a few key trading partners (e.g., the United States, European Union, and ASEAN countries) creates vulnerabilities. Disruptions in trade with any of these partners have substantial repercussions.

-

Global Supply Chain Integration: China's integration into global supply chains is extensive. Many multinational corporations rely on China for manufacturing and assembly, making it a crucial node in numerous production networks. This deep entanglement magnifies the ripple effects of tariffs.

The Interconnectedness of Global Supply Chains with China

China's role as a manufacturer of intermediate goods is integral to global supply chains. This interconnectedness means tariffs on Chinese goods have widespread consequences beyond just affecting Chinese exports. Consider the following:

-

Intermediate Goods Dominance: China is a major producer of intermediate goods – components and parts used in final products manufactured elsewhere. Tariffs on these components raise production costs for companies globally.

-

Central Node in Global Value Chains: Many global value chains rely on China for efficient and cost-effective manufacturing. Tariffs disrupt these chains, causing delays, increased costs, and potential supply shortages.

-

Ripple Effects Across Industries: The impact of tariffs isn't confined to a single industry; it ripples through multiple sectors. For example, tariffs on Chinese-made electronics components can affect the price and availability of finished electronic devices worldwide.

-

Foreign Direct Investment (FDI) Implications: The imposition of tariffs impacts foreign direct investment (FDI) in China. Companies may reconsider investing in China if tariffs make production and exports less profitable, leading to potential relocation of manufacturing facilities.

The Economic Impact of Tariffs on China's Export-Led Growth

The economic impact of tariffs on China’s export-led growth is multifaceted and far-reaching. The consequences extend beyond simple revenue losses.

-

GDP Growth Slowdown: Reduced export revenues directly affect China's GDP growth, potentially leading to an economic slowdown.

-

Inflationary Pressures: Tariffs can lead to inflation as higher import costs are passed onto consumers, impacting purchasing power and potentially slowing domestic consumption.

-

Unemployment in Export Sectors: Tariffs threaten jobs in China's export-oriented industries, leading to potential unemployment and social unrest.

-

Retaliatory Tariffs and Trade Wars: China may retaliate with its own tariffs, triggering trade wars that further disrupt global trade and negatively impact all participants.

Case Studies: Specific Examples of Tariff Impacts

The US-China trade war offers a prime example of the real-world effects of tariffs. The imposition of tariffs on various Chinese goods resulted in:

-

Sector-Specific Impacts: Specific sectors, such as agriculture and manufacturing, experienced significant disruptions due to tariffs.

-

Government Response: The Chinese government implemented various measures to mitigate the impact of tariffs, including subsidies and support for affected industries.

-

Ripple Effects: The trade war showed how tariffs create ripple effects throughout the global economy, affecting industries and consumers worldwide. The decreased supply of certain products, caused by the tariffs, highlighted the intricate interconnectedness of global markets.

Conclusion

China's export-led growth model, while tremendously successful, creates substantial vulnerability to tariff impacts. The sheer scale of Chinese exports, its crucial role in global supply chains, and the interconnectedness of the global economy all magnify the effects of these tariffs. The economic consequences for both China and the global economy are far-reaching and underscore the need for a nuanced understanding of these intricate relationships.

Call to Action: Understanding how China's export-led growth increases tariff impact is paramount for navigating the complexities of global trade. Further research into the intricacies of global supply chains and the development of effective mitigation strategies are essential to foster a more stable and resilient global economy. Learn more about the complex relationship between China's export-led growth and the impact of tariffs by exploring further resources on international trade and economic policy.

Featured Posts

-

Future Of Microsoft Activision Merger Uncertain After Ftc Appeal

Apr 22, 2025

Future Of Microsoft Activision Merger Uncertain After Ftc Appeal

Apr 22, 2025 -

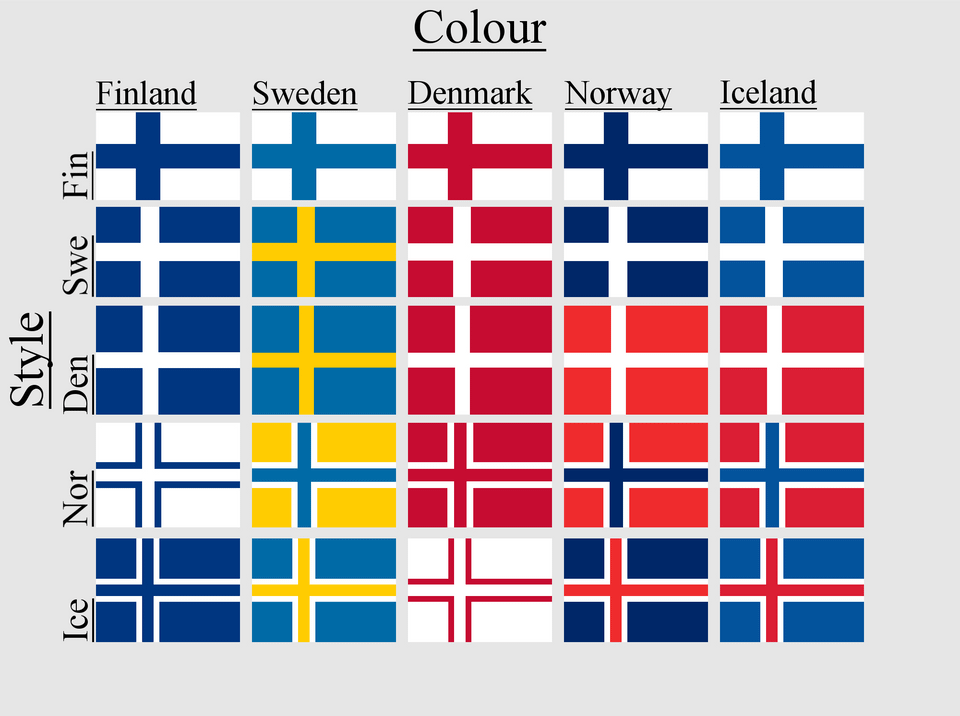

The Pan Nordic Army How Sweden And Finland Complement Each Other

Apr 22, 2025

The Pan Nordic Army How Sweden And Finland Complement Each Other

Apr 22, 2025 -

Ukraine Crisis Escalates Deadly Russian Air Strikes And The Us Peace Initiative

Apr 22, 2025

Ukraine Crisis Escalates Deadly Russian Air Strikes And The Us Peace Initiative

Apr 22, 2025 -

White House Cocaine Investigation Secret Service Releases Findings

Apr 22, 2025

White House Cocaine Investigation Secret Service Releases Findings

Apr 22, 2025 -

Hegseths Pentagon Chaos Claims Scrutinized After Signal Chat Leak

Apr 22, 2025

Hegseths Pentagon Chaos Claims Scrutinized After Signal Chat Leak

Apr 22, 2025