How Film Tax Credits Shape Minnesota's Entertainment Industry

Table of Contents

Economic Impact of Minnesota Film Tax Credits

The economic impact of Minnesota film tax credits is substantial and multifaceted. These incentives generate direct and indirect economic benefits, stimulating growth within the state's entertainment industry and beyond. The presence of movie production and TV production in Minnesota creates a ripple effect, influencing various sectors.

-

Job Creation: Film productions create numerous jobs, not just for actors and directors, but also for a vast support network including crew members (camera operators, gaffers, grips), editors, sound engineers, production assistants, and countless others. While precise figures fluctuate yearly, estimates suggest hundreds, if not thousands, of jobs are directly created or supported by film projects utilizing Minnesota film incentives.

-

Increased Spending in Local Businesses: Film productions inject significant capital into local economies. Hotels, restaurants, caterers, equipment rental companies, and transportation services all benefit from the increased spending associated with film shoots. This creates a vital boost for small businesses and stimulates wider economic activity. For example, a large-scale production might contract with local restaurants to cater meals for the cast and crew, significantly increasing the restaurant's revenue for that period.

-

Revenue Generation for the State: Although providing tax credits initially reduces state revenue, the overall economic activity generated by film productions leads to increased tax collection in other areas. This includes sales tax from increased spending by production crews and cast, as well as income tax generated from newly created jobs. Studies analyzing the economic multiplier effect of film tax credits often demonstrate a net positive impact on state revenue.

Attracting Productions to Minnesota

Minnesota film incentives make the state a significantly more competitive location for film and television productions. The tax credits help offset production costs, making Minnesota a more attractive option compared to states with less generous programs. This is crucial in a competitive market where productions actively seek out cost-effective filming locations.

-

Competitive Advantage: Minnesota’s film tax credits, when compared to neighboring states like Wisconsin or Iowa, often prove decisive in attracting projects. The percentage of production costs covered and the specific eligibility criteria play a role in this competitive landscape.

-

Unique Filming Locations: Beyond the financial incentives, Minnesota boasts diverse and visually appealing landscapes. From the vibrant cities of Minneapolis and St. Paul to the scenic North Shore and the rolling hills of southern Minnesota, the state offers a variety of locations suitable for a wide range of productions. This inherent attractiveness complements the financial incentives.

-

Role of the Minnesota Film Office: The Minnesota Film Office plays a vital role in attracting productions. They actively market the state's resources and incentives to filmmakers, providing support throughout the production process, and facilitating connections with local businesses and crew.

Types of Productions Benefiting from Minnesota Film Tax Credits

Minnesota's film tax credit program supports a broad spectrum of productions, fostering a diverse and thriving entertainment industry. Both large-scale studio productions and smaller, independent projects can benefit significantly from these incentives.

-

Feature Films: Minnesota has hosted the filming of numerous feature films, leveraging the tax credits to reduce production costs and make filming within the state financially viable.

-

Television Series: The rising popularity of streaming services has led to increased demand for television series, and Minnesota is increasingly attracting TV productions that benefit from the tax credits.

-

Commercials and Documentaries: The tax credits are not limited to major film and television productions. Commercials and documentaries also utilize the program, helping to support a wide range of creative endeavors and provide opportunities for smaller production crews.

-

Independent Film: The incentives are particularly beneficial for independent filmmakers, allowing them to access funding and resources that might otherwise be unavailable. This supports the development of local talent and fresh perspectives within the industry.

Challenges and Future of Minnesota Film Tax Credits

While Minnesota film tax credits have demonstrably positive effects, challenges and areas for improvement exist.

-

Budget Limitations: The budget allocated to the program may limit the number and scale of productions that can be supported. Increased funding could attract more substantial productions and stimulate greater economic growth.

-

Eligibility Requirements: The specific criteria for eligibility may need occasional review to ensure they remain relevant to the evolving film industry. Changes might be needed to accommodate emerging production technologies or business models.

-

Potential for Abuse: Like any incentive program, there’s a need for robust oversight and transparent regulations to prevent abuse or misuse of the tax credits. Regular reviews and adjustments to the rules can mitigate this risk.

Conclusion:

Minnesota film tax credits are instrumental in shaping the state’s entertainment industry. They provide significant economic benefits, attract diverse productions, and support both large and small-scale projects. While challenges remain, addressing budget limitations and refining eligibility requirements can further enhance the program's effectiveness and sustainability. Explore the possibilities of filming in Minnesota and harness the power of its film tax credits to bring your next project to life! Learn more about Minnesota's thriving film industry and how film tax credits can benefit your production.

Featured Posts

-

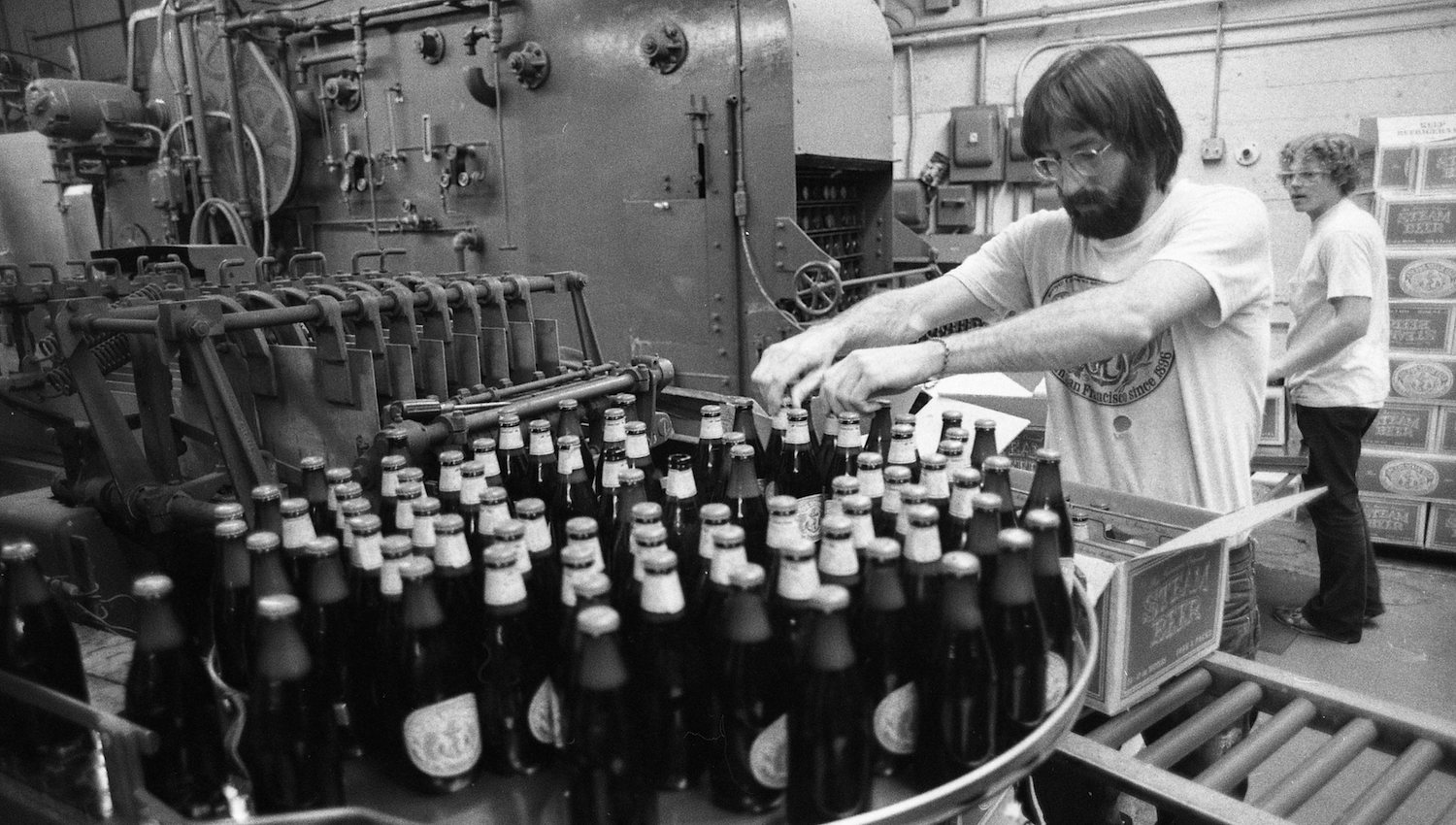

San Franciscos Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025

San Franciscos Anchor Brewing Company Announces Closure After 127 Years

Apr 29, 2025 -

How To Buy Capital Summertime Ball 2025 Tickets Now

Apr 29, 2025

How To Buy Capital Summertime Ball 2025 Tickets Now

Apr 29, 2025 -

D C Blackhawk Passenger Jet Crash A Sobering Account Of The Disaster

Apr 29, 2025

D C Blackhawk Passenger Jet Crash A Sobering Account Of The Disaster

Apr 29, 2025 -

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025

Willie Nelson And Rodney Crowell Duet On New Album Oh What A Beautiful World

Apr 29, 2025 -

Qualifikationsgruppensieg Fuer Lask 6 0 Kantersieg Gegen Klagenfurt

Apr 29, 2025

Qualifikationsgruppensieg Fuer Lask 6 0 Kantersieg Gegen Klagenfurt

Apr 29, 2025