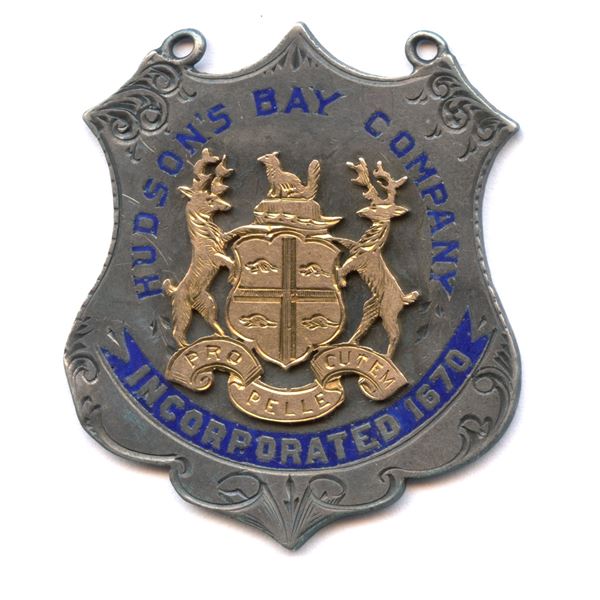

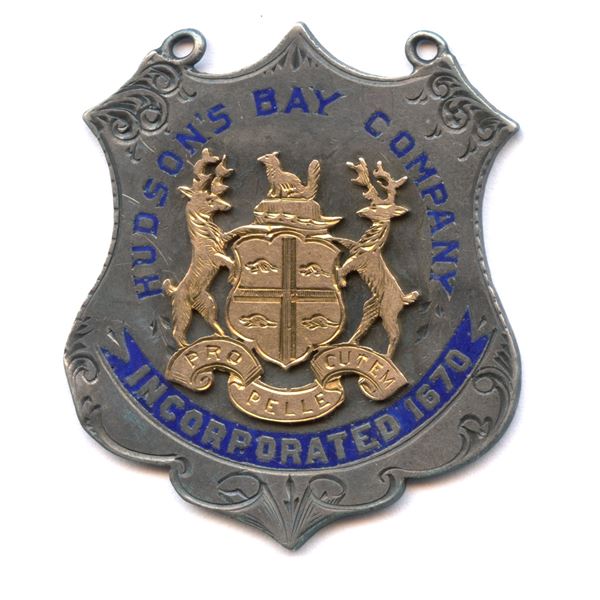

Hudson Bay Company Extends Creditor Protection To July 31st

Table of Contents

The Hudson's Bay Company (HBC), a Canadian retail giant with a history spanning centuries, has announced an extension to its creditor protection plan, pushing the deadline to July 31st. This significant development follows months of intense financial restructuring efforts and raises crucial questions about the future of this iconic retailer. This article delves into the details of this extension, its implications for HBC's future, and what it means for its stakeholders – creditors, employees, and customers alike. We'll explore the reasons behind the extension, the potential outcomes, and the ongoing challenges facing the company.

Reasons Behind the Creditor Protection Extension

The Hudson's Bay Company's financial troubles have been brewing for some time, culminating in the need for creditor protection. Several factors contributed to this difficult situation:

- High Debt Levels: HBC has been burdened by significant debt accumulated over years of expansion and acquisitions. This debt servicing cost has placed a considerable strain on the company's finances, limiting its ability to invest in growth and modernization.

- Declining Sales: The retail landscape has undergone a dramatic shift, with the rise of e-commerce significantly impacting brick-and-mortar stores. HBC has struggled to adapt to this changing environment, resulting in declining sales and reduced profitability.

- Impact of the Pandemic: The COVID-19 pandemic exacerbated existing challenges, forcing store closures and disrupting supply chains. The resulting economic downturn further impacted consumer spending, hitting HBC's sales hard.

- Intense Competition: HBC faces stiff competition from both established players and emerging online retailers. This competitive pressure has made it harder to maintain market share and achieve sustainable profitability.

Previous restructuring attempts have yielded mixed results. While some cost-cutting measures and strategic initiatives have been implemented, they haven't been sufficient to address the underlying financial issues. The current economic climate, marked by inflation and uncertainty, further complicates HBC's efforts to navigate its financial challenges. The keywords Hudson's Bay Company financial troubles, HBC debt restructuring, and retail industry challenges highlight the complexity of the situation.

Implications of the Extended Creditor Protection

The extension of creditor protection has significant implications for various stakeholders:

Impact on Creditors

The extension means that HBC's creditors will likely face further delays in receiving repayments. Negotiations with creditors will continue during this period, aiming to reach a restructuring agreement that balances the interests of all parties involved. This process involves complex legal and financial maneuvering, demanding careful consideration of the company's assets and liabilities.

Impact on Employees

The extended creditor protection period raises concerns about job security for HBC employees. While the company may aim to retain its workforce, restructuring efforts could lead to workforce reductions or changes in employment terms. Uncertainty regarding the future of the company is a significant concern for employees.

Impact on Customers

For customers, the extension of creditor protection might result in some changes. There could be adjustments to store operations, sales promotions, or customer service levels as the company navigates its financial challenges. Concerns regarding gift cards and loyalty programs are valid; however, HBC is likely to take steps to mitigate any disruption to these services. The company is keen to maintain customer loyalty amidst this challenging period.

Potential Outcomes and Future Outlook for HBC

Several potential scenarios could unfold for HBC:

- Successful Restructuring: HBC may successfully restructure its debt and operations, emerging as a more viable and competitive retailer. This would require significant changes to its business model, a focus on e-commerce integration, and a renewed commitment to customer experience.

- Sale of Assets: HBC might sell off some of its assets, such as individual stores or brands, to raise capital and reduce its debt burden. This would involve identifying potential buyers and negotiating favorable terms for the transactions.

- Potential Bankruptcy: In the worst-case scenario, HBC could face bankruptcy if it fails to secure a viable restructuring plan. This would have significant implications for its creditors, employees, and customers.

The long-term viability of HBC depends heavily on its ability to execute a successful restructuring plan. The company's strategic plans for recovery need to address the key challenges, including modernizing its operations, enhancing its online presence, and attracting new investments. The keywords Hudson's Bay Company future, HBC restructuring plan, and HBC bankruptcy risk capture the uncertainties surrounding the company's future.

Comparison to Other Retail Restructurings

HBC's situation mirrors that of other major retailers that have undergone similar restructuring processes, such as Sears and Toys R Us. While the specific circumstances may differ, these cases highlight the challenges facing brick-and-mortar retailers in the age of e-commerce. The success rates of such restructuring efforts vary widely, depending on factors such as the severity of the financial distress, the effectiveness of the restructuring plan, and the market conditions. Analyzing these precedents provides valuable context and insights into the potential outcomes for HBC. The keywords Retail industry restructuring, major retail bankruptcies, and retail recovery strategies offer a broader perspective on the challenges faced by the retail sector.

Conclusion

The extension of Hudson's Bay Company's creditor protection to July 31st underscores the significant financial challenges facing the retailer. The implications for creditors, employees, and customers are considerable, and the uncertainty surrounding HBC's future remains high. The coming months will be crucial in determining the outcome of the restructuring efforts and the long-term viability of this iconic Canadian retailer. To stay informed about further developments regarding the Hudson's Bay Company creditor protection situation, follow reputable financial news sources and HBC's official communications.

Featured Posts

-

One Month Later Jalen Brunsons Ankle Injury And Sundays Game

May 16, 2025

One Month Later Jalen Brunsons Ankle Injury And Sundays Game

May 16, 2025 -

Le Metier De Gardien Salaires Formations Et Perspectives De Carriere Dans Un Marche Tendu

May 16, 2025

Le Metier De Gardien Salaires Formations Et Perspectives De Carriere Dans Un Marche Tendu

May 16, 2025 -

Chicago Cubs Cody Poteet Conquers Abs Challenge In Spring Training

May 16, 2025

Chicago Cubs Cody Poteet Conquers Abs Challenge In Spring Training

May 16, 2025 -

Mlb Dfs Lineup Advice May 8th Sleeper Picks And Player To Avoid

May 16, 2025

Mlb Dfs Lineup Advice May 8th Sleeper Picks And Player To Avoid

May 16, 2025 -

12 Golov V Pley Off N Kh L Ovechkin Obnovlyaet Rekord

May 16, 2025

12 Golov V Pley Off N Kh L Ovechkin Obnovlyaet Rekord

May 16, 2025