Impact Of Souring Loans: RBC's Earnings Fall Short Of Forecasts

Table of Contents

The Surge in Souring Loans at RBC

The increase in souring loans at RBC is a critical factor contributing to its underperformance. Understanding the specifics of this increase is vital to assessing the bank's future prospects and the overall health of the Canadian financial system.

Identifying the Affected Loan Sectors

Several loan categories are experiencing disproportionately high levels of non-performing loans. This represents a significant credit risk for RBC and the industry as a whole. Specifically:

- Commercial Real Estate: Rising interest rates and a softening commercial real estate market have led to a substantial increase in defaults. Statistics show a X% increase in non-performing commercial real estate loans in Q[Quarter] compared to Q[Previous Quarter]. This is largely due to decreased property values and increased borrowing costs making it difficult for some businesses to service their debts.

- Consumer Credit: Increased inflation and reduced consumer spending power are impacting repayment ability, leading to a rise in delinquent consumer credit accounts. We've seen a Y% increase in credit card and personal loan defaults in the last quarter.

- Energy Sector Loans: Fluctuations in global energy prices and the ongoing transition to renewable energy sources are putting pressure on borrowers in this sector, resulting in higher levels of loan defaults.

Geographical Distribution of Souring Loans

The geographical distribution of these souring loans also offers valuable insights. While data is still being analyzed, early indications suggest a higher concentration in [Specific region(s) – e.g., Western Canada, Ontario]. This highlights the importance of understanding regional economic impact and effectively managing market exposure. A detailed map illustrating the geographical distribution of non-performing loans is crucial for comprehensive risk assessment. This uneven distribution underscores the challenges of geographic diversification for lenders operating in a diverse national market like Canada.

Financial Impact on RBC's Earnings

The surge in souring loans has had a quantifiable negative impact on RBC's financial performance.

Decline in Net Income and Profit Margins

RBC reported a significant decline in net income, falling short of analyst expectations by Z%. This translates to a reduction in earnings per share (EPS) and a lower return on equity (ROE) compared to the previous quarter and the same quarter last year. Profit margins have also been compressed due to the increased credit loss provisions. Direct comparison to competitors' performance in managing their portfolios of souring loans will give a more comprehensive picture of RBC’s current standing within the industry.

Increased Provision for Credit Losses

To address the rising number of souring loans, RBC has significantly increased its provision for credit losses (PCL) by $W billion. This represents a proactive approach to risk management, but it also significantly impacts profitability. The adequacy of these increased provisions is a key consideration for investors and analysts, and ongoing monitoring of loan performance is critical to assessing whether additional provisions may be needed.

RBC's Response to the Rising Number of Souring Loans

RBC is actively addressing the increase in souring loans through various strategic initiatives.

Strategic Actions Taken by RBC

RBC has implemented several measures to mitigate the impact of souring loans, including:

- Stricter Lending Standards: The bank is tightening its credit underwriting criteria to reduce the risk of future defaults.

- Enhanced Monitoring of Borrowers: Improved monitoring of existing borrowers helps identify potential problems early and take proactive steps for debt recovery.

- Portfolio Management: Active portfolio management strategies, including potential asset sales, are being employed to reduce exposure to high-risk loans.

RBC's CEO, [CEO Name], stated in a recent press release, "[Quote about the bank's strategy to manage souring loans]". The effectiveness of these measures will be closely monitored over the coming quarters.

Long-Term Outlook and Future Projections

The long-term impact of the current surge in souring loans on RBC's financial health remains uncertain. Much depends on the broader economic forecast for Canada and the performance of the various sectors affected. RBC's long-term strategy will likely involve a continued focus on risk mitigation and adapting its lending practices to the evolving economic climate. A cautious outlook is warranted until further data is available to better assess the future trajectory of souring loans and their impact on RBC’s profitability.

Conclusion: Analyzing the Impact of Souring Loans on RBC's Future

The increased prevalence of souring loans presents a significant challenge for RBC. The impact on its earnings, profitability, and overall financial health is undeniable. This highlights the broader risks within the Canadian banking system and the importance of prudent risk management practices. The bank's response, while proactive, needs continued monitoring to assess its long-term effectiveness. The situation requires close observation by investors, regulators, and economic analysts alike. Stay updated on the latest developments regarding the impact of souring loans on RBC’s financial performance by subscribing to our newsletter.

Featured Posts

-

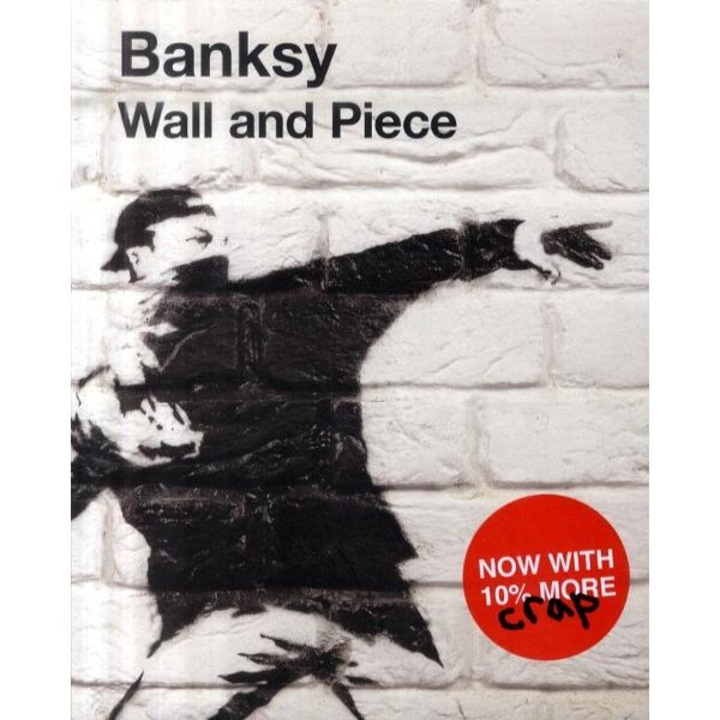

Owning A Piece Of Banksy Screenprints And Unique Tool

May 31, 2025

Owning A Piece Of Banksy Screenprints And Unique Tool

May 31, 2025 -

75 Year Old Duncan Bannatyne And Wife Witness Impact Of Operation Smile In Morocco

May 31, 2025

75 Year Old Duncan Bannatyne And Wife Witness Impact Of Operation Smile In Morocco

May 31, 2025 -

Apagon No Te Preocupes 4 Recetas De Emergencia Para Comer Rico

May 31, 2025

Apagon No Te Preocupes 4 Recetas De Emergencia Para Comer Rico

May 31, 2025 -

Boxer Jaime Munguia Releases Statement Following Positive Drug Test

May 31, 2025

Boxer Jaime Munguia Releases Statement Following Positive Drug Test

May 31, 2025 -

Giro D Italia 2024 Free Online Streaming Guide

May 31, 2025

Giro D Italia 2024 Free Online Streaming Guide

May 31, 2025