Ignoring The Recession? Stock Market Optimism Persists

Table of Contents

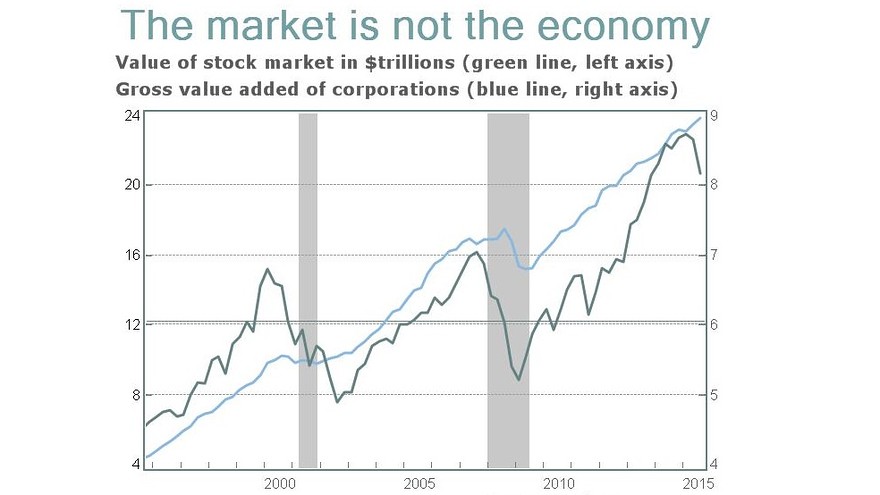

The Disconnect Between Economic Indicators and Market Performance

Recessionary Signals

Numerous economic indicators suggest a looming recession. Inflation, while easing slightly, remains stubbornly high, impacting consumer spending and business investment. Unemployment claims, though still relatively low, have shown a recent uptick, hinting at potential job losses. Consumer confidence, a key indicator of economic health, is also weakening.

- Inflation: The Consumer Price Index (CPI) remains above the Federal Reserve's target rate. [Link to Federal Reserve Data]

- Unemployment Claims: Initial jobless claims have risen in recent weeks. [Link to Bureau of Labor Statistics Data]

- Consumer Confidence: Surveys show a decline in consumer confidence. [Link to relevant consumer confidence index]

This economic data paints a picture of a weakening economy, yet the stock market continues to show relative strength. This discrepancy raises questions about whether the market is accurately pricing in the potential for a recession.

Market Resilience

Despite the recessionary signals, several factors contribute to the stock market's resilience. Strong corporate earnings, robust balance sheets of many major companies, and continued investor expectations of future growth play a significant role.

- Strong Corporate Earnings: Many companies, particularly in the tech sector, have reported strong earnings, demonstrating resilience to economic headwinds. [Link to example company earnings report]

- Robust Balance Sheets: Many businesses entered this period with healthy financial positions, allowing them to weather economic storms.

- Governmental Interventions: Quantitative easing and other government stimulus programs have played a role in supporting markets in the past, although their future impact remains uncertain.

This resilience raises the question of whether the market is overlooking, or perhaps misinterpreting, the potential severity of a recession.

The Role of Investor Sentiment and Market Psychology

Hope over Fear

The continued market optimism is driven by a mixture of hope and perhaps a degree of denial. Many investors cling to the belief in a "soft landing," where the economy slows down gradually without a sharp recession. This hope, coupled with continued faith in technological innovation and long-term growth potential, fuels investor confidence.

- Soft Landing Expectations: Analysts speculate that the Federal Reserve’s monetary policy might engineer a controlled economic slowdown.

- Technological Innovation: Investment in promising sectors, like AI and renewable energy, maintains positive sentiment.

- "This time is different" narrative: Some investors believe past recessionary indicators don't apply to the current economic climate.

The Impact of Market Volatility

Recent market volatility, characterized by periods of both significant gains and losses, has not significantly dampened overall optimistic sentiment. However, increased volatility could erode this optimism if negative economic news becomes more prevalent.

- Recent Market Fluctuations: Examples of specific market events and their short-term impacts should be cited here, referencing reputable financial news sources.

- Potential for Increased Volatility: The uncertainty surrounding the economic outlook suggests the potential for even greater market fluctuations in the future.

The ability of the market to absorb shocks, despite the persistent uncertainty, is a key factor to consider.

Potential Future Scenarios and Predictions

Soft Landing vs. Hard Landing

Two primary scenarios are possible: a "soft landing," where the economy slows gradually, or a "hard landing," characterized by a sharp recession and significant job losses. The stock market's performance will significantly differ depending on which scenario unfolds.

- Soft Landing: Characterized by controlled inflation, moderate unemployment, and a gradual economic slowdown.

- Hard Landing: Characterized by high inflation persisting, rising unemployment, and a sharp contraction in economic activity.

Predicting the most likely outcome remains highly debated among economists and financial analysts.

Strategies for Navigating Market Uncertainty

Given the uncertain economic outlook, investors need to take a cautious approach. Diversification, risk management, and a long-term perspective are key.

- Portfolio Diversification: Spread investments across different asset classes to mitigate risk.

- Risk Management: Adjust investment strategies based on risk tolerance and the potential for market volatility.

- Professional Financial Advice: Seek professional guidance to create a personalized investment strategy.

Staying informed about economic developments and adapting investment strategies accordingly is crucial.

Conclusion: Ignoring the Recession? Stock Market Optimism – A Cautious Approach

The stock market's surprising resilience in the face of looming recessionary concerns presents a paradox. While corporate earnings and investor sentiment contribute to the optimism, ignoring the significant economic headwinds would be reckless. Key factors driving market optimism include hopes for a soft landing, faith in technological innovation, and perhaps a degree of market inertia. However, the potential for increased market volatility and a hard landing remains significant. Understanding the potential risks associated with ignoring the recession is crucial. Therefore, employing robust recession-proof investments and carefully considering your investment strategies, along with staying informed about the economic outlook and market volatility, is paramount. Seek professional financial advice to create a personalized plan to navigate this period of market uncertainty effectively.

Featured Posts

-

Dhwq Almlk Tsharlz Almwsyqy Mfajat Ghyr Mtwqet

May 06, 2025

Dhwq Almlk Tsharlz Almwsyqy Mfajat Ghyr Mtwqet

May 06, 2025 -

Doechii Narrates Nikes First Super Bowl Commercial In 30 Years

May 06, 2025

Doechii Narrates Nikes First Super Bowl Commercial In 30 Years

May 06, 2025 -

Compstons Latest Thriller Highs And Lows Of A Promising Premise

May 06, 2025

Compstons Latest Thriller Highs And Lows Of A Promising Premise

May 06, 2025 -

A Potential Monkey Flop Assessing The Impact On Stephen Kings 2025

May 06, 2025

A Potential Monkey Flop Assessing The Impact On Stephen Kings 2025

May 06, 2025 -

Urdhri I Spak Ut Kontrolli Ne Banesen E Aldes Dhe Xhovanes Nikolli

May 06, 2025

Urdhri I Spak Ut Kontrolli Ne Banesen E Aldes Dhe Xhovanes Nikolli

May 06, 2025