How Will Upcoming Earnings Affect QBTS Stock Price?

Table of Contents

Analyzing QBTS's Past Performance

Understanding QBTS's historical financial performance is crucial for predicting how the upcoming earnings might affect the QBTS stock price. Analyzing trends in revenue growth, profitability, and key performance indicators (KPIs) provides valuable context.

Revenue Growth Trends

Examining QBTS revenue growth trends reveals important insights into the company's trajectory. Analyzing year-over-year revenue growth helps identify periods of strong expansion and potential slowdowns.

- Yearly Revenue Comparison: A comparison of QBTS revenue figures over the past five years shows [Insert data and chart here, if available. Otherwise, describe the trend – e.g., consistent growth, periods of acceleration/deceleration]. This illustrates the overall health of the business and its ability to generate sales.

- Key Growth Drivers: Identifying the primary factors driving QBTS revenue growth (e.g., successful product launches, expansion into new markets, strategic acquisitions) provides a deeper understanding of the company's strengths and future potential. This is crucial for predicting future QBTS revenue growth.

- Impact of Market Conditions: Assessing how macroeconomic conditions (e.g., economic recessions, industry trends) have influenced QBTS's revenue figures allows for a more nuanced interpretation of the data. This helps determine the company's resilience to external factors. Analyzing the impact of these conditions on QBTS revenue growth is key to understanding future performance.

Profitability and Margins

Profitability is another critical aspect of QBTS's past performance. Analyzing profit margins provides a clear picture of the company's efficiency and ability to convert revenue into profit.

- Gross Profit Margin: Tracking QBTS's gross profit margin shows trends in the cost of goods sold relative to revenue. This indicator is significant for understanding the company's pricing strategy and production efficiency.

- Operating Income Margin: Analyzing the operating income margin helps gauge the effectiveness of QBTS's operations, excluding interest and taxes. This metric reflects the company's ability to manage its operating expenses.

- Net Profit Margin: The net profit margin shows QBTS's overall profitability after all expenses, including taxes and interest, are considered. This metric is a key indicator of the company's financial health and efficiency.

- Factors Affecting Profitability: Understanding the factors impacting QBTS's profitability, such as pricing strategies, cost control measures, and changes in operating expenses, provides valuable context for interpreting past performance and anticipating future results. The understanding of factors affecting QBTS profitability can greatly influence your QBTS stock forecast. Tracking QBTS earnings per share (EPS) is another critical aspect.

Key Performance Indicators (KPIs)

Beyond the traditional financial metrics, certain key performance indicators (KPIs) provide additional insights into QBTS's performance and future prospects.

- Customer Acquisition Cost: Analyzing QBTS's customer acquisition cost reveals the effectiveness of its marketing and sales efforts. This is a key metric for assessing the company's ability to grow its customer base.

- Customer Churn Rate: Tracking QBTS's customer churn rate indicates the level of customer satisfaction and loyalty. A high churn rate might signal problems with product quality or customer service.

- Market Share: Analyzing QBTS's market share relative to competitors provides context for evaluating the company's competitive position and growth potential.

- Product Adoption Rates: Tracking the adoption rates of new products launched by QBTS helps gauge their success and potential impact on future revenue. Examining QBTS key performance indicators like these provides a more comprehensive view of the company's overall health.

Expectations for Upcoming Earnings

Analyzing analyst estimates and potential catalysts, alongside market sentiment, provides a clearer picture of expectations for the upcoming QBTS earnings report.

Analyst Estimates and Predictions

Understanding the consensus expectations among financial analysts is vital for assessing the potential market reaction to the upcoming QBTS earnings announcement.

- Average EPS Estimate: The average earnings per share (EPS) estimate from various analysts provides a benchmark for comparing the actual results.

- Revenue Projection Range: The range of revenue projections from different analysts highlights the uncertainty surrounding the upcoming earnings. This range reflects varying perspectives on QBTS's prospects.

- Differing Analyst Opinions: Analyzing the range of opinions and predictions among analysts helps gauge the level of consensus and potential for surprises in the upcoming QBTS earnings report. The differing analyst opinions contribute to the QBTS stock outlook.

Potential Catalysts for Positive/Negative Surprises

Several factors could cause QBTS to exceed or fall short of expectations in the upcoming earnings report.

- New Product Launches: Successful new product launches can significantly boost revenue and positively impact the QBTS stock price. Conversely, failed product launches can have a negative impact.

- Competitive Landscape: Changes in the competitive landscape, such as the emergence of new competitors or increased competition from existing players, can affect QBTS's market share and profitability.

- Macroeconomic Factors: Broad economic conditions, such as inflation or interest rate changes, can impact consumer spending and affect QBTS's performance.

- Supply Chain Issues: Disruptions in the supply chain, such as shortages of raw materials or production bottlenecks, can impact QBTS's ability to meet demand and negatively affect the QBTS stock price. These factors greatly influence the QBTS earnings surprise potential.

Market Sentiment and Investor Confidence

Understanding the overall market sentiment and investor confidence surrounding QBTS is crucial for anticipating the stock's reaction to the upcoming earnings report.

- News Articles: Analyzing news articles and financial media coverage of QBTS can reveal prevalent sentiment.

- Social Media Sentiment: Monitoring social media discussions and sentiment analysis tools can provide insights into investor perceptions of QBTS.

- Investor Discussions: Tracking investor forums and discussions can help gauge overall optimism or pessimism surrounding the company.

- Overall Market Trends: Considering the broader market trends and economic outlook can provide additional context for interpreting investor sentiment toward QBTS. The QBTS investor sentiment is a critical factor in predicting the stock price reaction.

How Earnings Could Impact QBTS Stock Price

The upcoming QBTS earnings report could significantly impact its stock price depending on whether the company beats, meets, or misses expectations.

Scenario Planning (Beat/Meet/Miss)

We can explore different scenarios and their potential impact on the QBTS stock price.

- Beat Expectations: If QBTS surpasses analyst expectations, a significant price increase is likely, potentially exceeding the QBTS price target set by some analysts.

- Meet Expectations: If QBTS meets expectations, the QBTS stock price is likely to remain relatively stable, although minor fluctuations may occur depending on other market factors.

- Miss Expectations: If QBTS underperforms, a significant price drop is possible, potentially causing the QBTS stock reaction to be sharp and negative. Support and resistance levels will play a critical role in determining the extent of the price movement. This scenario analysis helps in developing your QBTS stock outlook.

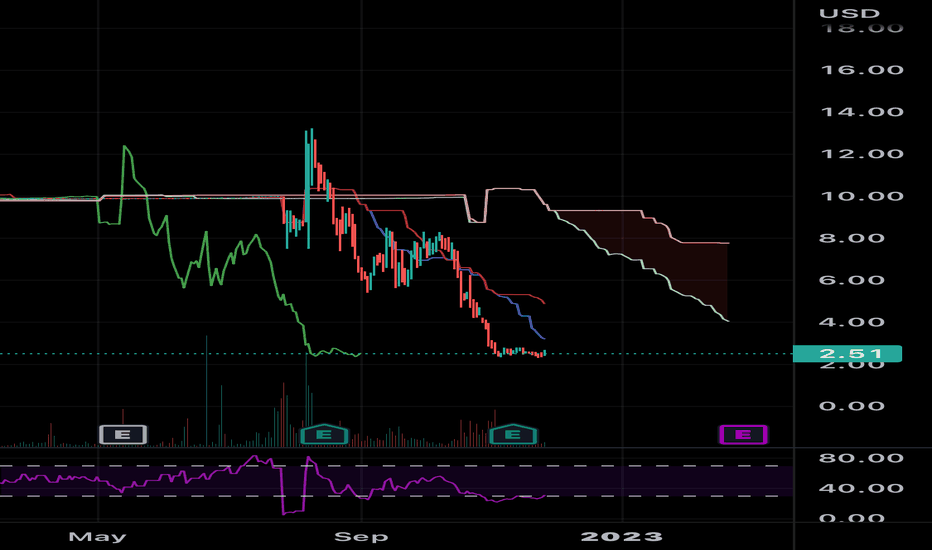

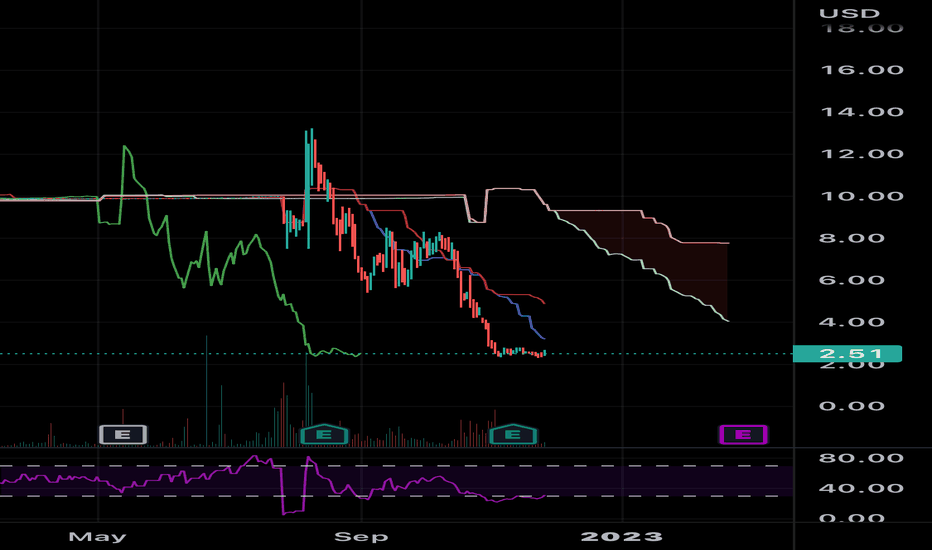

Technical Analysis Considerations

Technical analysis indicators can provide additional insights into potential price movements.

- Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can help identify potential support and resistance levels for the QBTS stock price.

- Trading Volume: Monitoring trading volume can provide insights into the strength of price movements.

- Relative Strength Index (RSI): The RSI can help identify overbought or oversold conditions, which may indicate potential reversals in the QBTS stock price.

- Support/Resistance Levels: Identifying key support and resistance levels based on past price action can help predict potential price ranges for the QBTS stock after the earnings announcement. This technical analysis of QBTS contributes to a well-rounded assessment.

Risk Assessment

Several factors could negatively impact QBTS's performance and its stock price.

- Geopolitical Risks: Global political instability or conflicts can impact the overall market and negatively affect QBTS's performance.

- Regulatory Changes: Changes in regulations or government policies could impact QBTS's operations and profitability.

- Economic Downturn: A general economic downturn or recession could reduce consumer spending and negatively affect QBTS's sales.

- Competition: Increased competition from rivals could erode QBTS's market share and profitability. Understanding these QBTS stock risks is crucial for any investment decision.

Conclusion

The impact of upcoming QBTS earnings on its stock price will depend on several intertwined factors. Analyzing past performance, considering analyst estimates, assessing potential catalysts for surprises, and monitoring market sentiment are all vital for forming an informed opinion. The interplay between QBTS revenue growth, profitability, and key performance indicators will shape the overall picture. While this analysis offers insights into how upcoming earnings might affect QBTS stock price, remember to perform your own due diligence before investing. Stay informed on QBTS earnings and other key developments to make informed decisions about your QBTS stock investments. Pay close attention to the QBTS share price movements following the earnings release. Consider consulting a financial advisor before making any QBTS investment.

Featured Posts

-

Abc News Shows Fate Hangs In Balance Amidst Company Restructuring

May 21, 2025

Abc News Shows Fate Hangs In Balance Amidst Company Restructuring

May 21, 2025 -

Kult Comeback Dexter Lithgow Und Smits Wieder Vereint

May 21, 2025

Kult Comeback Dexter Lithgow Und Smits Wieder Vereint

May 21, 2025 -

Mysterious Red Flashes In France Eyewitness Accounts And Analysis

May 21, 2025

Mysterious Red Flashes In France Eyewitness Accounts And Analysis

May 21, 2025 -

Stephane Une Artiste Suisse Romande Qui Brille A Paris

May 21, 2025

Stephane Une Artiste Suisse Romande Qui Brille A Paris

May 21, 2025 -

Nyt Mini Crossword Answers And Hints For April 20 2025

May 21, 2025

Nyt Mini Crossword Answers And Hints For April 20 2025

May 21, 2025