How To Read And Interpret Proxy Statements (Form DEF 14A) Effectively

Table of Contents

Understanding the Structure of a Proxy Statement (Form DEF 14A)

Navigating a proxy statement can feel daunting, but understanding its structure is the first step to effective interpretation. Form DEF 14A, the official SEC designation for a proxy statement, follows a generally consistent format, making it easier to locate key information once you know what to look for.

The Cover Page and Key Information

The cover page provides essential initial information. Always check this first!

- Company Name and Symbol: Quickly confirms you're reviewing the correct document.

- Filing Date: Crucial to ensure you have the most up-to-date version. Older filings may be superseded.

- Annual Meeting Date and Time: Indicates when shareholder votes are tallied.

- Shareholder Meeting Location (if applicable): Informs you if the meeting will be held in person or virtually.

Always verify the filing date to ensure you are reviewing the most current version of the proxy statement. Outdated proxy statements may contain inaccurate or superseded information.

Identifying the Key Proposals

The heart of the proxy statement lies in the proposals put forth for shareholder vote. Common proposal types include:

- Election of Directors: This section outlines the candidates for the board of directors, often including biographical information and relevant experience. Pay attention to director independence and expertise.

- Executive Compensation: This details the compensation packages of the company's top executives. We'll delve deeper into this section later.

- Shareholder Proposals: These are proposals submitted by shareholders themselves, addressing various corporate governance or social issues.

- Ratification of Auditors: This proposal seeks shareholder approval for the company's independent auditors.

- Advisory Votes on Executive Compensation: These are non-binding votes allowing shareholders to express their opinions on executive pay packages.

Understanding the significance of each proposal type is essential for making informed voting decisions. Each proposal requires careful review to assess its potential impact on the company and your investment.

Understanding the Voting Process

Proxy statements explain how to vote. Methods typically include:

- Voting by Mail: Traditional method requiring a paper ballot.

- Voting Online: Convenient and increasingly common.

- Voting at the Meeting: Requires attending the annual shareholder meeting in person.

Deadlines for submitting votes are clearly stated, and missing these deadlines can result in your vote not being counted. Therefore, pay close attention to the instructions and deadlines provided in the proxy statement. Your vote counts – actively participate in the corporate governance process.

Analyzing Key Sections of the Proxy Statement (Form DEF 14A)

Once you understand the structure, focus on key sections that directly impact shareholder value and corporate governance.

Executive Compensation

Scrutinize executive compensation packages. Look for:

- Salary: Base compensation.

- Bonuses: Performance-based incentives.

- Stock Options: Equity-based compensation.

- Other Benefits: Perks such as retirement plans, health insurance, and other perks.

Analyze the relationship between executive compensation and company performance. Are executive pay packages aligned with shareholder returns and company success?

Corporate Governance

Review the company’s corporate governance structure. Key aspects include:

- Board Composition: Analyze the independence and expertise of the board members. Look for diversity in skills, experience, and background.

- Audit Committee: Responsible for overseeing the company's financial reporting. Assess the independence and expertise of the members.

- Risk Management: How does the company identify and manage risks? Look for robust policies and procedures.

- Nominating and Corporate Governance Committee: The roles and responsibilities of these committees are crucial for maintaining good corporate governance.

A strong corporate governance structure protects shareholder interests and promotes long-term value creation.

Financial Statements (if included)

While proxy statements don't typically contain detailed financial statements, any included financial information should be reviewed. Remember, however, this is likely to be summary information. For a comprehensive analysis, consult the company's quarterly and annual reports (10-Q and 10-K filings).

Shareholder Proposals

Carefully review any shareholder proposals. Consider:

- Background: The context of the proposal.

- Rationale: The reasons behind the proposal.

- Potential Impact: How could this proposal affect the company and its shareholders?

Understanding shareholder proposals is critical as they represent important issues raised by fellow shareholders.

Utilizing Resources to Interpret Proxy Statements (Form DEF 14A)

Several resources can aid your understanding.

SEC's EDGAR Database

The SEC's EDGAR database () is the official source for SEC filings, including proxy statements.

Proxy Voting Services

Many proxy voting services offer analysis and recommendations to help investors make informed decisions.

Financial News and Analyst Reports

Consult financial news sources and analyst reports for additional insights and perspectives on the company and its proxy statement.

Conclusion

Mastering the art of reading and interpreting proxy statements (Form DEF 14A) is essential for every informed investor and shareholder. By understanding the structure, analyzing key sections (executive compensation, corporate governance, shareholder proposals), and utilizing available resources, you can make well-informed decisions. Take the time to carefully review these crucial documents before making investment decisions. By actively engaging with proxy statements, you're taking an active role in corporate governance and protecting your financial interests. Start improving your investment strategy today by learning how to effectively read and interpret proxy statements and Form DEF 14A documents.

Featured Posts

-

Premiile Gopo 2025 Nominalizari Complete Pentru Anul Nou Care N A Fost Si Morometii 3

May 17, 2025

Premiile Gopo 2025 Nominalizari Complete Pentru Anul Nou Care N A Fost Si Morometii 3

May 17, 2025 -

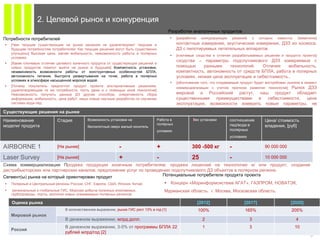

V Industrialnykh Parkakh Vysokaya Konkurentsiya I Vozmozhnosti

May 17, 2025

V Industrialnykh Parkakh Vysokaya Konkurentsiya I Vozmozhnosti

May 17, 2025 -

Killer Cartoons Terrorize The Fifteenth Doctor In Doctor Who Season 2 Trailer

May 17, 2025

Killer Cartoons Terrorize The Fifteenth Doctor In Doctor Who Season 2 Trailer

May 17, 2025 -

Toni Naumovski Lena I Vladimir A Osvoi A Nagradata Na Sedona Film Festival

May 17, 2025

Toni Naumovski Lena I Vladimir A Osvoi A Nagradata Na Sedona Film Festival

May 17, 2025 -

Knicks News Jalen Brunson Injury Update Koleks Extended Role And Season Finish Breakdown

May 17, 2025

Knicks News Jalen Brunson Injury Update Koleks Extended Role And Season Finish Breakdown

May 17, 2025