How HMRC Is Using Voice Recognition To Improve Customer Service

Table of Contents

Enhanced Accessibility for Taxpayers

Voice recognition offers a crucial accessibility benefit for taxpayers with disabilities, including visual impairments or motor difficulties. It provides a more intuitive and inclusive way to interact with HMRC services, breaking down barriers and promoting inclusivity. This user-friendly interface is a significant step towards ensuring equal access to vital tax services.

- Easier navigation of online services for visually impaired individuals: Instead of relying solely on visual cues, users can navigate HMRC's online portal through voice commands, accessing information and completing tasks independently.

- Simplified interaction for those with limited mobility: Voice input eliminates the need for extensive keyboard or mouse use, making interaction easier for individuals with limited dexterity or mobility challenges.

- Increased independence for taxpayers with disabilities: Voice recognition empowers individuals with disabilities to manage their tax affairs with greater autonomy and reduces reliance on assistance from others.

- Improved user experience for a wider range of users: Even those without disabilities can appreciate the convenience and speed of voice-activated systems, leading to a generally improved user experience.

Streamlined Tax Queries and Resolution

Voice recognition allows HMRC to automate responses to common tax queries, significantly improving efficiency and reducing wait times. This technology acts as a sophisticated virtual assistant, providing instant answers to frequently asked questions and freeing up human agents to focus on more complex issues.

- Faster resolution of simple tax inquiries through automated systems: Taxpayers can quickly obtain answers to straightforward questions about tax deadlines, allowances, or basic tax calculations, without having to wait for a human agent.

- 24/7 availability for basic tax information and support: Voice-activated systems can provide support around the clock, offering convenient access to information at any time.

- Reduced call waiting times for human agents: Automating routine inquiries reduces the workload on human agents, leading to shorter wait times for those needing assistance with more complex tax matters.

- Improved efficiency in handling routine inquiries: By automating responses to common queries, HMRC can allocate its human resources more effectively, improving overall efficiency and service delivery.

Improved Data Collection and Accuracy

Voice recognition can significantly enhance the accuracy and efficiency of data collection. Automated transcription of calls and interactions provides a fast and accurate record of taxpayer information, drastically reducing manual data entry and the potential for human error.

- Reduced manual data entry, minimizing human error: Automated transcription eliminates the need for manual data entry, reducing the risk of errors and ensuring data accuracy.

- Faster processing of tax returns and other applications: Automated data capture speeds up the processing of tax returns and other applications, improving overall efficiency within HMRC.

- Enhanced data security through secure voice recording and transcription systems: HMRC utilizes secure systems to protect sensitive taxpayer data collected through voice recognition, ensuring compliance with data protection regulations.

- More efficient auditing and verification of taxpayer information: Accurate and readily available data improves the efficiency of auditing and verification processes, supporting better tax administration.

Challenges and Future Developments

While offering numerous advantages, the implementation of voice recognition technology presents challenges. Data privacy concerns require careful consideration, and continued improvements in accuracy and natural language processing are vital. Future developments will focus on harnessing the power of AI and machine learning.

- Addressing concerns regarding data privacy and security: HMRC is committed to implementing robust security measures to protect sensitive taxpayer data collected through voice recognition systems.

- Improving accuracy in handling complex or accented speech: Ongoing development is focused on enhancing the system's ability to accurately understand a wider range of accents and more complex language patterns.

- Integrating with other HMRC systems for a seamless user experience: Future integrations will aim to provide a unified and streamlined experience across all HMRC services.

- Exploring the use of AI-powered chatbots for more sophisticated interactions: The use of AI will allow for more nuanced and complex interactions, further improving the customer experience.

Conclusion

HMRC's adoption of voice recognition technology represents a significant step towards modernizing and improving customer service. By enhancing accessibility, streamlining query resolution, and improving data accuracy, this innovation is making interacting with HMRC easier and more efficient for taxpayers across the UK. The future of HMRC customer service is undoubtedly intertwined with advancements in voice recognition and AI. Stay informed about the continued evolution of HMRC’s use of voice recognition and experience the benefits firsthand. Learn more about how HMRC is using voice recognition to improve customer service and how you can utilize these advancements to make your tax interactions smoother and more efficient.

Featured Posts

-

The Significance Of Accents In Robert Pattinsons Acting With A Focus On Mickey7

May 20, 2025

The Significance Of Accents In Robert Pattinsons Acting With A Focus On Mickey7

May 20, 2025 -

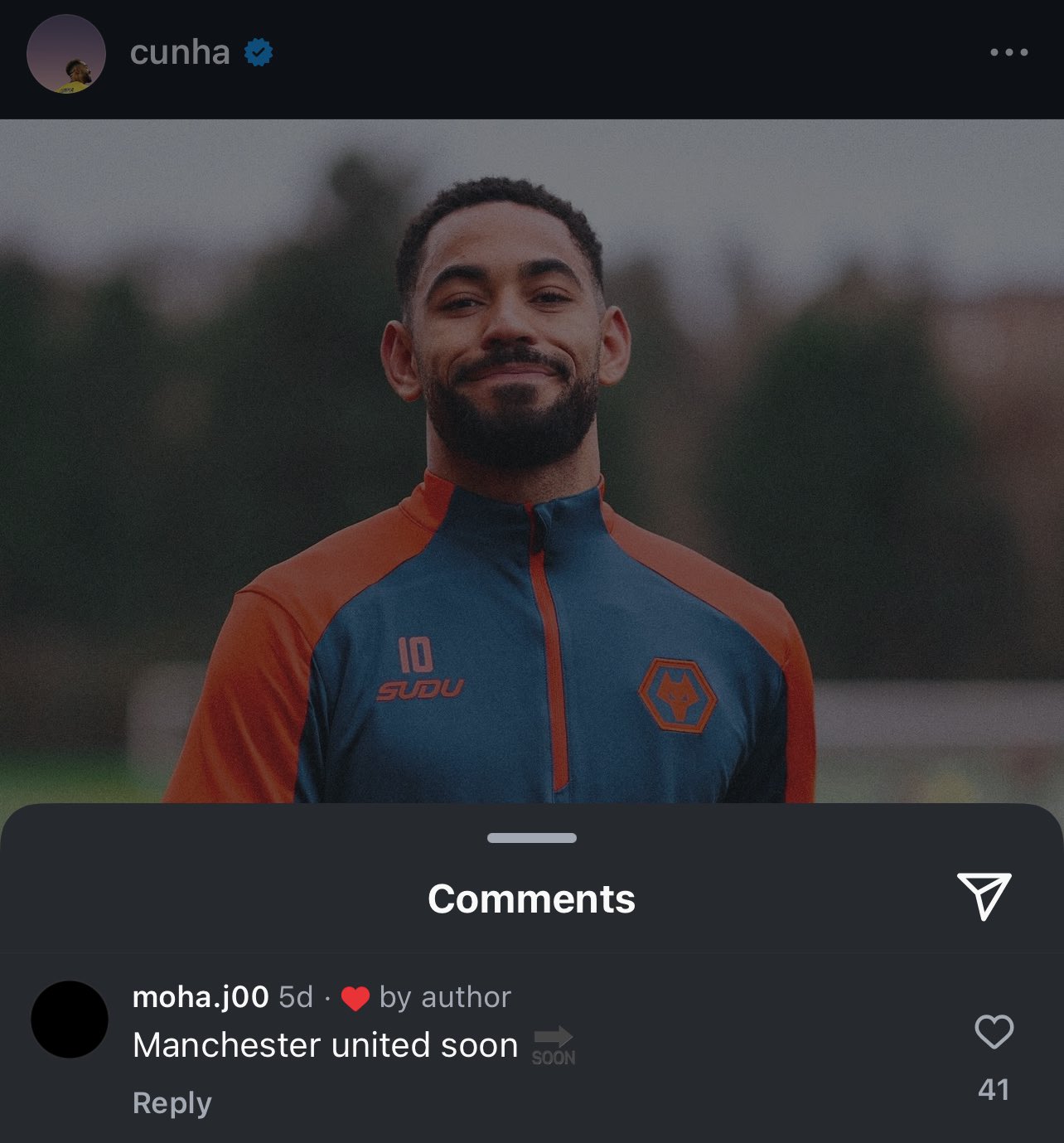

Matheus Cunha To Man Utd Deal Accelerates Backup Plan Unveiled

May 20, 2025

Matheus Cunha To Man Utd Deal Accelerates Backup Plan Unveiled

May 20, 2025 -

The Kite Runners Moral Choices In A Nigerian Context A Comparative Analysis

May 20, 2025

The Kite Runners Moral Choices In A Nigerian Context A Comparative Analysis

May 20, 2025 -

Understanding The Narrative In Suki Waterhouses On This Love Lyrics

May 20, 2025

Understanding The Narrative In Suki Waterhouses On This Love Lyrics

May 20, 2025 -

Nyt Crossword April 25 2025 Find The Answers Here

May 20, 2025

Nyt Crossword April 25 2025 Find The Answers Here

May 20, 2025