Huge Stock Swings: Navigating The New Normal For Investors

Table of Contents

Identifying the Causes of Increased Stock Market Volatility

Several interconnected factors contribute to the heightened volatility we're witnessing in the stock market. Understanding these underlying causes is crucial for developing an effective investment strategy.

-

Global Economic Uncertainty: Global economic uncertainty, driven by factors like persistent inflation, looming recession fears, and ongoing geopolitical instability (e.g., the war in Ukraine), significantly impacts investor sentiment and market stability. These uncertainties create a climate of fear and uncertainty, leading to sharp price movements.

-

Tech Stock Dependence: The increased reliance on technology stocks in many portfolios amplifies market fluctuations. Significant shifts in the tech sector, driven by factors like interest rate hikes or regulatory changes, can trigger substantial ripples across the entire market.

-

Social Media's Impact: The rapid dissemination of information via social media can fuel speculative trading and amplify market sentiment, both positive and negative. Viral news and social media trends can quickly drive massive buying or selling, contributing to dramatic price swings.

-

Interest Rate Hikes: Central bank decisions regarding interest rates significantly impact stock valuations. Rising interest rates typically lead to decreased borrowing and investment, potentially causing stock prices to fall.

-

Supply Chain Disruptions: Global supply chain issues, exacerbated by events like pandemics and geopolitical tensions, create economic uncertainty and contribute to market volatility. Unexpected disruptions can negatively impact company profits and investor confidence.

Bullet Points: Recent Events Causing Significant Stock Swings:

- The ongoing war in Ukraine and its impact on energy prices and global supply chains.

- Rapid inflation in many developed economies.

- Concerns about a potential global recession.

- Significant interest rate hikes by central banks worldwide.

Developing a Robust Investment Strategy for Volatile Markets

Navigating huge stock swings requires a proactive and well-considered investment strategy. Here are key elements to consider:

-

Diversification: A well-diversified portfolio spread across different asset classes (stocks, bonds, real estate, commodities) is crucial in mitigating risk. Don't put all your eggs in one basket! Consider diversifying geographically as well.

-

Dollar-Cost Averaging: This strategy involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This helps reduce the impact of buying high and selling low. For example, investing $500 every month, regardless of the market's performance, averages out your purchase price.

-

Long-Term Perspective: Maintaining a long-term investment horizon is vital. Avoid emotional decision-making, such as panic selling during market downturns. Remember that markets tend to recover over the long term.

-

Risk Tolerance Assessment: Understanding your own risk tolerance is paramount. Are you comfortable with potentially higher returns and greater risk, or do you prefer a more conservative approach? Tailor your portfolio to your individual risk profile.

-

Asset Allocation Strategies: Adjust your asset allocation based on market conditions. During periods of high volatility, you might consider shifting towards more conservative investments, such as bonds, to reduce risk.

Bullet Points: Diversification and Dollar-Cost Averaging Examples:

- Diversification: Invest in a mix of large-cap, mid-cap, and small-cap stocks across different sectors (technology, healthcare, energy, etc.) Consider international diversification as well.

- Dollar-Cost Averaging: Set up automatic monthly investments into your chosen funds or ETFs.

Utilizing Tools and Resources for Informed Decision-Making

Informed decision-making is critical when navigating market volatility. Utilize the following tools and resources:

-

Fundamental Analysis: Evaluate the intrinsic value of a company by analyzing its financial statements, business model, and competitive landscape. This helps you identify undervalued companies.

-

Technical Analysis: Use charts and other technical indicators to identify trends and potential turning points in the market. This can help you time your entries and exits more effectively.

-

Financial News and Analysis: Stay informed about market trends by reading reputable financial news sources. Be discerning about the information you consume, however, and avoid sensationalist or biased sources.

-

Portfolio Tracking Software: Use software to monitor your portfolio's performance, track your investments, and manage risk effectively.

-

Seeking Professional Advice: Consult with a qualified financial advisor to create a personalized investment strategy aligned with your goals and risk tolerance. This is especially important during periods of high volatility.

Bullet Points: Reputable Resources:

- Financial News Sources: The Wall Street Journal, Bloomberg, Financial Times, Reuters

- Portfolio Tracking Software: Personal Capital, Mint, Fidelity Portfolio View

Conclusion: Mastering the Art of Navigating Huge Stock Swings

Navigating huge stock swings effectively requires a multifaceted approach. This involves diversifying your portfolio, adopting a long-term perspective, utilizing dollar-cost averaging, and staying informed through reliable sources. Remember that market volatility is an inherent characteristic of investing, and continuous adaptation is key. By understanding the causes of these swings and employing the strategies discussed, you can significantly improve your chances of successfully navigating future periods of uncertainty. Start building your diversified portfolio today, or consult with a financial advisor to create a personalized investment plan that accounts for market volatility and helps you achieve your financial goals.

Featured Posts

-

Maquiagem Em Aquarela A Tendencia Mais Sonhadora Do Momento

Apr 25, 2025

Maquiagem Em Aquarela A Tendencia Mais Sonhadora Do Momento

Apr 25, 2025 -

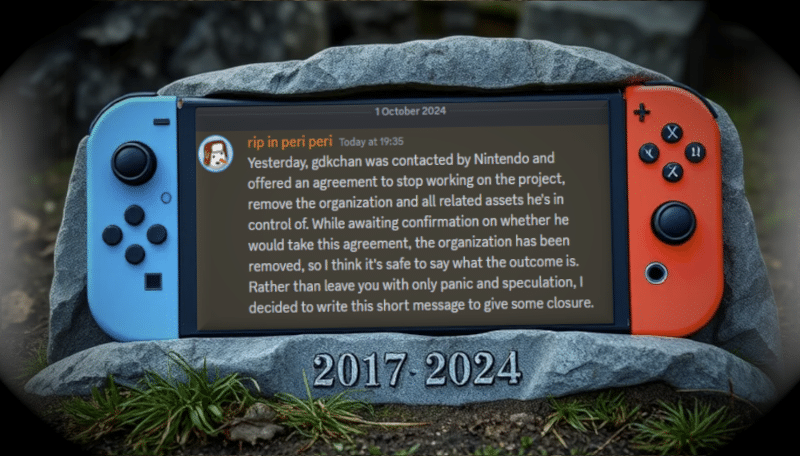

Ryujinx Emulator Shuts Down After Nintendo Contact What We Know

Apr 25, 2025

Ryujinx Emulator Shuts Down After Nintendo Contact What We Know

Apr 25, 2025 -

Is Ashton Jeanty Headed To Chicago Examining The 2025 Nfl Draft Buzz

Apr 25, 2025

Is Ashton Jeanty Headed To Chicago Examining The 2025 Nfl Draft Buzz

Apr 25, 2025 -

Tramp I Okonchanie Rossiysko Ukrainskogo Konflikta Analiz Soglasheniya

Apr 25, 2025

Tramp I Okonchanie Rossiysko Ukrainskogo Konflikta Analiz Soglasheniya

Apr 25, 2025 -

Chinas Economic Response Special Bonds To Counter Trumps Tariffs And Trade War

Apr 25, 2025

Chinas Economic Response Special Bonds To Counter Trumps Tariffs And Trade War

Apr 25, 2025