Impact Of China's Selective Tariff Exemptions On US Businesses

Table of Contents

Types of Exemptions Granted by China

China's approach to tariff exemptions is far from uniform. The exemptions granted fall into several distinct categories, each with its own implications for US businesses.

Product-Specific Exemptions

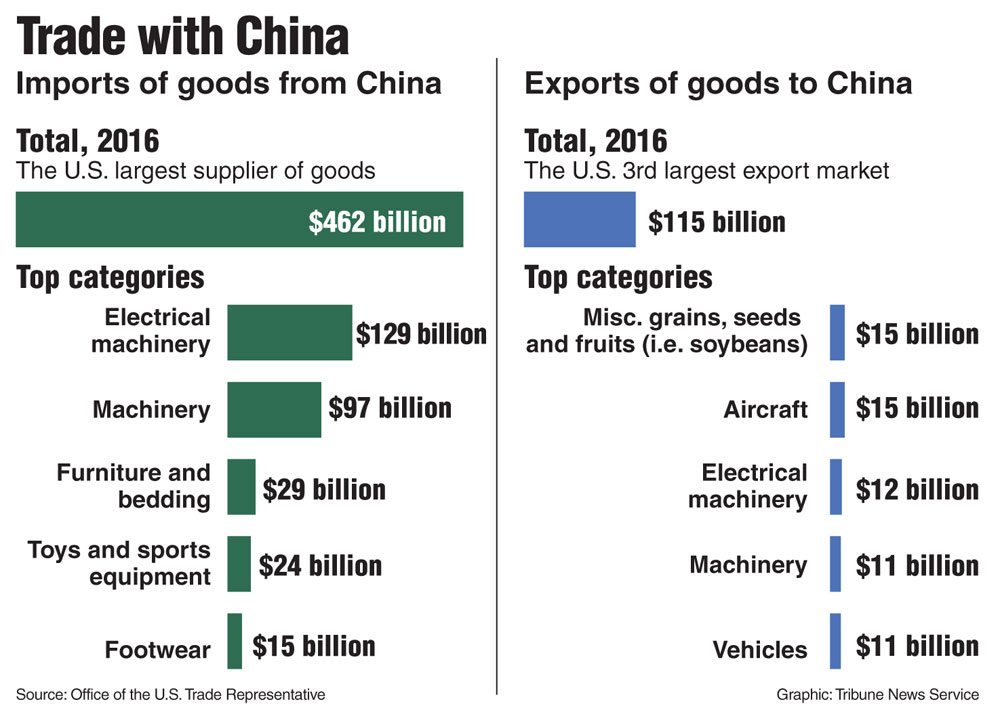

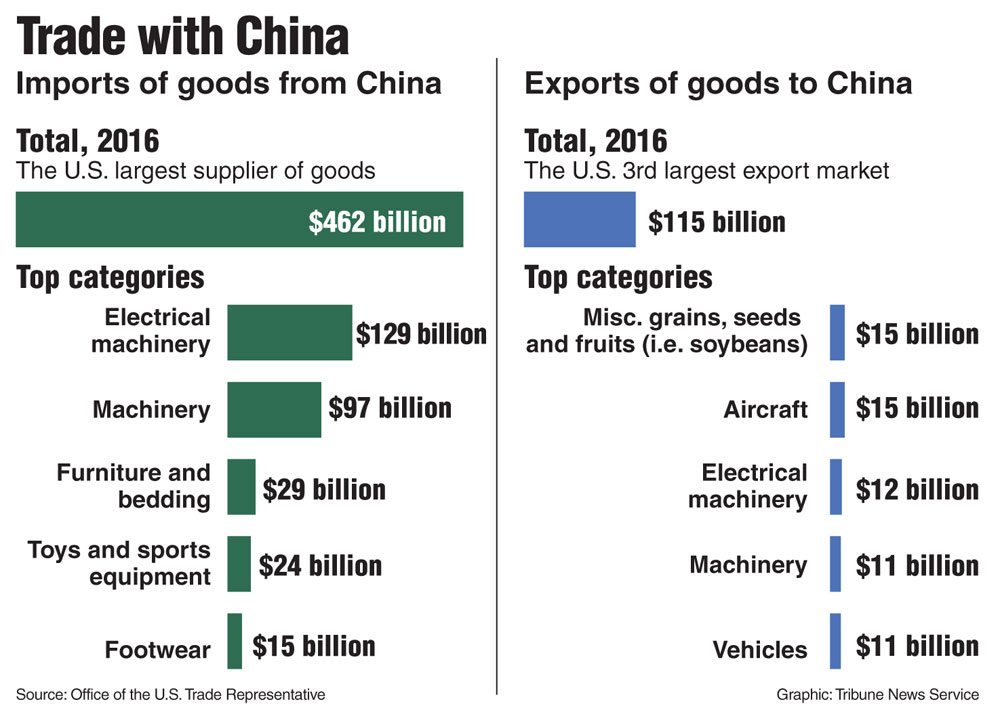

These exemptions target specific goods deemed essential for the Chinese economy or lacking readily available domestic alternatives. Examples include particular agricultural products (like soybeans at certain times) and certain high-tech components crucial for manufacturing. These targeted tariff exemptions provide relief for businesses heavily reliant on exporting these specific products. The impact is a direct reduction in costs and an easing of supply chain pressures for the exempted goods. However, this relief is limited to the specific products included, leaving other related products still subject to tariffs.

Company-Specific Exemptions

This category of exemptions is granted to individual US companies, often based on unique circumstances, demonstrated economic hardship, or promises of investment in China. Examples include exemptions for smaller businesses struggling with the increased costs of tariffs or exemptions contingent upon substantial investments in Chinese infrastructure or manufacturing. Targeted tariff relief of this nature creates an uneven playing field, potentially leading to accusations of favoritism and prompting increased lobbying efforts from companies seeking similar treatment. This approach introduces an element of unpredictability and can exacerbate existing competitive imbalances.

Time-Limited Exemptions

Many exemptions are temporary, with a clearly defined expiration date. These temporary tariff waivers often provide relief for specific industries during transition periods or to address immediate shortages. Examples include short-term exemptions for essential medical supplies or components for crucial manufacturing processes. The impact of these time-limited exemptions is twofold. While providing short-term relief, they also create significant uncertainty for long-term business planning, requiring constant monitoring of changing exemption policies and forcing businesses to continuously re-evaluate their strategies.

Economic Impact on US Businesses

The economic consequences of China's selective tariff exemptions are complex and multifaceted, presenting both positive and negative impacts on US businesses.

Positive Impacts

- Reduced costs: For businesses fortunate enough to receive exemptions, the reduction in tariffs directly translates to lower costs, leading to increased profitability and potentially greater competitiveness.

- Improved competitiveness: Exemptions can level the playing field for some US companies, allowing them to better compete with rivals not facing the same tariff burdens.

- Maintenance of supply chains: Exemptions for essential goods ensure the continued flow of crucial products, preventing disruptions to production and preventing supply chain bottlenecks. This is vital for maintaining operations and market share. This is also beneficial to Chinese businesses reliant on the imported goods.

Negative Impacts

- Increased complexity and uncertainty: The unpredictable nature of exemptions adds significant complexity to business planning, demanding continuous monitoring of policy changes and adaptation of strategies.

- Unequal access to exemptions: The uneven distribution of exemptions creates an unfair competitive advantage for some businesses, further exacerbating existing inequalities in the market.

- Potential for lobbying and political influence: The process of securing exemptions can be heavily influenced by lobbying efforts, potentially leading to a skewed allocation of benefits based on political connections rather than economic need. This lack of transparency is a major concern.

Strategic Implications for US Businesses

Navigating the complexities of China's selective tariff exemptions requires a strategic approach that incorporates proactive engagement, diversification, and adaptable planning.

Lobbying and Advocacy

Actively engaging in lobbying efforts to secure exemptions is paramount. US businesses must effectively communicate their needs and demonstrate the economic impact of tariffs on their operations to influence policy decisions.

Diversification of Supply Chains

To mitigate future tariff risks, diversifying supply chains is crucial. Businesses should explore alternative sourcing options outside of China to reduce reliance on a single market and lessen the impact of future trade disputes.

Long-Term Planning in Uncertain Times

Adapting to the dynamic trade environment necessitates robust long-term planning. This includes developing contingency plans, forecasting potential policy changes, and implementing strategies to manage risks associated with fluctuating tariffs.

Conclusion

China's selective tariff exemptions have presented a mixed bag for US businesses. While offering temporary relief to some, they've also introduced significant uncertainty and complexities. The unequal distribution of exemptions underscores the importance of proactive engagement in trade policy and highlights the necessity of diversifying supply chains. To navigate this challenging landscape, US businesses must carefully monitor changes in China's tariff policies, actively engage in lobbying efforts, and develop robust strategies for mitigating trade risks. Understanding the impact of China's Selective Tariff Exemptions, including the nuances of targeted tariff relief and temporary tariff waivers, is vital for long-term success. Proactive planning and strategic adaptation are crucial for US companies seeking to thrive despite ongoing trade tensions.

Featured Posts

-

Weak Retail Sales Fuel Speculation Of Bank Of Canada Interest Rate Cuts

Apr 28, 2025

Weak Retail Sales Fuel Speculation Of Bank Of Canada Interest Rate Cuts

Apr 28, 2025 -

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025

Is This Red Sox Outfielder The Next Jarren Duran A Breakout Season Prediction

Apr 28, 2025 -

Get A 10 Gb Uae Sim And 15 Off Abu Dhabi Activities With This Pass

Apr 28, 2025

Get A 10 Gb Uae Sim And 15 Off Abu Dhabi Activities With This Pass

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025 -

Hudsons Bay Liquidation Sale Up To 70 Off At Remaining Stores

Apr 28, 2025

Hudsons Bay Liquidation Sale Up To 70 Off At Remaining Stores

Apr 28, 2025

Latest Posts

-

Thomas Mueller Konci V Bayerne Mnichov Po 25 Rokoch

May 12, 2025

Thomas Mueller Konci V Bayerne Mnichov Po 25 Rokoch

May 12, 2025 -

Thomas Mueller 25 Ans Au Bayern La Fin D Une Histoire

May 12, 2025

Thomas Mueller 25 Ans Au Bayern La Fin D Une Histoire

May 12, 2025 -

Le Depart De Thomas Mueller Du Bayern Munich Un Adieu Apres Une Longue Carriere

May 12, 2025

Le Depart De Thomas Mueller Du Bayern Munich Un Adieu Apres Une Longue Carriere

May 12, 2025 -

Apres 25 Ans Au Bayern Thomas Mueller Tire Sa Reverence

May 12, 2025

Apres 25 Ans Au Bayern Thomas Mueller Tire Sa Reverence

May 12, 2025 -

Rykten Thomas Mueller Kan Laemna Bayern Foer Mls

May 12, 2025

Rykten Thomas Mueller Kan Laemna Bayern Foer Mls

May 12, 2025