How US Politics And Economics Shape Elon Musk's Billions

Table of Contents

Government Subsidies and Tax Incentives

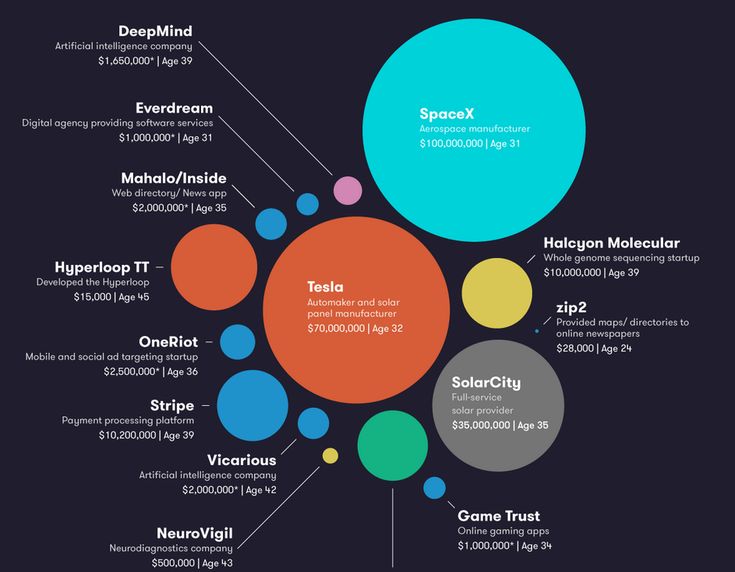

Government support plays a pivotal role in the success of both Tesla and SpaceX. Significant Tesla subsidies and SpaceX funding, largely driven by policies promoting electric vehicles (EVs) and space exploration, have undeniably boosted their growth trajectories. These government incentives for renewable energy and space technology have provided critical financial lifelines, allowing Musk's companies to scale operations and compete effectively.

-

Specific examples: Tesla has benefited significantly from federal and state tax credits for EV purchases, as well as grants and loans supporting research and development in battery technology and manufacturing. SpaceX, similarly, has received various government contracts for space launch services and research projects.

-

Impact on profitability and market position: These subsidies have played a crucial role in Tesla's ability to achieve economies of scale, reduce production costs, and become a dominant player in the EV market. For SpaceX, government contracts have provided essential revenue streams, facilitating its rapid technological advancements and securing its place as a leading player in the commercial space industry.

-

Political debates: The allocation of government funding to these industries remains a subject of ongoing political debate. Critics argue that such subsidies distort the market, creating an unfair advantage for favored companies and potentially diverting resources from other important sectors.

Regulatory Environment and Lobbying

The regulatory environment, or lack thereof, in the US significantly impacts Musk's business ventures. Regulations surrounding environmental protection, labor laws, and technological innovation directly influence the operations of Tesla and SpaceX. The influence of Tesla regulations and SpaceX regulations are ever present.

-

Lobbying efforts: Musk and his companies actively engage in lobbying efforts to influence legislation affecting their operations. This includes advocating for policies that support EV adoption, ease environmental regulations (sometimes seen as controversial), and streamline the regulatory processes for space launches.

-

Impact of regulatory changes: Regulatory changes can have profound impacts on Tesla's production and expansion plans. Stricter environmental regulations, for instance, might increase production costs, while relaxed labor laws could potentially lower production costs. For SpaceX, regulatory hurdles relating to space launches and satellite deployment heavily influence its business model and expansion plans.

-

Ethical implications: The ethical implications of corporate lobbying remain a contentious issue. Critics raise concerns about potential conflicts of interest and the disproportionate influence of powerful corporations on policymaking.

The Impact of Economic Cycles and Market Trends

Economic fluctuations significantly affect the valuations of Tesla and SpaceX. The impact of economic booms and downturns, along with inflation and recession, has a profound effect on the companies' financial health. Understanding the impact of these cycles is critical to understanding Musk's net worth.

-

Consumer spending and investor sentiment: Tesla's sales are directly influenced by consumer spending patterns and overall investor sentiment towards the EV market. During economic downturns, consumer demand for luxury goods, including high-end EVs, tends to decrease.

-

Interest rates and inflation: Interest rates and inflation affect the cost of production and capital investment for both Tesla and SpaceX. Higher interest rates increase borrowing costs, potentially impacting expansion plans and profitability. Inflation can also drive up the costs of raw materials and labor.

-

Resilience during economic uncertainty: The resilience of Musk's companies during periods of economic uncertainty is a crucial factor in understanding their success. Their ability to innovate and adapt to changing market conditions has helped them navigate challenges and maintain a strong market position.

The Role of the US Stock Market

The US stock market plays a paramount role in shaping Elon Musk's net worth. The volatility of the market and investor behavior directly impact the value of Tesla stock, which constitutes a substantial portion of his wealth. This makes understanding the Tesla stock price crucial.

-

Short selling and its impact: Short selling Tesla stock can heavily influence its price, creating significant volatility. Market speculation and short selling, both factors heavily influenced by Musk's public pronouncements, profoundly affect the stock's value.

-

Musk's tweets and market fluctuations: Musk's frequent use of Twitter to make announcements and express opinions has been known to cause significant market fluctuations in Tesla's stock price. His tweets often impact investor confidence, leading to dramatic price swings.

-

Investor confidence and speculation: Investor confidence and speculative trading play a crucial role in determining the value of Tesla stock and consequently, Musk's overall wealth. Positive news and technological breakthroughs often lead to surges in stock value, while negative news or controversies can trigger sharp declines.

Conclusion

The phenomenal success of Elon Musk's ventures is inextricably linked to the dynamic interplay of US politics and economics. Government support in the form of Tesla subsidies and SpaceX funding, the regulatory environment, cyclical economic fluctuations, and the volatile nature of the US stock market all significantly influence his billions. Understanding this complex relationship is essential for comprehending the factors that shape the fortunes of influential figures like Elon Musk within the modern global economy. Continue learning about how US politics and economics shape Elon Musk's billions – delve deeper into the specifics by exploring further research on the topics discussed.

Featured Posts

-

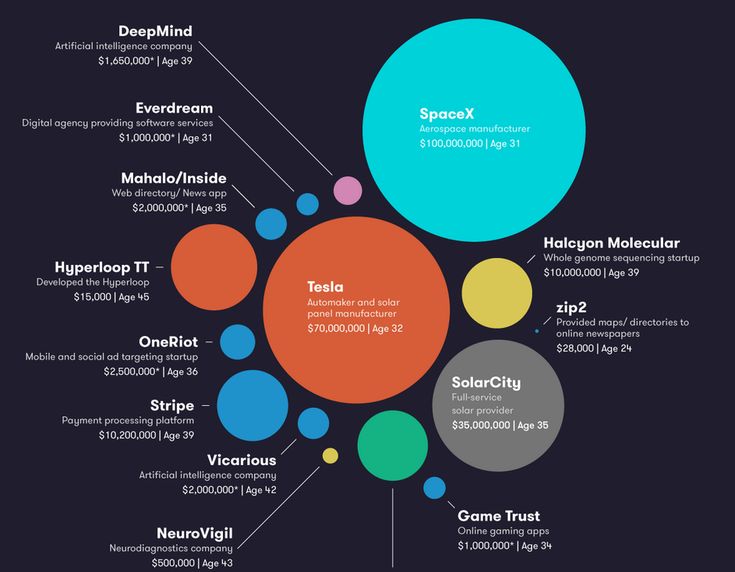

Young Thug And Mariah The Scientist Collaboration A Snippet Reveals All

May 10, 2025

Young Thug And Mariah The Scientist Collaboration A Snippet Reveals All

May 10, 2025 -

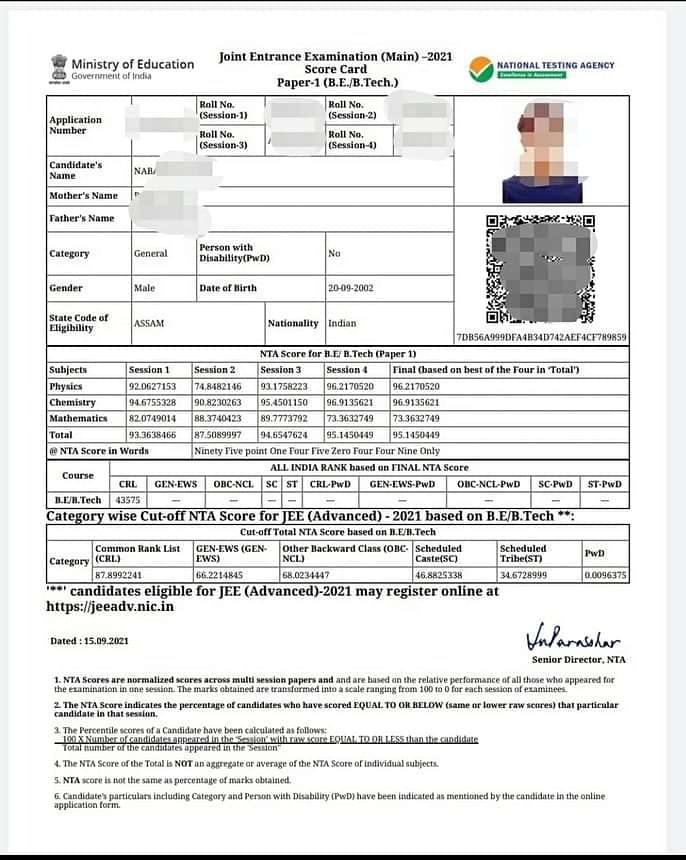

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025

Madhyamik Pariksha 2025 Result Check Merit List Online

May 10, 2025 -

Queen Elizabeth 2 Post Makeover A Glimpse Inside The 000 Guest Vessel

May 10, 2025

Queen Elizabeth 2 Post Makeover A Glimpse Inside The 000 Guest Vessel

May 10, 2025 -

Executive Orders Under Trump A Transgender Perspective

May 10, 2025

Executive Orders Under Trump A Transgender Perspective

May 10, 2025 -

The Jeffrey Epstein Files Should We Vote On Their Release A Look At Pam Bondis Actions

May 10, 2025

The Jeffrey Epstein Files Should We Vote On Their Release A Look At Pam Bondis Actions

May 10, 2025