How Norway's Top Investor, Nicolai Tangen, Navigated Trump's Tariffs

Table of Contents

Nicolai Tangen, the head of Norway's massive sovereign wealth fund (NBIM), faced significant challenges during the Trump administration's era of escalating tariffs. This article delves into Tangen's strategic maneuvering to protect the fund's massive portfolio amidst the turbulent global trade landscape created by these tariffs. We'll examine his approaches to risk management, diversification, and long-term investment strategies during this period of economic uncertainty. Understanding how Tangen navigated this complex situation offers valuable insights for investors navigating similar global economic headwinds.

Understanding the Impact of Trump's Tariffs on Global Investments

Trump's tariffs, implemented primarily between 2018 and 2020, significantly impacted global markets. These protectionist measures aimed to bolster domestic industries but triggered retaliatory tariffs from other countries, leading to widespread economic disruption. The impact rippled across various sectors, but some were hit particularly hard.

-

Manufacturing: The manufacturing sector faced increased costs for imported raw materials and components, impacting production costs and competitiveness. Industries reliant on global supply chains, like automotive and electronics, were particularly vulnerable.

-

Technology: The tech sector, heavily reliant on global trade for components and finished products, also felt the strain. Tariffs on specific technologies increased costs and created uncertainty for companies planning long-term investments.

Key Impacts of Trump's Tariffs:

- Increased costs for imported goods, squeezing profit margins for businesses.

- Supply chain disruptions, leading to production delays and shortages.

- Increased market volatility, making investment decisions more challenging.

- Uncertainty for long-term investment planning, forcing companies to reassess their strategies.

Nicolai Tangen's Preemptive Strategies

Nicolai Tangen, before assuming his role at NBIM, had a successful career in the financial industry, developing a reputation for shrewd investment strategies. His appointment as CEO of the NBIM in 2020 brought a fresh perspective focused on proactive risk management, particularly crucial during the lingering effects of the Trump tariffs. Tangen’s approach prioritized a long-term perspective, acknowledging the inherent volatility of global markets affected by protectionist policies.

Tangen's Proactive Approach:

- Enhanced Due Diligence: NBIM implemented more rigorous due diligence processes for potential investments, carefully evaluating companies' exposure to tariff risks and supply chain vulnerabilities.

- Diversification: The fund further diversified its portfolio across various asset classes (equities, bonds, real estate) and geographic regions, reducing reliance on any single sector or economy heavily impacted by tariffs.

- ESG Focus: Increased emphasis on Environmental, Social, and Governance (ESG) factors allowed for a more nuanced assessment of investment risks, potentially reducing exposure to industries particularly vulnerable to trade wars.

- Strategic Partnerships: NBIM actively pursued strategic partnerships and collaborations to mitigate risks and gain access to diverse investment opportunities globally, lessening the impact of regional trade disputes.

NBIM's Portfolio Adjustments and Risk Mitigation Tactics

In response to the tariffs, the NBIM made significant portfolio adjustments to mitigate potential losses and capitalize on emerging opportunities. Tangen’s leadership steered the fund towards a more resilient and adaptable investment strategy.

NBIM's Key Adjustments:

- Shifting Investments: The NBIM strategically shifted investments away from sectors highly sensitive to tariffs, such as certain manufacturing and technology sub-sectors.

- Domestic Supply Chains: The fund prioritized companies with strong domestic supply chains, reducing their vulnerability to trade disruptions.

- Emerging Markets: The NBIM explored investment opportunities in emerging markets less directly affected by US trade policies, diversifying its geographical exposure.

- Hedging Strategies: Utilizing hedging strategies helped mitigate the negative impact of currency fluctuations resulting from the tariff-related market volatility.

Long-Term Vision and Sustainable Investing During Uncertainty

Tangen’s long-term investment philosophy proved instrumental in navigating the challenges posed by Trump's tariffs. His emphasis on sustainable investing resonated with the NBIM's commitment to responsible investing.

NBIM's Long-Term Approach:

- Long-Term Value Creation: The NBIM maintained its focus on creating long-term value rather than chasing short-term gains, a crucial strategy during periods of market uncertainty.

- Sustainable Investing: Prioritizing investments in companies with strong ESG profiles not only aligned with the fund's values but also helped mitigate long-term risks associated with environmental and social issues.

- Responsible Investing: Emphasizing responsible investment practices served as a buffer against future economic and geopolitical risks.

- Adaptability: The fund demonstrated adaptability and flexibility, modifying its investment strategies in response to evolving global trade dynamics.

Conclusion

Nicolai Tangen's leadership of Norway's sovereign wealth fund during the era of Trump's tariffs showcased a strategic approach to navigating global economic uncertainty. His emphasis on diversification, risk mitigation, and long-term value creation proved crucial in protecting the fund's assets. The NBIM's proactive adjustments, including shifting investments and enhancing due diligence, highlight the importance of adapting investment strategies to respond to significant geopolitical and economic events.

Call to Action: Learn more about how successful investors like Nicolai Tangen adapt their strategies to navigate global economic challenges. Research the impact of trade policies on investment strategies and explore how to implement effective risk mitigation techniques for your own portfolio. Understanding the strategies employed by leading figures like Nicolai Tangen is crucial for navigating the complexities of global investment in the face of future economic uncertainty.

Featured Posts

-

Predicting The 2025 Kentucky Derby Pace Speed Strategy And Winners

May 04, 2025

Predicting The 2025 Kentucky Derby Pace Speed Strategy And Winners

May 04, 2025 -

The Count Of Monte Cristo Review A Classic Tale Of Revenge

May 04, 2025

The Count Of Monte Cristo Review A Classic Tale Of Revenge

May 04, 2025 -

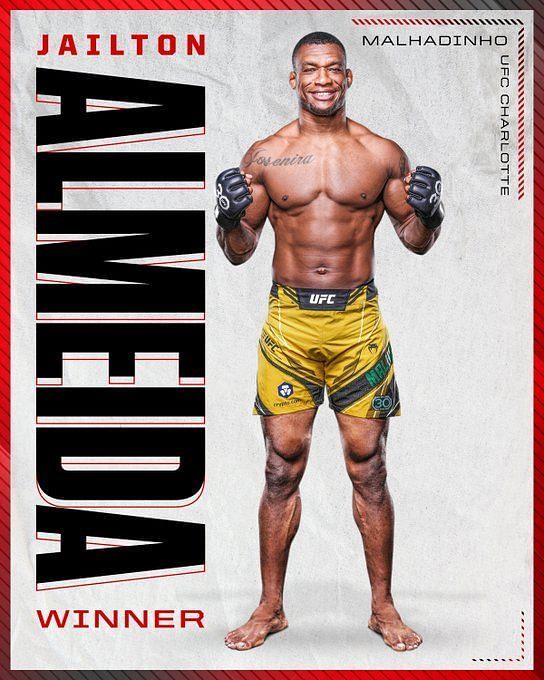

Ajagba The Making Of A World Champion

May 04, 2025

Ajagba The Making Of A World Champion

May 04, 2025 -

Former Ufc Champion Announces Comeback Fight For May 3rd

May 04, 2025

Former Ufc Champion Announces Comeback Fight For May 3rd

May 04, 2025 -

Bakole Vs Ajagba Boxing Betting Predictions And Odds

May 04, 2025

Bakole Vs Ajagba Boxing Betting Predictions And Odds

May 04, 2025