How Trump's Tariffs Crippled The Fintech IPO Market: Examining Affirm Holdings (AFRM)

Table of Contents

The Trump Administration's Trade War and its Economic Ripple Effects

The Trump administration's imposition of tariffs, ostensibly aimed at protecting American industries and leveling the global trade playing field, inadvertently triggered a chain reaction of unforeseen consequences. The intended goals, while debated, centered around boosting domestic manufacturing and reducing the US trade deficit. However, the reality was far more complex. The resulting trade war created significant uncertainty in the global economy, impacting investor sentiment and fueling risk aversion. This uncertainty rippled through various sectors, significantly affecting the appetite for riskier investments, like many Fintech IPOs.

The economic ramifications were widespread:

- Increased import costs for businesses: Tariffs inflated the prices of imported goods, increasing production costs for companies reliant on global supply chains.

- Supply chain disruptions: The trade war created bottlenecks and delays, disrupting established supply chains and impacting production schedules.

- Reduced consumer spending: Higher prices on goods, coupled with economic uncertainty, led to decreased consumer spending.

- Increased volatility in financial markets: The unpredictable nature of the trade war created volatility in stock markets, making investors hesitant to commit to new, high-growth ventures.

The Fintech Sector's Vulnerability to Economic Downturns

The Fintech sector, particularly companies preparing for IPOs, is uniquely susceptible to economic downturns. These businesses often rely heavily on investor confidence and successive rounds of venture capital funding to fuel their rapid growth. Many Fintech startups operate with higher risk profiles, focusing on innovative, often untested, business models. This makes them especially vulnerable during periods of economic uncertainty when investors become more risk-averse.

Several factors exacerbate this vulnerability:

- Dependence on venture capital funding: Fintech companies heavily rely on securing substantial venture capital investments to fund their operations and expansion.

- High growth expectations from investors: Investors expect exceptionally high growth rates from Fintech startups, making them sensitive to even minor setbacks.

- Sensitivity to interest rate changes: Interest rate hikes, often a response to economic uncertainty, can increase borrowing costs and hinder expansion plans.

- Competition within the Fintech sector: The Fintech landscape is fiercely competitive, making it challenging for companies to stand out and secure funding during periods of economic stress.

Affirm Holdings (AFRM) as a Case Study

Affirm Holdings (AFRM), a Buy Now, Pay Later (BNPL) Fintech company, provides a compelling case study. Its business model, offering installment payment options to consumers, positions it within a rapidly growing but also volatile sector. Affirm's IPO coincided with the height of the trade war's economic impact, making it a particularly vulnerable case study. The uncertainty surrounding the economy and investor sentiment directly impacted AFRM's performance post-IPO. The slowing economy, directly influenced by the trade war, affected consumer spending, impacting AFRM's user base and revenue growth.

Key challenges faced by AFRM during this period include:

- AFRM's IPO valuation and performance post-IPO: The overall market uncertainty likely influenced AFRM's initial valuation and subsequent stock price performance.

- Impact of tariff-related economic slowdown on AFRM's user base and revenue: The reduced consumer spending directly affected the demand for Affirm's services.

- Comparison to other Fintech IPOs during the same period: Comparing AFRM's performance to other Fintech IPOs during the same period reveals the extent of the trade war's impact on the sector.

- AFRM's strategies to mitigate the effects of the trade war: Analyzing AFRM's response to the economic challenges reveals its resilience and adaptability.

Long-Term Effects on the Fintech IPO Market

The Trump administration's trade war left a lasting scar on investor confidence within the Fintech sector. The increased economic uncertainty made investors more cautious, resulting in a more stringent vetting process for Fintech IPOs. This shift impacted future IPOs and funding rounds, leading to a more conservative approach to investing in high-growth, but inherently riskier, Fintech ventures. The period also saw a shift in focus towards more established, profitable Fintech companies with demonstrably lower risk profiles.

The long-term effects include:

- Changes in investor risk tolerance: Investors became more risk-averse, demanding higher levels of profitability and lower risk before investing.

- Shift in focus to more established Fintech companies: Investors prioritized established companies with proven track records over high-growth startups.

- Increased scrutiny of Fintech business models: Investors subjected Fintech business models to greater scrutiny, examining their sustainability and resilience to economic downturns.

- Impact on global Fintech expansion: The trade war created uncertainty about global markets, impacting the expansion plans of many Fintech companies.

Conclusion: Understanding the Impact of Trump's Tariffs on Fintech IPOs - The Affirm Holdings (AFRM) Example

In conclusion, the Trump tariffs created a climate of significant economic uncertainty, negatively impacting investor sentiment and significantly affecting the Fintech IPO market. Affirm Holdings (AFRM) serves as a compelling example of the challenges faced by Fintech companies during this period. The inherent vulnerabilities of the Fintech sector, coupled with the broader economic instability, created a perfect storm that hindered the success of many IPOs. Understanding these macroeconomic factors is crucial when evaluating investment opportunities within the Fintech sector.

Learn more about how Trump's tariffs impacted Fintech IPOs, analyze the risks associated with Fintech investments, and understand the long-term consequences of trade wars on the Fintech market. The insights gained from examining the AFRM case study and the broader impact of the Trump tariffs offer valuable lessons for investors and entrepreneurs alike.

Featured Posts

-

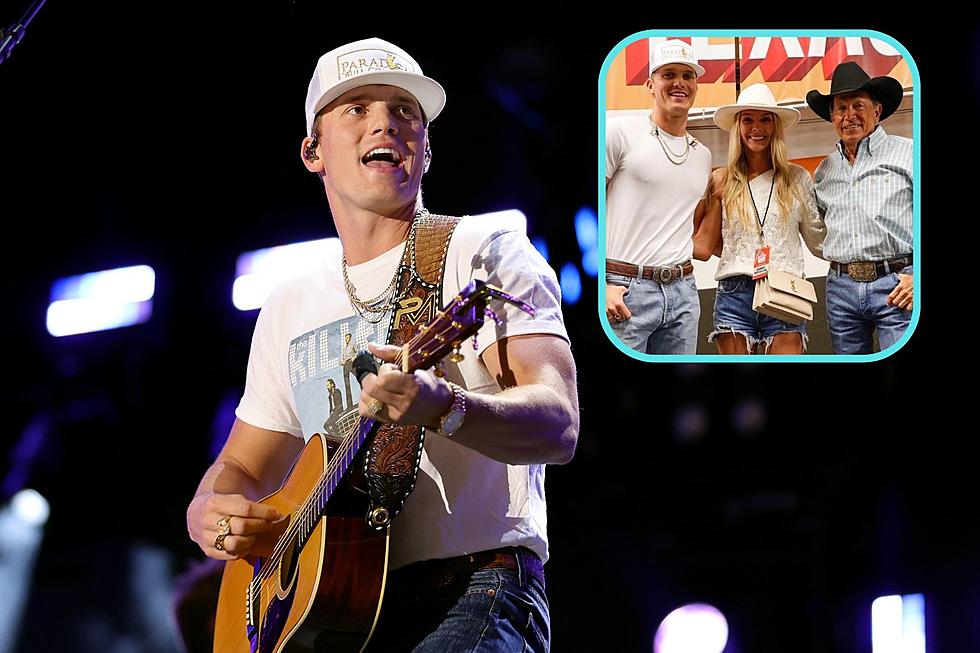

Parker Mc Collum Eyes George Straits Throne A Generational Shift In Country Music

May 14, 2025

Parker Mc Collum Eyes George Straits Throne A Generational Shift In Country Music

May 14, 2025 -

Liverpool Transfer News Teammate All But Confirms Move

May 14, 2025

Liverpool Transfer News Teammate All But Confirms Move

May 14, 2025 -

The Dont Hate The Playaz Philosophy Building Better Online Experiences

May 14, 2025

The Dont Hate The Playaz Philosophy Building Better Online Experiences

May 14, 2025 -

Transfer News Dean Huijsen Faces Competition From Premier League Giants

May 14, 2025

Transfer News Dean Huijsen Faces Competition From Premier League Giants

May 14, 2025 -

The New Lindt Store A Central London Chocolate Experience

May 14, 2025

The New Lindt Store A Central London Chocolate Experience

May 14, 2025