Impact Of China's Lithium Export Controls: Positive Outlook For Eramet

Table of Contents

Increased Global Demand for Lithium and the Tightening Supply Chain

The electric vehicle revolution is transforming the automotive industry, fueling unprecedented demand for lithium-ion batteries. Simultaneously, the urgent need for renewable energy storage, driven by the global transition to solar and wind power, further amplifies the pressure on lithium supplies. This surging demand is clashing with a concentrated global supply chain. China currently dominates lithium processing and refining, holding a significant portion of the global market share. This concentration poses risks to the stability and reliability of the global lithium supply.

- Growing EV sales worldwide: Millions of electric vehicles are sold annually, with projections for exponential growth in the coming years.

- Expansion of renewable energy infrastructure (solar, wind): The increasing adoption of renewable energy sources requires massive investments in energy storage, directly increasing lithium demand.

- Increased demand for lithium-ion batteries in consumer electronics: From smartphones to laptops, the pervasive use of lithium-ion batteries in consumer electronics contributes significantly to overall lithium consumption.

- China's dominance in lithium processing and refining: China's control over processing and refining capabilities creates a bottleneck in the global supply chain.

China's Lithium Export Controls: A Strategic Move and its Consequences

China's recent export control measures are driven by a strategic imperative: securing its domestic supply of lithium and bolstering its own burgeoning domestic lithium industry. These controls have had immediate and far-reaching consequences. The reduced availability of lithium from China has already led to significant price increases for lithium raw materials and processed products, creating uncertainty for downstream industries reliant on stable and affordable lithium supplies. The long-term effects remain to be seen, but the geopolitical implications are significant, pushing other nations to seek diversified and more secure lithium sources.

- Reduced lithium exports from China: China's export restrictions are directly impacting the availability of lithium on the global market.

- Price increases for lithium raw materials and processed products: Reduced supply has led to a surge in lithium prices, affecting manufacturers and consumers alike.

- Increased uncertainty for lithium-dependent industries: The volatility in lithium prices creates significant risks for businesses reliant on consistent lithium supply.

- Geopolitical implications of China's policy: China's actions are spurring efforts by other countries to develop their own domestic lithium industries and diversify their supply chains.

Eramet's Strategic Positioning and its Beneficiary Status

Eramet is a global leader in mining and processing metals, including lithium. Unlike many of its competitors, Eramet has strategically diversified its geographical footprint, investing in lithium projects outside China. This foresight significantly mitigates the risks associated with China's export controls. Furthermore, Eramet is committed to sustainable and responsible lithium production, utilizing advanced technologies to minimize environmental impact. This combination of geographical diversification and sustainable practices positions Eramet to capitalize on the opportunities created by the evolving global lithium landscape.

- Eramet's lithium mining and processing operations: Eramet possesses a strong portfolio of lithium projects across various regions.

- Geographic diversification reducing reliance on China: Eramet's geographically diverse operations reduce its vulnerability to disruptions in specific regions.

- Investment in sustainable lithium extraction technologies: Eramet's commitment to sustainability aligns with the growing demand for ethically sourced lithium.

- Projected increase in market share and profitability for Eramet: The current market dynamics are strongly favorable to Eramet's growth strategy.

Investment Opportunities and the Future of the Lithium Market

The Impact of China's Lithium Export Controls has created significant investment opportunities within the lithium sector. Companies like Eramet, with their strategic positioning and commitment to sustainable practices, represent attractive investment prospects. While forecasting precise lithium prices remains challenging, the long-term outlook for the lithium market is undeniably positive. The focus on sustainable and responsible lithium sourcing will further shape the market landscape, rewarding companies that prioritize ethical and environmentally conscious practices.

- Attractive investment opportunities in the lithium sector: The current market conditions are creating a favorable environment for investment in responsible lithium producers.

- Forecasting lithium prices in the coming years: While precise predictions are difficult, the long-term price outlook remains bullish.

- Focus on ethical and environmentally conscious lithium production: Investors are increasingly prioritizing ESG (Environmental, Social, and Governance) factors.

- Importance of diversification in the supply chain: Investors are seeking companies with diversified geographical footprints and robust supply chains.

Conclusion: The Impact of China's Lithium Export Controls: A Promising Future for Eramet

China's export controls, the escalating global demand for lithium, and Eramet's strategic positioning create a compelling narrative. Eramet is uniquely positioned to benefit significantly from the current market dynamics, experiencing substantial growth and market share expansion. The Impact of China's Lithium Export Controls underscores the importance of responsible lithium sourcing and presents compelling investment opportunities within the lithium market. Learn more about Eramet and explore the possibilities of investing in this crucial sector, taking into account the long-term implications of the changing global lithium landscape.

Featured Posts

-

From Open Doors To Closed Borders Understanding Portugals New Immigration Stance

May 14, 2025

From Open Doors To Closed Borders Understanding Portugals New Immigration Stance

May 14, 2025 -

Disneys Woke Snow White Flops Did Insulting Half The Country Backfire

May 14, 2025

Disneys Woke Snow White Flops Did Insulting Half The Country Backfire

May 14, 2025 -

Liverpools Summer Transfer Plans Could Huijsen Join

May 14, 2025

Liverpools Summer Transfer Plans Could Huijsen Join

May 14, 2025 -

O Reconhecimento Frances Da Divida Historica Do Haiti

May 14, 2025

O Reconhecimento Frances Da Divida Historica Do Haiti

May 14, 2025 -

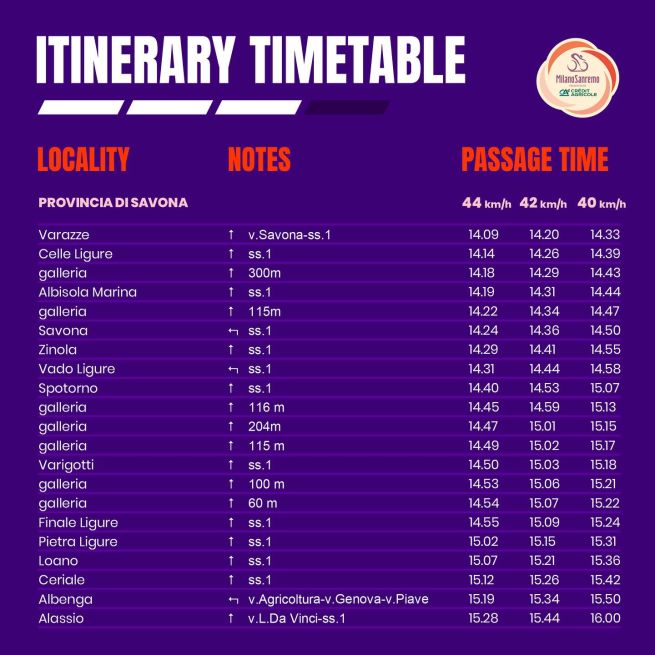

Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women In Provincia Di Imperia

May 14, 2025

Orari Di Passaggio Milano Sanremo 2025 E Sanremo Women In Provincia Di Imperia

May 14, 2025