How Student Loan Debt Affects Your Ability To Buy A House

Table of Contents

The Impact of Student Loan Debt on Your Credit Score

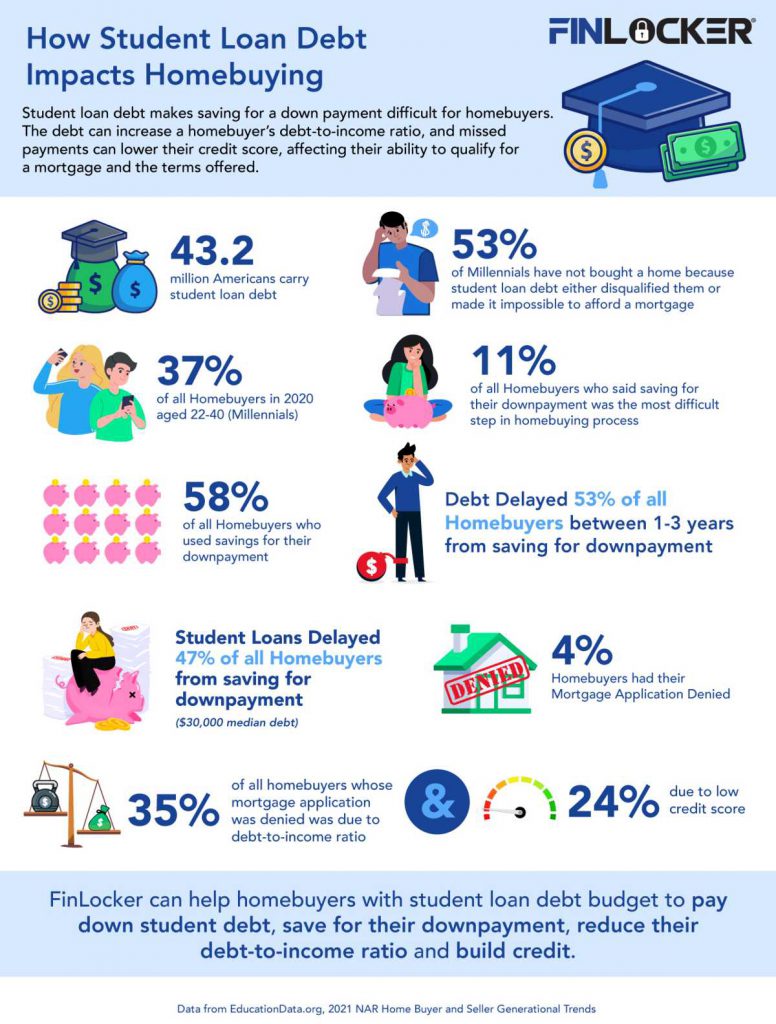

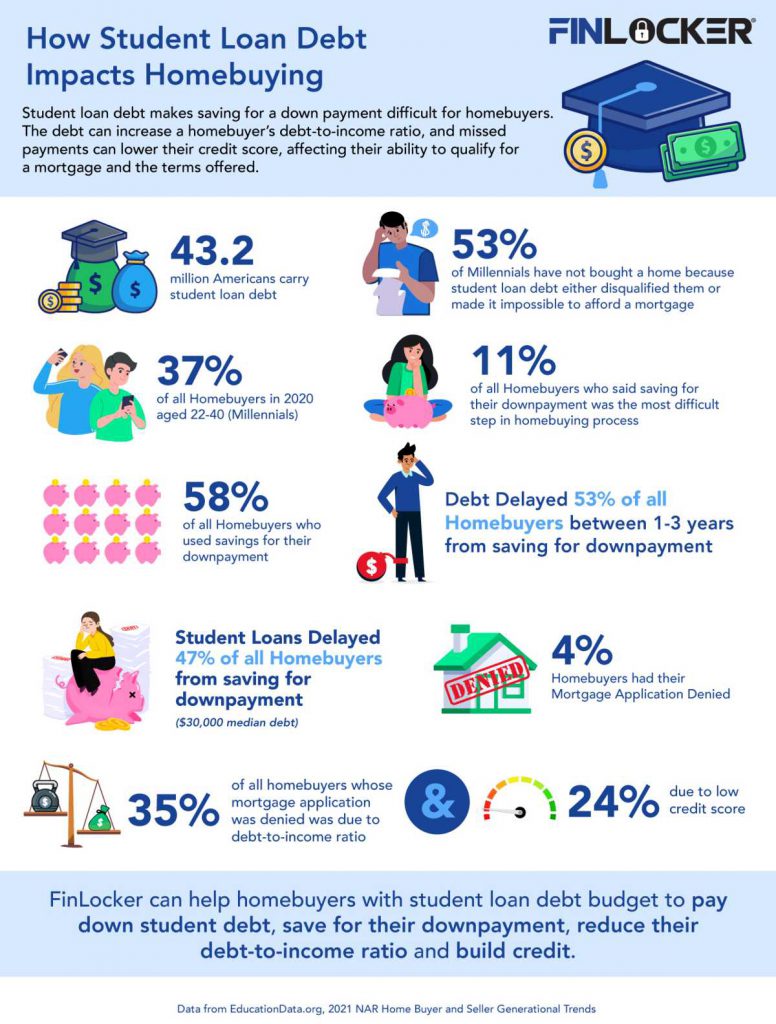

Successfully navigating the home-buying process hinges significantly on your credit score. Understanding how student loan debt impacts this crucial factor is paramount.

Understanding Credit Scores and Mortgage Approval

Your credit score is a three-digit number that lenders use to assess your creditworthiness. Lenders primarily use FICO scores, which range from 300 to 850. A higher score indicates a lower risk to the lender, resulting in more favorable mortgage terms. A lower score, often caused by poor financial management, can lead to higher interest rates, increased down payment requirements, or even mortgage denial.

- Late or missed student loan payments significantly lower your credit score. Even one missed payment can have a noticeable negative impact, lingering on your credit report for years.

- A lower credit score results in higher interest rates or even mortgage denial. The higher your score, the lower the interest rate you’ll likely qualify for, saving you thousands over the life of your mortgage.

- Maintaining good payment history on student loans is crucial for improving your creditworthiness. Consistent on-time payments demonstrate responsible financial behavior, boosting your credit score over time.

- Strategies for improving your credit score include using credit monitoring services and paying bills on time. Credit monitoring services can alert you to potential problems, while consistently paying all your bills on time is essential for building a strong credit history.

The Weight of Student Loan Debt on Your Debt-to-Income Ratio (DTI)

Your debt-to-income ratio (DTI) is another critical factor lenders consider. It represents the percentage of your gross monthly income that goes towards debt repayment. A high DTI indicates a greater financial burden, making lenders less likely to approve your mortgage application.

- High student loan payments significantly reduce your DTI, impacting your ability to qualify for a mortgage. The more you owe in student loans, the less you have available to put towards a mortgage payment without exceeding a lender’s acceptable DTI threshold.

- Lenders prefer lower DTI ratios, making it harder to secure a loan with significant student loan debt. A general guideline is to keep your DTI below 43%, although this can vary depending on the lender and type of mortgage.

- Strategies to improve your DTI include paying down high-interest debts. Before applying for a mortgage, focus on reducing other high-interest debt, such as credit card debt, to free up more of your income for mortgage payments.

Navigating the Mortgage Application Process with Student Loan Debt

Even with student loan debt, securing a mortgage is possible. Understanding the process and available options is key.

Types of Mortgages and Their Suitability

Several mortgage options cater to different financial situations. Understanding these can increase your chances of approval.

- FHA loans often have lower credit score requirements. Federal Housing Administration (FHA) loans are backed by the government, making them more accessible to borrowers with lower credit scores.

- USDA loans are available for rural properties and may be more accessible. The United States Department of Agriculture (USDA) loans are designed to assist homebuyers in rural areas, often having more lenient requirements.

- Conventional loans often require higher credit scores and lower DTI ratios. Conventional loans are not government-backed, resulting in stricter qualification criteria.

Providing Documentation and Transparency

Accuracy and completeness are crucial during the mortgage application process.

- Lenders will review all aspects of your financial situation, including student loans. Be prepared to provide detailed information about your student loan debt, including balances, interest rates, and payment history.

- Being transparent about your student loan debt is crucial. Hiding or downplaying your student loan debt can severely damage your chances of approval and even have legal consequences.

- Failing to disclose debts can lead to loan denial. Complete honesty and accurate documentation are essential for a successful application.

Strategies for Homeownership with Student Loan Debt

Even with substantial student loan debt, homeownership is attainable with careful planning and strategic action.

Creating a Realistic Budget and Saving for a Down Payment

Careful financial management is paramount.

- Develop a detailed budget to track income and expenses, including student loan payments. This will help you understand your financial situation and identify areas where you can save.

- Prioritize saving for a down payment to reduce the loan amount needed. A larger down payment typically results in better mortgage terms.

- Explore ways to increase income and reduce expenses. Consider taking on a side hustle or finding ways to cut back on unnecessary spending.

Exploring Debt Consolidation or Repayment Plans

Managing your student loan debt effectively is crucial.

- Explore income-driven repayment plans (IDR) to lower monthly payments. IDRs adjust your monthly payments based on your income and family size.

- Consider student loan refinancing to potentially lower interest rates. Refinancing can consolidate multiple loans into one with a lower interest rate, potentially reducing your monthly payments.

- Consult with a financial advisor to determine the best repayment strategy. A financial advisor can provide personalized guidance on managing your student loans and preparing for homeownership.

Conclusion

Student loan debt presents significant challenges to aspiring homeowners, impacting credit scores and DTI ratios, thereby affecting mortgage approval. However, by understanding these challenges and proactively addressing your finances, homeownership remains achievable. Through careful budgeting, strategic debt management, and exploring various mortgage options, you can navigate the complexities of student loan debt and achieve your dream of owning a home. Don't let student loan debt derail your homeownership dreams; take control of your finances and start planning your path to homeownership today! Learn more about how to manage your student loan debt and improve your chances of buying a house.

Featured Posts

-

51 Million Bid Liverpools Interest In German Midfielder Intensifies

May 17, 2025

51 Million Bid Liverpools Interest In German Midfielder Intensifies

May 17, 2025 -

Vr

May 17, 2025

Vr

May 17, 2025 -

Long Term Impact Of Ohio Train Derailment Toxic Chemical Residues In Structures

May 17, 2025

Long Term Impact Of Ohio Train Derailment Toxic Chemical Residues In Structures

May 17, 2025 -

Putin Dhe Presidenti I Eau Detajet E Bisedes Se Fundit Telefonike

May 17, 2025

Putin Dhe Presidenti I Eau Detajet E Bisedes Se Fundit Telefonike

May 17, 2025 -

Sansele Lui Stiller De A Juca Pentru Vf B Stuttgart In Finala Cupei

May 17, 2025

Sansele Lui Stiller De A Juca Pentru Vf B Stuttgart In Finala Cupei

May 17, 2025