Impact Of Ontario's Permanent Gas Tax Cut And Highway 407 East Toll Removal

Table of Contents

Economic Impacts of the Gas Tax Cut and Toll Removal

The elimination of the gas tax and Highway 407 East tolls presents a complex economic picture, with both potential gains and losses.

Benefits for Consumers

- Lower Transportation Costs: The most immediate impact is a reduction in transportation costs for commuters and businesses. Lower fuel prices directly translate to more disposable income for individuals and reduced operating expenses for businesses. This could stimulate consumer spending and boost economic activity.

- Increased Disposable Income: This extra money in consumers' pockets can lead to increased spending on goods and services, injecting vitality into the economy. This potential economic stimulus could offset some of the revenue losses to the government.

- Positive Impacts on Transportation-Reliant Businesses: Businesses heavily dependent on transportation, such as trucking companies and delivery services, will experience significant cost savings. This improved profitability could lead to business expansion and job creation.

- Inflationary Concerns: While the gas tax cut lowers transportation costs, it's crucial to acknowledge potential inflationary pressures. The reduction in government revenue may necessitate other adjustments, and increased consumer spending could drive up prices in certain sectors. However, the overall net impact on inflation is a subject of ongoing debate and economic modelling.

Impact on Government Revenue

The permanent gas tax cut represents a significant loss of revenue for the provincial government. The Ontario budget will need to account for this shortfall, potentially impacting other government programs and services.

- Offsetting Revenue Sources: The government hopes increased economic activity, fueled by the gas tax cut and increased consumer spending, will partially offset the revenue loss. This is a key assumption underpinning the policy's rationale.

- Fiscal Policy Implications: The government's fiscal policy will be closely scrutinized in the coming years to assess the effectiveness of this strategy and potential need for adjustments. Transparency in fiscal planning will be critical to public confidence.

Impact on Businesses

Reduced operational costs represent a clear advantage for businesses across Ontario.

- Reduced Operating Costs: Businesses, particularly those with large fleets of vehicles, will experience significant savings in their fuel bills. This cost reduction can enhance profitability and competitiveness.

- Increased Competitiveness: Lower operating expenses can allow Ontario businesses to offer more competitive pricing compared to businesses in other provinces without similar tax reductions.

- Job Creation Potential: The anticipated economic stimulus from the gas tax cut could contribute to job creation across various sectors.

Impact on Traffic Flow and Congestion

The policy changes are likely to significantly influence traffic patterns in Ontario.

Highway 407 East Toll Removal

- Increased Traffic Volume: The removal of tolls on Highway 407 East is expected to lead to a substantial increase in traffic volume on this highway, particularly during peak hours.

- Potential for Increased Congestion: The increased traffic flow might easily overwhelm the existing highway capacity, leading to significant congestion, particularly during peak commuting times. This could negate some of the time-saving benefits intended by the toll removal.

- Infrastructure Capacity: Addressing the potential congestion requires a thorough assessment of the Highway 407 East's capacity and exploration of potential solutions, such as infrastructure upgrades or alternative transportation strategies.

Gas Tax Cut and its Effect on Driving Habits

- Potential for Increased Driving: Lower fuel prices might encourage more people to drive, leading to increased vehicle miles traveled (VMT).

- Impact on Overall Traffic Patterns: This increase in driving could lead to higher congestion levels on various roads and highways across the province, not just the 407 East.

- Environmental Implications: The increased VMT has significant environmental implications, particularly regarding greenhouse gas emissions.

Environmental Considerations

The environmental impact of the gas tax cut and toll removal is a critical concern.

Increased Vehicle Miles Traveled (VMT)

- Increased Greenhouse Gas Emissions: The anticipated increase in VMT will likely lead to a rise in greenhouse gas emissions, worsening air quality and contributing to climate change.

- Government Mitigation Strategies: The government needs to implement effective strategies to mitigate the environmental impact of increased driving. This might involve investments in public transit or incentives for electric vehicles.

- Comparison with Other Jurisdictions: A comparison with similar policies in other jurisdictions and their environmental outcomes will be essential for assessing the long-term effects.

Offsetting Environmental Measures

The government needs to actively pursue initiatives to offset the increased emissions.

- Promoting Electric Vehicles: Investing in charging infrastructure and offering incentives for purchasing electric vehicles could help reduce reliance on gasoline-powered vehicles.

- Sustainable Transportation Options: Promoting public transportation, cycling, and walking can reduce reliance on private vehicles and lower overall carbon emissions.

- Long-Term Sustainability Strategies: A comprehensive long-term strategy for achieving environmental sustainability is crucial to counteract the negative environmental consequences of the policy changes.

Conclusion: Assessing the Long-Term Effects of Ontario's Gas Tax Cut and Highway 407 Toll Removal

The permanent gas tax cut and Highway 407 East toll removal in Ontario present a complex scenario with both potential economic benefits and environmental challenges. While reduced transportation costs and potential economic stimulus are significant positives, the increased traffic congestion and greenhouse gas emissions require careful consideration. The long-term success of this policy hinges on the government's ability to effectively manage the increased traffic flow, mitigate environmental impacts, and ensure fiscal responsibility. The interplay between economic growth, traffic management, and environmental protection will shape the ultimate success or failure of this significant policy change. We urge readers to actively participate in discussions surrounding the Ontario gas tax cut and Highway 407 East toll removal, seeking out further information and engaging with policy makers to ensure the long-term well-being of Ontario. Stay informed about upcoming policy discussions and initiatives to understand the evolving impact of this substantial change to Ontario's transportation system.

Featured Posts

-

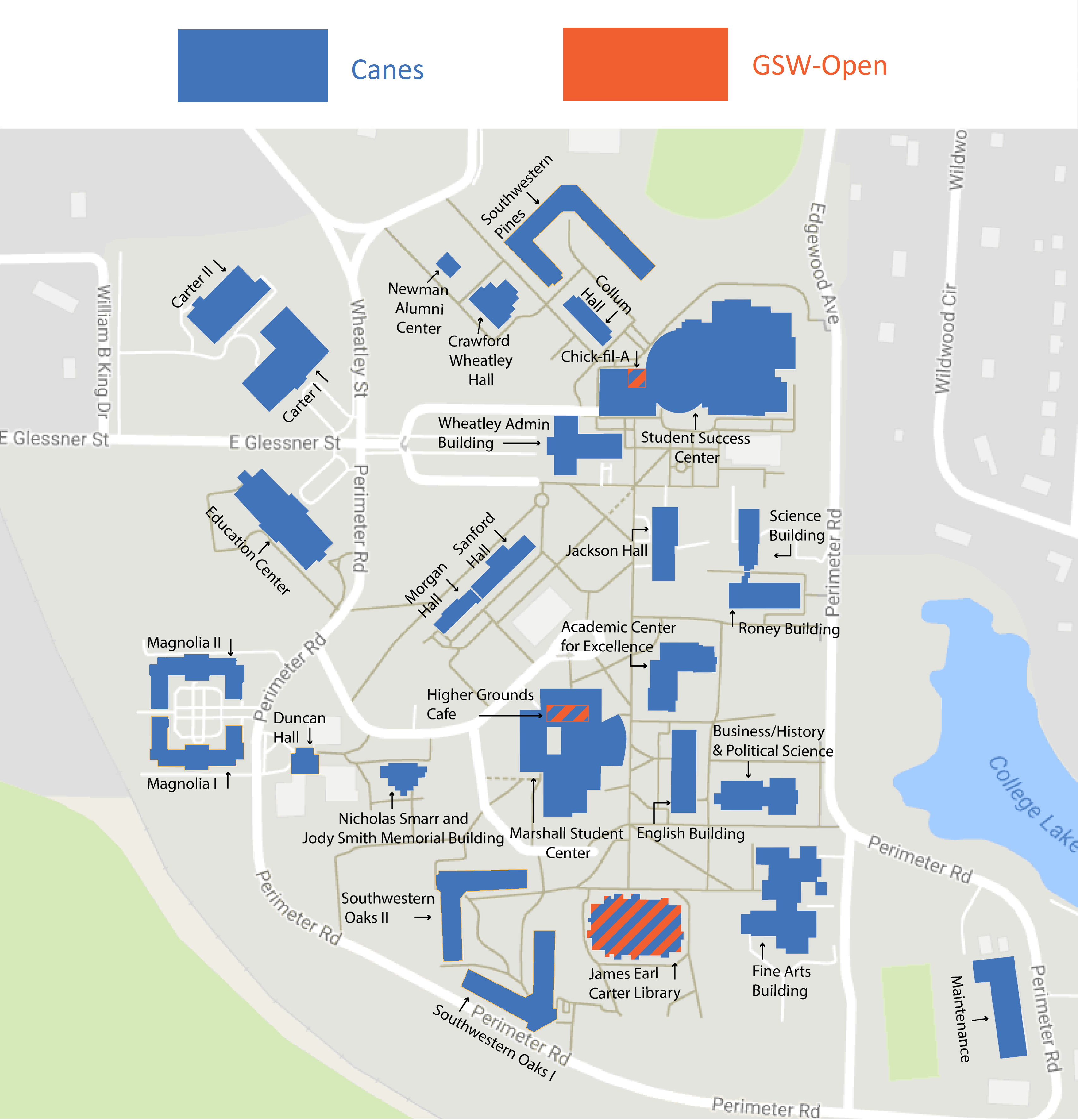

Gsw Campus Security Alert Police Investigating Armed Person Report

May 15, 2025

Gsw Campus Security Alert Police Investigating Armed Person Report

May 15, 2025 -

College Van Omroepen Streeft Naar Vertrouwen Bij De Npo

May 15, 2025

College Van Omroepen Streeft Naar Vertrouwen Bij De Npo

May 15, 2025 -

Auction Of Kid Cudis Personal Items Yields Unexpected Results

May 15, 2025

Auction Of Kid Cudis Personal Items Yields Unexpected Results

May 15, 2025 -

Joint Interview Chandler And Pimblett Predict Ufc 314 Outcomes

May 15, 2025

Joint Interview Chandler And Pimblett Predict Ufc 314 Outcomes

May 15, 2025 -

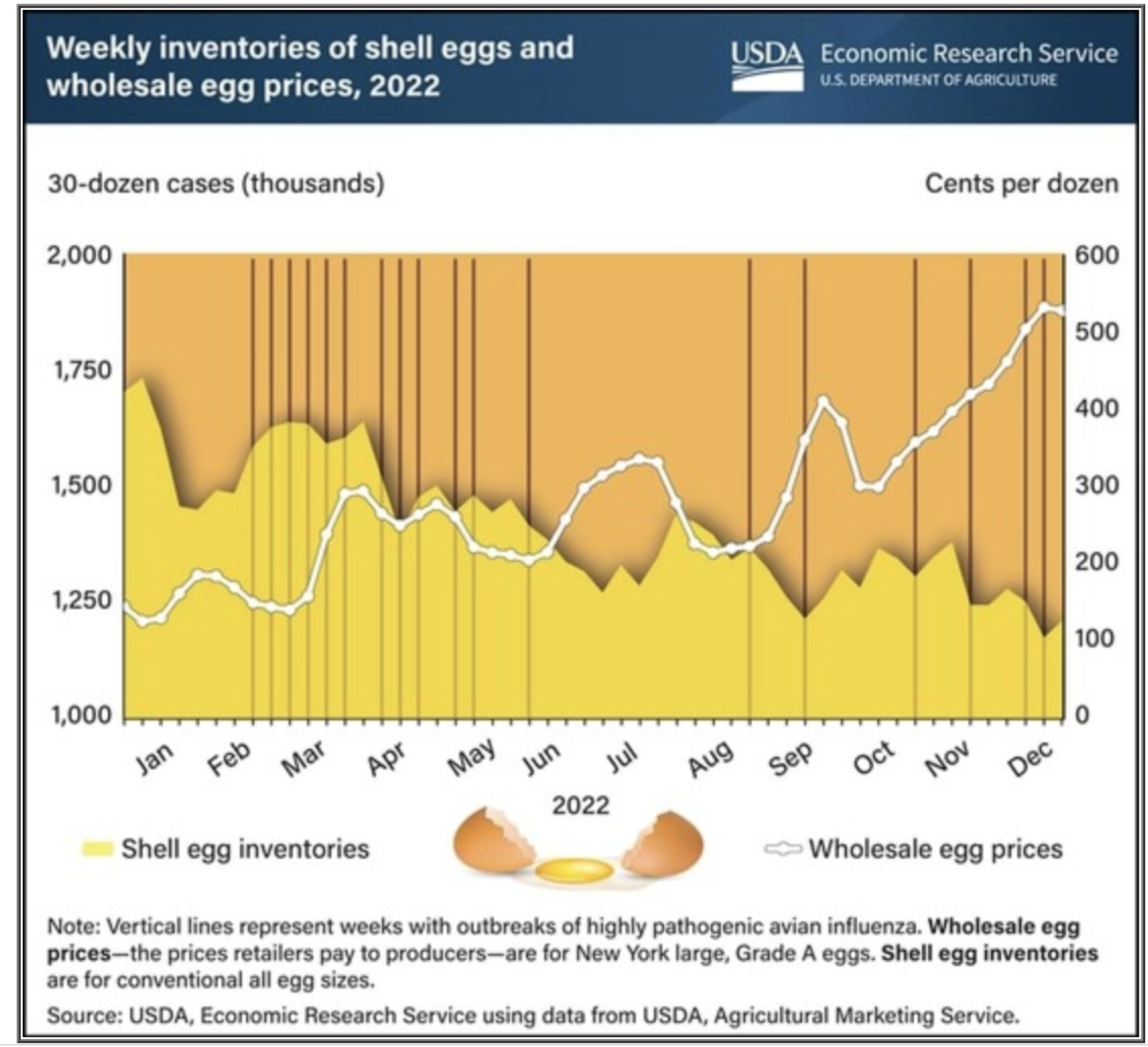

Us Egg Prices Drop To 5 A Dozen Relief For Consumers

May 15, 2025

Us Egg Prices Drop To 5 A Dozen Relief For Consumers

May 15, 2025