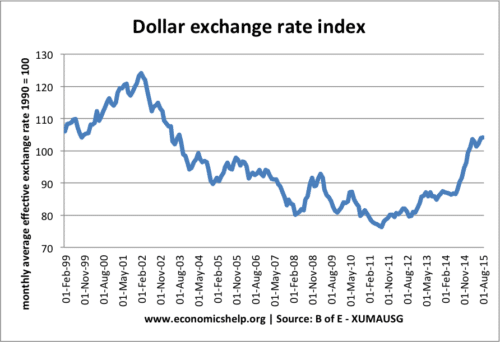

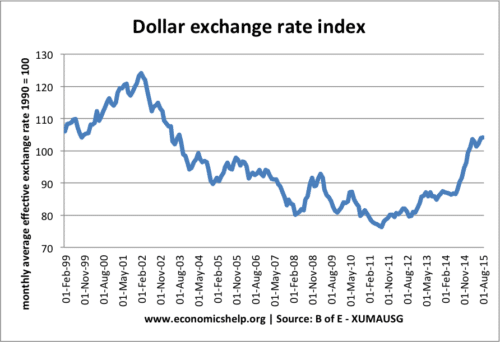

Impact Of Dollar's Fall On Asian Exchange Rates

Table of Contents

Reasons for the Dollar's Decline

Several factors contribute to the fluctuation and potential decline of the US dollar. Analyzing these factors provides crucial insight into the broader implications for Asian economies.

Monetary Policy Shifts

The Federal Reserve (Fed)'s monetary policy decisions heavily influence the dollar's value. Changes in interest rates and quantitative easing programs directly impact investor sentiment and capital flows.

- Examples of recent Fed decisions and their immediate effect on the USD: For instance, the recent interest rate hikes by the Fed aimed at curbing inflation initially strengthened the dollar, but prolonged high rates can attract investors seeking higher returns, potentially leading to future weakening if other global economies recover faster.

- Potential future policy changes and their projected impact: Future rate cuts or a resumption of quantitative easing could weaken the dollar significantly, as it would make it less attractive compared to currencies offering higher yields.

- Lower interest rates make the dollar less attractive to foreign investors: When US interest rates are low relative to other countries, foreign investors are less inclined to hold USD-denominated assets, leading to a decrease in demand and a fall in the dollar's value.

Geopolitical Factors

Global political instability and trade wars significantly impact investor confidence and the dollar's value. Uncertainty often leads to capital flight away from the US dollar, seeking safer havens.

- Examples of geopolitical events impacting the dollar's value: The ongoing war in Ukraine, escalating tensions between the US and China, and political instability in various regions all contribute to dollar volatility. Trade disputes, like those involving tariffs, have historically weakened investor sentiment and the dollar.

- Specific trade disputes and their impact: Trade wars can create uncertainty and disrupt global supply chains, negatively affecting economic growth and investor confidence in the US, thereby weakening the dollar.

- Uncertainty in global politics can lead to capital flight away from the dollar: Investors often move their assets to perceived safer havens (like gold or other stable currencies) during times of geopolitical uncertainty, reducing demand for the dollar.

Economic Performance of the US

The US economy's performance, reflected in key indicators, plays a crucial role in determining the dollar's value. Strong economic growth generally strengthens the dollar, while weak performance weakens it.

- Examples of key economic indicators and how they influence the dollar's value: GDP growth, inflation rates, unemployment figures, and consumer confidence all influence investor sentiment and the dollar's strength. High inflation can erode the dollar's purchasing power, weakening its value.

- Strong/weak economic performance affects investor confidence and the USD's value: A strong US economy attracts foreign investment, increasing demand for the dollar and strengthening its value. Conversely, a weak economy reduces investor confidence, leading to a fall in the dollar.

Impact on Asian Currencies

The fall of the dollar creates a ripple effect across Asian currencies, causing both appreciation and depreciation depending on various factors.

Currency Appreciation

Some Asian currencies tend to appreciate against a weakening dollar due to strong domestic economies or increased global demand.

- Examples of Asian currencies that typically strengthen when the dollar falls: The Japanese Yen and the Chinese Yuan often appreciate against the dollar when it weakens.

- Reasons behind appreciation – strong domestic economies, increased demand, etc.: Strong economic fundamentals in countries like Japan or China can attract foreign investment, increasing demand for their currencies and causing appreciation against a weakening dollar.

Currency Depreciation

Other Asian currencies might depreciate due to factors such as dependence on dollar-denominated trade or weaker domestic economies.

- Examples of Asian currencies vulnerable to depreciation: Currencies of countries heavily reliant on exports to the US might depreciate if the dollar weakens, as their export prices in dollar terms increase, reducing competitiveness.

- Reasons behind depreciation – dependence on dollar-denominated trade, weaker economies, etc.: Countries with significant dollar-denominated debt might face increased debt servicing costs when the dollar weakens, potentially leading to currency depreciation. Weaker economies are also more vulnerable to depreciation.

Increased Volatility

Fluctuating exchange rates due to dollar weakness increase risk and uncertainty for businesses and investors across Asia.

- Examples of the challenges faced by businesses dealing with volatile exchange rates (forecasting, hedging costs): Businesses struggle with forecasting future exchange rates, making it difficult to plan budgets and investments. Hedging against exchange rate risk adds to operational costs.

- How volatility can affect import/export costs, investment decisions, and overall economic stability: Volatile exchange rates create uncertainty, impacting investment decisions, and potentially destabilizing economies heavily reliant on exports or imports.

Economic Consequences for Asian Nations

The dollar's fall has significant consequences for Asian economies, impacting trade, investment, and inflation.

Impact on Trade

A weaker dollar makes Asian exports cheaper, potentially boosting demand, but also increases the cost of imports.

- A weaker dollar makes Asian exports cheaper and potentially increases demand: This can lead to increased export volumes and boost economic growth in exporting nations.

- Impact on import costs: Increased import costs due to a weaker dollar can lead to higher inflation and reduce purchasing power.

- Trade balance implications and potential benefits/drawbacks for different Asian economies: The net effect varies depending on a country's export-import balance and its reliance on dollar-denominated trade.

Impact on Investment

Exchange rate fluctuations influence the attractiveness of Asian investment opportunities for foreign investors.

- Changes in exchange rates can influence the attractiveness of Asian investment opportunities: A weaker dollar can make investments in Asian countries more attractive to investors from other countries, increasing capital inflow.

- Impact on capital flows and potential shifts in investment strategies: Changes in exchange rates can significantly impact investment decisions, leading to shifts in capital flows and investment strategies.

Impact on Inflation

Increased import costs resulting from a weaker dollar contribute to inflation in Asian countries.

- Increased import costs due to a weaker dollar could lead to higher inflation: This can reduce consumer purchasing power and necessitate monetary policy adjustments.

- Implications for monetary policy and potential government responses: Governments might need to adjust monetary policies, such as raising interest rates, to control inflation caused by a weaker dollar.

Conclusion

The fall of the dollar presents a complex scenario for Asian economies, offering both opportunities and challenges. Understanding the reasons behind the dollar's decline and its impact on Asian currencies is vital for businesses, investors, and policymakers. While some Asian currencies may appreciate, leading to increased export competitiveness and potential economic growth, others may experience depreciation, requiring careful management of economic policies. Staying informed on the dollar's fall impact on Asian exchange rates and adapting strategies accordingly is vital for navigating this dynamic economic landscape. Regularly monitor global financial news and consult with economic experts to effectively manage the risks and opportunities presented by fluctuations in the USD. Proactive monitoring of the dollar's influence on Asian exchange rates is crucial for successful economic planning and strategic decision-making.

Featured Posts

-

A New Fitness Brand Nike Teams Up With Kim Kardashians Skims

May 06, 2025

A New Fitness Brand Nike Teams Up With Kim Kardashians Skims

May 06, 2025 -

Fortnite Update Sabrina Carpenter Emotes Arrive

May 06, 2025

Fortnite Update Sabrina Carpenter Emotes Arrive

May 06, 2025 -

Review Shotgun Cop Man A Bizarre Platformer With A Devilish Twist

May 06, 2025

Review Shotgun Cop Man A Bizarre Platformer With A Devilish Twist

May 06, 2025 -

Pogashenie Zadolzhennosti Turkmenistan Azerbaydzhan

May 06, 2025

Pogashenie Zadolzhennosti Turkmenistan Azerbaydzhan

May 06, 2025 -

Unlocking Sabrina Carpenter Fortnite Skins A Complete Guide

May 06, 2025

Unlocking Sabrina Carpenter Fortnite Skins A Complete Guide

May 06, 2025