How The Weakening Dollar Affects Asian Currency Stability

Table of Contents

Increased Volatility in Asian Exchange Rates

A weakening dollar often translates to increased volatility in Asian exchange rates. This is because many Asian currencies are pegged or indirectly linked to the dollar, meaning their value fluctuates in relation to the dollar's strength. This increased volatility creates uncertainty and risk within the Asian financial landscape.

- Increased uncertainty for businesses engaging in international trade: Fluctuating exchange rates make it difficult for businesses to accurately predict future profits and manage their financial risks, especially those involved in import and export activities. Hedging strategies become more complex and costly.

- Potential for currency speculation and rapid fluctuations: The uncertainty surrounding a weakening dollar can attract speculators who attempt to profit from short-term currency movements, further exacerbating volatility. This can lead to rapid and unpredictable shifts in exchange rates.

- Impact on import and export prices: A weaker dollar can make imports more expensive for Asian countries, potentially increasing inflation. Conversely, it can make Asian exports more competitive in the global market, but the extent depends on the specific currency's movement against other major currencies.

- Examples of specific Asian currencies affected and the extent of volatility: The Japanese Yen, South Korean Won, and the Chinese Yuan, among others, often experience significant fluctuations in response to dollar movements. The extent of volatility varies depending on factors such as the country's economic policies, trade balance, and the level of foreign exchange reserves.

Impact on Asian Exports and Economic Growth

The impact of a weakening dollar on Asian exports and economic growth is multifaceted. While a weaker dollar can boost demand for Asian goods priced in US dollars, it presents both opportunities and challenges.

- Increased demand for Asian goods priced in US dollars: A weaker dollar makes Asian exports relatively cheaper for US and other dollar-based consumers, potentially stimulating demand and economic growth in export-oriented Asian economies.

- Potential for economic growth in export-oriented Asian economies: Countries like Vietnam, Bangladesh, and others heavily reliant on exports to the US might experience a surge in economic activity.

- Conversely, challenges for countries heavily reliant on dollar-denominated imports: A weaker dollar increases the cost of imports for all Asian countries, which can negatively affect businesses reliant on imported raw materials or components. This leads to higher production costs and reduced profitability.

- Examples of industries and countries most affected: The electronics, textile, and manufacturing sectors are particularly vulnerable to changes in exchange rates. Countries with significant trade surpluses with the US may benefit more while those with large trade deficits could experience challenges.

The Role of Central Bank Intervention

Central banks in Asia play a crucial role in managing the impact of a weakening dollar on their respective currencies. They employ various strategies to mitigate volatility and maintain stability.

- Strategies employed by central banks to manage exchange rates (e.g., interest rate adjustments, foreign exchange reserves): Central banks may raise interest rates to attract foreign investment and strengthen their currencies. They may also utilize their foreign exchange reserves to intervene directly in the foreign exchange market, buying or selling their currency to influence its value.

- Challenges faced by central banks in managing currency stability amidst external pressures: External factors like global economic uncertainty and speculative attacks can significantly hamper central bank efforts to control exchange rates. The effectiveness of intervention strategies depends heavily on market conditions and the size of the central bank's reserves.

- The effectiveness of different intervention strategies: The effectiveness of these strategies varies depending on many factors and there's no one-size-fits-all solution.

- Examples of specific central bank actions in response to dollar weakness: The People's Bank of China, for example, has employed various measures, including managing the Yuan's exchange rate against a basket of currencies, to mitigate the effects of dollar weakness.

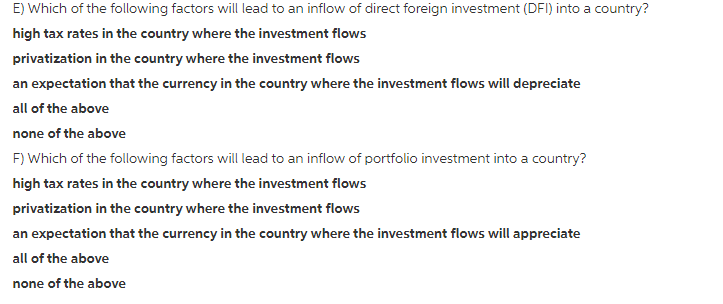

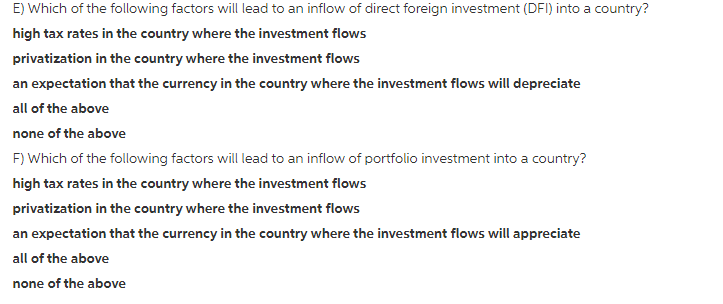

Implications for Foreign Investment in Asia

A weakening dollar can significantly influence foreign direct investment (FDI) flows into Asia. The impact, however, is not always straightforward and depends on several factors.

- Impact on the attractiveness of Asian markets for foreign investors: A weaker dollar can initially make Asian assets cheaper for foreign investors, potentially attracting more investment. However, increased currency volatility can also deter investors seeking stable returns.

- Changes in investment returns due to currency fluctuations: Unpredictable exchange rates can impact the returns that foreign investors receive from their investments in Asia.

- Potential for capital flight or increased investment depending on various factors: If investors anticipate further dollar weakening and increased volatility, they might withdraw investments (capital flight). Conversely, some investors might see opportunities for higher returns in certain Asian markets.

- Analysis of FDI trends in relation to dollar movements: Historical data can reveal correlations between dollar movements and FDI flows into specific Asian countries, allowing for a deeper understanding of these dynamics.

Case Studies: Specific Examples of Asian Economies

Analyzing specific instances of dollar weakening and their effects on individual Asian economies offers valuable insights. For example, the Asian Financial Crisis of 1997-98 was partly triggered by a strong dollar and subsequent capital flight from several Asian nations. Conversely, periods of dollar weakness have sometimes benefitted export-oriented economies in Southeast Asia. Detailed case studies examining these scenarios with data from relevant time periods are crucial for understanding the complex relationships involved.

Conclusion

Understanding the intricate relationship between a weakening dollar and Asian currency stability is crucial for investors, businesses, and policymakers alike. A weaker dollar can lead to increased exchange rate volatility, impacting trade, investment flows, and economic growth across the Asian region. Central banks play a vital role in managing these fluctuations, but external pressures and market dynamics can significantly affect their effectiveness. The impact varies across different Asian economies, depending on their economic structures and policy responses. Monitoring key economic indicators, including exchange rates, interest rates, and trade balances, is essential for navigating this dynamic landscape. Continue to monitor key economic indicators and stay informed about the evolving dynamics between the US dollar and Asian currencies to effectively manage risks and opportunities presented by a weakening dollar.

Featured Posts

-

Patrick Schwarzenegger On His Missed Chance At Superman A David Corenswet Conversation

May 06, 2025

Patrick Schwarzenegger On His Missed Chance At Superman A David Corenswet Conversation

May 06, 2025 -

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Scene

May 06, 2025

Chris Pratts Reaction To Patrick Schwarzeneggers White Lotus Scene

May 06, 2025 -

Watch Celtics Vs Heat Game Details For February 10th

May 06, 2025

Watch Celtics Vs Heat Game Details For February 10th

May 06, 2025 -

San Antonio Spurs Mitch Johnson Succede A Gregg Popovich

May 06, 2025

San Antonio Spurs Mitch Johnson Succede A Gregg Popovich

May 06, 2025 -

Gregg Popovich Absent L Avenir Des Spurs Sur Le Banc

May 06, 2025

Gregg Popovich Absent L Avenir Des Spurs Sur Le Banc

May 06, 2025