How Net Asset Value (NAV) Affects Your Amundi MSCI All Country World UCITS ETF USD Acc Investment

Table of Contents

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. Essentially, it's the current market value of everything the ETF owns, less any debts, divided by the total number of outstanding shares. This article aims to explain how NAV fluctuations affect the Amundi MSCI All Country World UCITS ETF USD Acc and provide investors with the knowledge they need to navigate this important aspect of their investment.

How NAV is Calculated for the Amundi MSCI All Country World UCITS ETF USD Acc

The NAV of the Amundi MSCI All Country World UCITS ETF USD Acc is calculated daily, typically at the close of market trading. This calculation involves determining the market value of all the assets held within the ETF and subtracting its liabilities.

-

Components of NAV Calculation: The calculation includes the market value of the diverse assets within the ETF, which primarily consist of equities from around the world, reflecting the broad global market exposure of the MSCI All Country World Index. Liabilities include management fees and any other outstanding expenses.

-

Asset Classes: The ETF’s holdings are diversified across various sectors and geographic regions. This diversification includes a mix of equities from developed and emerging markets, creating exposure to various global economic trends. The specific weighting of each asset class varies according to the underlying MSCI All Country World Index.

-

Currency Fluctuations: Because the ETF is denominated in USD, fluctuations in foreign exchange rates can impact the NAV. A strengthening US dollar relative to other currencies will generally decrease the USD value of assets held in other currencies, and vice versa.

-

Expense Ratios: The ETF's expense ratio, which covers management and operational costs, is deducted from the total asset value before calculating the NAV per share. This expense ratio slightly reduces the overall NAV.

Factors Affecting the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc

Several factors influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc, impacting its value and potential returns.

-

Market Performance: Overall market trends significantly affect the NAV. During bull markets, when the global economy is strong and asset prices are rising, the NAV typically increases. Conversely, bear markets characterized by declining asset prices generally lead to a decrease in the NAV.

-

Specific Asset Class Performance: The performance of specific asset classes within the ETF, such as technology stocks, energy companies, or emerging market equities, also directly impacts the NAV. For example, strong performance in the technology sector will positively contribute to the overall NAV. Geographic regions also influence the NAV; strong economic growth in certain regions boosts the value of companies located there.

-

Bullet Points:

- Geopolitical Events: Global political instability, trade wars, or major geopolitical events can significantly affect market sentiment and, consequently, the ETF's NAV.

- Economic Indicators: Macroeconomic factors like inflation rates, interest rate changes, and economic growth forecasts influence investor behavior and market valuations, directly impacting the NAV.

- Company-Specific News: Positive or negative news about individual companies held within the ETF, such as strong earnings reports, mergers, acquisitions, or scandals, can affect the NAV.

Understanding NAV and Your Investment Strategy

Monitoring the NAV is crucial for informed investment decisions, but the approach depends on your investment strategy.

-

Buy/Sell Decisions: While NAV is a significant indicator, it shouldn't be the sole factor driving buy/sell decisions. Consider using it in conjunction with long-term market trends and your overall financial goals.

-

Long-Term vs. Short-Term: For long-term investors, short-term NAV fluctuations are less critical. Dollar-cost averaging (investing a fixed amount at regular intervals) helps mitigate the impact of NAV volatility. Short-term trading based solely on NAV changes, however, can be risky due to transaction costs and the potential for losses.

-

Bullet Points:

- Dollar-Cost Averaging: This strategy helps reduce the risk associated with buying high and selling low by investing consistently regardless of NAV.

- Risks of Frequent Trading: Excessive trading based solely on NAV changes can lead to higher transaction costs and increased tax liabilities, potentially diminishing overall returns.

- Diversification: A diversified portfolio, including the Amundi MSCI All Country World UCITS ETF USD Acc, helps reduce the impact of NAV volatility from any single asset or sector.

Where to Find the NAV for your Amundi MSCI All Country World UCITS ETF USD Acc

You can easily find the daily NAV for your Amundi MSCI All Country World UCITS ETF USD Acc investment through several reliable sources.

-

Amundi Website: The official Amundi website provides up-to-date NAV information for all their ETFs.

-

Financial Platforms: Many brokerage and financial data platforms (like Bloomberg, Yahoo Finance, Google Finance) offer real-time or historical NAV data for this ETF.

-

Bullet Points:

- Specific Links: [Insert links to relevant Amundi pages and other financial data platforms]. Note: Replace bracketed information with actual links.

- Official Sources: Always use official sources to ensure the accuracy of the NAV data.

- Time Zone Differences: Be aware that the reported NAV might vary slightly depending on the time zone of the data provider.

Conclusion: Making Informed Decisions with Net Asset Value (NAV)

Understanding the Net Asset Value (NAV) of your Amundi MSCI All Country World UCITS ETF USD Acc investment is crucial for making informed decisions. While NAV is a key indicator of your investment's performance, it shouldn't be the only factor you consider. Remember to assess market trends, diversify your portfolio, and consider your long-term investment goals. Regular monitoring of the NAV combined with a well-defined investment strategy will empower you to make smart investment choices.

Stay informed about your Amundi MSCI All Country World UCITS ETF USD Acc investment by regularly checking its Net Asset Value (NAV). Understanding NAV is key to successful long-term investing! Consult with a financial advisor for personalized guidance if needed.

Featured Posts

-

La Main De Fer Chinoise Comment Pekin Reduit Au Silence Les Dissidents En France

May 25, 2025

La Main De Fer Chinoise Comment Pekin Reduit Au Silence Les Dissidents En France

May 25, 2025 -

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 25, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 25, 2025 -

Nvidias Rtx 5060 Launch A Warning For Gamers And Tech Reviewers

May 25, 2025

Nvidias Rtx 5060 Launch A Warning For Gamers And Tech Reviewers

May 25, 2025 -

F1 Lewis Hamiltons Show Of Respect In Recent Testing Footage

May 25, 2025

F1 Lewis Hamiltons Show Of Respect In Recent Testing Footage

May 25, 2025 -

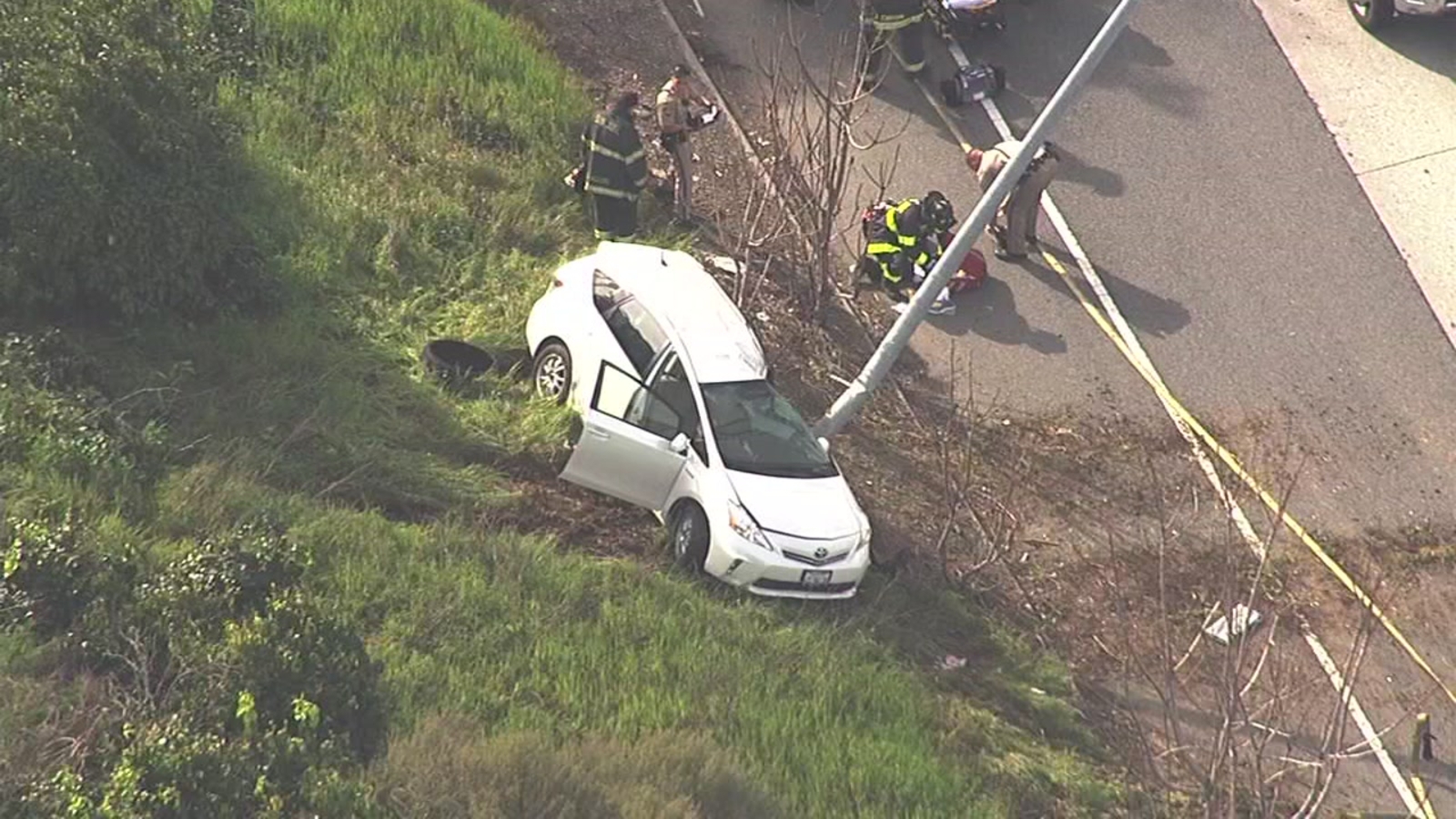

M56 Closed Serious Crash Causes Major Traffic Disruption

May 25, 2025

M56 Closed Serious Crash Causes Major Traffic Disruption

May 25, 2025