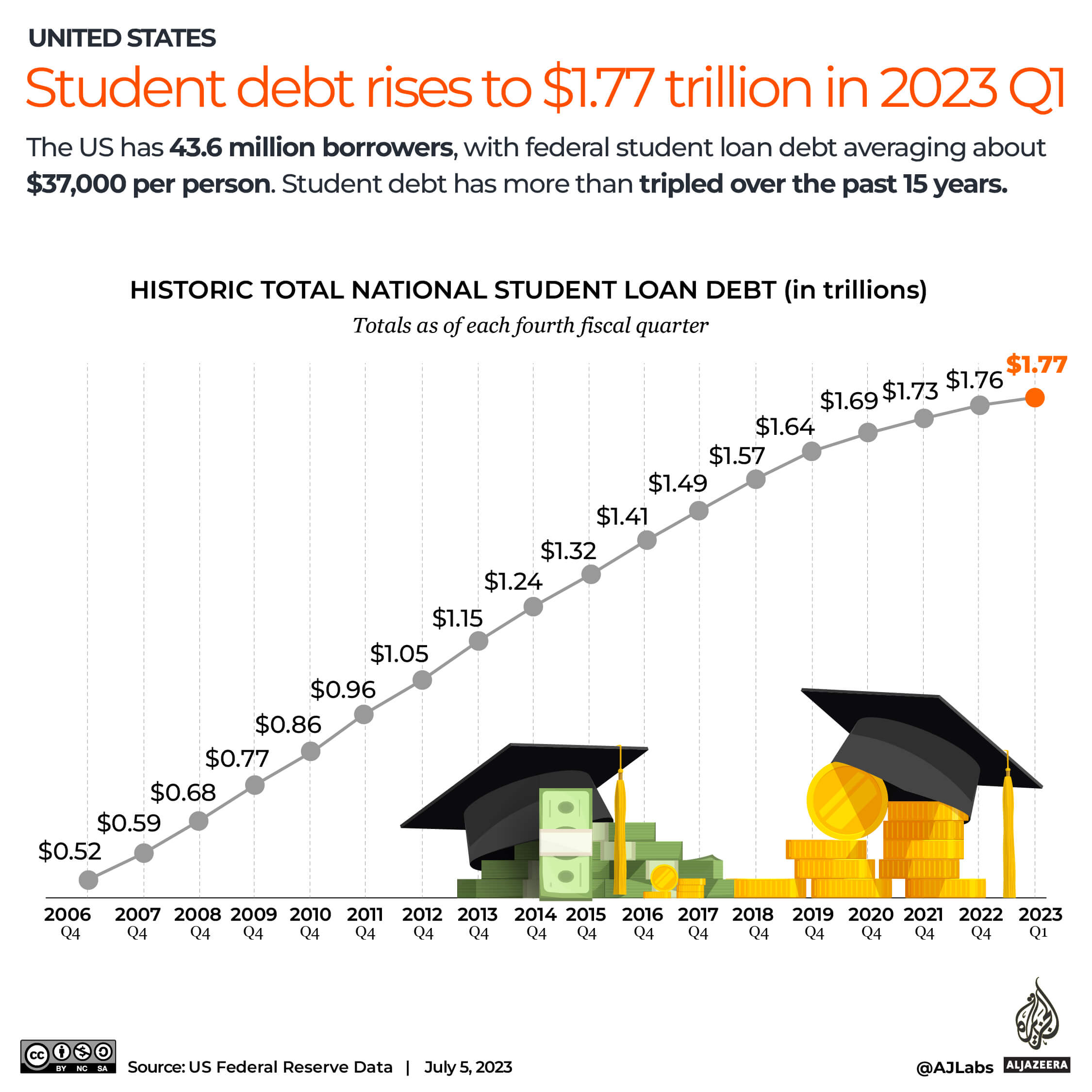

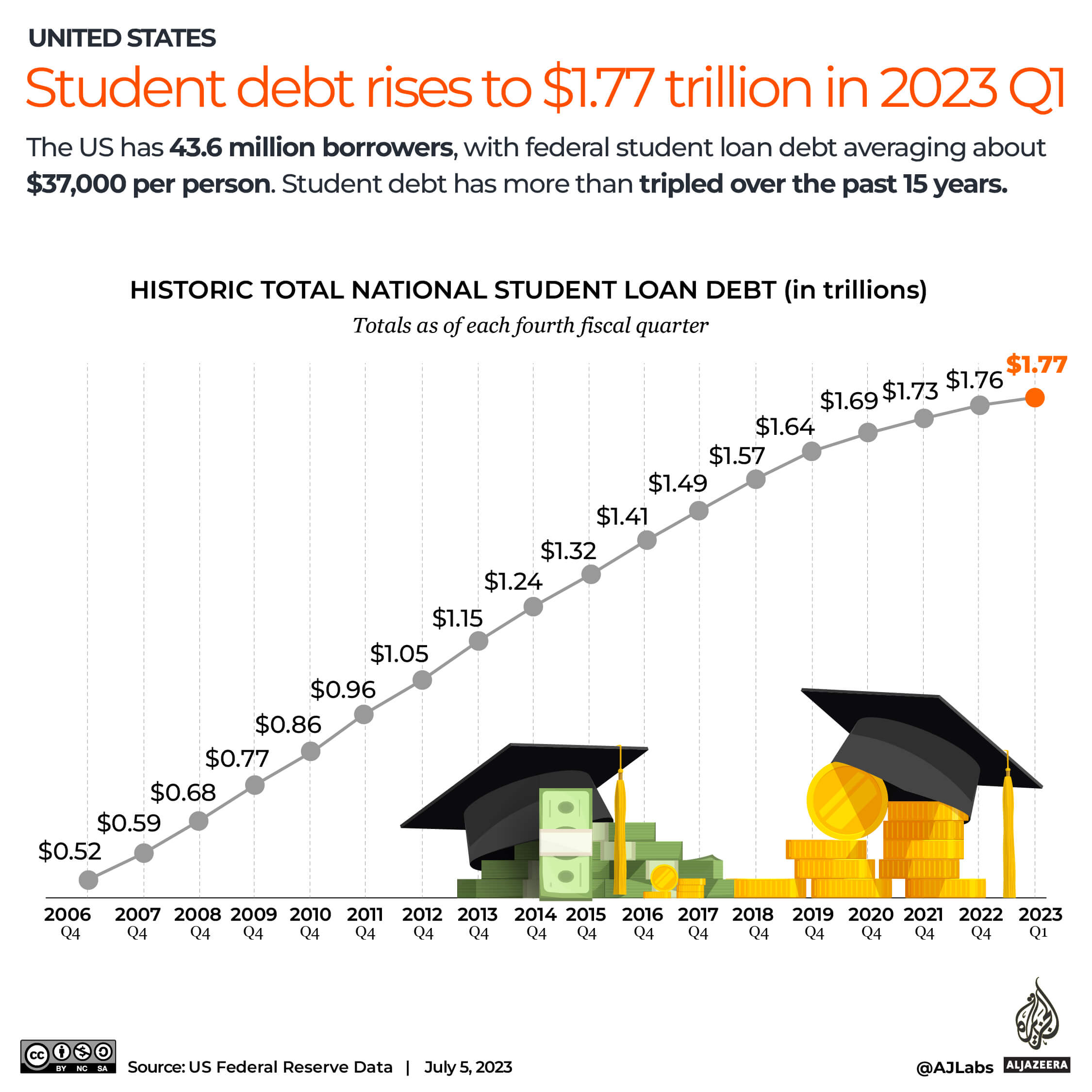

How The Student Loan Crisis Will Impact The US Economy

Table of Contents

Reduced Consumer Spending and Economic Growth

The crushing weight of student loan debt significantly impacts consumer spending and overall economic growth. The sheer volume of debt owed by millions of Americans directly translates to less disposable income available for other crucial economic activities.

Lower Disposable Income

Student loan payments consume a significant portion of borrowers' income, leaving less for essential expenses and discretionary spending.

- Reduced consumer spending translates to slower economic growth. This decreased spending power ripples throughout various sectors.

- This impacts various sectors, from retail to restaurants to the travel industry. Businesses reliant on consumer spending experience reduced revenue and are forced to make difficult decisions, potentially leading to job losses.

- Studies show a direct correlation between high student loan debt and decreased consumer confidence, leading to less investment in the economy. For instance, a study by the Federal Reserve Bank of New York found that increased student loan debt is associated with lower levels of homeownership and reduced overall spending. [Insert link to study here]. This reduced confidence creates a negative feedback loop, further slowing economic growth.

Impact on Housing Market

High student loan debt makes it harder for young adults to save for a down payment on a home, depressing the housing market. This has significant consequences for the overall economy.

- Fewer home purchases mean less construction and related economic activity. The construction industry, along with related sectors like furniture and appliance sales, suffers when fewer homes are being built.

- This delays the formation of new families and impacts related markets. Delaying homeownership has a ripple effect on family formation, impacting markets catering to families like childcare, education, and consumer goods.

- This also impacts mortgage lenders and related financial institutions. Reduced demand for mortgages affects the profitability and stability of financial institutions.

Impact on Entrepreneurship and Small Business Growth

The student loan crisis significantly stifles entrepreneurship and small business growth, hindering innovation and job creation. The financial burden associated with repaying loans often discourages individuals from taking the risk of starting their own business.

Stifled Business Creation

The burden of student loans discourages many young adults from starting their own businesses, hindering innovation and job creation.

- Fewer startups mean fewer jobs and less economic diversification. A vibrant economy thrives on new businesses, offering diverse employment opportunities and driving innovation.

- This limits competition and potential for economic advancement. A lack of new businesses hinders competition, potentially leading to higher prices and slower innovation.

- The impact on venture capital and angel investing is also significant. Investors may be less inclined to fund startups founded by individuals heavily burdened with student loan debt, perceiving them as higher risk.

Delayed Career Advancement

The financial strain of student loan repayment can delay career advancement, as individuals may prioritize paying down debt over pursuing higher education or training.

- This limits overall productivity and wage growth. Individuals may forgo opportunities for professional development or advanced training to focus on debt repayment.

- A less skilled and less mobile workforce impacts long-term economic growth. The lack of professional development restricts overall economic productivity and limits potential earnings.

- This also connects to reduced tax revenue for the government due to lower earning potential. Lower incomes translate to less tax revenue for the government, potentially impacting public services and infrastructure.

The Ripple Effect on the Financial System

The student loan crisis creates a ripple effect throughout the financial system, posing significant risks to lenders, investors, and the overall stability of the economy.

Increased Risk of Defaults

A high rate of student loan defaults can create instability in the financial system, affecting lenders and investors.

- This can lead to a credit crunch, impacting access to capital for businesses and consumers. Increased defaults make lenders more cautious, potentially restricting credit availability.

- It also impacts the government's budget due to increased costs associated with default management. The government bears significant costs associated with managing defaults, adding to the national debt.

- This highlights the potential for systemic risk and the role of government intervention. The government's response to the crisis, including potential bailout measures, impacts the overall financial system.

Impact on Federal Budget

The cost of student loan forgiveness programs or increased government intervention to address the crisis will have a significant impact on the federal budget.

- This could lead to cuts in other essential government programs or an increase in national debt. Funding student loan relief programs may necessitate cuts in other crucial areas like infrastructure or healthcare.

- It influences fiscal policy and overall economic stability. The government's response to the student loan crisis affects fiscal policy decisions and the overall stability of the economy.

- Different scenarios and their economic consequences must be carefully explored. The long-term economic impact of different policy responses to the student loan crisis needs comprehensive analysis.

Conclusion

The student loan crisis is not merely a personal financial issue; it’s a systemic threat to the US economy with far-reaching consequences. From reduced consumer spending and stifled entrepreneurship to increased risks within the financial system and burdens on the federal budget, the impact is undeniable. Addressing this crisis requires comprehensive solutions, including policy changes to make higher education more affordable, innovative repayment plans, and increased support for borrowers struggling with debt. Ignoring the student loan crisis will only exacerbate its negative impact on the US economy. Understanding the implications of the student loan crisis is crucial for policymakers, businesses, and individuals alike. Let's work together to find solutions to mitigate the damaging effects of the student loan debt crisis and secure a more prosperous future for the US.

Featured Posts

-

Smartphone Samsung Galaxy S25 256 Go Avis Prix Et Bon Plan

May 28, 2025

Smartphone Samsung Galaxy S25 256 Go Avis Prix Et Bon Plan

May 28, 2025 -

Ipswich Town Team News Injury Update Ahead Of Bournemouth Trip

May 28, 2025

Ipswich Town Team News Injury Update Ahead Of Bournemouth Trip

May 28, 2025 -

Natos Progress On 5 Defense Spending A Report From Stoltenberg

May 28, 2025

Natos Progress On 5 Defense Spending A Report From Stoltenberg

May 28, 2025 -

Nhayt Almwsm Ayndhwfn Yhtfl Blqb Aldwry Alhwlndy

May 28, 2025

Nhayt Almwsm Ayndhwfn Yhtfl Blqb Aldwry Alhwlndy

May 28, 2025 -

Taylor Swift And Beyonce Secure Multiple 2025 Ama Nominations

May 28, 2025

Taylor Swift And Beyonce Secure Multiple 2025 Ama Nominations

May 28, 2025