How Federal Debt Affects Your Mortgage: Understanding The Risks

Table of Contents

The Relationship Between Federal Debt and Interest Rates

Increased federal debt significantly impacts interest rates. When the government borrows heavily, it increases demand for funds, competing with private sector borrowing, including mortgages. This increased competition drives up interest rates. The Federal Reserve (also known as "the Fed"), the central bank of the US, plays a crucial role. To combat inflation – often exacerbated by government spending – the Fed may raise interest rates. This makes borrowing more expensive for everyone, including those seeking mortgages.

- Increased government borrowing: The government's need to borrow more money competes with private sector borrowing, driving up interest rates.

- Inflationary pressures: Significant government spending can fuel inflation, prompting the Fed to raise interest rates to cool down the economy.

- Higher mortgage rates: Consequently, higher interest rates translate directly to increased costs for mortgages, making them less affordable.

How Rising Interest Rates Impact Mortgage Affordability

Higher mortgage rates directly impact mortgage affordability. The monthly mortgage payment is calculated based on the loan amount, interest rate, and loan term. Even a small increase in the interest rate can substantially increase your monthly payment, reducing your purchasing power. This is especially impactful for first-time homebuyers and those with lower incomes who may have less financial flexibility.

- Reduced purchasing power: Higher monthly payments mean you can afford a smaller home or need a larger down payment.

- Slowdown in the housing market: Decreased affordability can lead to a slowdown in the housing market, with fewer buyers able to afford homes at current prices.

- Impact on vulnerable populations: First-time homebuyers and low-to-moderate-income individuals are disproportionately affected by rising interest rates.

The Impact of Federal Debt on the Housing Market

The effects of increased federal debt extend beyond individual mortgage rates. It impacts the overall stability of the housing market. Economic uncertainty stemming from high national debt can lead to decreased investor confidence, potentially causing decreased housing demand and price corrections. This can create market volatility and even contribute to housing bubbles bursting.

- Decreased investor confidence: Uncertainty about the economy can make investors hesitant to put money into the real estate market.

- Potential for market corrections: A drop in demand can lead to a correction in housing prices, impacting homeowners and investors alike.

- Ripple effect on related industries: A struggling housing market negatively affects related industries, including construction and real estate services.

Protecting Yourself from the Effects of Federal Debt on Your Mortgage

While you can't control national economic trends, you can take steps to mitigate the impact of federal debt on your mortgage. Proactive financial planning and smart decision-making can significantly improve your position.

- Shop around for mortgage rates: Compare offers from multiple lenders to secure the best interest rate possible.

- Improve your credit score: A higher credit score qualifies you for better mortgage terms and lower interest rates.

- Consider a fixed-rate mortgage: A fixed-rate mortgage protects you from future interest rate increases.

- Build a strong financial foundation: This helps you withstand economic downturns and manage unexpected expenses.

Conclusion: Understanding How Federal Debt Affects Your Mortgage

Federal debt significantly influences interest rates, directly impacting mortgage affordability and the overall housing market stability. Understanding this connection between national economic trends and your personal finances is crucial for making informed decisions. Stay informed about the effects of federal debt on your mortgage and take proactive steps to protect your financial future. Regularly monitor interest rates, compare mortgage options, and seek professional financial advice to navigate the complexities of homeownership in a dynamic economic landscape.

Featured Posts

-

Payden And Rygel Analyzing The Shift In Containerized Shipping From China To The Us

May 19, 2025

Payden And Rygel Analyzing The Shift In Containerized Shipping From China To The Us

May 19, 2025 -

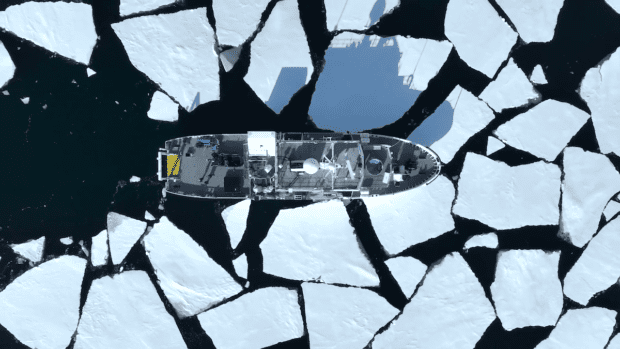

Sea World Orlando Explore The Arctic With Expedition Odyssey

May 19, 2025

Sea World Orlando Explore The Arctic With Expedition Odyssey

May 19, 2025 -

I Synodos Toy Patriarxeioy Ierosolymon Analytiki Paroysiasi Ton Apofaseon

May 19, 2025

I Synodos Toy Patriarxeioy Ierosolymon Analytiki Paroysiasi Ton Apofaseon

May 19, 2025 -

Eurovision 2025 Haennis Contribution To The Swiss Entry

May 19, 2025

Eurovision 2025 Haennis Contribution To The Swiss Entry

May 19, 2025 -

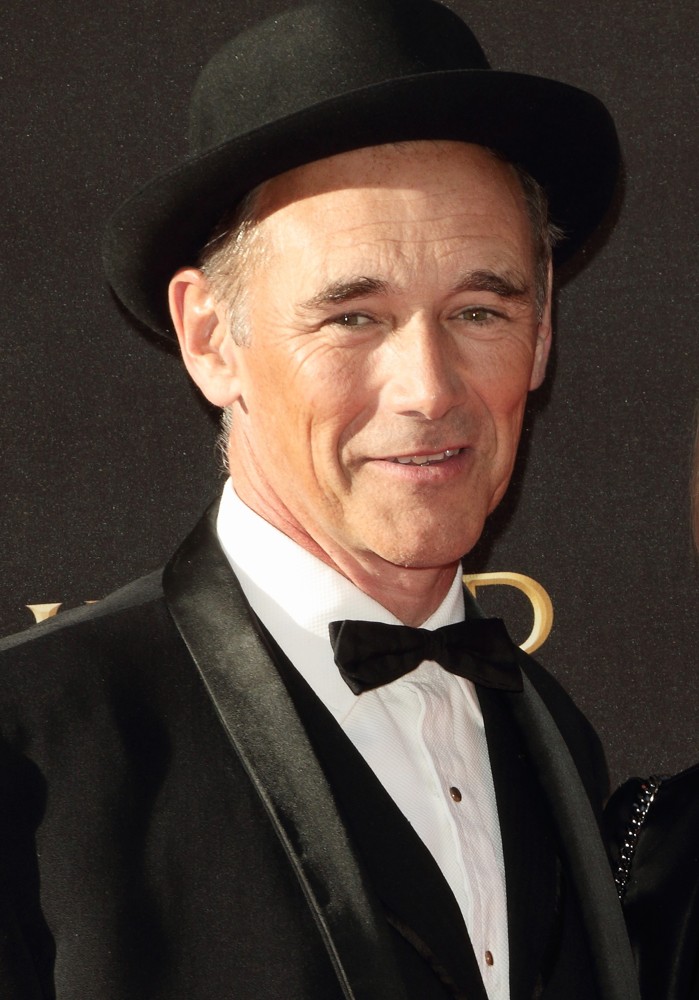

London Parks Mark Rylances Condemnation Of Music Festival Impact

May 19, 2025

London Parks Mark Rylances Condemnation Of Music Festival Impact

May 19, 2025