How Trump's Southeast Asia Tariffs Reshaped India's Solar Export Landscape

Table of Contents

The Pre-Tariff Scenario: India's Solar Industry Before 2018

Before 2018, India's solar energy sector was heavily reliant on imports, primarily from China. This dependence significantly influenced the development of the domestic industry.

Dependence on Chinese Solar Imports

- Overwhelming reliance: China supplied a dominant share of India's solar panels and other equipment, often at significantly lower costs than domestic options. Import volumes were massive, representing a critical component of India’s solar installations.

- Cost-effectiveness: The low prices of Chinese imports made solar power projects more economically viable, driving the rapid expansion of solar energy capacity in India. However, this dependence created vulnerabilities in the supply chain.

- Key Chinese Suppliers: Several major Chinese manufacturers dominated the Indian market, controlling a substantial portion of the supply chain. This concentration of power limited bargaining leverage for Indian buyers.

Limited Domestic Manufacturing Capacity

India's domestic solar manufacturing sector was relatively underdeveloped before the tariffs.

- Nascent industry: Indian manufacturers struggled to compete with the economies of scale and technological advancements of their Chinese counterparts. High production costs hindered their growth.

- Technological gap: A significant technological gap existed between Indian and Chinese manufacturers, limiting the competitiveness of Indian-made solar products.

- Lack of government support: While government support for renewable energy was growing, substantial incentives and investments in domestic manufacturing were lacking.

Early Export Attempts and Their Limitations

Despite the challenges, some Indian companies attempted to export solar products. However, these efforts faced significant hurdles.

- Limited market access: International competition, particularly from Chinese companies, was fierce, making it difficult for Indian exporters to gain a foothold in global markets.

- Logistical challenges: Exporting solar products requires specialized logistics and handling, which presented a challenge for many Indian companies.

- Pricing competitiveness: Indian manufacturers struggled to match the low prices offered by Chinese competitors, hindering export potential.

The Impact of Trump's Southeast Asia Tariffs

The Trump administration's tariffs on solar products from Southeast Asia created a ripple effect throughout the global solar industry, significantly influencing the Indian market.

Disruption of the Global Supply Chain

- Significant tariffs: The tariffs imposed substantially increased the cost of solar panels from Southeast Asia, disrupting the global supply chain.

- Price increases: The tariffs led to significant price increases for solar panels in many markets, affecting project costs and slowing down the expansion of solar power capacity in certain regions.

- Shortages: The reduction in supply from Southeast Asia created shortages in some markets, further impacting project timelines and costs.

Increased Demand for Indian Solar Products

The disruption caused by the tariffs created an unexpected opportunity for India.

- New market access: Some countries sought alternative suppliers, leading to increased demand for Indian solar products.

- Increased competitiveness: With Chinese and Southeast Asian supplies constrained, Indian manufacturers became more competitive in price and delivery.

- Shift in demand: The tariffs accelerated a shift in demand away from traditional suppliers like China and Southeast Asia, towards countries like India.

Challenges Faced by Indian Exporters

Despite the newfound opportunities, Indian exporters faced challenges in meeting the increased demand.

- Production capacity constraints: Many Indian manufacturers struggled to quickly scale up production to meet the growing demand.

- Quality control: Maintaining consistent quality across increased production volumes was crucial, and ensuring adherence to international standards presented a challenge.

- Certification requirements: Meeting the certification requirements of different international markets was a complex process.

Reshaping India's Solar Export Landscape: Post-Tariff Developments

The tariffs triggered a period of significant change for the Indian solar industry, impacting its export capabilities.

Growth in Indian Solar Exports

- Quantifiable increase: Post-tariffs, there was a measurable increase in the volume and value of Indian solar exports. While precise figures vary depending on the data source and time frame, a notable shift is demonstrable.

- Key export destinations: Indian solar exports expanded to new markets in Asia, Africa, and other regions, diversifying its customer base.

- Types of products: The types of solar products exported expanded beyond basic panels to include more sophisticated systems and components.

Government Initiatives and Policies

The Indian government played a significant role in supporting the growth of the solar industry.

- Production Linked Incentive (PLI) Scheme: The PLI scheme provided substantial financial incentives to domestic solar manufacturers, enhancing their competitiveness.

- Investment in R&D: Increased investment in research and development helped improve the technological capabilities of Indian manufacturers.

- Renewable energy targets: Ambitious renewable energy targets set by the government spurred domestic manufacturing and exports.

Long-Term Implications for the Indian Solar Sector

The changes triggered by the tariffs have long-term implications for India's solar sector.

- Increased domestic manufacturing: The tariffs accelerated the development of India’s domestic solar manufacturing capacity, reducing reliance on imports.

- Job creation: The growth of the solar industry led to significant job creation across manufacturing, installation, and related sectors.

- Technological advancement: The pressure to compete internationally spurred technological innovation and advancements within the Indian solar industry.

Conclusion

Trump's Southeast Asia tariffs presented a watershed moment for India's solar export landscape. While initially reliant on imports, primarily from China, the tariffs disrupted global supply chains, creating an unexpected opportunity for Indian manufacturers. The resulting increase in demand, coupled with supportive government policies, accelerated the growth of the domestic solar industry and significantly boosted exports. The long-term implications are substantial, pointing towards a more self-sufficient and globally competitive Indian solar sector. Understanding the impact of trade policies on the Indian solar export market is crucial. Stay informed about how Trump's Southeast Asia tariffs and subsequent developments continue to shape India's renewable energy future.

Featured Posts

-

Economic Uncertainty Elevated A Deeper Look At Inflation And Unemployment

May 30, 2025

Economic Uncertainty Elevated A Deeper Look At Inflation And Unemployment

May 30, 2025 -

Alcaraz Conquers Monte Carlo A Week Of Challenges Culminates In Victory

May 30, 2025

Alcaraz Conquers Monte Carlo A Week Of Challenges Culminates In Victory

May 30, 2025 -

Awstabynkw Ttqdm Bthbat Me Tsaed Wtyrt Mwsm Almlaeb Altrabyt

May 30, 2025

Awstabynkw Ttqdm Bthbat Me Tsaed Wtyrt Mwsm Almlaeb Altrabyt

May 30, 2025 -

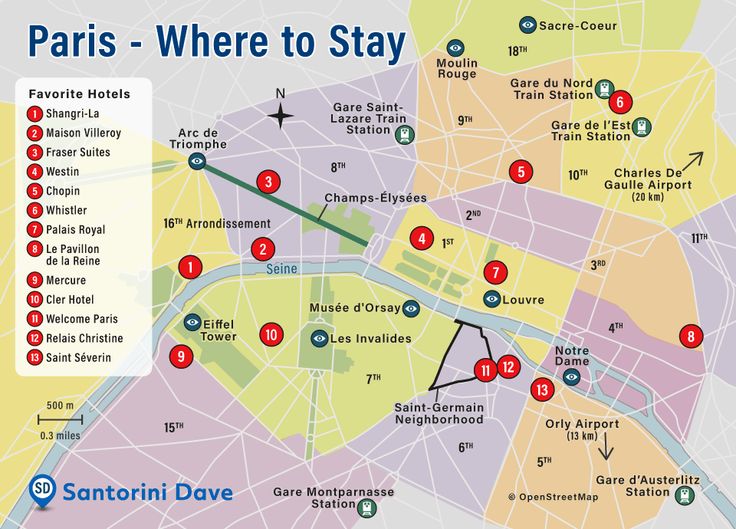

Discover The Best Areas To Stay In Paris A Neighborhood Guide

May 30, 2025

Discover The Best Areas To Stay In Paris A Neighborhood Guide

May 30, 2025 -

Glastonbury Tickets Official Resale Sold Out In 30 Minutes

May 30, 2025

Glastonbury Tickets Official Resale Sold Out In 30 Minutes

May 30, 2025