Ignoring The Hype: BofA's View On Elevated Stock Market Valuations

Table of Contents

BofA's Concerns Regarding Current Valuations

BofA analysts highlight a growing disconnect between current stock prices and underlying company fundamentals. Their market analysis points to several key valuation metrics that signal potential overvaluation. Understanding these metrics is crucial for informed investment decisions.

-

High Price-to-Earnings Ratios (P/E): BofA's research likely reveals that many stocks boast P/E ratios significantly above historical averages, suggesting the market may be pricing in excessive future growth. This means investors are paying a premium for each dollar of earnings.

-

Elevated Market Capitalization: The market capitalization of several companies, particularly in the technology sector, has reached unprecedented levels relative to their earnings and revenue. BofA's assessment likely flags this discrepancy as a cause for concern.

-

Overvalued Sectors: BofA's analysis might pinpoint specific sectors, such as technology or certain growth stocks, as being particularly vulnerable to a correction due to their inflated valuations. Understanding which sectors are identified as overvalued is crucial for strategic portfolio management.

BofA's reasoning stems from potential future economic headwinds. Concerns about further interest rate hikes by central banks to combat inflation and the potential for an economic slowdown contribute to their cautious outlook. These macroeconomic factors could significantly impact company earnings and subsequently stock prices, potentially leading to a market correction.

BofA's Suggested Investment Strategies in a High-Valuation Market

Given their concerns about elevated stock market valuations, BofA likely recommends a more conservative investment approach. This involves adopting defensive strategies and carefully managing risk.

-

Defensive Investing: BofA's advice probably emphasizes shifting towards value stocks—companies trading at lower valuations relative to their fundamentals—to mitigate potential losses during a market downturn.

-

Increased Cash Holdings: Maintaining a larger proportion of cash in your portfolio is likely recommended as a buffer against market volatility and to capitalize on potential buying opportunities during a correction.

-

Portfolio Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) and sectors is vital to reduce the impact of any single investment underperforming. This risk management strategy is especially important in a potentially volatile market environment.

-

Sector Selection: BofA may suggest focusing on sectors less susceptible to economic downturns or those with strong underlying fundamentals, potentially including consumer staples or healthcare.

The Role of Macroeconomic Factors in BofA's Analysis

BofA's assessment of stock market valuations is intrinsically linked to the macroeconomic environment. Several key factors play a significant role:

-

Inflation: High inflation erodes purchasing power and increases the cost of borrowing, negatively impacting company profits and stock prices. BofA's analysis likely incorporates inflation projections and their potential effect on valuations.

-

Interest Rates: Rising interest rates increase borrowing costs for companies and reduce the attractiveness of stocks relative to bonds. BofA's outlook likely considers the trajectory of interest rates and their impact on market valuations.

-

Economic Growth: Slower-than-expected economic growth can lead to lower corporate earnings and reduced stock prices. BofA’s analysis considers GDP forecasts and their implications for the stock market.

-

Geopolitical Uncertainty: Global events like geopolitical tensions or trade disputes can negatively impact market sentiment and valuations. BofA likely incorporates geopolitical risks into their assessment.

These factors collectively contribute to BofA's cautious outlook on current stock market valuations.

Alternative Perspectives and Counterarguments

While BofA expresses caution, it's important to acknowledge alternative perspectives. Some analysts maintain a bullish outlook, citing:

-

Technological Innovation: Breakthroughs in AI and other technologies could drive significant future growth, justifying higher valuations for certain companies.

-

Strong Corporate Earnings: While some sectors show high valuations, others continue to post robust earnings growth, supporting a positive market outlook.

However, even with these counterarguments, the potential risks associated with high valuations remain. A balanced perspective recognizes both the opportunities and the risks in the current market.

Conclusion

BofA's analysis highlights significant concerns regarding elevated stock market valuations, primarily driven by a disconnect between current prices and underlying fundamentals, exacerbated by macroeconomic uncertainties. Their recommended investment strategies emphasize a more cautious and defensive approach, including diversification and increased cash holdings. While the market presents opportunities, it is crucial to acknowledge the risks.

Before making any significant investment decisions, conduct thorough research, consult with financial advisors, and carefully consider BofA’s perspective on elevated stock market valuations to create a strategy aligned with your individual risk tolerance. Don’t ignore the hype; understand the risks and make informed decisions about your investment portfolio.

Featured Posts

-

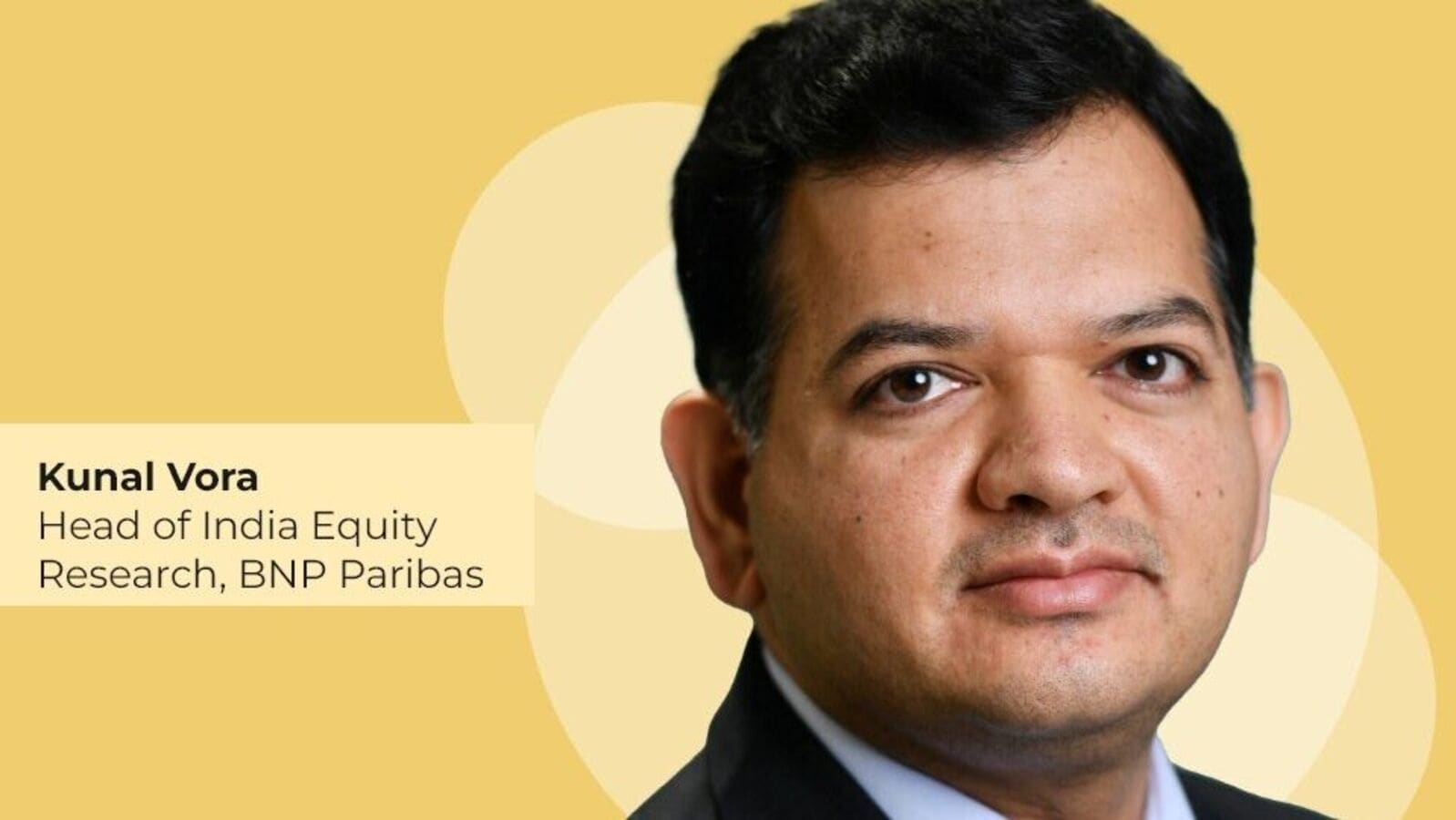

Tuckers Home Run Odds And More Mlb Prop Bets For April 26th

May 13, 2025

Tuckers Home Run Odds And More Mlb Prop Bets For April 26th

May 13, 2025 -

Where To Stream Den Of Thieves 2 Netflix And Other Options

May 13, 2025

Where To Stream Den Of Thieves 2 Netflix And Other Options

May 13, 2025 -

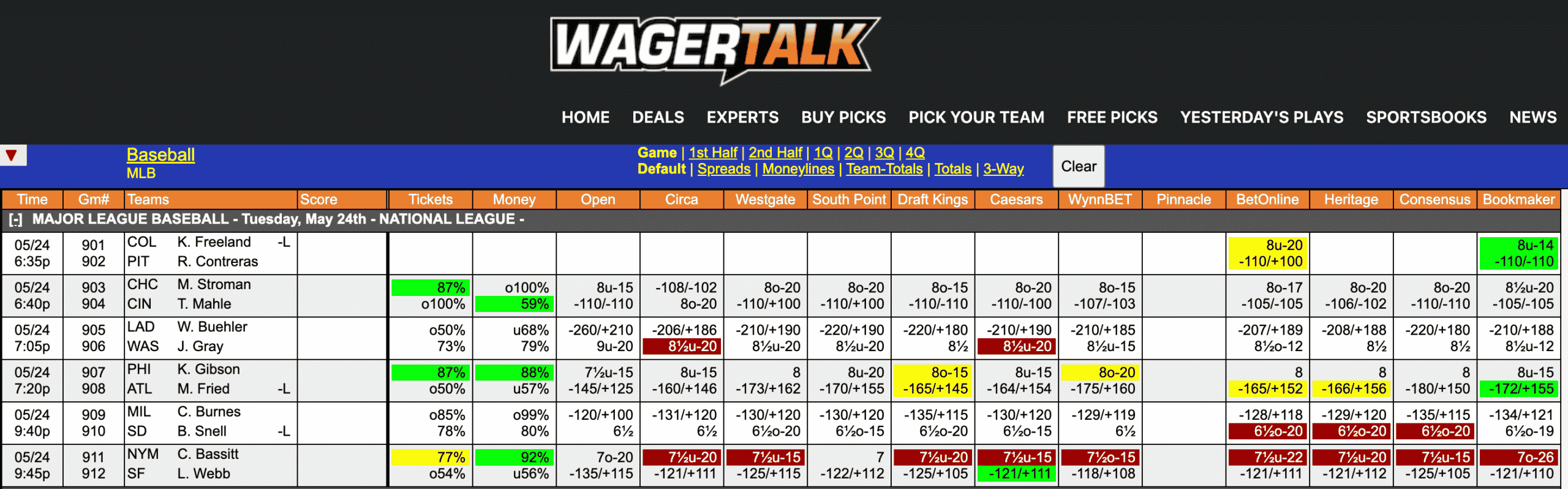

Sabalenka Falls To Ostapenko In Stuttgart Open Championship Match

May 13, 2025

Sabalenka Falls To Ostapenko In Stuttgart Open Championship Match

May 13, 2025 -

Four Walls Appoints New Chief Executive Officer

May 13, 2025

Four Walls Appoints New Chief Executive Officer

May 13, 2025 -

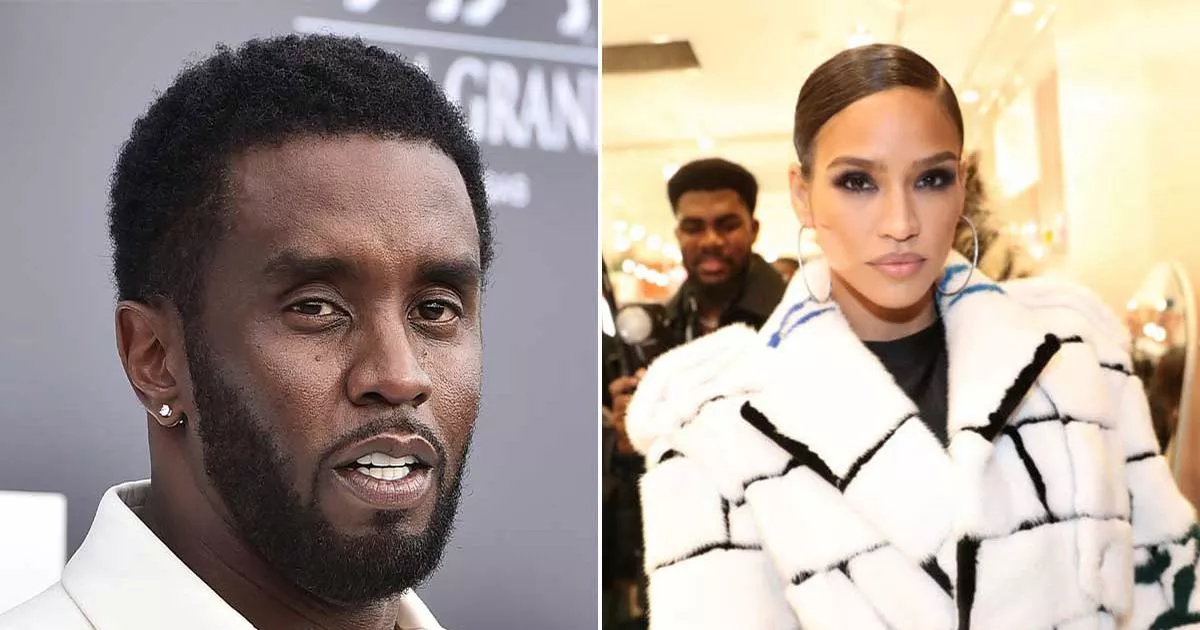

Cassie Announces Pregnancy Third Child On The Way

May 13, 2025

Cassie Announces Pregnancy Third Child On The Way

May 13, 2025